May 12th, 2023

About a decade ago, the industrial market was a critical yet often overlooked asset class within the economy. Manufacturing, logistics, and transportation firms still provided the same services as they do today, however, much of the world’s attention was focused on urban development, globalization, rising technology and internet startups, and lavish retail malls.

Today, news headlines offer a different story.

Predictions of future commercial real estate loan defaults are rippling through discussions, just as stakeholders brainstorm the future of office, coupled with Ontario’s housing shortage. Technology companies are being rocked by the rise of Artificial Intelligence – both positively and negatively – and economic concerns have seen wave after wave of layoffs. Furthermore, near-shoring and e-commerce have flipped the script on global supply chains and the way consumers shop.

Meanwhile, all of the Parties above have become acutely aware of the importance of industrial assets; whether as a means to receive goods the same day, a key component of their logistics and fulfilment operations, or as a hedge against potential investment risks stemming from traditional and/or alternative asset classes.

The first quarter of 2023 was pegged to be a litmus test after the ongoing interest rate hikes and broader woes of inflation and consumer demand.

We posed the question late last year: “Was the investment volume slump of mid-2022 simply a period of re-adjustment? Or was it a systemic shift in overall investments throughout the economy?” These questions were particularly pertinent given the phenomenal bounce-back in Q4 2022, and are hypotheses we will examine in-depth in coming issues.

However, on top of these concerns was an underlying flirtation with the idea that possibly – just quite possibly – these macro forces may spillover into industrial tenant demand at the same time we see enormous amounts of inventory come online.

