July 25th, 2025

The Toronto Central Markets—encompassing Toronto, North York, Etobicoke, and Scarborough—form a key segment of the Greater Toronto Area’s industrial real estate sector.

Investors and occupiers appreciate these areas for their access to labor and population density, which helps reduce transportation costs. Development charges are lower than in the 905 regions, and proximity to highways, public transit, and transportation nodes supports their utility.

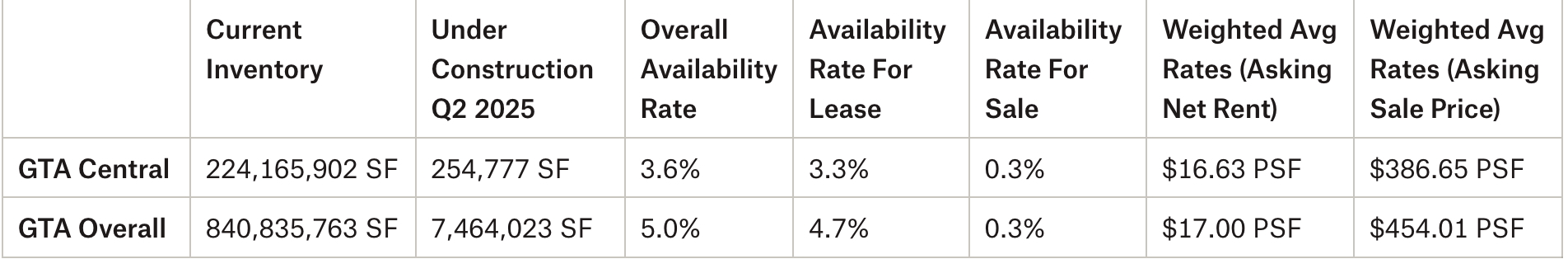

In Q2 2025, the market displayed adjustments. The overall availability rate rose from 3.3% to 3.6%, with lease availability at 3.3% and sale availability at 0.3%.

Absorption registered a whopping negative 655,382 square feet, while the square footage under construction was just 254,777 SF; a far cry from the GTA’s alleged 50-million-square-foot pipeline post-pandemic.

The weighted average asking net rent fell to $16.63 per square foot (PSF) from $16.66 PSF, though additional rent increased to $4.42 PSF. The average asking sale price rose to $386.65 PSF from $382.86 PSF.

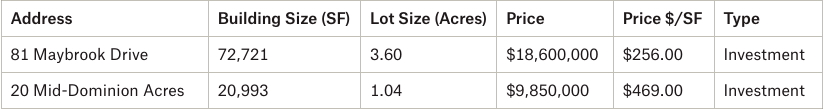

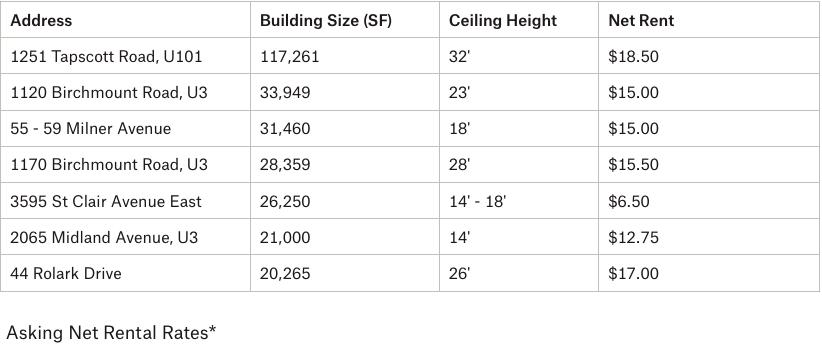

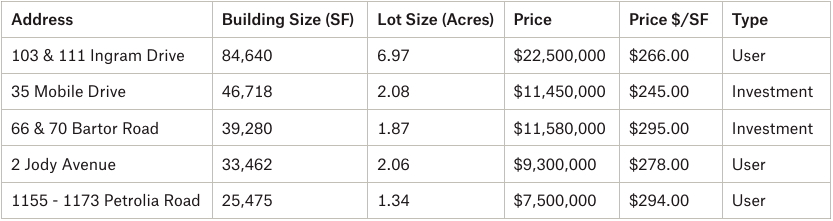

This quarterly report examines submarket details, covering sales and leases in Scarborough, North York, and Etobicoke. Scarborough recorded two investment sales totaling 93,714 square feet at an average of $362.50 PSF. North York had five transactions averaging $275.60 PSF. Etobicoke featured 10 leases totaling 354,655 square feet at an average net rent of $13.43 PSF.

Ahead, rental rates could see further declines amid tariff uncertainties and economic influences, potentially impacting property values. Interest rate reductions may aid stabilization. Development efforts target infill sites for distribution centers and industrial condos, leveraging the central position and access to highways and labor.

For investors, landlords, and owner-occupiers assessing property value, rental expectations, or sale prices, this report offers relevant data tied to factors like building age, size, lot size, ceiling height, and amenities.

