Q3 2021 Insight, Toronto-West Markets

Establishing True Valuations Across Differing Markets

November 26th, 2021

“Only when the tide goes out do you discover who’s been swimming naked.”

- Warren Buffett

In good times, we are faced with an abundance of opportunities to grow and prosper. In the context of commercial real estate, this could mean investing in facilities for our operations, developing land to construct new buildings, or acquiring and leasing out properties.

Savvy investors and business operators always perform due diligence throughout the decision- and deal-making processes. However, in a strong and active market, there is relatively less uncertainty, and thus, less risk. Making moves is much more straightforward as there are more options to consider, with outcomes easier to predict and to forecast.

As we head towards winter, we find ourselves in a position fraught with question marks. Assumptions are being questioned and redefined. The underlying industrial market in the GTA is in an extreme imbalance, with many players chasing scarce inventory of land and properties. As a result, pricing is at all-time highs. And once secured, these assets are subject to economic forces, which themselves are far from normal.

Labour and material shortages (and cost inflation) continue to plague developers, who are working to orchestrate and time the construction process as they apply for permits and zoning – which have also been delayed. Industrial occupiers also feel the pinch as their leases renew or they look to expand. Nothing is guaranteed. And success comes at a premium.

Those who planned well in advance are reaping the rewards of having assets in place or the capacity to take on new business and more projects. Those who moved in reaction – or who were slow to adapt – are looking for new strategies to position themselves for the future.

Patience and readiness have become virtues for the modern GTA CRE professional. The patience to wait for opportunities. And the readiness to act upon them.

The current state will only continue to grow more competitive, with product harder to find.

