GTA Industrial Real Estate Market Shows Nothing but Continued Growth

Many brokerages and their research departments will crunch the numbers about 2019 and come out with reports that are essentially carbon copies of the previous year.

Brokers will take to social media and announce that the Industrial Market is on fire (yet again, but this time with emojis) and point to values, rental rates, vacancies, absorption, and new supply to reinforce said notion.

However, what is most important about reading the tea leaves of yesteryear is not in proclaiming that nothing is for sale and product is becoming more and more expensive. Rather, it is in understanding the driving forces and underlying trends… and trying to predict what will happen next.

This is because every Influential Player at the steering wheel of the Industrial Market – such as Amazon, FedEx, UPS, WalMart, Target, Kroger, BestBuy, eBay, WholeFoods, BlueApron, Instacart, etc. – is operating selfishly and competitively in their own best interest. And we are just along for the ride, reacting to their decisions, and profiting from the demand they are generating.

Or can we contribute to the decision-making process? And help these cutting-edge, essential, technologically-leading firms find or develop the best Product… Properties that are in line with the most efficient Occupational Strategy to deliver their products and services to consumers?

Because grasping the evolution of the verticals and the companies within the broader asset class is a great start to the question, “What’s next for the GTA Industrial Market?”

In order to better understand what to expect in 2020 and beyond, let’s take a quick peek back into 2019…

And what a stellar year it was…

Demand for industrial facilities from both an Owner-Occupier and an Investment perspective has never been stronger…

Furthermore, low-interest rates have fuelled both the profitability and investment demand in this red-hot sector…

It’s no surprise that cap rates supporting the industrial sector continued to compress in 2019 in both key markets as well as secondary markets. We expect that the demand from Owner-Occupiers will continue to be strong in 2020, and therefore, selling prices per-square-foot will continue to rise as well….

THE HOTTEST ASSET CLASS OF 2019 (AND OF THE YEARS TO COME….)

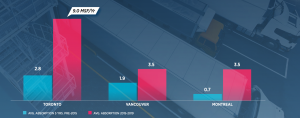

E-commerce’s continued growth in market share and the proliferation of online consumer behaviour across industries and product types has sustained demand for distribution and logistics facilities in major Canadian cities, such as Toronto, Montreal, and Vancouver (pictured below).

While there is growing sentiment of a recession looming in the near-term, and rumours of ‘Logistics Wars’ between FedEx, Amazon (and other 3PL firms, such as UPS and DHL), the vast majority of retailers have all made significant and public commitments to investing in and upgrading their fulfillment and supply chain networks.

Whether these plans for Capital Expenditure come to fruition or not, rising industry verticals with less-mature and more-newly-adopted distribution networks – such as cold storage for food and grocery deliveries – can fill the gap… leaving the broader Market with little to no relief.

In the Greater Toronto Area alone, absorption has averaged 9.0 million square feet (MSF) per year since 2015. Compare that to the previous five-year average absorption of just 2.8 MSF per annum, and you can get a sense of how hot this climate has become.

GTA Industrial Real Estate Average Annual Absorption – Source: Cushman & Wakefield

SHOW ME THE PRODUCT (OR LACK THEREOF)

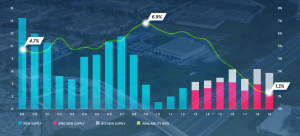

One of the first lagging indicators of this ferocious demand has been the shortage of supply. There just isn’t enough to satiate interested Parties, and over time, this imbalance has caused overall availability in the GTA’s 800-MSF Industrial market to free-fall to all-time lows.

Toronto now sits at a vacancy rate of just 1.3%. It’s crazy to think that that would be possible for the third largest industrial market in North America, but yet, here we are.

Nobody, in particular, is to blame, as developers and investors are clearly seeing and reacting to price signals showing them healthy margins on new development activity and upside on previously-acquired inventory.

A key setback, however, is the painfully slow Municipal approval and building permit process, which is slowing capital deployment (and even causing some Investors to look to markets south of the border).

