May 26th, 2023

What does affordability mean to you?

When looked at through one lens, it can mean the difficulty in obtaining the necessary resources to acquire or rent a thing. We hear this term often across Southern Ontario when people speak of how expensive housing has become; a function of borrowing costs, foreign investment, and the general and obvious imbalance between supply and demand, themselves a topic of discussion for another afternoon.

Viewed from a different perspective, however, affordability can also be taken to mean the inverse. Namely, how can one not pay the price to acquire said thing because of its intrinsic value, its long-term benefit, and other concrete and intangible attributes.

Applied to industrial real estate, investors and occupiers may find themselves in one camp or the other; or with firm footing on both sides as they make real estate decisions.

Certain industrial assets, such as aging or obsolete stock were always seen as value plays. Yet they too are subject to the dramatic rental rate increases – giving tenants sticker shock when initiating renewal discussions with their landlords.

On the other end of the spectrum, we see large, multinational corporations willing to fork over a premium to secure a well-located, modern warehouse with all the bells and whistles – such as high clear heights, excellent shipping, and the ability to install cutting-edge technologies and warehouse management systems.

In a similar vein, investors may see little upside in certain assets (not enough to take the risk of borrowing, acquiring, and managing), while other assets are mathematically impossible to replace at their values given the cost of land, labour, materials, and financing. This is especially true where the weighted-average-lease-terms are low and in-place rents are well below market value.

Depending on your situation and objectives, the concept of affordability truly has become one of two clear and resounding questions in each stakeholder’s mind.

“How can I afford to do this?” – or – “How can I afford not to do this?”

Both seem to plague the active participant in the GTA industrial market right now. The only caveats to this scenario are opportunity and uncertainty. These two sirens further complicate matters should one contemplate where to find deals… and whether or not the market will be able to continue sustaining its current trajectory indefinitely.

So with that said, let’s examine how each of the Greater Toronto Area regions performed in Q1 2023, and where we expect the market to go moving forward.

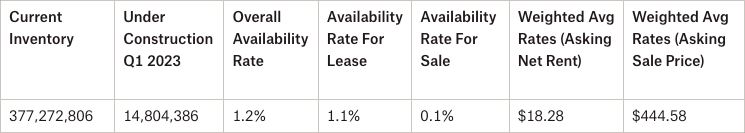

- The availability rate was 1.2%, with a lease availability rate of 1.1% and a sale availability rate of 0.1%;

- We had 1,068,374 SF of construction completed and 14,804,386 SF still under construction;

- We had absorption of 652,642 SF;

- Caledon achieved the highest weighted asking net rental rates in Q1 2023 at $19.42 PSF, followed by Brampton at $19.28 PSF and Oakville at $18.84 PSF;

- The weighted average asking net rent increased from $17.52 to $18.28 PSF with additional rent of $4.48 PSF; and the

- Weighted average asking sale price was $444.58.

Why are the GTA West Markets in such demand?

The GTA West Industrial Markets are by far the largest industrial markets in the GTA, representing about 46.8% of GTA Industrial Inventory, or about 377,272,806 SF. The GTA West Markets were very active this quarter, with more than 14,804,386 SF under construction and a flurry of lease and sale transactions completed.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

This week we are covering the Toronto-West Markets

(Mississauga, Brampton, Oakville, Milton, Caledon, Burlington & Halton Hills)