Key Takeaways from Q3 2021 – Toronto West Markets

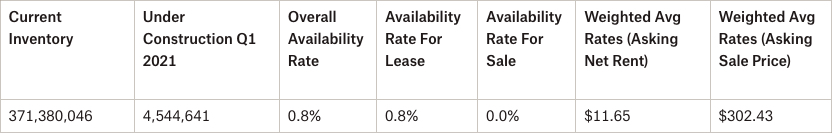

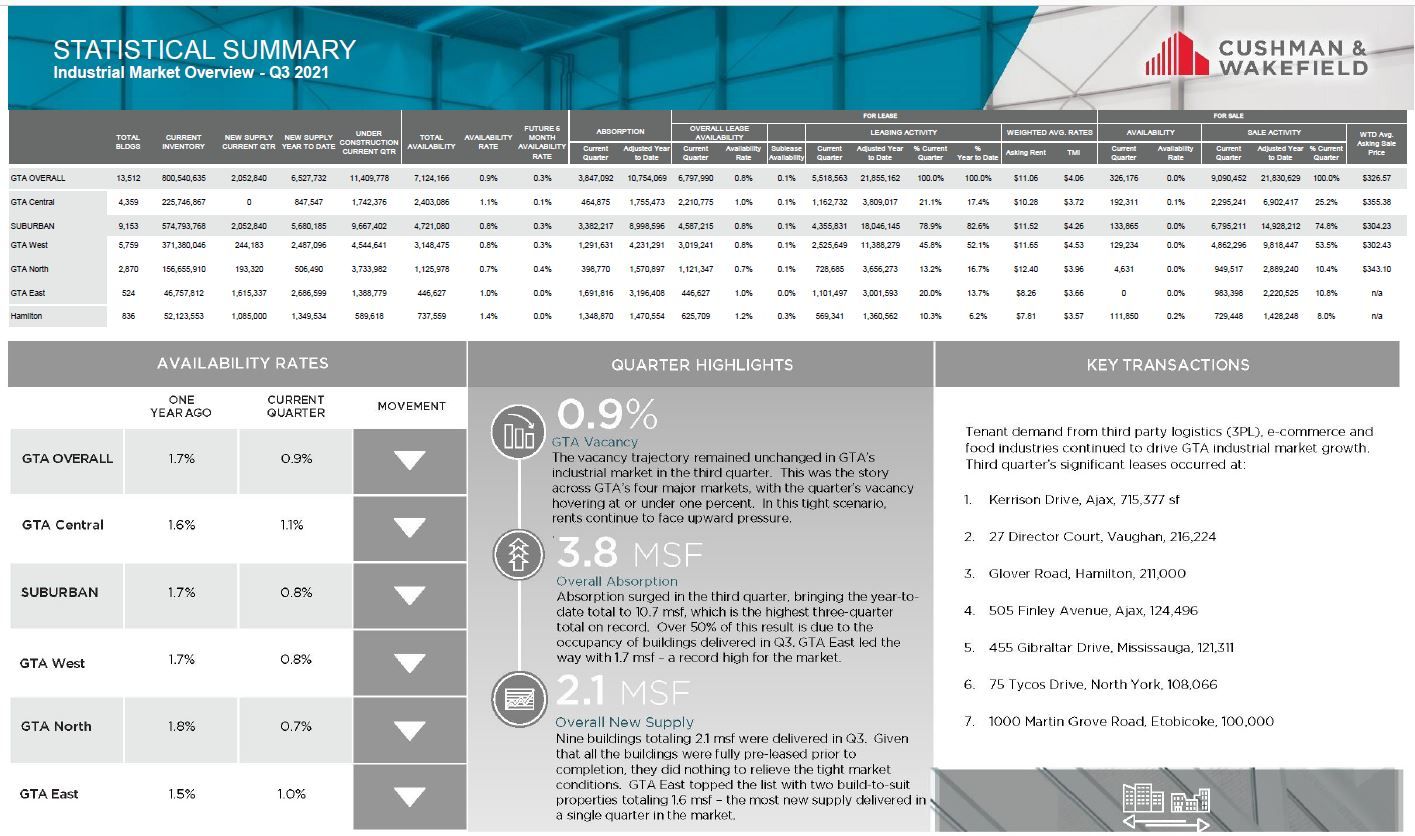

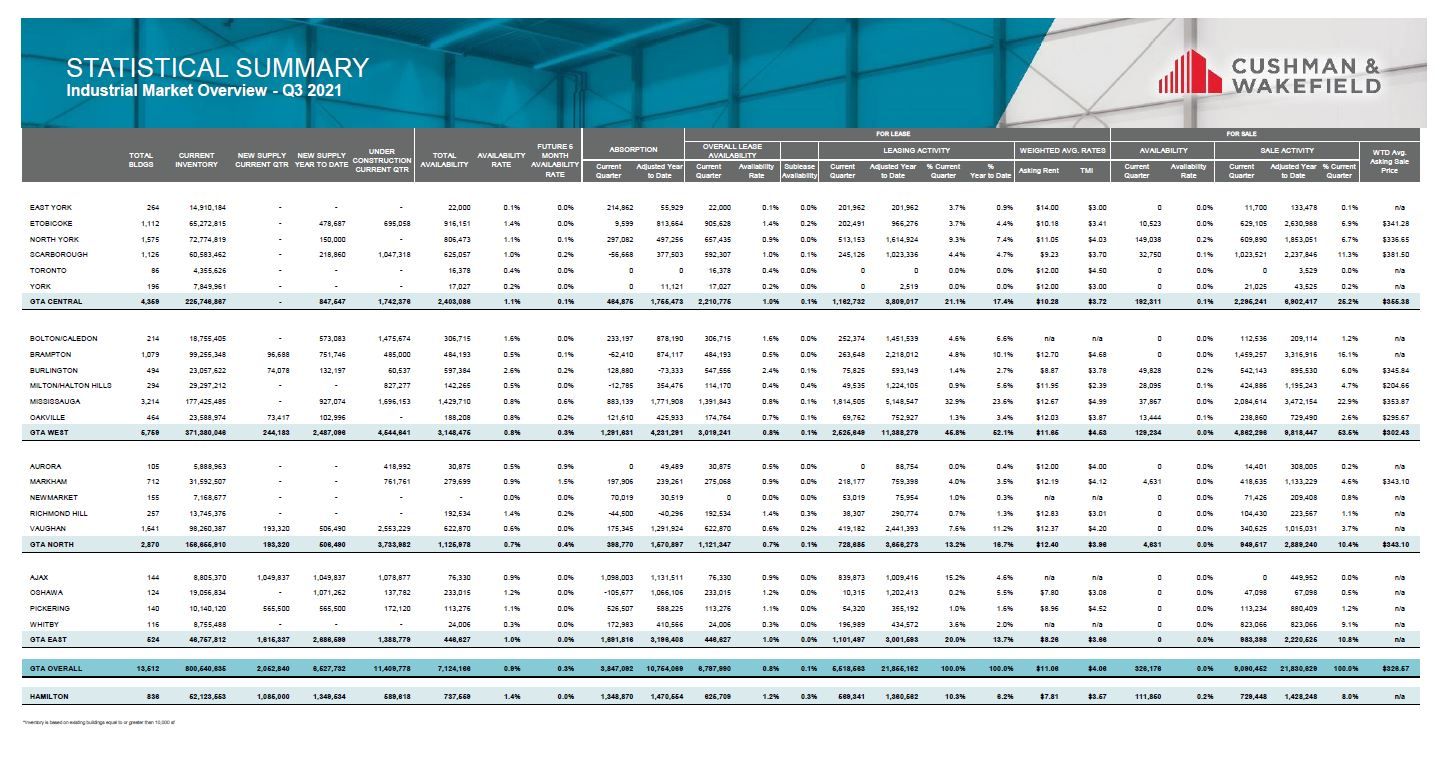

- The availability rate decreased from 1.1% to 0.8%, with a lease availability rate of 0.8% and a sale availability rate close to 0% (129,234 SF out of 371M SF of inventory);

- We had 244,183 SF of construction completed and 4,544,641 SF still under construction;

- We had absorption of 1,291,631 SF;

- The City of Brampton achieved the highest net rental rates in Q3 2021 at $12.70 PSF, followed by the City of Mississauga at $12.67 PSF and Oakville at $12.03 PSF;

- The availability rate across the entire GTA is 0.9%, down from 1.1% in Q2 2021;

- The weighted average asking net rent increased from $11.15 to $11.65 PSF with additional rent of $4.53 PSF; and the

- Weighted average asking sale price was $302.43 PSF, although there is almost no existing inventory.

Why are the GTA West Markets in such demand?

The GTA West Industrial Markets are by far the largest industrial markets in the GTA, representing about 45% of GTA Industrial Inventory, or about 371,000,000 SF. The GTA West Markets were very active this quarter, with more than 4,544,641 SF under construction and a flurry of lease and sale transactions completed.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

This week we are covering the Toronto-West Markets

(Mississauga, Brampton, Oakville, Milton, Caledon, Burlington & Halton Hills)

