How Much Is Your Building Really Worth?

Establishing True Valuations Across Differing Markets

Q2 2020 Insight, Toronto-East Markets

September 4th, 2020

This has been the first full quarter operating under COVID-19 and the resulting economic shutdowns. Obviously, events have had a big impact on commercial real estate across the board, but it looks like, on the surface, that it wasn’t tough on industrial.

As a matter of fact, due to an increased volume of online retail sales and omnichannel distribution, industrial rental rates and property values continued to increase. Industrial real estate remains a top-performing asset class.

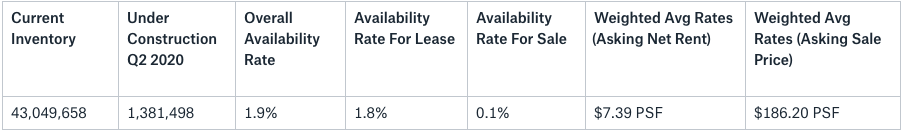

The GTA–East Industrial Markets are the smallest in the GTA with about 43,000,000 SF; just 5% of overall Industrial Inventory in the entire region.

Key Takeaways from Q2 2020

- 1.381 Million SF was under construction;

- We had 622,419 SF of new supply;

- The overall vacancy rate was just 1.9% with 1.8% available for lease and 0.1% available for sale;

- Weighted average asking lease rate was $7.39 PSF; and the

- Weighted average sale price was $186.20 PSF.

Interesting Announcement this Quarter

200 Salem Road, Ajax – Construction Completion

Gordon Food Services’ East Toronto Distribution Centre was completed and occupied in Q2 2020. The facility is approximately 343,413 SF in size with the option to expand/enlarge by 100,000 SF in the future.

It comes with two-storey office space, maintenance shop, refrigeration machine room, ambient and 38°F refrigerated docks, ambient, and both medium- and low-temperature warehouse storage zones. About 60% of the warehouse area will be for manual selection from conventional racking while the remaining 40% will be made up of automated warehouse technology.

This new state-of-the-art warehouse will support the distribution of food service products across Ontario.

The property was designed and constructed by Maple Reinders, an award-winning construction services company that has been providing creative solutions in ICI buildings and environmental construction for over 50 years. For more information contact Ken Kamminga, National Director of Sales and Estimating.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

In order to get to the truth, we need to dig a bit deeper…

This week we are covering the Toronto-East Markets (Pickering, Ajax, Whitby & Oshawa)

