Q2 2023 Insight, Toronto-Central Markets

Establishing True Valuations Across Differing Markets

July 21st, 2023

“The stability we cannot find in the world, we must create in our own persons.”

- Nathaniel Branden

Finding one’s own stillness or tranquility is often mentioned by those seeking to understand how to deal with uncertain and chaotic periods of life.

This ritual can provide the space to think clearly, while removed from emotion, and helps us to process enormous amounts of information in order to try to find a path forward.

It is the foundational bedrock on which we stand to draw strength and courage to attack the day. For some, it is exercise or a hobby. For others, it may be their faith or family.

Whatever the case, returning to this baseline is a necessary practice when we all else has become unpredictable.

Seen through an economic lens, the “yin and yang” forces of price stability and unemployment are similarly critical, and are, in fact, the dual mandate of institutions such as the Federal Reserve. In practice, achieving a balance between them is what allows us to collectively pursue opportunities while not tripping up in the process.

The only downside is, reversing momentum can be a long and painful process. The tools often limited and with unexpected consequences. And the data to prove a successful policy change are backward-looking.

Zooming in on the GTA industrial market: Following the re-opening of the economy and systemic shift in consumer behaviour towards in e-commerce, we saw an unprecedented amount of opportunity in the industrial market as demand for warehousing and logistics space exploded. This phenomenon was generally extremely positive for the market as developers, investors, and businesses were able to partake in the upswing.

As a matter of circumstance, though, we also experienced the effects of shortages on labour, land, and materials. Whether as a result of, or contributor to, or a participant in the feedback loop that was created, the global economy saw record levels of inflation and moves by policymakers to control it through interest rate hikes.

At that time, stability was the core focus, and – now – we are beginning to see the convergence of these forces on the commercial real estate market.

Availabilities remain extremely low, despite an increase from historic lows. Pricing remains strong, despite the highest interest rates in decades. Inflated costs are being priced into both net and additional rents.

On the other hand, many businesses are pausing their growth plans or struggling to mitigate large rent increases upon renewals as well-capitalized corporates scoop up behemoth buildings. The buyer pool has thinned, while the top institutional and private investors holding on to record-levels of dry powder.

Overall, we see a duality throughout each asset class and stakeholder group of cutbacks and mega-moves. The GTA industrial market is still highly sought after, despite the added complexity in completing transactions. What may be said is, for those seeking to navigate the uncertainty, a certain level of stability and prudence are needed to cut through the noise, process the patterns, and uncover opportunities which do undoubtedly rise to the top each and every week.

So with that said, let’s examine how each of the Greater Toronto Area regions performed in Q2 2023, and where we expect the market to go moving forward.

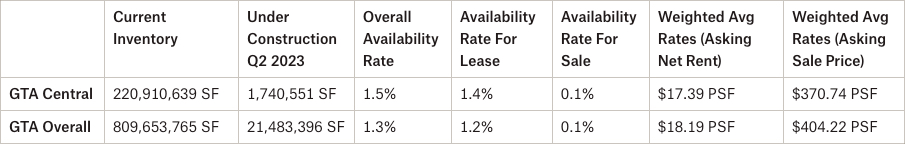

- The availability rate stayed flat at 1.5%, with a lease availability rate of 1.4% and a sale availability rate of 0.1%;

- We had 1,740,551 SF under construction;

- We had 196,860 SF of absorption;

- The weighted average asking net rent was $17.39 PSF, down slightly from $17.45 the previous quarter, with additional rent of $4.47 PSF (an increase from $4.33 PSF); and

- The weighted average asking sale price decreased from $420.38 PSF to $370.74 PSF.

Why are the GTA Central Markets in such demand?

Is it proximity to labour and a higher population density, and thus, a reduction in transportation cost? Or is it savings in development charges vs 905 areas, proximity to major transportation nodes, highways, public transportation, etc?… Or all of the above?

Well, one thing is for certain, the Toronto-Central Markets are highly sought-after by both Investors and Occupiers of commercial real estate and is an environment worth exploring for opportunities.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

This week we are covering the Toronto Central Markets (Toronto, North York, Etobicoke & Scarborough)

