Q3 2021 Insight, Toronto-Central Markets

Establishing True Valuations Across Differing Markets

November 5th, 2021

“Only when the tide goes out do you discover who’s been swimming naked.”

- Warren Buffett

In good times, we are faced with an abundance of opportunities to grow and prosper. In the context of commercial real estate, this could mean investing in facilities for our operations, developing land to construct new buildings, or acquiring and leasing out properties.

Savvy investors and business operators always perform due diligence throughout the decision- and deal-making processes. However, in a strong and active market, there is relatively less uncertainty, and thus, less risk. Making moves is much more straightforward as there are more options to consider, with outcomes easier to predict and to forecast.

As we head towards winter, we find ourselves in a position fraught with question marks. Assumptions are being questioned and redefined. The underlying industrial market in the GTA is in an extreme imbalance, with many players chasing scarce inventory of land and properties. As a result, pricing is at all-time highs. And once secured, these assets are subject to economic forces, which themselves are far from normal.

Labour and material shortages (and cost inflation) continue to plague developers, who are working to orchestrate and time the construction process as they apply for permits and zoning – which have also been delayed. Industrial occupiers also feel the pinch as their leases renew or they look to expand. Nothing is guaranteed. And success comes at a premium.

Those who planned well in advance are reaping the rewards of having assets in place or the capacity to take on new business and more projects. Those who moved in reaction – or who were slow to adapt – are looking for new strategies to position themselves for the future.

Patience and readiness have become virtues for the modern GTA CRE professional. The patience to wait for opportunities. And the readiness to act upon them.

The current state will only continue to grow more competitive, with product harder to find.

Key Takeaways from Q3 2021 – Toronto Central Markets

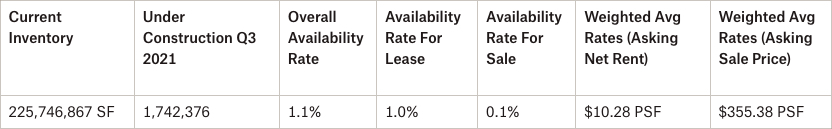

- The availability rate decreased from 1.3% to 1.1%, with a lease availability rate of 1.0% and a sale availability rate of 0.1%;

- We had 1,742,376 SF under construction;

- We had 464,875 SF of absorption;

- The weighted average asking net rent was $10.28 PSF, down from $10.75 the previous quarter, with additional rent of $3.72 PSF; and

- The weighted average asking sale price was $355.38 PSF.

Why are the GTA Central Markets in such demand?

Is it proximity to labour and a higher population density, and thus, a reduction in transportation cost? Or is it savings in development charges vs 905 areas, proximity to major transportation nodes, highways, public transportation, etc?… Or all of the above?

Well, one thing is for certain, the Toronto-Central Markets are highly sought-after by both Investors and Occupiers of commercial real estate and is an environment worth exploring for opportunities.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

This week we are covering the Toronto Central Markets (Toronto, North York, Etobicoke & Scarborough)

