Q2 2021 Insight, Toronto-West Markets

Establishing True Valuations Across Differing Markets

August 13th, 2021

Suppose a vote were taken by all of the commercial real estate professionals in the Greater Toronto Area.

Which asset class would they likely agree is the most in demand right now? Chances are, they would be fighting over who could shout out “Industrial!” first.

Now, let’s suppose we asked them a follow-up question as to why that is the case. Again, we would probably hear testimony applauding the specific type of space whose use perfectly complements the needs of many burgeoning industry sectors. Let’s face it, companies such as Amazon, WalMart, GoodFood, Costco, Home Depot, and Lowe’s haven’t been doing so bad lately.

Once the praise and excitement wore off, however, we may hear the grumbles and undertones of frustration – or even, desperation – cut through the crowd. That’s because the supply of industrial properties throughout the GTA is tapped out almost immediately as any new supply is released to the market. In fact, most of this ‘new supply’ are simply renderings of state-of-the-art facilities to one day take the place of dozens of acres of dirt; pre-leasing becoming a standard vehicle for securing space.

Yet when truly examining the broader commercial real estate industry, the fact that industrial real estate is in its current position might seem baffling. Out of all the various property types, industrial is the definition of simplicity.

Four walls on a slab. Covered by a roof. That’s it.

Yes, there are many ways to elevate the features to another level – but – both its form and function are repeatable and predictable.

Which begs the question… why is product so scarce?

Now, we’ve been down this road many times before, but, needless to say, we are simply going through growing pains. The market can only grow so fast (no matter how quickly it would like to). And bottlenecks are occurring at almost every stage of the process, from servicing land to permitting, and constructing, and sourcing inputs such as labour and raw materials.

Opportunity will present itself, albeit sometimes in unexpected and unpredictable ways. Investors seeking to deploy capital will need to remain competitive. Meanwhile, Users in need of a new home should remain patient and persistent while not being discouraged by changing pricing. And Landlords or Owner-Occupiers considering selling will have most of the bargaining power, and thus, should find ways to maximize proceeds.

The past couple of years have been chock full of change. However, barring any significant unexpected events, we should expect industrial real estate to continue cruising on its current trajectory for the months and years to come.

Key Takeaways from Q2 2021

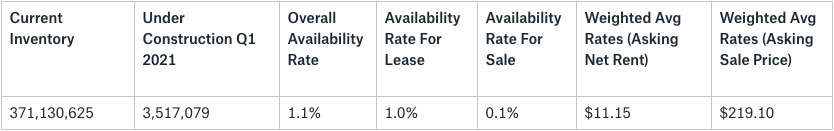

- The overall availability rate in the GTA-West Markets in Q2 2021 is 1.1%, down from 1.4% in Q1 2021;

- Currently, there is about 3,517,079 SF under construction in the GTA-West Markets;

- The GTA West markets delivered 1,607,413 SF of new space to the market in Q2 2021;

- Absorption in Q2 2021 was 1,643,375 SF;

- The City of Brampton achieved the highest net rental rates in Q2 2021 at $12.73 PSF, followed by the City of Oakville at $11.55 PSF and Mississauga at $11.37 PSF;

- The availability rate across the entire GTA is 1.1%, down from 1.5% in Q1 2021;

- The weighted average net rental rates in GTA West markets reached $11.15 per SF, up from $10.53 per SF in Q1 2021.

- Finally, the weighted average sale price in the West markets was $219.10 per SF in Q2 2021, down from $274.39 per SF in Q1 2021 and down from $253.48 per SF in Q4 2020.

