How Much Is Your Building Really Worth?

Establishing True Valuations Across Differing Markets

Q1 2020 Insight, Toronto-North Markets

May 15th, 2020

This year started off extremely strong with vacancy rates hitting historically low levels and net rental rates increasing in excess of 20% year over year. Everyone was struggling to find the right property to lease and/or purchase as the economy was firing on all cylinders. And then the COVID-19 pandemic hit…

It is too early to say but one thing is for sure, the lockdown and shutting down of businesses will have a long-lasting impact on our economy and the real estate market as well.

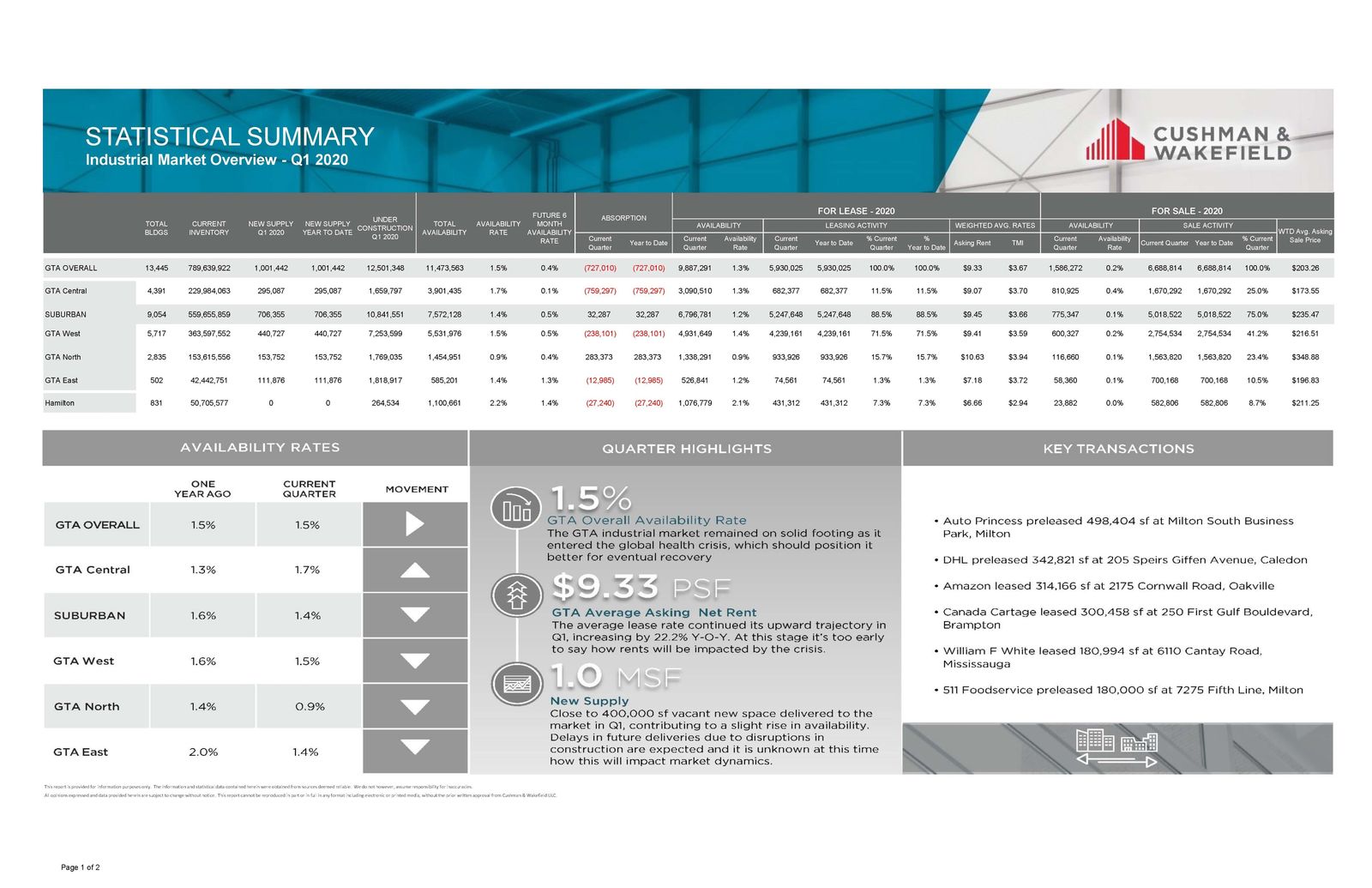

In the first quarter of 2020, the City of Vaughan’s Industrial Market was once again the most active among the GTA-North Markets, with more than 283,000 SF transacted, leased, or sold.

The Vaughan Leasing Market achieved the highest net rental rates at $11.74 PSF, while Richmond Hill was a close second with $10.28 PSF.

The largest transaction this quarter by dollar volume ($45,150,000) and by size (228,719 SF) was an investment sale; SUMMIT Industrial REIT’s purchase of Cochrane Business Park, a six-building, light industrial campus in Markham.