Statistical Summary – GTA Central Markets – Q2 2023

Q2 2023 GTA Industrial Market Overview – Source: Cushman & Wakefield

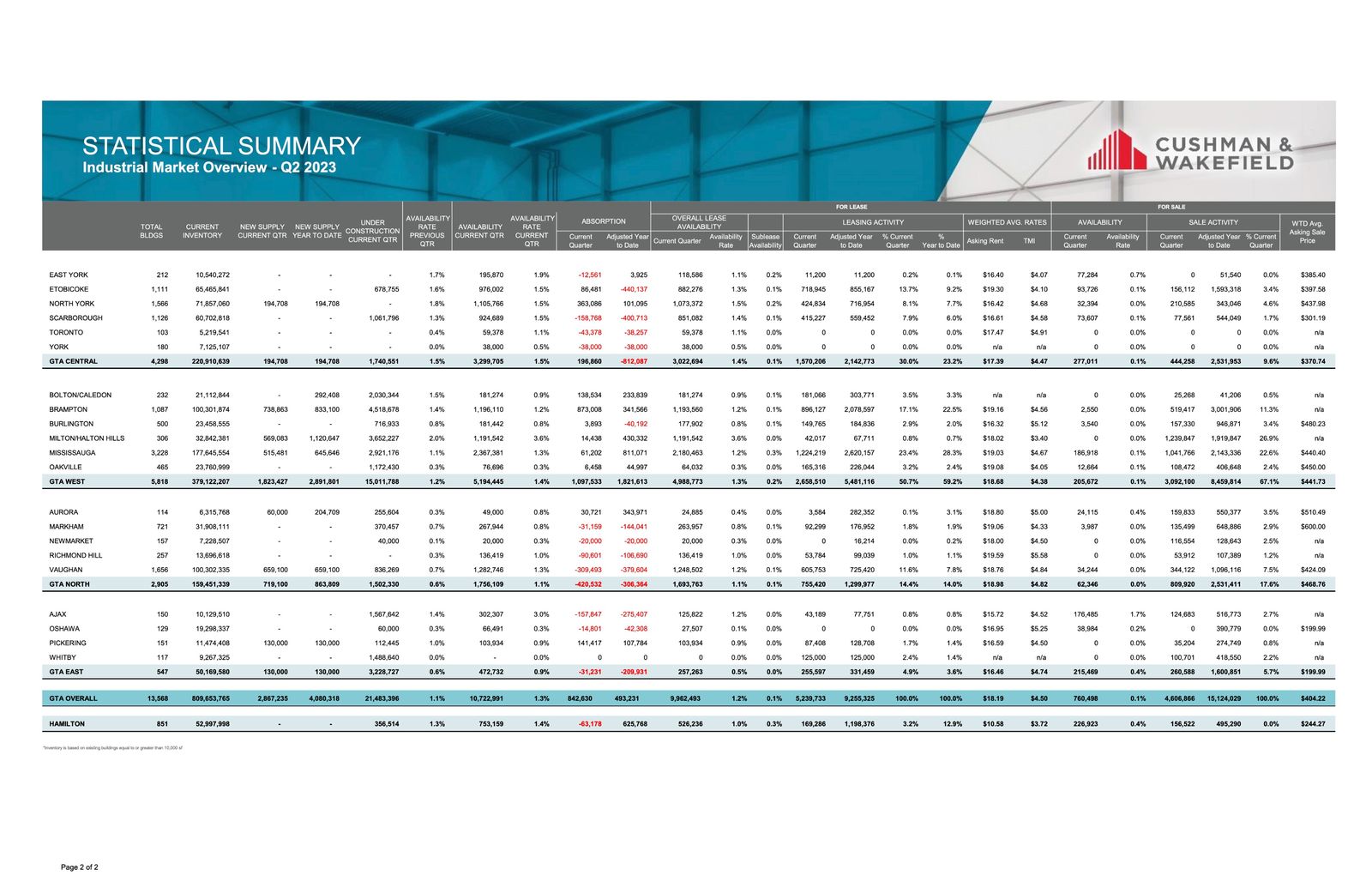

Q2 2023, Industrial Market Overview – Source: Cushman & Wakefield

GTA Central Markets (Scarborough)