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

This week we are covering the Toronto-West Markets (Mississauga, Brampton, Oakville, Milton, Caledon, Burlington & Halton Hills)

Statistical Summary – GTA West Markets – Q2 2021

So let’s take a closer look at how the different Toronto West Markets performed this quarter…

Properties Sold between April 2021 – June 2021, from 20,000 SF plus

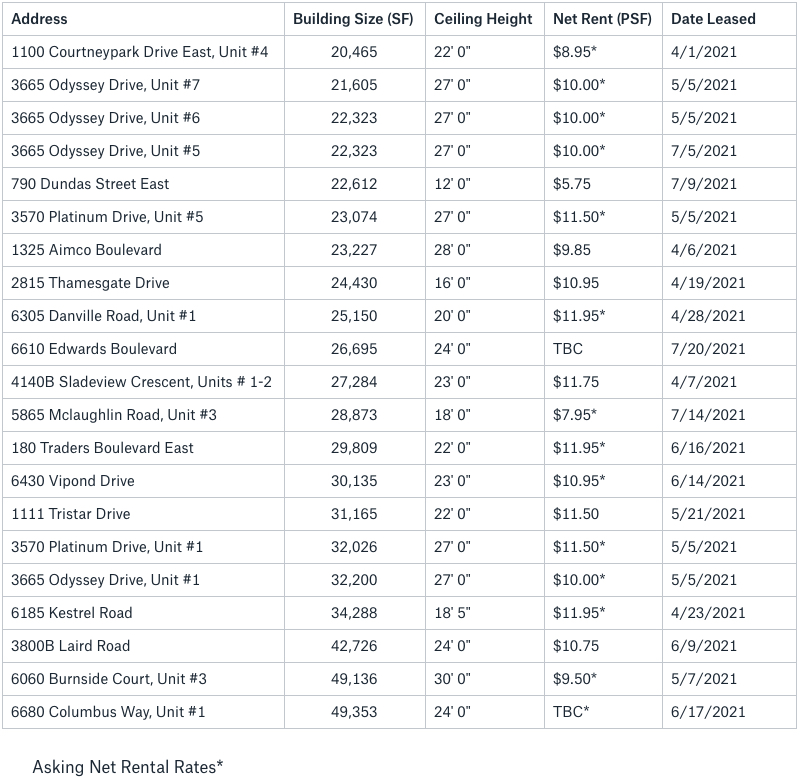

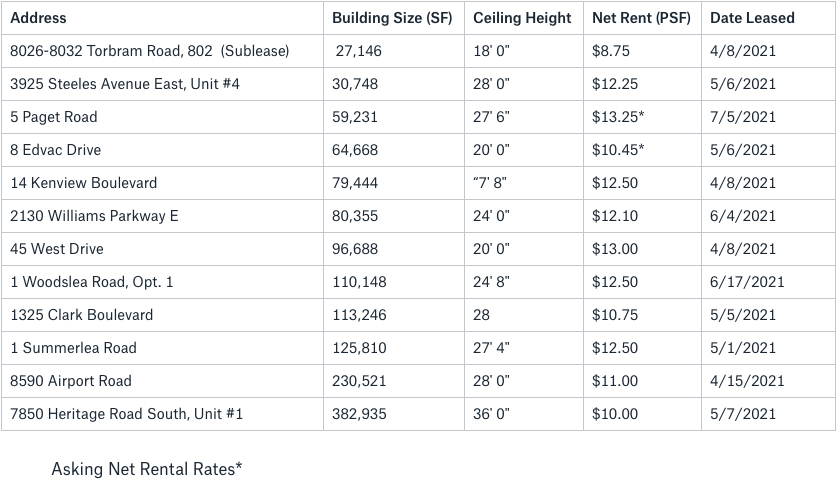

Properties Leased between April 2021 – June 2021, from 20,000 SF – 50,000 SF

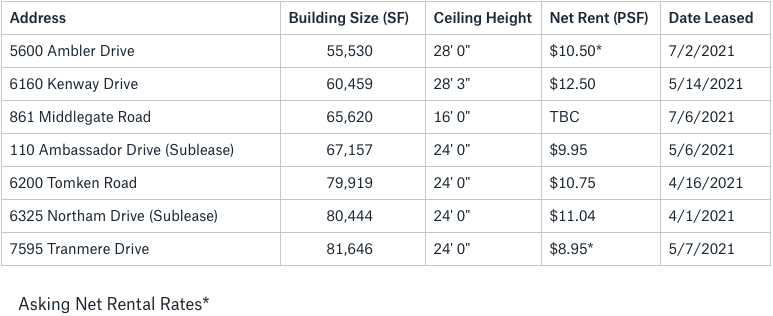

Properties Leased between April 2021 – June 2021, from 50,000 SF -100,000 SF

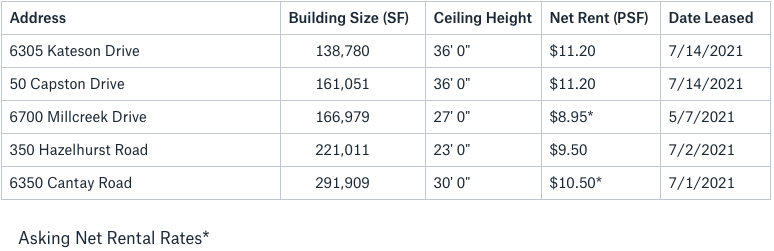

Properties Leased between April 2021 – June 2021, from 100,000 SF plus

Properties Sold between April 2021 – June 2021, from 20,000 SF plus

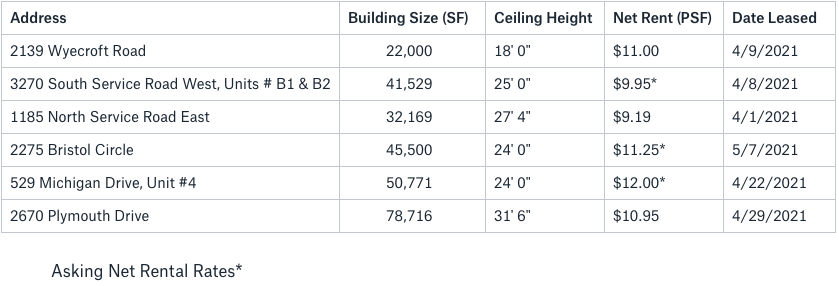

Properties Leased between April 2021 – June 2021, from 20,000 SF plus

A total of 12 properties 20,000 SF plus were leased in Brampton in Q2 2021. The net rental rates achieved were from $8.75 PSF – $13.25 PSF, with an average building size of 116,745 SF and an average net rental rate of $11.59 PSF.

Properties Sold between April 2021 – June 2021, from 20,000 SF plus

Properties Leased between April 2021 – June 2021, from 20,000 SF plus

In Burlington, a total of 6 properties were leased in Q2 2021 from 20,000 SF plus. The net rental rates achieved were from $5.28 PSF – $11.25 PSF, with an average building size of 57,230 SF and an average net rental rate of $9.25 PSF.

Properties Sold between April 2021 – June 2021, from 20,000 SF plus

Properties Leased between April 2021 – June 2021, from 20,000 SF plus

In Halton Hills/Milton, a total of 2 properties were leased in Q2 2021 from 20,000 SF plus. The net rental rates achieved were from $10.40 – $11.50 PSF, with an average building size of 88,670 SF and an average net rental rate of $10.95 PSF.

