Q1 2021 Insight, Toronto-East Markets

Establishing True Valuations Across Differing Markets

April 30th, 2021

Spring is finally upon us, and despite the sunny outlook and promising signs of global recovery, the Greater Toronto Area is still dealing with the aftermath of a dark winter. Specifically, we have found ourselves in yet another lockdown. Only this time around, all non-essential goods at retailers such as WalMart or Costco have been blocked off, forcing consumers to purchase all of their non-food or medical-related items online.

While this may not seem like much… and while it may not be a huge inconvenience to us as customers of these establishments… this small policy change may have increased household online order volume by a factor of two or three, overnight. Where we once delivered a full carload of supplies home, a sizeable portion must now be picked off warehouse shelving elsewhere (essentially, duplicate inventory) and shipped via freight, LTL truck, or last-mile delivery vans.

Multiply this effect over millions of households in Southern Ontario and you get an even further strained supply chain and logistics network.

So what does this mean in the context of the industrial market?

Well, for a market that was already at sub-2% availabilities for 11 straight months, it means the competition for industrial space will only increase.

Retailers hoping for everything to re-open by May or June might finally be convinced that an e-commerce pivot (or add-on) is necessary to survive. Grocery delivery services are naturally blossoming and eating up dry and cold storage space. And 3PLs are swallowing up inventories at a torrid pace while maturing and diversifying their services with flexible offerings such as ‘warehousing on-demand.’

And so, we find ourselves back where we seem to always be.

New sectors and applications for industrial bolstering demand… And still no answer to the issue of a chronic lack of space.

Key Takeaways from Q1 2021

- 2,055,337 SF was under construction;

- We had 631,262 SF of new supply;

- The overall vacancy rate was 2.7% with 2.5% available for lease and 0.2% available for sale;

- Weighted average asking lease rate was $7.94, increase from 7.17 PSF in the previous quarter.

Interesting Announcement

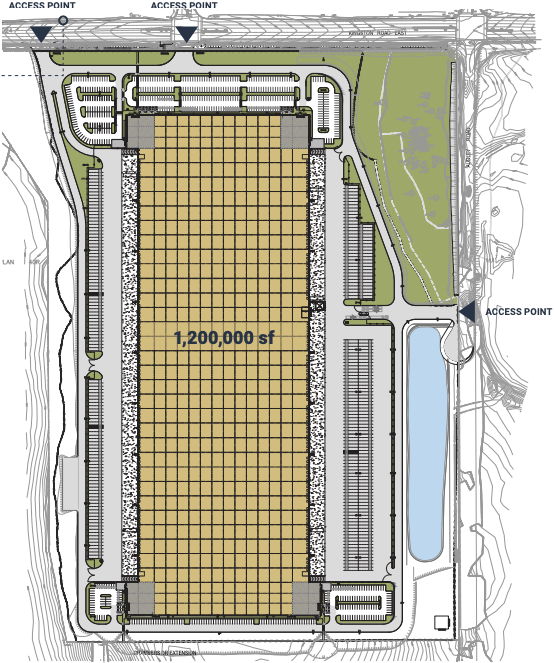

Ivanhoe Cambridge is bringing to market a 1.2 MSF state-of-the-art industrial logistics distribution facility with 401 exposure in Ajax, Ontario. Much like the rest of the Big Box industry, and because of both the tight market and relative value of the East markets, we can expect this to pre-lease in advance of its expected availability of Q4 2022.

537 Kingston Rd East, Ajax, ON. Source: Avison Young.

537 Kingston Rd East, Ajax, ON. Source: Avison Young.

Why are the GTA East Markets in such demand?

Generally, the Toronto-East markets have strong economics – relatively inexpensive land compared to other markets in the GTA, better availability of land, better located industrial land with proximity to the City, relatively low development charges, and great access to major highways.