So without further ado, let’s examine how each of the Greater Toronto Area regions performed in Q2 2025, and where we expect the market to go moving forward.

- The availability rate increased from 3.3% to 3.6%, with a lease availability rate of 3.3% and a sale availability rate of 0.3%;

- We had 254,777 SF under construction;

- We had 655,382 SF of negative absorption;

- The weighted average asking net rent was $16.63 PSF, down from $16.66 the previous quarter, with additional rent of $4.42 PSF (an increase from $4.35 PSF); and

- The weighted average asking sale price increased from $382.86 PSF to $386.65 PSF.

Why are the GTA Central Markets in such demand?

Is it proximity to labour and a higher population density, and thus, a reduction in transportation cost? Or is it savings in development charges vs 905 areas, proximity to major transportation nodes, highways, public transportation, etc?… Or all of the above?

Well, one thing is for certain, the Toronto-Central Markets are highly sought-after by both Investors and Occupiers of commercial real estate and is an environment worth exploring for opportunities.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

This week we are covering the Toronto Central Markets (Toronto, North York, Etobicoke & Scarborough)

Statistical Summary – GTA Central Markets – Q2 2025

Q2 2025, GTA Industrial Market Overview – Source: Cushman & Wakefield

Q2 2025, Industrial Market Overview – Source: Cushman & Wakefield

GTA Central Markets (Scarborough)

81 Maybrook Drive, Scarborough.

GTA Central Markets (Scarborough)

GTA Central Markets (North York)

35 Mobile Drive, North York.

1381 Castlefield Avenue, North York.

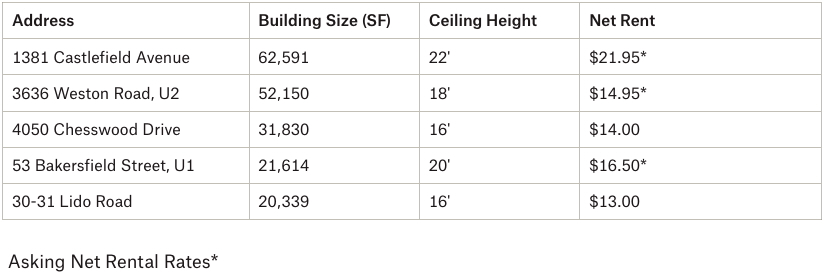

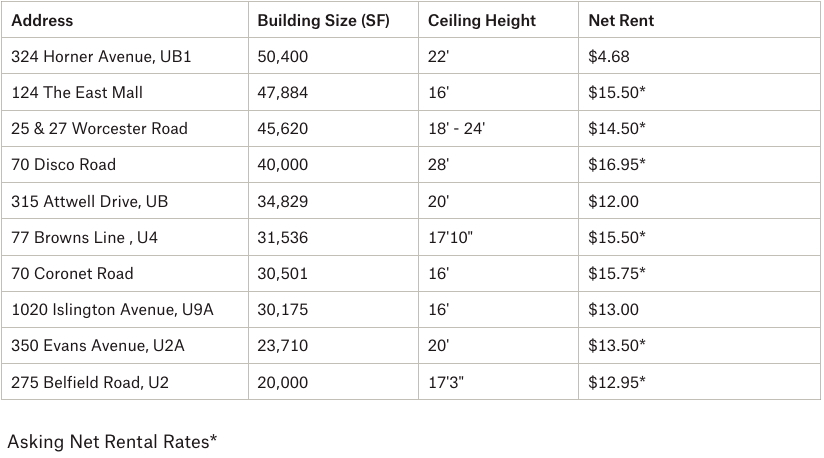

Properties Sold/Leased between January 2025 – March 2025, from 20,000 SF plus

124 The East Mall, Etobicoke.

- Rental Rates: Rents continue to adjust and, in many cases, we continue to see rate reductions. We expect this to continue. Likewise, annual rental escalations have plateaued and have decreased. Generally, businesses are looking to make decisions, however, tariffs have put many projects on pause due to the uncertainty and long-term unpredictability. There is continued downward pressure on rents, specifically in Class B or C industrial buildings. Overall, we are in a more balanced market between Landlords and Tenants.

- Property Values: As rental rates plateau, and as we see rents decrease in certain properties, we are going to see a decrease in value of investment properties. The recent and continued interest rate cuts may stabilize this trend. However, economic uncertainty surrounding tariffs continues to stifle activity; dampening rents and values. For users, we expect to see values remain elevated as supply of properties for sale is extremely limited. Finally, and despite the downward trend of interest rates, economic uncertainty and the relatively smaller pipeline of new construction has decreased the value of development land by at least 30% since peak.

- Development Opportunities: Looking across the Toronto-Central markets, there is still great interest from developers to purchase infill sites and redevelop older and obsolete industrial buildings to newer, modern distribution centres, as well as industrial condos. Given its central location and proximity to major highways and labour, larger industrial sites in the Toronto-Central markets will continue to be in great demand.

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com