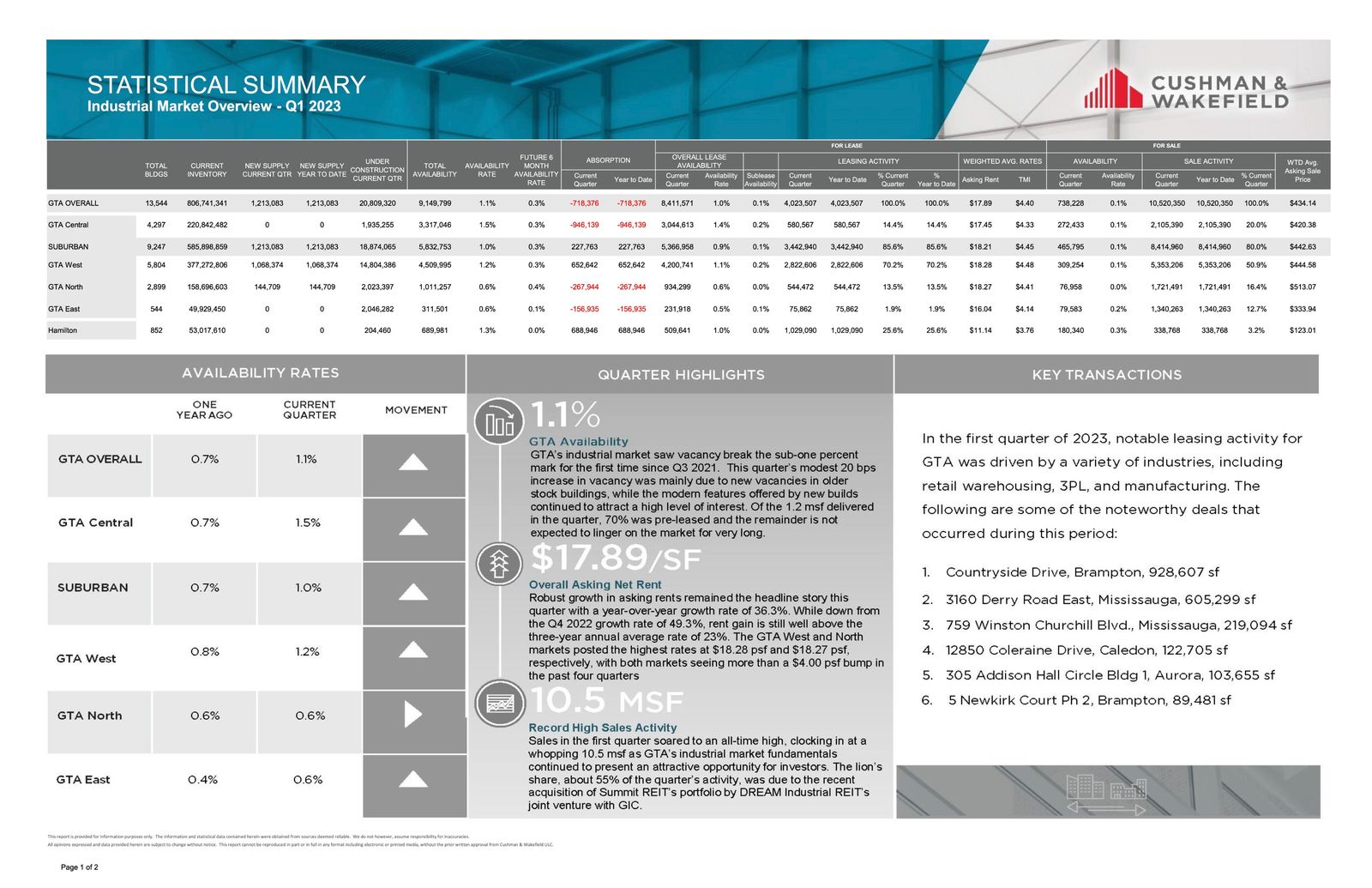

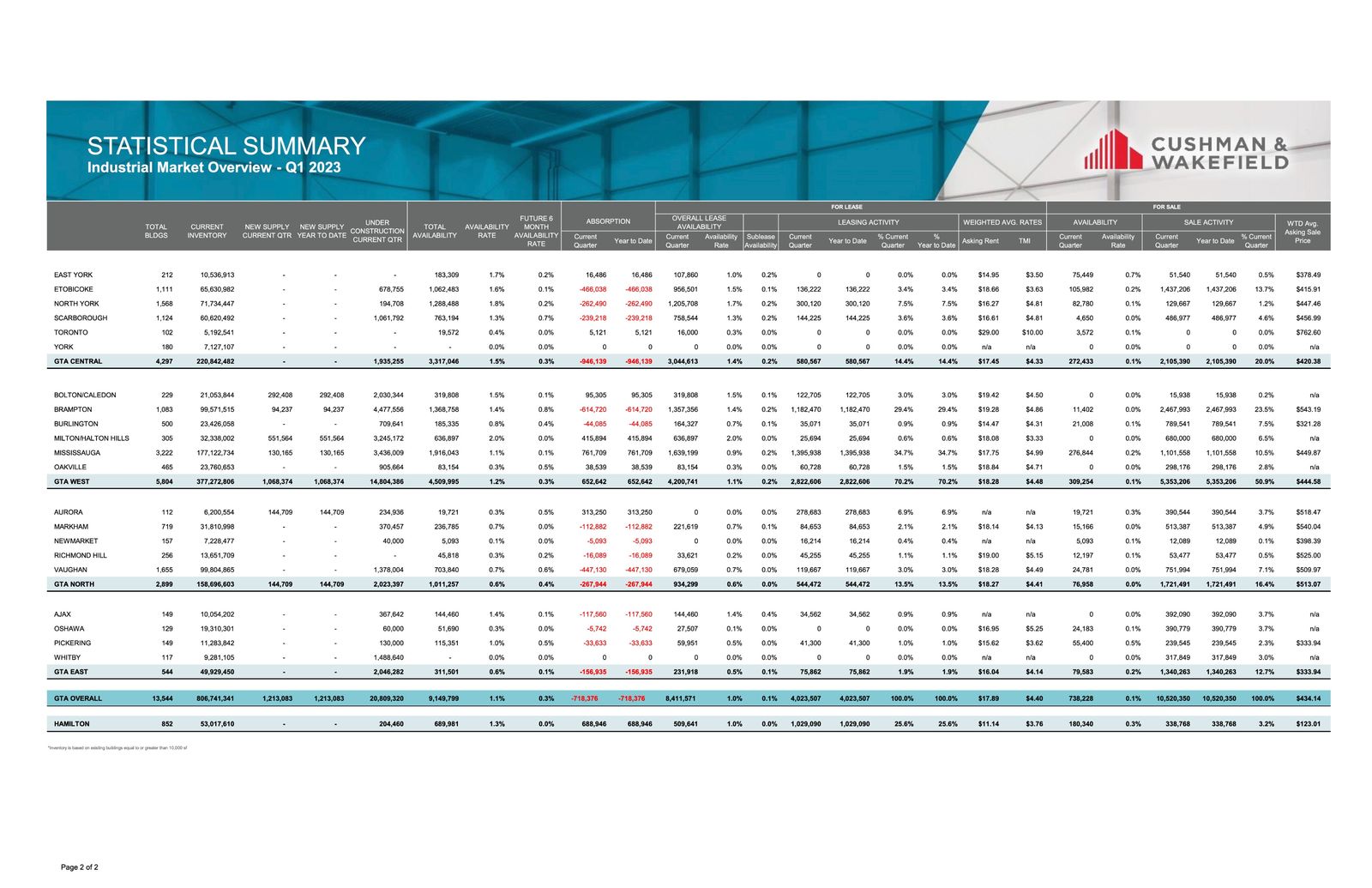

How will this play out? The jury is out until further data can confirm either way. What we have seen so far, though, is a modest amount of negative absorption and an uptick in availabilities. Similar to the investment volume recovery, we do expect this slack to be re-absorbed as new businesses expand and take market share. How quickly this occurs is difficult to predict.