Statistical Summary – GTA West Markets – Q3 2021

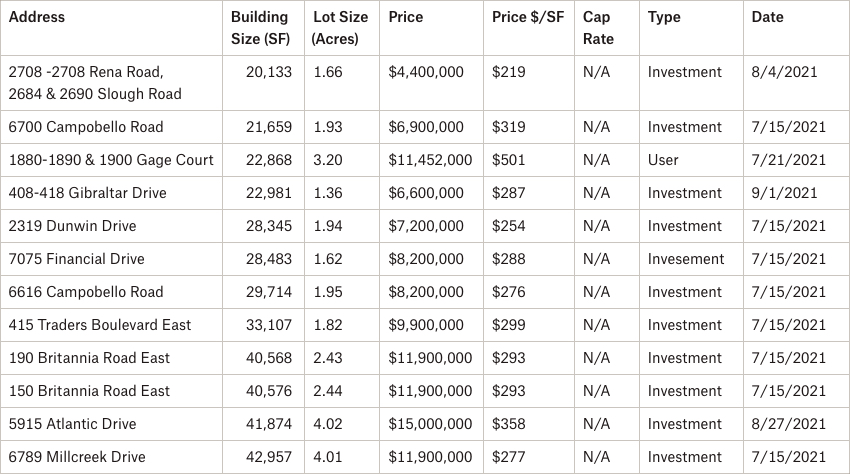

Properties Sold between July 2021 – September 2021, from 20,000 SF – 50,000 SF

6789 Millcreek Dr, Mississauga

Properties Sold between July 2021 – September 2021, from 50,000 SF plus

7400 – 7420 Bramalea Road, Mississauga

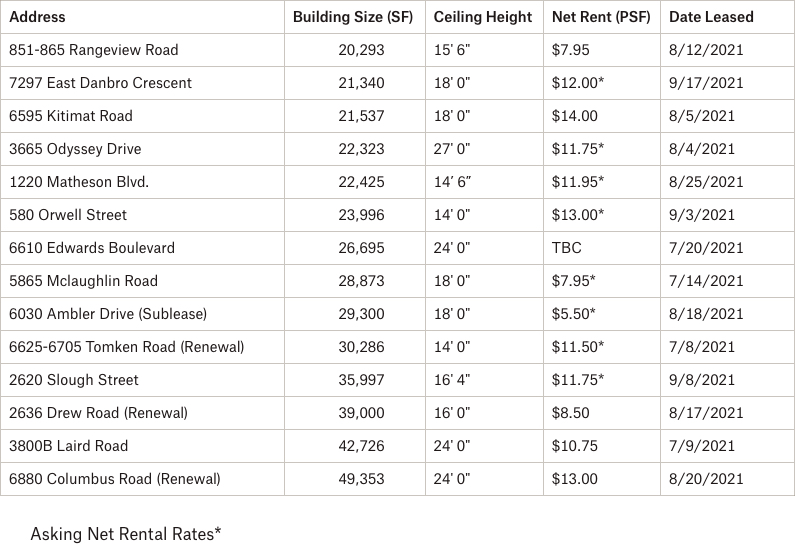

Properties Leased between July 2021 – September 2021, from 20,000 SF – 50,000SF

3800B Laird Road, Mississauga

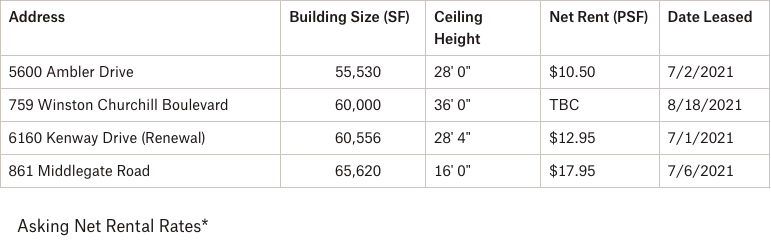

Properties Leased between July 2021 – September 2021, from 50,000 SF – 100,000SF

861 Middlegate Rd, Mississauga

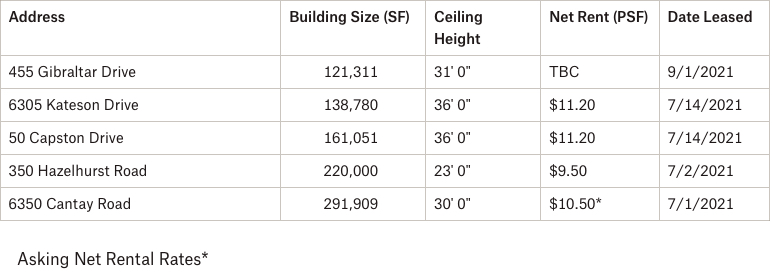

Properties Leased between July 2021 – September 2021, from 100,000 SF plus

6350 Cantay Road, Mississauga

Properties Sold between July 2021 – September 2021, from 20,000 SF plus

175-201 Westcreek Boulevard, Brampton

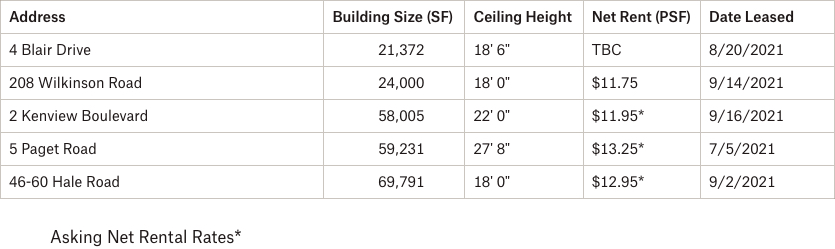

Properties Leased between July 2021 – September 2021, from 20,000 SF plus

46-60 Hale Road, Brampton

3100 Mainway, Burlington