Statistical Summary – GTA Central Markets – Q3 2021

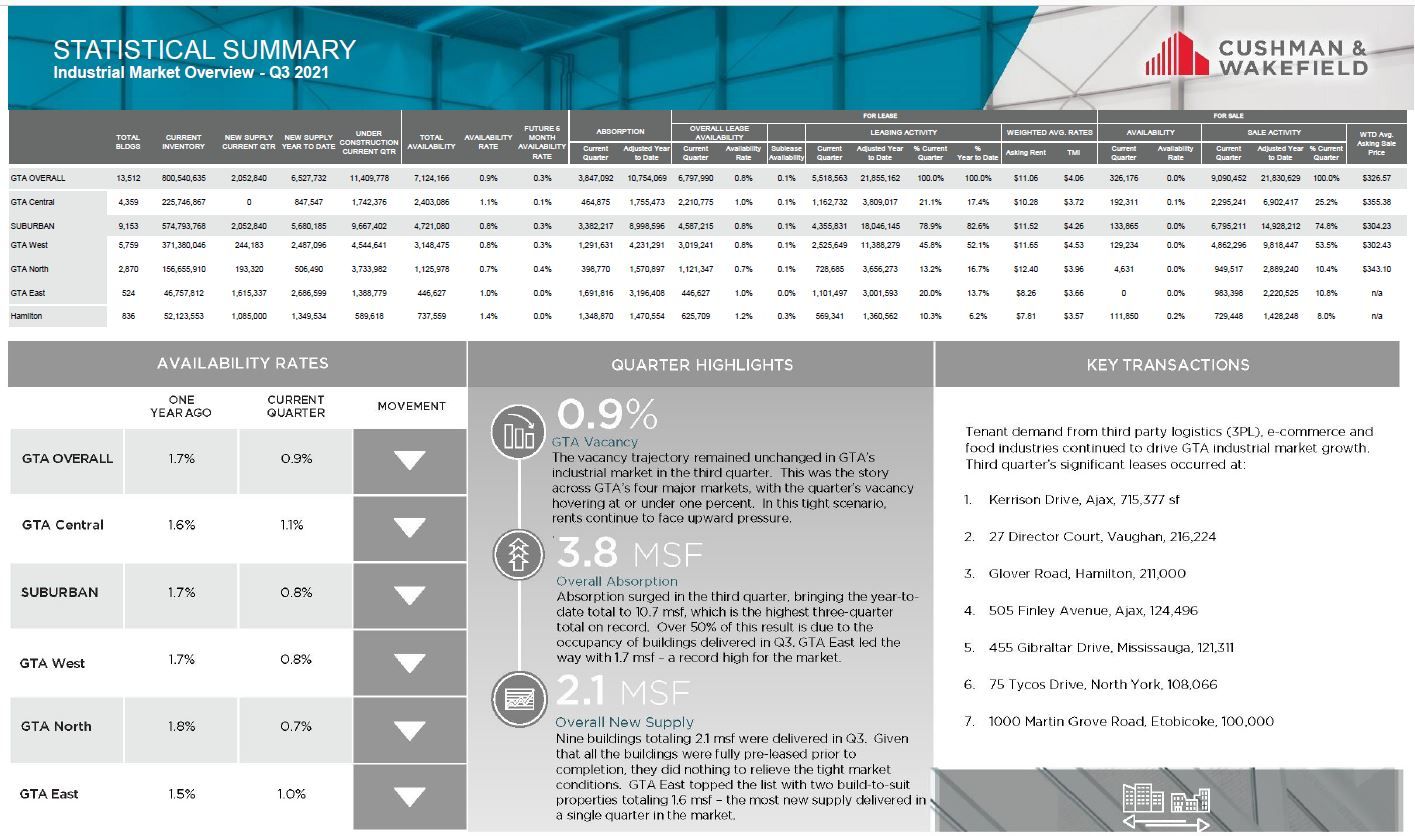

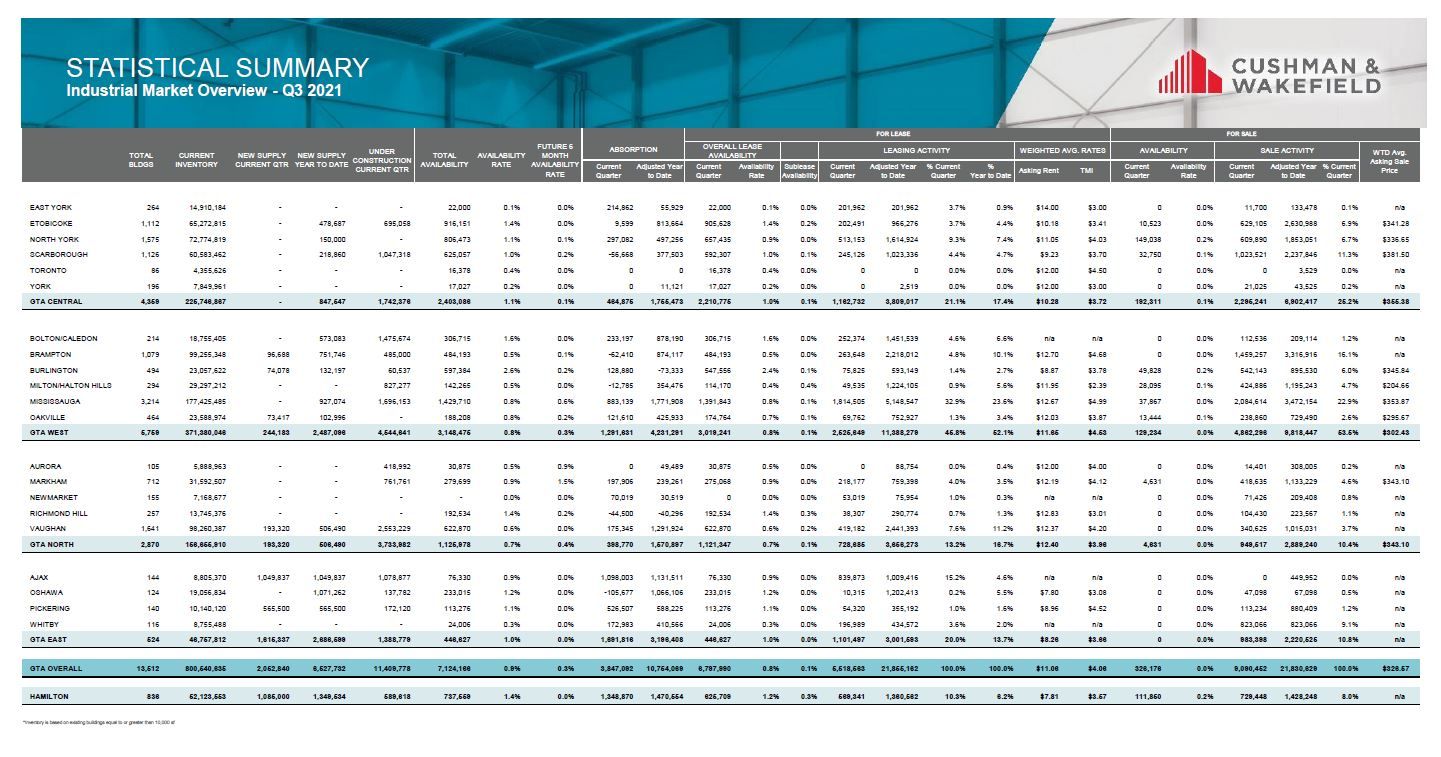

Q3 2021 GTA Industrial Market Overview – Source: Cushman & Wakefield

Q3 2021, Industrial Market Overview – Source: Cushman & Wakefield

GTA Central Markets (Toronto)