Properties Sold between April 2021 – June 2021, from 20,000 SF plus

Properties Leased between April 2021 – June 2021, from 20,000 SF plus

In Oakville, a total of 6 properties were leased in Q2 2021 from 20,000 SF plus. The net rental rates achieved were from $9.19 SF – $12.00 PSF, with an average building size of 77,339 SF and an average net rental rate of $10.72 PSF.

Properties Sold between April 2021 – June 2021, from 20,000 SF plus

Properties Leased between April 2021 – June 2021, from 20,000 SF plus

In Caledon, a total of 6 properties were leased in Q2 2021 from 20,000 SF plus. The net rental rates achieved were from $8.95 SF – $10.90 PSF, with an average building size of 103,218 SF and an average net rental rate of $10.08 PSF.

- Rental Rates: We see many transactions achieving in excess of $10 PSF net. We are also hearing that some of the current developments are increasing their price guidance to above $12 PSF net. That trend will continue.

- Property Values: With Oakville’s weighted average asking sale price at $320.47 PSF and Mississauga’s at $355.66… these submarkets lead the GTA-West markets. And with a sale availability rate of 0.1%, prices will appreciate further.

- Development Opportunities: In the second quarter of 2021, we had over 3.5 million square feet under construction in the GTA-West markets. This represents approximately 37% of all new development across the GTA (9.58 million SF), making this the most active region by far. This comes as no surprise as the West markets have the most land available for development.

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 29 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 29 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com