Q2 2021 Insight, Toronto-East Markets

Establishing True Valuations Across Differing Markets

August 6th, 2021

Suppose a vote were taken by all of the commercial real estate professionals in the Greater Toronto Area.

Which asset class would they likely agree is the most in demand right now? Chances are, they would be fighting over who could shout out “Industrial!” first.

Now, let’s suppose we asked them a follow-up question as to why that is the case. Again, we would probably hear testimony applauding the specific type of space whose use perfectly complements the needs of many burgeoning industry sectors. Let’s face it, companies such as Amazon, WalMart, GoodFood, Costco, Home Depot, and Lowe’s haven’t been doing so bad lately.

Once the praise and excitement wore off, however, we may hear the grumbles and undertones of frustration – or even, desperation – cut through the crowd. That’s because the supply of industrial properties throughout the GTA is tapped out almost immediately as any new supply is released to the market. In fact, most of this ‘new supply’ are simply renderings of state-of-the-art facilities to one day take the place of dozens of acres of dirt; pre-leasing becoming a standard vehicle for securing space.

Yet when truly examining the broader commercial real estate industry, the fact that industrial real estate is in its current position might seem baffling. Out of all the various property types, industrial is the definition of simplicity.

Four walls on a slab. Covered by a roof. That’s it.

Yes, there are many ways to elevate the features to another level – but – both its form and function are repeatable and predictable.

Which begs the question… why is product so scarce?

Now, we’ve been down this road many times before, but, needless to say, we are simply going through growing pains. The market can only grow so fast (no matter how quickly it would like to). And bottlenecks are occurring at almost every stage of the process, from servicing land to permitting, and constructing, and sourcing inputs such as labour and raw materials.

Opportunity will present itself, albeit sometimes in unexpected and unpredictable ways. Investors seeking to deploy capital will need to remain competitive. Meanwhile, Users in need of a new home should remain patient and persistent while not being discouraged by changing pricing. And Landlords or Owner-Occupiers considering selling will have most of the bargaining power, and thus, should find ways to maximize proceeds.

The past couple of years have been chock full of change. However, barring any significant unexpected events, we should expect industrial real estate to continue cruising on its current trajectory for the months and years to come.

