October 31st, 2025

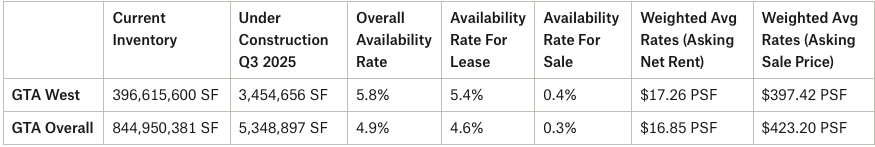

Encompassing Mississauga, Brampton, Oakville, Milton, Caledon, Burlington, and Halton Hills, the GTA West markets command 396.6 million square feet—47% of the GTA’s total industrial inventory.

This quarter underscored resilient demand amid evolving conditions. Transaction activity was relatively strong, with notable sales and leasing across submarkets. Mississauga led with 11 sales totaling 547,285 SF (average $346.78 PSF) and 31 leases aggregating 2.1 million SF (average $16.21 PSF). Brampton recorded one sale and 10 leases totaling 1.51 million SF (average $16.19 PSF). Milton, Halton Hills, and Caledon posted two sales (736,429 SF, average $316 PSF) and five leases (1.26 million SF, average $15.43 PSF).

Brampton commanded the highest asking net rents at $17.93 PSF, followed by Oakville ($17.26) and Milton/Halton Hills ($17.25). Sales asking prices were shaped significantly by industrial condominium activity, however sales transactions are occurring, on average, in the low- to mid-$300’s per square foot.

Strategic infrastructure, proximity to Pearson International Airport, major highways, and a deep talent pool continue to drive occupancy from e-commerce, third-party logistics, and advanced manufacturing tenants. Yet, downward pressure on rents in Class B and C assets, tariff concerns, and the impact of recent interest rate adjustments point to a more balanced landlord-tenant dynamic.

So without further ado, let’s examine how each of the Greater Toronto Area regions performed in Q3 2025, and where we expect the market to go moving forward.

- The availability rate decreased from 6.2% to 5.8%, with 5.4% available for lease and 0.4% available for sale;

- We had 2,946,397 SF of new supply year-to-date and 3,454,656 SF still under construction;

- We had 2,621,518 SF of absorption;

- Brampton achieved the highest weighted asking net rental rates in Q3 2025 at $17.93 PSF, followed by Oakville at $17.26 PSF and Milton/Halton Hills at $17.25 PSF;

- The weighted average asking net rent was $17.26 PSF, down from $17.30 the previous quarter, with additional rent of $3.98 PSF (a slight increase from $3.95 PSF); and

- The weighted average asking sale price rose from $463.99 PSF to $397.42 PSF; with values largely determined by industrial condo sales.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

This week we are covering the Toronto-West Markets

(Mississauga, Brampton, Oakville, Milton, Caledon, Burlington & Halton Hills)