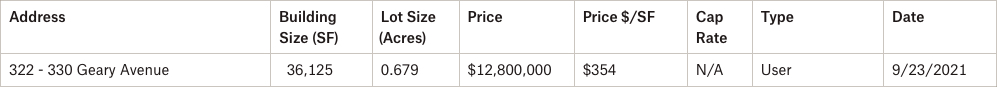

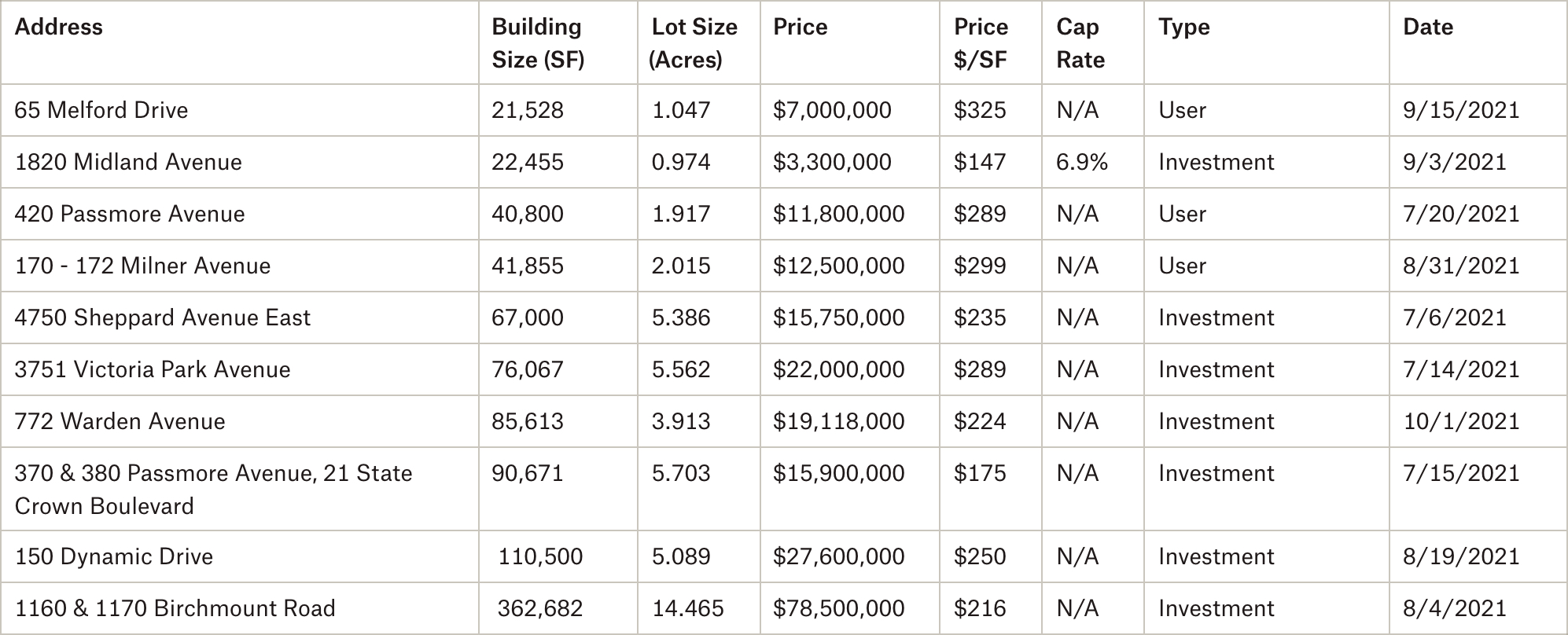

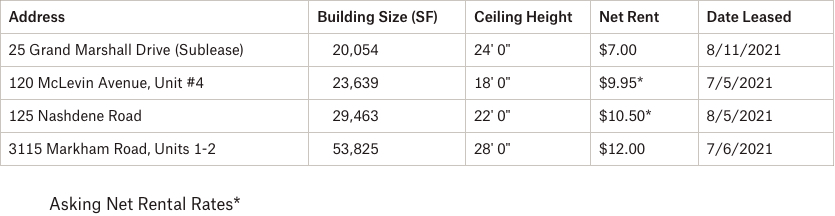

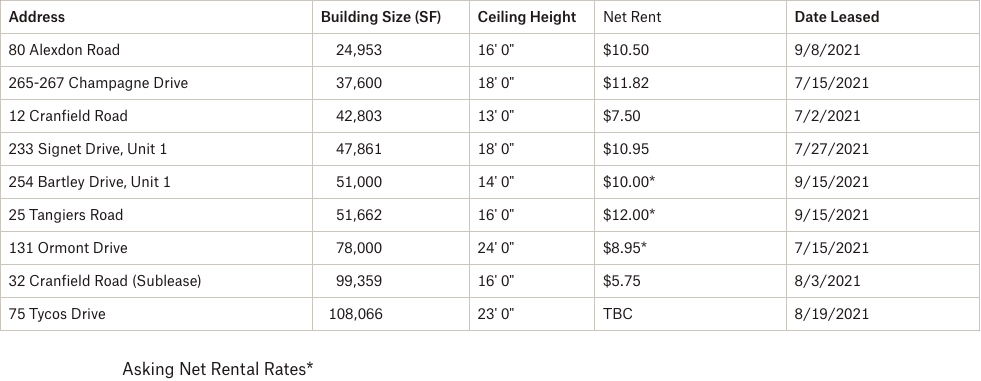

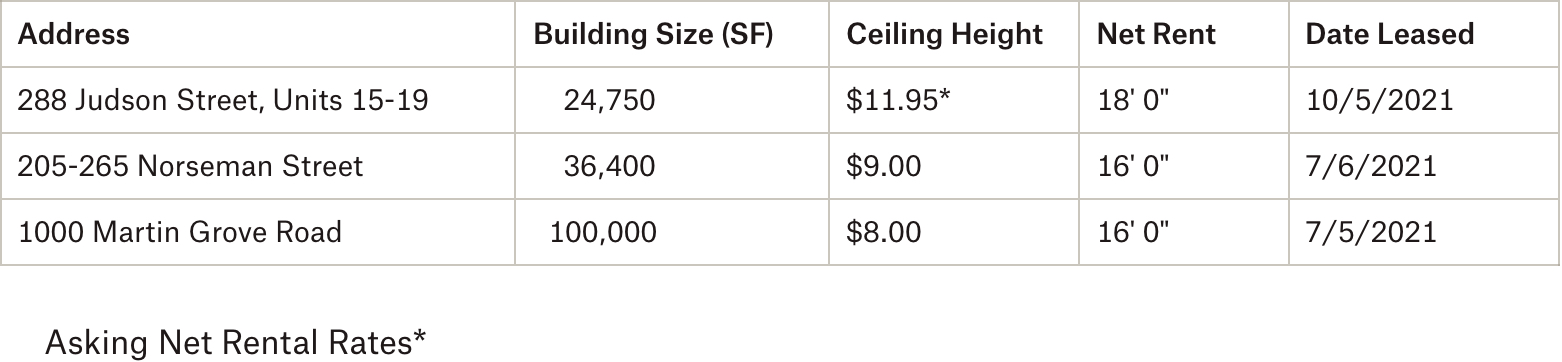

Properties Sold between July 2021 – September 2021, from 20,000 SF plus

Properties Leased between July 2021 – September 2021, from 20,000 SF plus

Properties Sold between July 2021 – September 2021, from 20,000 SF plus

Properties Leased between July 2021 – September 2021, from 20,000 SF plus

Properties Sold between July 2021 – September 2021, from 20,000 SF plus

Properties Leased between July 2021 – September 2021, from 20,000 SF plus

Properties Sold between July 2021 – September 2021, from 20,000 SF plus

Properties Leased between July 2021 – September 2021, from 20,000 SF plus

1000 Martin Grove Road, Etobicoke

- Rental Rates: Despite a reported stabilization of net rental rates for deals completed in Q3 2021, we continue to see a general upward pressure across the board into double-digit territory, depending on a number of factors, such as building size, location, ceiling height, etc. Based on the increase of value of industrial land, infill sites, construction costs, etc… we can only see these rates continue to grow. Overall, we are still in a Landlord’s market.

- Property Values: Values continue to increase, depending on the building size and location. We see pricing going as far north as $400 PSF, and more. CAP rates are still somewhere between 4.5% to 4.75% but it really depends on the rental rates in place. If we have older rental rates with immediate growth potential, then CAP rates could end up below 4%.

- Development Opportunities: Looking across the Toronto-Central markets, there is still great interest from developers to purchase infill sites and redevelop older and obsolete industrial buildings to newer, modern distribution centres. Given its central location and proximity to major highways and labour, larger industrial sites in the Toronto-Central markets will continue to be in great demand.

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 29 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 29 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com