Key Takeaways from Q2 2021

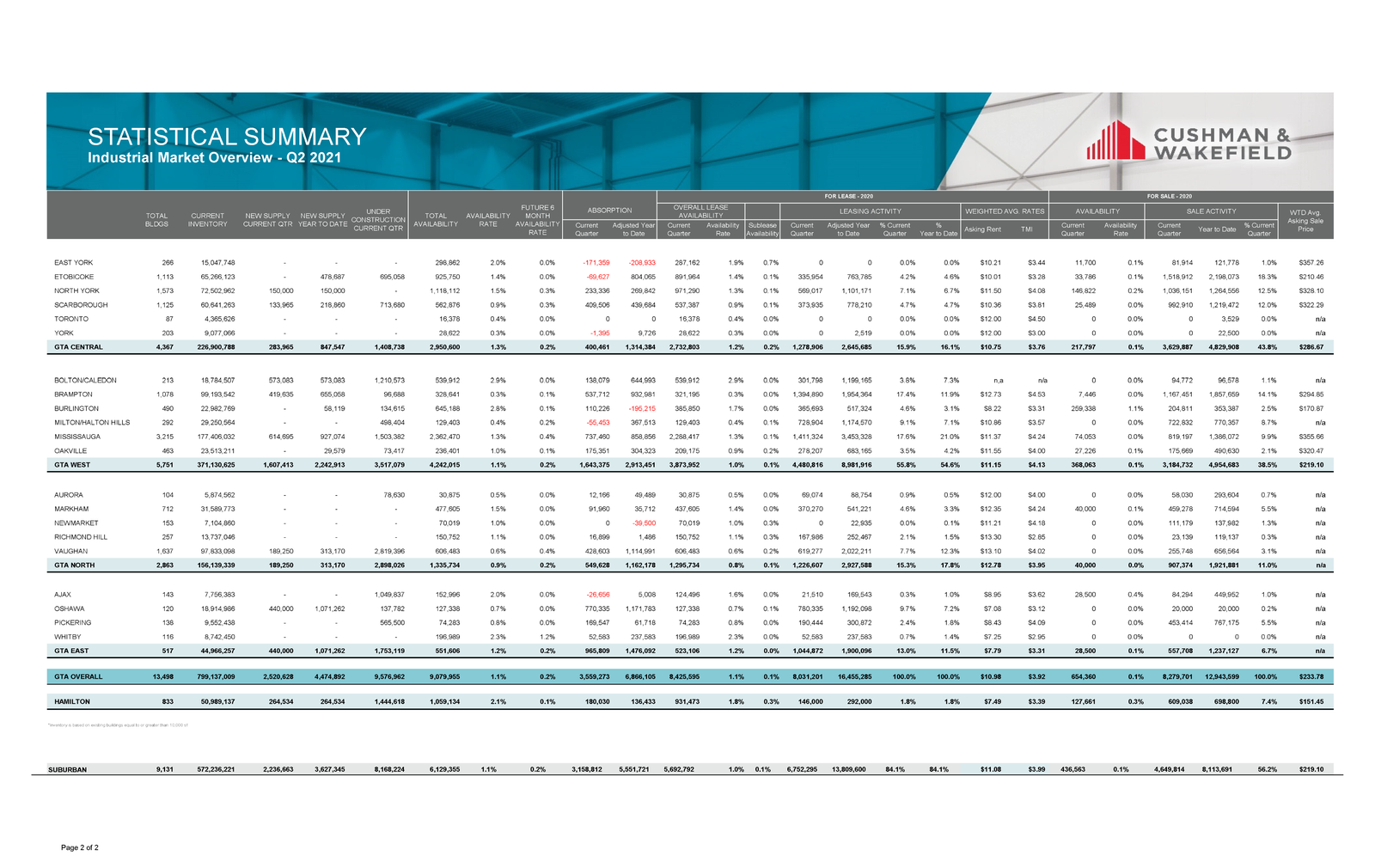

- The overall vacancy rate was 1.2% with 1.2% available for lease and less than 0.1% available for sale (just 28,500 SF of space for sale out of 44,966,257 SF of inventory);

- 1,753,119 SF of space was under construction;

- We had 440,000 SF of new supply; and there was

- No applicable weighted average asking sale price due to the almost non-existent inventory.

Featured Transaction

955 Brock Road, Pickering

Generally, the Toronto-East markets have strong economics – relatively inexpensive land compared to other markets in the GTA, better availability of land, better located industrial land with proximity to the City, relatively low development charges, and great access to major highways.

We have seen a number of major Users and Developers step in and make commitments on large pieces of land for spec development and design build, which amounts to millions of square feet being built and in the pipeline.

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

This week we are covering the Toronto-East Markets (Pickering, Ajax, Whitby & Oshawa)

Statistical Summary – GTA East Markets – Q2 2021

So let’s take a closer look at how the different Toronto East Markets performed this quarter…

Properties Sold between April 2021 – June 2021, from 20,000 SF plus

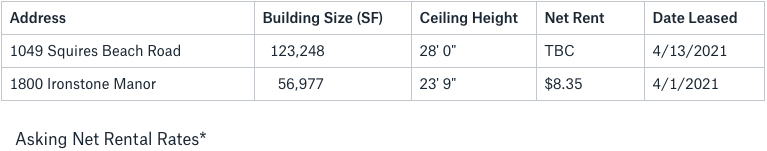

Properties Leased between April 2021 – June 2021, from 20,000 SF plus

In the Pickering sub-market, 2 properties were leased (totalling 180,225 SF) in Q2 2021. The net rental rates achieved was $8.35 PSF, with an average building size of 90,113 SF.

Properties Sold between April 2021 – June 2021, from 20,000 SF plus

GTA East Markets (Ajax)

Properties Leased between April 2021 – June 2021, from 20,000 SF plus

No properties were leased in the Ajax sub-market in Q2 2021.

GTA East Markets (Whitby)

Properties Sold between April 2021 – June 2021, from 20,000 SF plus

GTA East Markets (Whitby)

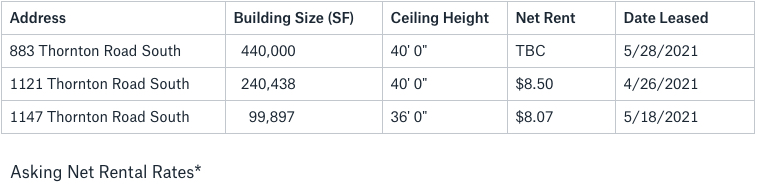

Properties Leased between April 2021 – June 2021, from 20,000 SF plus

In the Whitby sub-market, just 1 property was leased (33,383 SF) in Q2 2021. The net rental rate achieved was $8.50 PSF.

Properties Sold between April 2021 – June 2021, from 20,000 SF plus

Properties Leased between April 2021 – June 2021, from 20,000 SF plus

- Rental Rates: Currently, rental rates average $7.79 PSF in the GTA East, the lowest of all GTA submarkets; where all of the others are already in double-digits. We have already seen quite an increase in rental rates and land values in the East, with this trend poised to continue.

- Property Values: Property values, like rental rates, are considerably lower relative to the other GTA submarkets… but also increasing as investors and developers act on the opportunities and relative discount.

- Development Opportunities: We are seeing a lot more development than ever before. Big players such as Panattoni, Carttera, Crestpoint, Blackwood, PIRET, etc. (to name a few) are all involved… and it will continue.

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 29 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 29 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com