We have seen a number of major Users and Developers step in and make commitments on large pieces of land for spec development and design build, which amounts to millions of square feet being built and in the pipeline.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

In order to get to the truth, we need to dig a bit deeper…

This week we are covering the Toronto-East Markets (Pickering, Ajax, Whitby & Oshawa)

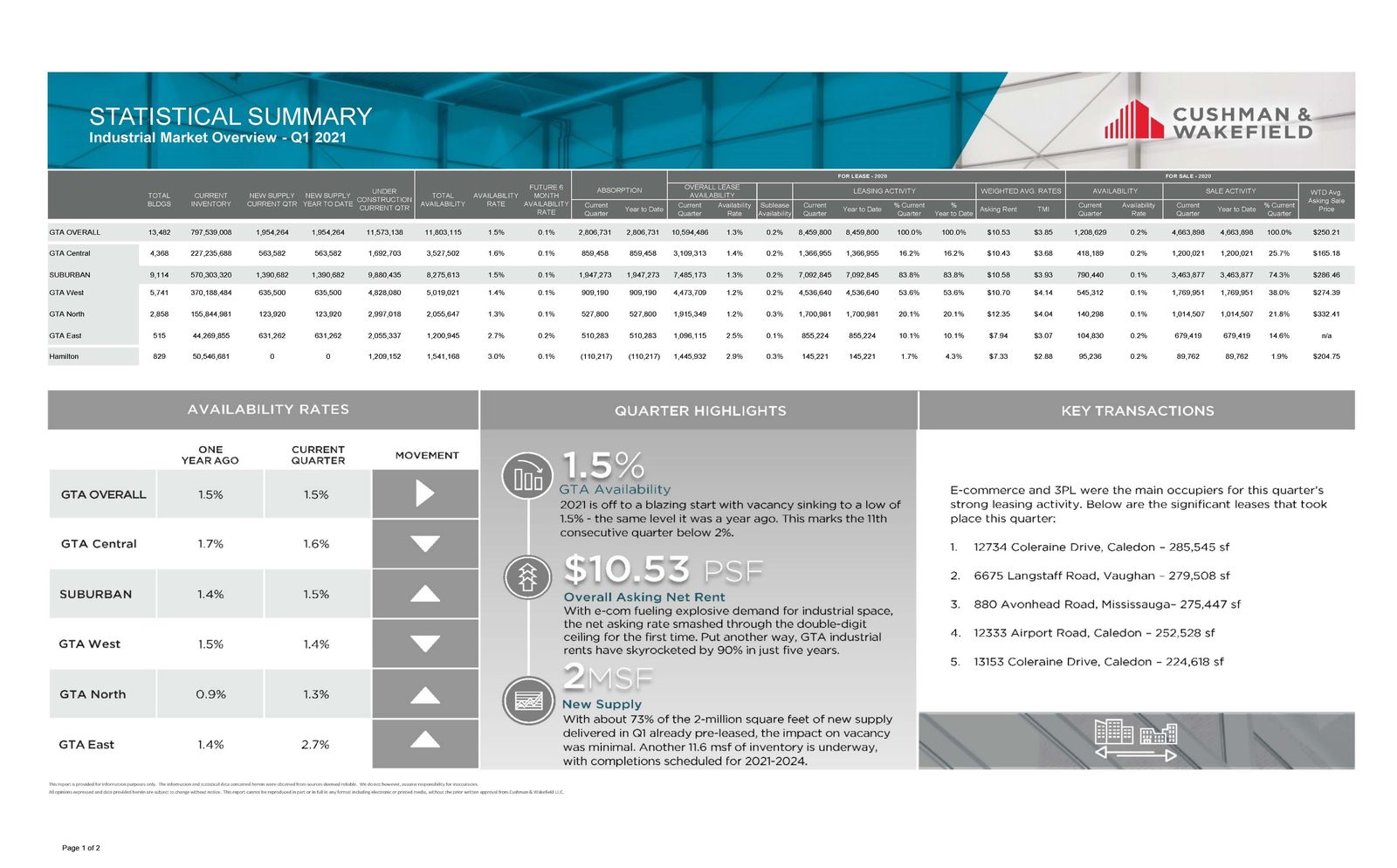

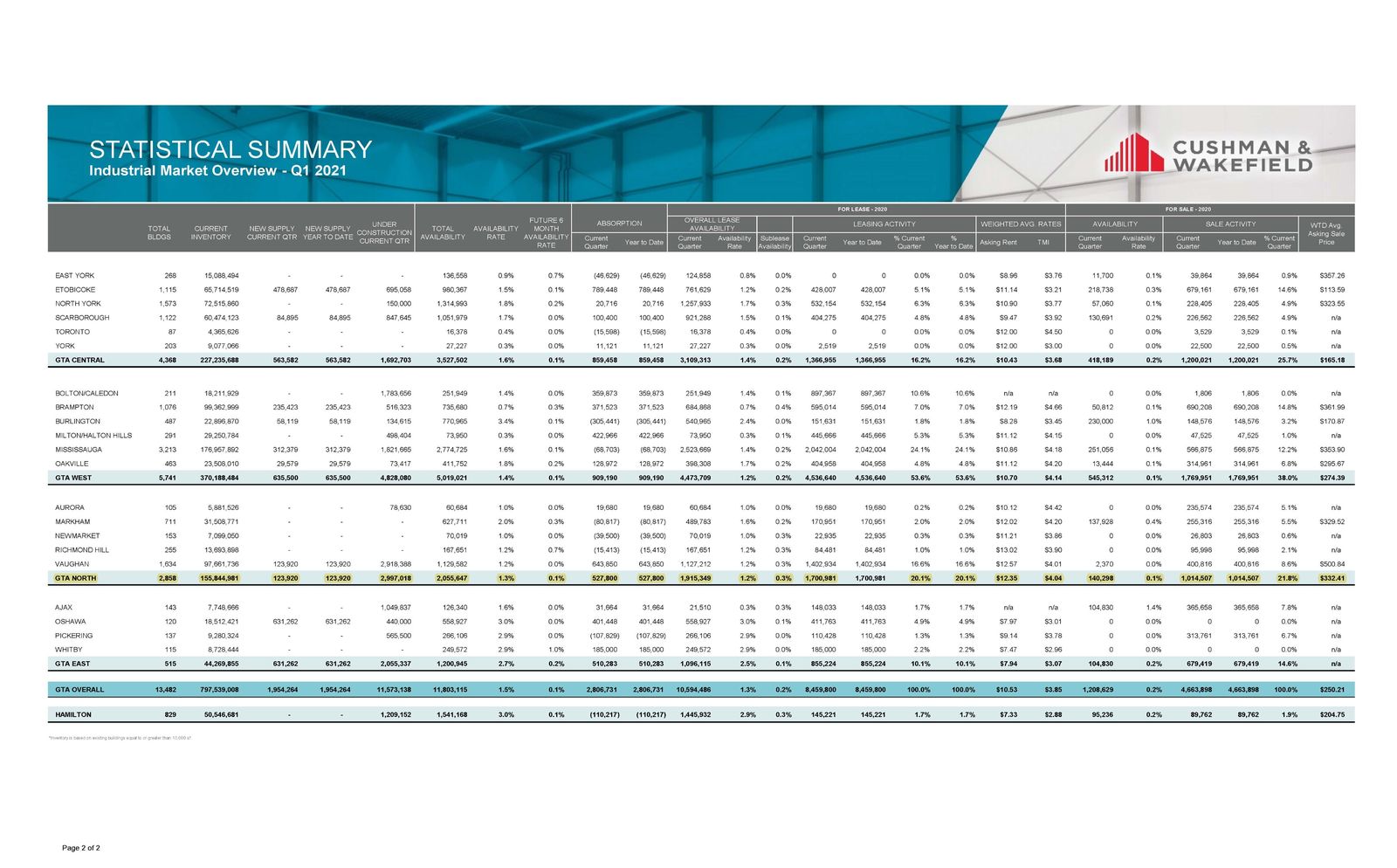

Statistical Summary – GTA Industrial Market – Q1 2021

GTA Industrial Market Overview – Q1 2021 – Credit – Cushman & Wakefield ULC

GTA Industrial Market Overview – Q1 2021 – Credit – Cushman & Wakefield ULC

So let’s take a closer look at how the different Toronto East Markets performed this quarter…