Properties Leased between July 2021 – September 2021, from 20,000 SF plus

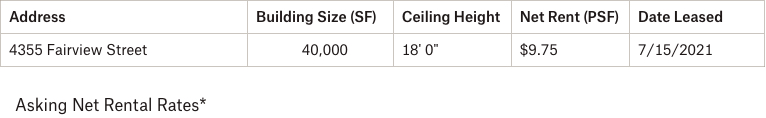

4355 Fairview Street, Burlington

Properties Sold between July 2021 – September 2021, from 20,000 SF plus

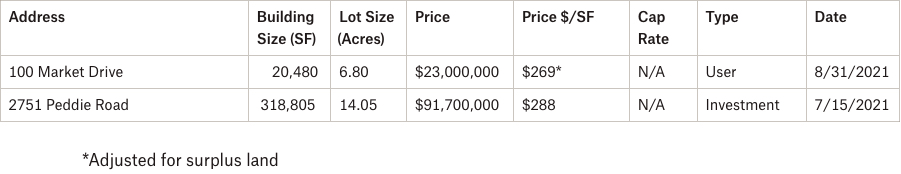

2751 Peddie Road, Milton

Properties Leased between July 2021 – September 2021, from 20,000 SF plus

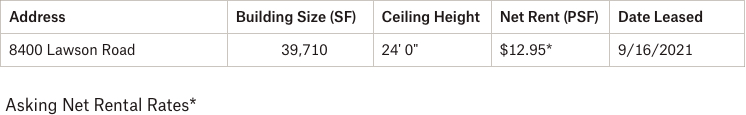

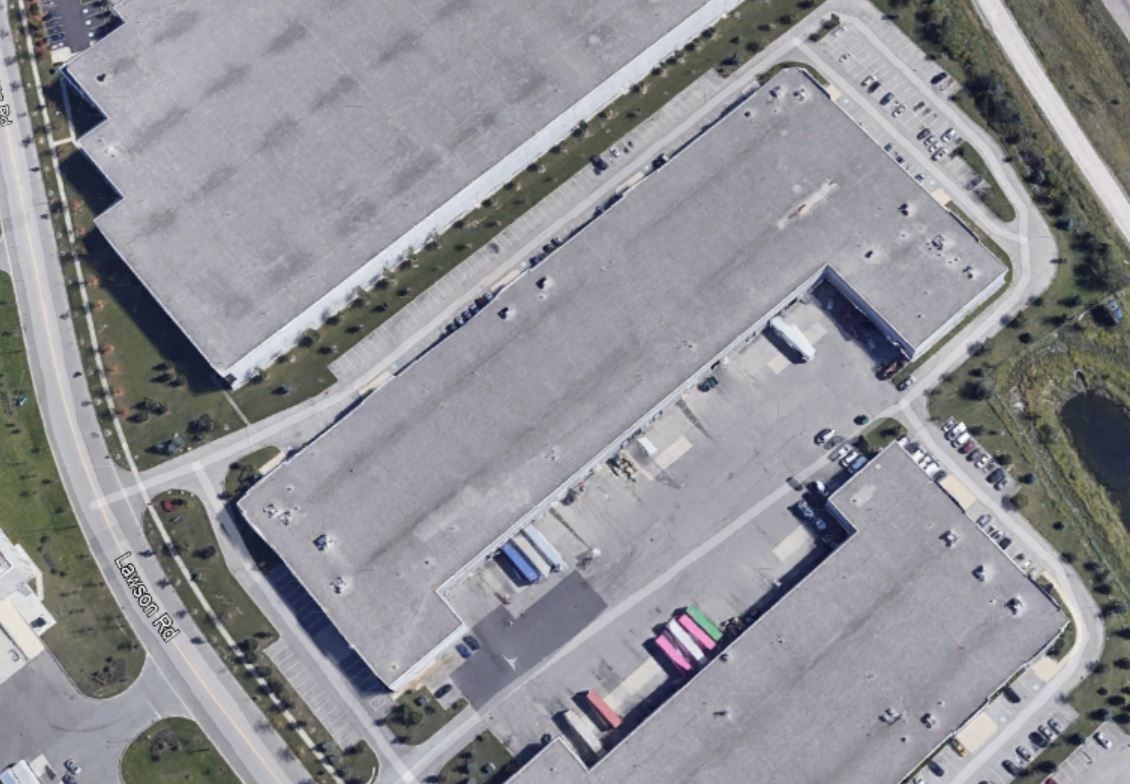

8400 Lawson Road, Milton

Properties Sold between July 2021 – September 2021, from 20,000 SF plus

760 Pacific Road, Oakville

Properties Leased between July 2021 – September 2021, from 20,000 SF plus

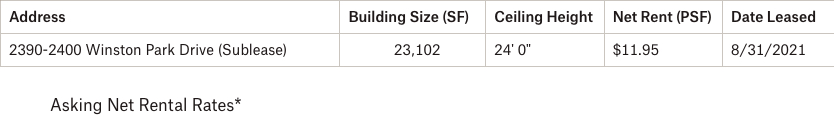

2390-2400 Winston Park Drive, Oakville

Properties Sold between July 2021 – September 2021, from 20,000 SF plus

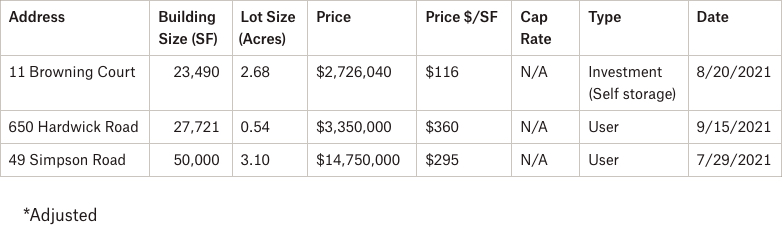

49 Simpson Road, Caledon

Properties Leased between July 2021 – September 2021, from 20,000 SF plus

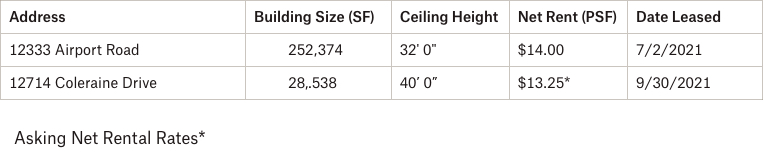

12333 Airport Road, Caledon

- Rental Rates: We see many transactions achieving in excess of $12 PSF net. We are also hearing that some of the current developments are increasing their price guidance to above $14 PSF net. That trend will continue.

- Property Values: With Mississauga’s weighted average asking sale price at $353.87 PSF and Burlington’s at $345.84… these submarkets lead the GTA-West markets. And with a sale availability rate of close to 0% – or just 129,234 SF for sale out of 371M of inventory – prices will appreciate further.

- Development Opportunities: In the third quarter of 2021, we had over 4.5 million square feet under construction in the GTA-West markets. This represents approximately 39% of all new development across the GTA (11.4 million SF), making this the most active region by far. This comes as no surprise as the West markets have the most land available for development.

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 29 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 29 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com