GTA Industrial Market, New Supply vs. Availability Rate – Source: Cushman & Wakefield

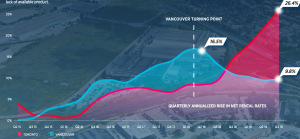

RISING RENTAL RATES CONTINUE TO CLIMB

As demand pushed availability rates down further, and overall supply coming to market remained slow and inconsistent, it was only a matter of time before it turned into a ‘Landlord’s market’. A lack of options quickly creates competition for space, which has resulted in record-high rental rates in 2019 in Toronto, Vancouver, and Montreal. Despite Vancouver traditionally leading the nation in terms of pricing and growth, Toronto has since eclipsed its Western Canadian sibling, with annualized rates rising by 26.4% in Q3 2019.

As a result of the aforementioned record-low availability, as well as all signs pointing to Industrial Users continuing to hunger for more space, rental rates in the GTA should continue to rise over the coming years, albeit at a more modest pace.

Industrial Net Rental Rates Growth – Source: Cushman & Wakefield

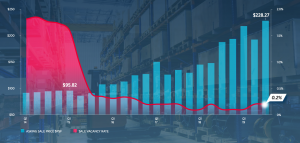

GTA INDUSTRIAL SALE PRICES CAN ONLY GO ONE WAY

As would be expected, Industrial sale prices in the GTA have grown just as dramatically as their leasing (rental rates) counterpart. With the availability of Industrial buildings for sale dropping to just 0.2%, and with cap rates beginning to stabilize or compress more slowly, sale prices have exploded upwards; increasing by 138% in the GTA since Q1 2015.

Examining our argument up until now… that we have a strong Industrial market with a hot underlying base of Industrial Users, and a lack of overall Supply… we cannot expect this upward pressure to subside in the near-term. Given all of this, however, Toronto still remains very competitive in terms of pricing when considering other North American Industrial markets.

GTA Industrial Sale Vacancy Rates vs Sale Prices – Source: Cushman & Wakefield

What Lies Ahead:

- Rental Rates: Small- and mid-size bay industrial product is already priced in the mid-teens in some markets. We anticipate that others will follow. Larger buildings are achieving from low $10’s per SF net in the North and West markets to high $6‘s in the East markets… but we expect this to change as well…

- Property Values: As a rising tide lifts all the boats, and with small- and mid-bay industrial product trading north of $300 per SF, even the old generation of large industrial with low ceilings is approaching $200 PSF… CAP rates on select triple-A product are dipping below 4%, while most industrial is valued on a CAP rate between 4.5-5.25%. Of course, it depends on the location, property, tenant, and the lease in place. The old rule that a long term lease in place is beneficial for the property value doesn’t apply anymore. A shorter term remaining on a lease allows the Landlord to re-lease the property at a new (considerably higher) rate, and if there are no existing options to renew, then even better…

- Development Opportunities: Land, they don’t make it any more…. You’ve heard this one before… as supply diminishes with every purchase then prices will increase… Bingo, this is exactly what is happening at the moment… One of our clients acquired an off-the-market piece of land for consolidation of their operations at $1,250,000 per acre. And as the construction of a new building is being finalized, and we take a look at the land market today, it has gone to north of $2 Million per acre…. never mind development charges which have also increased by a huge margin…

CONCLUSION:

So, what’s next for the GTA Industrial market?

Will Users of Industrial space continue to be constrained by slower growth in supply? Or will these well-funded, fast-growing Occupiers find creative ways to secure their real estate?

Will Developers and Landlords continue to exploit the proven strategy of rural ‘Big-Box’ warehousing? Or will these savvy Investors move to more Value-Add and Opportunistic plays, such as urban infill sites, industrial condo conversions, or more niche product, such as cross-docks, cold storage, and small- and mid-bay warehouses?

One thing is for sure. The GTA Commercial and Industrial Real Estate Market is maturing into a global leader… one which can sustain an entire ecosystem of diverse Investors and Occupiers; and the Properties they will develop, acquire, sell, or occupy.

The only question left will be how the pieces will all fit together to integrate with the antiquated-but-evolving transportation network, the growing labour force, and the eventual end-consumers.

On that note, if you are looking to acquire, sell, or lease Industrial space in the Greater Toronto Area, there may be mission-critical information or off-market opportunities you should know about before you make a final decision. For a confidential consultation and assessment of your situation, please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.