So with that said, let’s examine how each of the Greater Toronto Area regions performed in Q1 2023, and where we expect the market to go moving forward.

Key Takeaways from Q1 2023 – Toronto East Markets

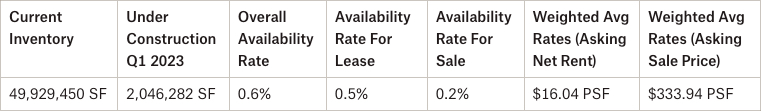

- The availability rate was 0.6% with 0.5% available for lease and 0.2% available for sale;

- We had no new supply and 2,046,282 SF still under construction;

- We had 156,935 SF of negative absorption;

- The weighted average asking net rent was $16.04 with additional rent of $4.14 PSF; and

- The weighted average asking sale price was $333.94 PSF.

Why are the GTA East Markets in such demand?

Generally, the Toronto-East markets have strong economics – relatively inexpensive land compared to other markets in the GTA, better availability of land, better located industrial land with proximity to the City, relatively low development charges, and great access to major highways.

We have seen a number of major Users and Developers step in and make commitments on large pieces of land for spec development and design build, which amounts to millions of square feet being built and in the pipeline.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

This week we are covering the Toronto-East Markets

(Pickering, Ajax, Whitby & Oshawa)

Statistical Summary – GTA East Markets – Q1 2023

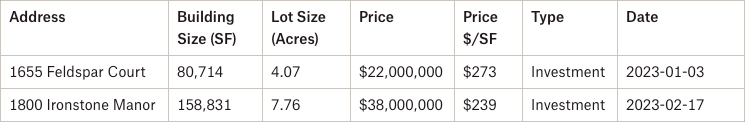

Properties Sold between January 2023 – March 2023, from 20,000 SF plus

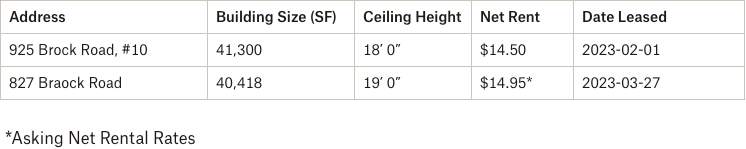

Properties Leased between January 2023 – March 2023, from 20,000 SF plus

827 Brock Road, Pickering

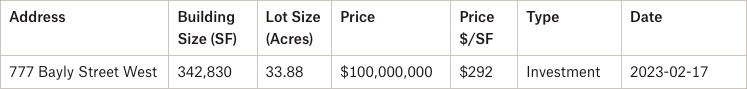

Properties Sold between January 2023 – March 2023, from 20,000 SF plus

777 Bayly Street West, Ajax

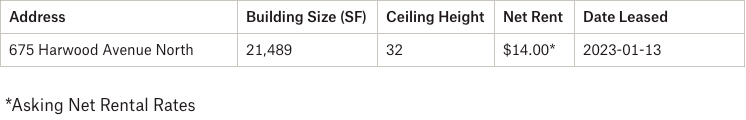

Properties Leased between January 2023 – March 2023, from 20,000 SF plus

675 Harwood Avenue North, Ajax

Properties Sold/Leased between January 2023 – March 2023, from 20,000 SF plus

1001 Thornton Road South, Oshawa

Portfolio Sale

- Rental Rates: Currently, rental rates average $16.04 PSF net in the GTA East – almost $1.50 PSF net higher than in Q4 2022 – but still the lowest of all GTA submarkets; where all of the others are already well over $17.00 PSF net. We have already seen quite an increase in rental rates and land values in the East as they catch up to other Regions, however, we expect rents to increase at a slower, decelerating rate.

- Property Values: Property values, like rental rates, are considerably lower relative to the other GTA submarkets at $333.94 PSF (where all other regions are over $420 PSF)… but also increasing as investors and developers act on the opportunities and relative discount.

- Development Opportunities: We are seeing a lot more development than ever before as the GTA East now has more pipeline than the Central and North Regions at 2,046,282 SF under construction. Big players such as Panattoni, Carttera, Crestpoint, Blackwood, PIRET, etc. (to name a few) are all involved… and it will continue.

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com

Newsletter

Join our mailing list to receive the latest news and updates from our team.