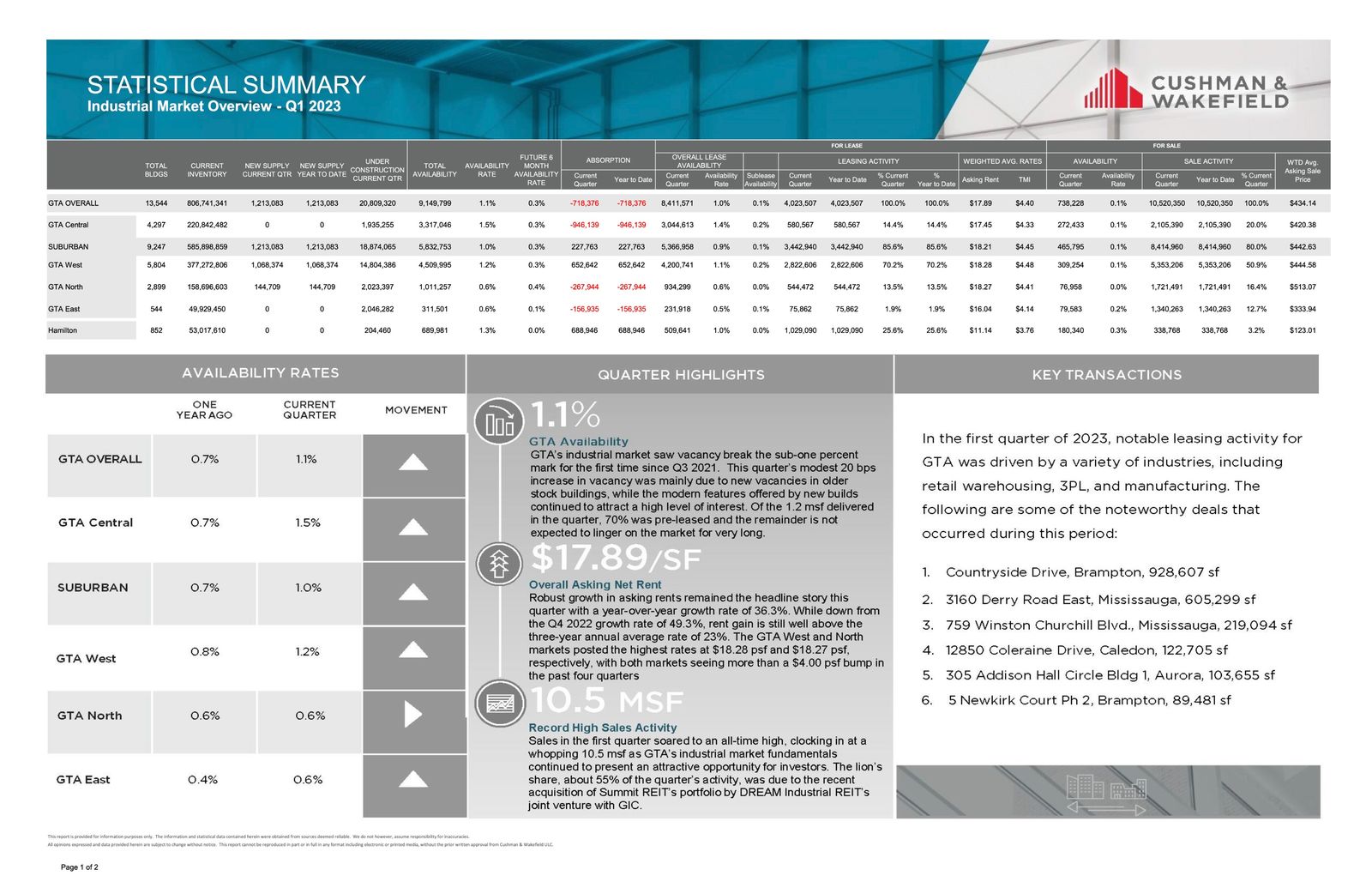

Statistical Summary – GTA West Markets – Q1 2023

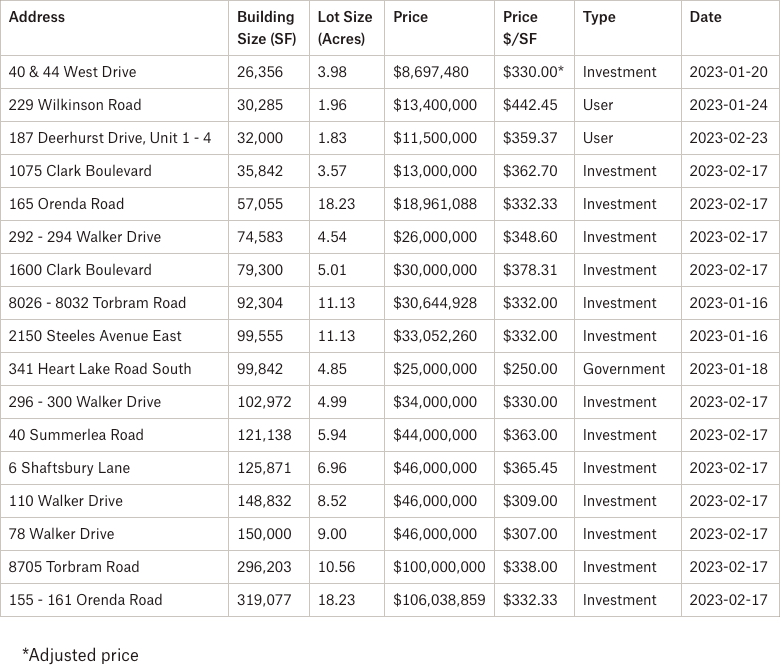

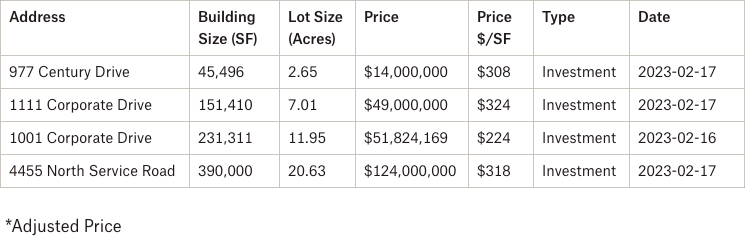

Properties Sold between January 2023 – March 2023, from 20,000 SF plus

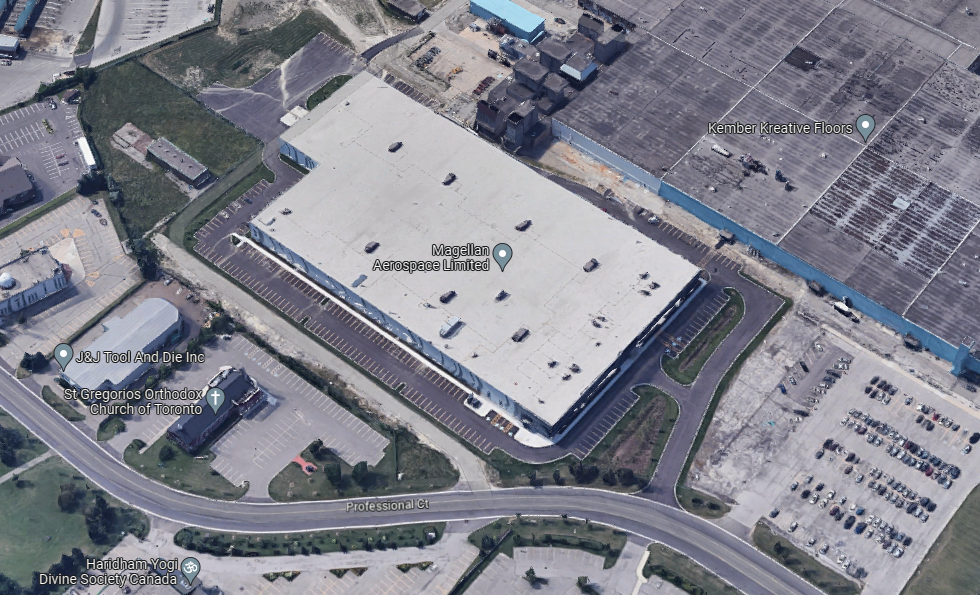

5101 Orbitor Drive, Mississauga

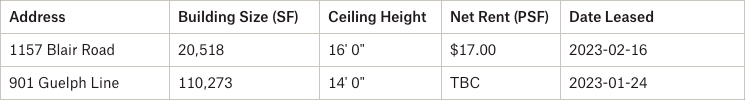

Properties Leased between January 2023 – March 2023, from 20,000 SF plus

3160 Derry Road East, Mississauga

8705 Torbram Road, Brampton

Properties Leased between January 2023 – March 2023, from 20,000 SF plus

100 Sandalwood Parkway West, Brampton

4455 North Service Road, Burlington

Properties Leased between January 2023 – March 2023, from 20,000 SF plus

901 Guelph Line, Burlington

Properties Sold between January 2023 – March 2023, from 20,000 SF plus

8450 Boston Church Road, Milton

Properties Leased between January 2023 – March 2023, from 20,000 SF plus

12950 Coleraine Drive, Caledon

Properties Sold between January 2023 – March 2023, from 20,000 SF plus

2335 Speers Road, Oakville

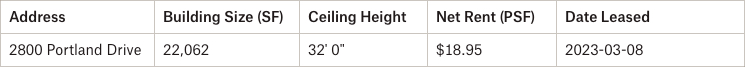

Properties Leased between January 2023 – March 2023, from 20,000 SF plus

2800 Portland Drive, Oakville

- Rental Rates: We see many transactions achieving in excess of $16-18 PSF net. We are also hearing that some of the current developments are increasing their price guidance to above $19-20 PSF net. That trend will continue.

- Property Values: The average weighted asking sale price for the GTA-West markets in Q1 2023 was $444.58 PSF. Depending on the submarket, we would expect values to further increase due to the lack of available properties for sale. Despite economic uncertainty and rising interest rates, and even though the buyer pool may have thinned for some investors and operators, we continue to see major deals taking place.

- Development Opportunities: In the first quarter of 2024, we had approximately 14.8 million square feet under construction in the GTA-West markets. This represents approximately 71% of all new development across the GTA (20.8 million SF), with the bulk of activity taking place in Brampton (4.48 MSF), Mississauga (3.44 MSF), and Milton/Halton Hills (3.25 MSF).

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com