Key Takeaways from Q1 2020

- Strong demand and brisk leasing of available space pushed the availability rate down to just 0.9% in the GTA-North Markets in Q4 2019, with 0.1% available for purchase;

- Absorption this quarter was 283,373 SF;

- Currently, there is about 1,769,000 SF under construction in the GTA-North Markets;

- With all of this activity and demand, and existing inventory being reduced to a historically new record of 0.9% of overall inventory, the weighted average net rental rates reached $10.63 per SF; still, the highest in the GTA Industrial markets, while the weighted average sale price was $348.88 per SF.

Moving on to market activity, sales, and leasing in the GTA-North Markets…

If you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

In order to get to the truth, we need to dig a bit deeper…

This week we are covering the Toronto-North Markets (Vaughan, Markham, Richmond Hill, Newmarket & Aurora)

Statistical Summary – GTA Industrial Market – Q1 2020

GTA Industrial Market Overview – Q1 2020 – Source: Cushman & Wakefield ULC

Statistical Summary – GTA-North Markets (Vaughan, Markham, Richmond Hill, Newmarket & Aurora) – Q1 2020

Q1 2020 GTA Industrial Market Statistics – Source: Cushman & Wakefield ULC

So, let’s take a closer look at how the different Toronto North Markets performed during Q1 2020…

GTA North Markets (Markham)

Properties Sold between January 2020 – March 2020, from 20,000 SF plus

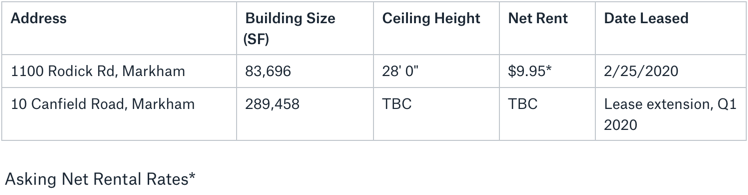

GTA North Markets (Markham)

Properties Leased between January 2020 – March 2020, from 20,000 SF plus

On the leasing side, 1 property of 83,696 SF was leased in Markham, with one lease renewal on a 289,458 SF property.

1100 Rodick Road, Markham

GTA North Markets (Vaughan, Richmond Hill, Aurora, Newmarket)

Properties Sold between January 2020 – March 2020, from 20,000 SF plus

In Q1 2020, a total of 3 properties (totaling 1,429,117 SF) were sold in the GTA-North markets, not including Markham. The prices achieved were in the range of $207 – $246 PSF, with an average building size of 178,640 SF and an average price of $311 PSF. Two transactions were investment sales and one was a User purchase.

455 Magna Drive, Aurora

GTA North Markets (Vaughan)

Properties Leased between January 2020 – March 2020, from 20,000 SF plus

On the leasing side, a total of 10 properties (totaling 463,765 SF) were leased in Vaughan in Q1 2020. The net rental rates achieved were from $8.95 – $11.68 PSF, with an average building size of 46,377 SF and an average net rental rate of $10.29 PSF.

85 Basaltic Road, Vaughan

What Lies Ahead:

- Rental Rates: Not all real estate is created equal…. It is important to note that the Industrial asset class will weather this storm and come out strong, if not stronger than before… with the only exception potentially being small-bay properties. Increases in online retail sales, moving away from “just in time” inventory and relocating parts of manufacturing back to Canada from overseas (and including the production of PPE equipment) will continue to put pressure on industrial markets; keeping our rental rates steady and increasing, although maybe at a slower pace. Overall, we are still in a Landlord’s market and have a long way to go….

- Property Values: Multi-tenant industrial properties that are owned by private equity funds (and are highly leveraged) may see some difficult days ahead… we may see vacancy rates increase and maybe even CAP rates as well… However, larger, single-tenant, logistics, warehouses and distribution facilities, and even manufacturing, should keep their values. A telling sign: those Landlords collected over 90% of their rents in April and May 2020….

- Development Opportunities: In addition to opportunities for development along the Highway 427 extension, a number of new blocks for industrial development will be released along Highway 50, as well as a new proposed industrial building of 320,000 SF in the Weston Road and Hwy #407 area in Vaughan.

Conclusion

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation.

And whether you are an Investor or Occupier or Lender we understand that the impact of the COVID-19 pandemic on your business may be significant. All parties involved have keen issues they are focused on and potentially different priorities at this moment. Proper and transparent communication is what will sustain and strengthen the relationships that will get us to the other side… Just remember…

We are all in this together…

DISCLAIMER: All information herein is for informational purposes only. This is not intended as professional legal, tax or accounting advice. We are not liable for any damages, real or perceived, as a result of you receiving or consuming this information. Please consult your attorney, accountant, or other counsel prior to making any decisions…

As we navigate through these uncertain times, rest assured that our team is working diligently to meet the needs of our clients and colleagues. The manner in which we do business is changing constantly, but our commitment to providing the best information and advice remains the same.

Cushman & Wakefield’s leadership team and research resources are committed to providing information on the overall economic and, specifically, the commercial real estate impact due to this pandemic. Please continue to check cushmanwakefield.com for the latest information regarding COVID-19 and the commercial real estate industry.

We’re all in this together, so please reach out with any needs you may have during this time.

Please stay healthy and safe.

Best Regards,

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com