Statistical Summary – GTA West Markets – Q3 2025

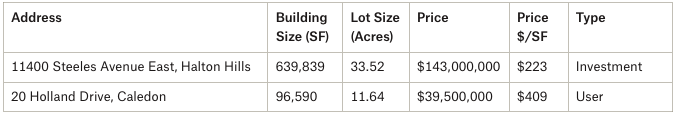

Properties Sold between July 2025 – September 2025, from 20,000 SF plus

6325 Northam Drive, Mississauga.

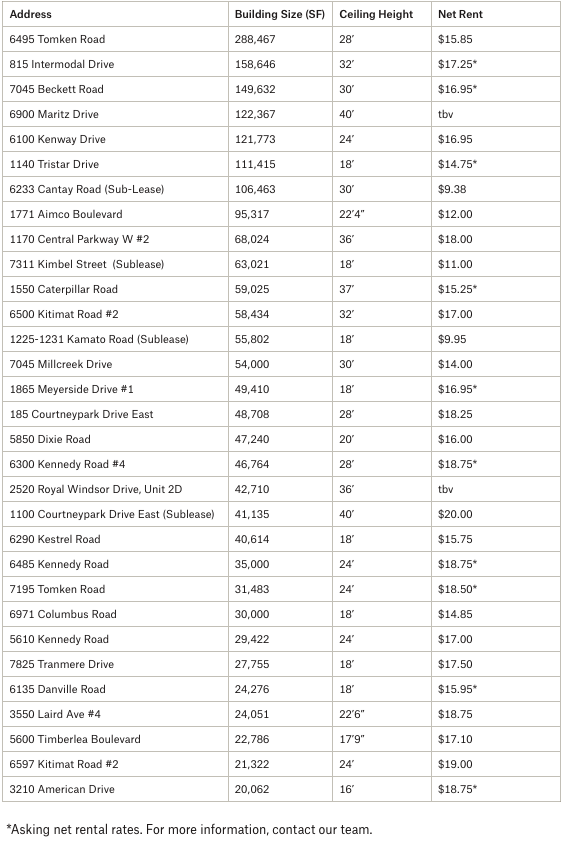

Properties Leased between July 2025 – September 2025, from 20,000 SF plus

6495 Tomken Road, Mississauga.

346 Orenda Road, Brampton.

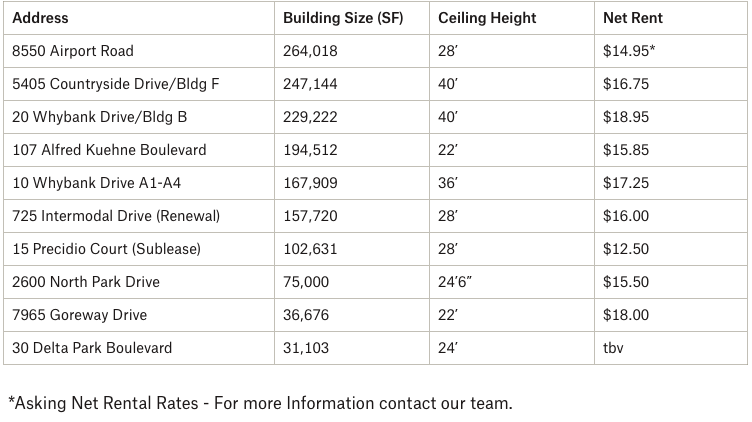

Properties Leased between July 2025 – September 2025, from 20,000 SF plus

20 Whybank Drive, Brampton.

20 Holland Drive, Caledon.

Properties Leased between July 2025 – September 2025, from 20,000 SF plus

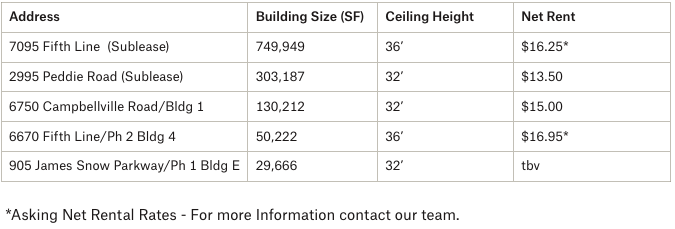

7095 Fifth Line, Milton.

- Rental Rates: Rents continue to adjust and, in many cases, we continue to see rate reductions. We expect this to continue. Likewise, annual rental escalations have plateaued and have decreased. Leasing is picking up and businesses are making decisions, however, the ongoing threat of tariffs are a concern. Further, there is continued downward pressure on rents, specifically in Class B or C industrial buildings. Overall, we are in a more balanced market between Landlords and Tenants.

- Property Values: As rental rates plateau, and as we see rents decrease in certain properties, we are going to see a decrease in value of investment properties. The recent and continued interest rate cuts may stabilize this trend, however. For users, we expect to see values remain elevated as supply of properties for sale is extremely limited. Finally, and despite the downward trend of interest rates, previously elevated levels have decreased the value of development land.

- Development Opportunities: In the third quarter of 2025, we had approximately 3.45 million square feet under construction in the GTA-West markets. This represents about 65% of all new development across the GTA (5.34 million SF), with the bulk of activity taking place in Mississauga (1.49 MSF) and Brampton (1.24 MSF).

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com