Properties Sold between April 2023 – June 2023, from 20,000 SF plus

1145 – 1149 Bellamy Road, Scarborough

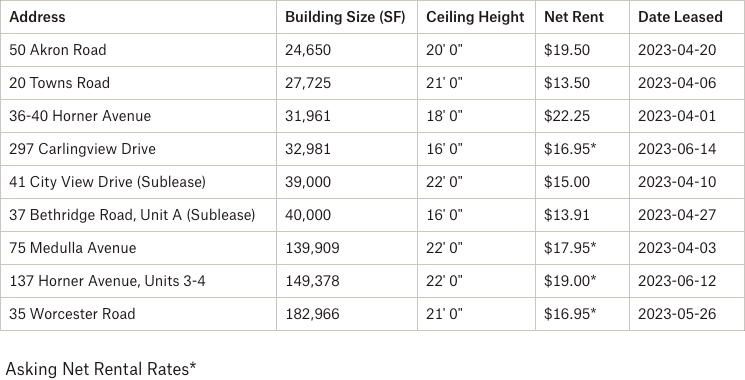

Properties Leased between April 2023 – June 2023, from 20,000 SF plus

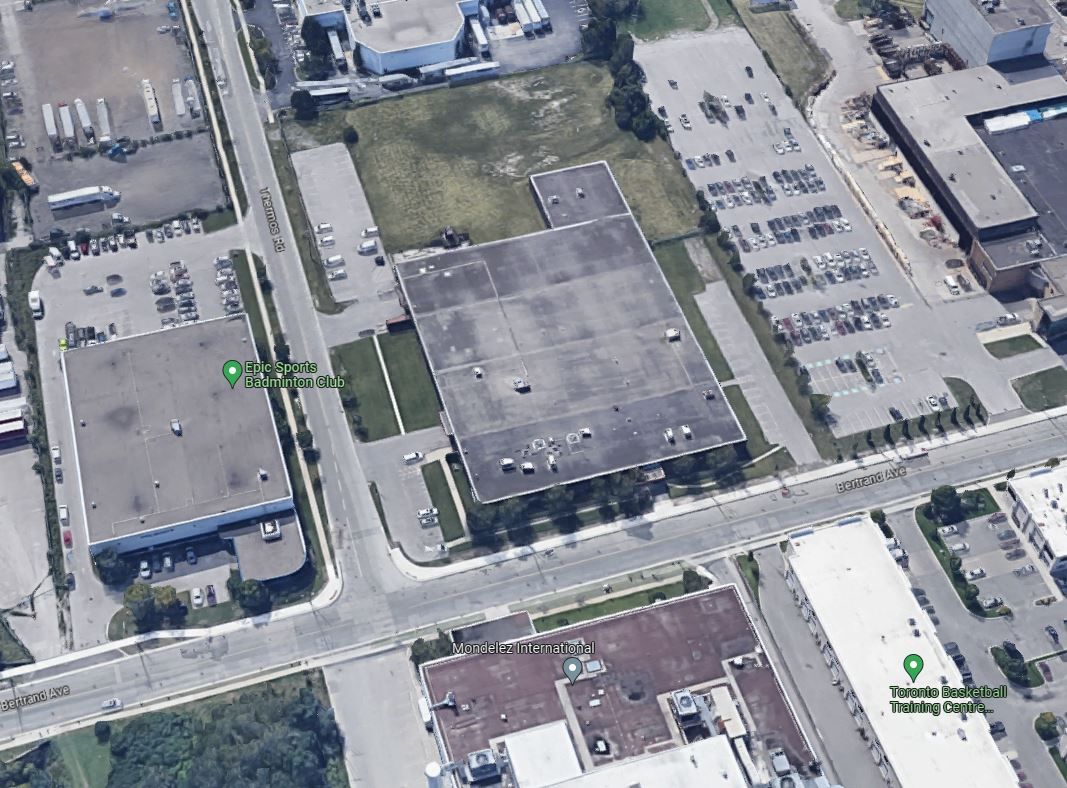

35 Bertrand Avenue, Scarborough

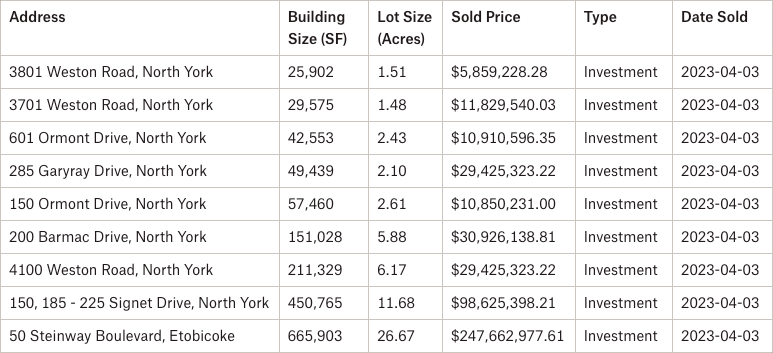

Properties Sold between April 2023 – June 2023, from 20,000 SF plus

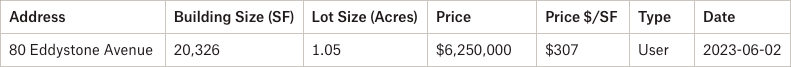

80 Eddystone Avenue, North York

Properties Leased between April 2023 – June 2023, from 20,000 SF plus

2243 Sheppard Avenue West, North York

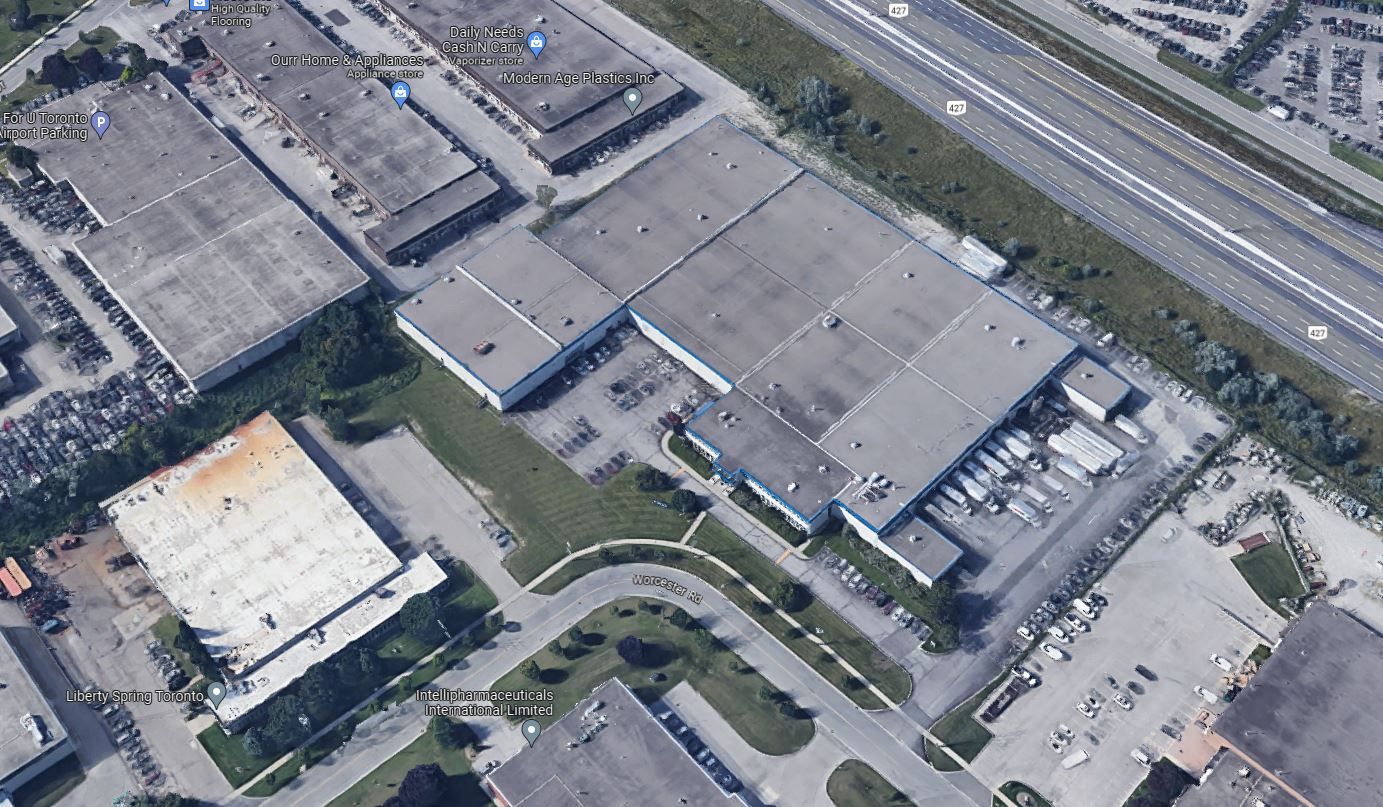

1040 Martin Grove Road, Etobicoke

Properties Leased between April 2023 – June 2023, from 20,000 SF plus

35 Worcester Road, Etobicoke

Portfolio Sale

- Rental Rates: We continue to see a general upward pressure across the board into the high-teens – and even low-twenties – PSF net, depending on a number of factors, such as building size, location, ceiling height, etc. Based on the increase of value of industrial land, infill sites, construction costs, etc… we will see these rates continuing to grow. Overall, we are still in a Landlord’s market. Although sales pricing has been impacted by interest rates and despite a modest increase in availabilities, finding industrial space remains challenging – and – constructing it is expensive. As such, rents will remain elevated and increasing, albeit at a slower pace. Lastly, these higher construction and maintenance costs may be passed through in the form of stronger additional rents (TMI).

- Property Values: We have seen a decrease in value in some properties that have been taken to the market at new watermark values. That said, depending on the building size and location, and especially for Class A, well-located space, pricing shall remain strong. Given the most recent increases in interest rates, we will see a continued impact on CAP rates.

- Development Opportunities: Looking across the Toronto-Central markets, there is still great interest from developers to purchase infill sites and redevelop older and obsolete industrial buildings to newer, modern distribution centres, as well as industrial condos. Given its central location and proximity to major highways and labour, larger industrial sites in the Toronto-Central markets will continue to be in great demand.

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com