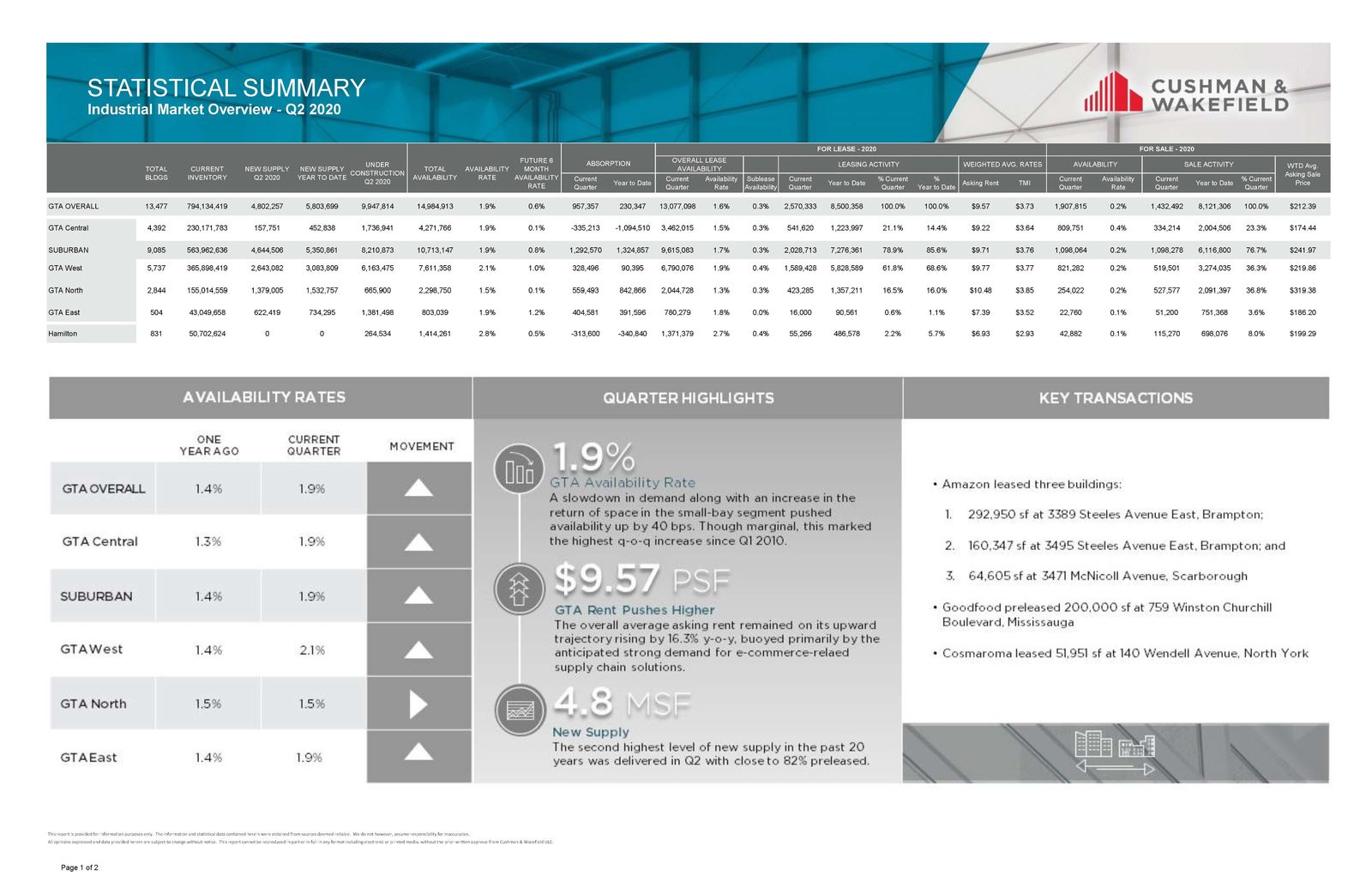

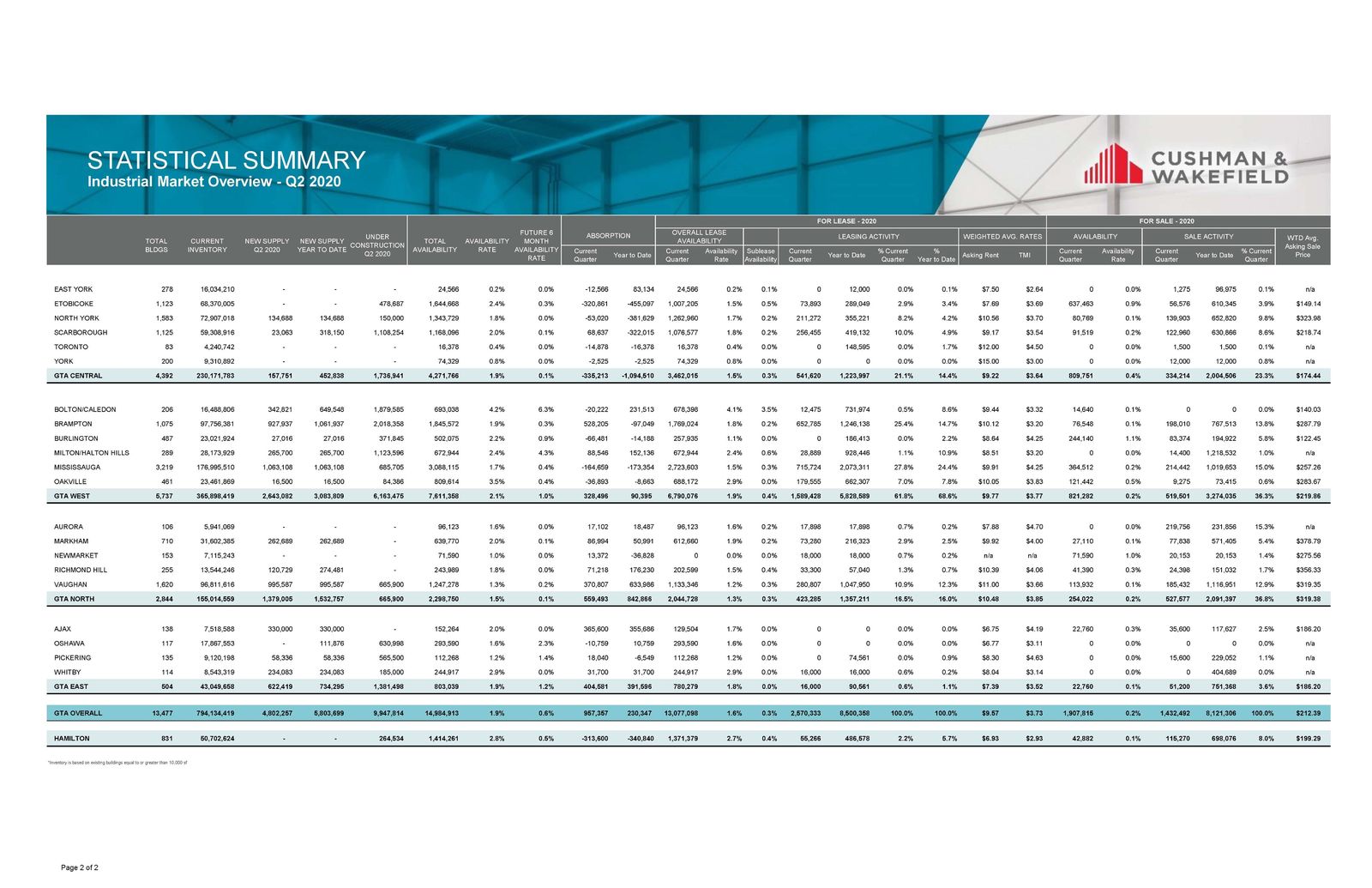

Statistical Summary – GTA Industrial Market – Q2 2020

GTA Industrial Market Overview – Q2 2020 – Credit – Cushman & Wakefield ULC

Statistical Summary – GTA East Markets (Pickering, Ajax, Whitby & Oshawa) – Q2 2020

So let’s take a closer look at how the different Toronto East Markets performed during Q2 2020…

GTA East Markets (Pickering, Ajax, Whitby & Oshawa)

Properties Sold between April 2020 – June 2020, from 20,000 SF plus

Properties Leased between April 2020 – June 2020, from 20,000 SF plus

- Rental Rates: Net rental rates in the GTA East markets are considerably lower than rates in the other GTA markets. You could still secure a building at $7.95 PSF net for brand new product, with 32 to 40 feet clear… and as low as $6.50 PSF net for older product with 28-foot clearance. This represents a 20 – 30% price difference. Therefore, we expect to see increased interest in the GTA East markets from users looking for space.

- Property Values: The weighted average asking sale price in the GTA East Markets in Q2 2020 was $186.20 PSF. And with an availability rate for purchase of just 0.1%, we can expect further upward pressure on property values.

- Development Opportunities: We have 1.4Million SF under construction in the GTA East Markets with only one building completed and delivered this quarter; that property being 200 Salem Road in Ajax, a new 343,000 SF warehouse for Gordon Food Services. New speculative construction is being delivered by a number of major developers such as Panattoni, Carttera, and PIRET.

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation.

And with our vacancy rates, rental rates, and valuations having hit all-time highs right before COVID-19 took place, there may be plenty of opportunities to find creative solutions; whether it be through rightsizing, refinancing, bridge financing, sale-leasebacks, or otherwise.

While there may exist challenges in execution, Buyers are ever more hungry for product. Local, high-net-worth developers and investors are often active in bottom-of-market conditions. And well-capitalized institutional investors and pension funds are still willing to take a look at a deal if the numbers make sense.

Furthermore, a number of our clients are considering sale-leasebacks to re-capitalize their operations.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com