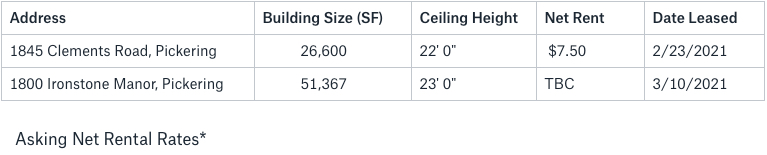

GTA East Markets (Pickering)

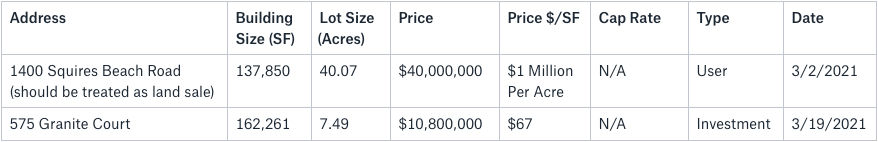

Properties Sold between January 2021 – March 2021, from 20,000 SF plus

1400 Squires Beach Road, Pickering

Properties Leased between January 2021 – March 2021, from 20,000 SF plus

1800 Ironstone Manor, Pickering

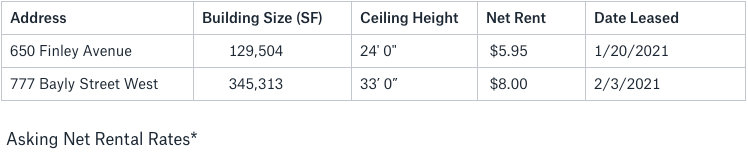

GTA East Markets (Ajax)

Properties Sold between January 2021 – March 2021, from 20,000 SF plus

777 Bayly Street, Ajax

GTA East Markets (Ajax)

650 Finley Avenue, Ajax

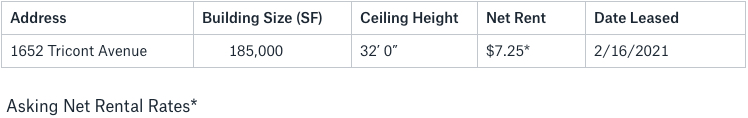

GTA East Markets (Whitby)

Properties Sold between January 2021 – March 2021, from 20,000 SF plus

113 Warren Road, Whitby

GTA East Markets (Whitby)

1652 Tricont Avenue, Whitby

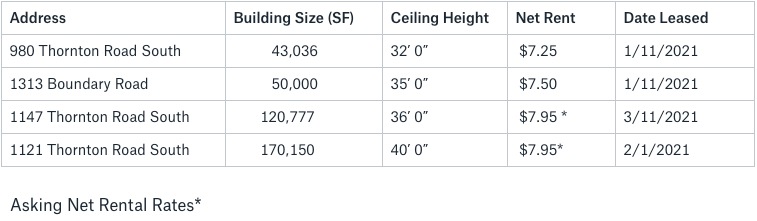

GTA East Markets (Oshawa)

Properties Sold between January 2021 – March 2021, from 20,000 SF plus

Properties Leased between January 2021 – March 2021, from 20,000 SF plus

1121 Thornton Road South, Oshawa

- Rental Rates: Currently, rental rates average $7.94 PSF in the GTA East, the lowest of all GTA submarkets, which are already in double-digits. We have seen already quite a bit of increase in rental rates and land values, which will continue.

- Property Values: Property values, like rental rates, are considerably lower relative to the other GTA submarkets… but are increasing.

- Development Opportunities: We are seeing a lot more development than ever before. Big players such as Panattoni, Carttera, Crestpoint, Blackwood, PIRET, etc. (to name a few) are all involved… and it will continue.

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com