Q3 2022 Insight, Toronto-West Markets

Establishing True Valuations Across Differing Markets

November 11th, 2022

Winter is coming.

As the long summer of near-zero rates, limitless demand, and unbounded growth taper off into a new reality, we find ourselves in a remarkable period of transition.

Although the industrial (and broader commercial real estate) market remains healthy in terms of sales volume, new construction, and red-hot demand for space, a structural shift has already begun to take place.

Decision makers, in larger and larger numbers (and with more boldness), are beginning to question the economic fundamentals underlying the industrial market as a whole; even if only in private, for now.

Rising costs remain the biggest question on everyone’s minds – from construction, materials, and labour to borrowing, operating, purchasing, and leasing.

The second-most contemplated item is how will investors continue to extract yields or how will users be able to adapt to rising rents as each line item slowly creeps into margins.

The past decade saw a degree of certainty within the market whereby users could lock in reasonable rates for a period of 10 years or more. Meanwhile, investors were assured of their returns as values seriously lagged behind other global markets, providing ample runway and a buffer should any mistakes be made.

Now, however, all of these forces are beginning to converge, which have raised many questions.

How rich will the buyer pool be when selling assets?

How many tenants, aside from the AAA-covenant corporates, will be lining up to scoop up new space?

How will owners of smaller facilities deal with renewals when tenants are faced with a doubling or tripling of their rents while having few alternative options for relocation?

Overall, each stakeholder in the market is becoming more cautious and calculated as the general landscape brings forward more risk. How they negotiate and come to terms to make things work will largely dictate the success of the broader market moving forward. To what degree, and when, we see a recession finally play out remains to be seen. However, the fact remains that working together to get deals done in tougher economic climates is a critical mantra looking forward.

In the meantime, we observe a market continuing to charge forward, albeit much more carefully. Opportunity still abounds, however, strategy and timing will largely determine how successful each venture will be.

So with that said, let’s examine how each of the Greater Toronto Area regions performed in Q3 2022, and where we expect the market to go moving forward.

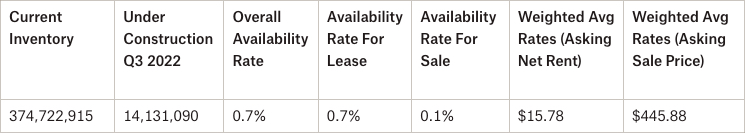

Key Takeaways from Q3 2022 – Toronto West Markets

- The availability rate was 0.7%, with a lease availability rate of 0.7% and a sale availability rate of 0.1%;

- We had 555,081 SF of construction completed and 14,131,090 SF still under construction;

- We had absorption of 721,043 SF;

- Milton/Halton Hills achieved the highest weighted asking net rental rates in Q3 2022 at $19.39 PSF, followed by Mississauga at $16.45 PSF and Brampton at $16.02 PSF;

- The weighted average asking net rent increased from $15.35 to $15.78 PSF with additional rent of $4.62 PSF; and the

- Weighted average asking sale price increased from $417.05 PSF in Q2 2022 to $445.88 in Q3 2022.

Why are the GTA West Markets in such demand?

The GTA West Industrial Markets are by far the largest industrial markets in the GTA, representing about 46.5% of GTA Industrial Inventory, or about 374,722,915 SF. The GTA West Markets were very active this quarter, with more than 14,131,090 SF under construction and a flurry of lease and sale transactions completed.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

This week we are covering the Toronto-West Markets

(Mississauga, Brampton, Oakville, Milton, Caledon, Burlington & Halton Hills)

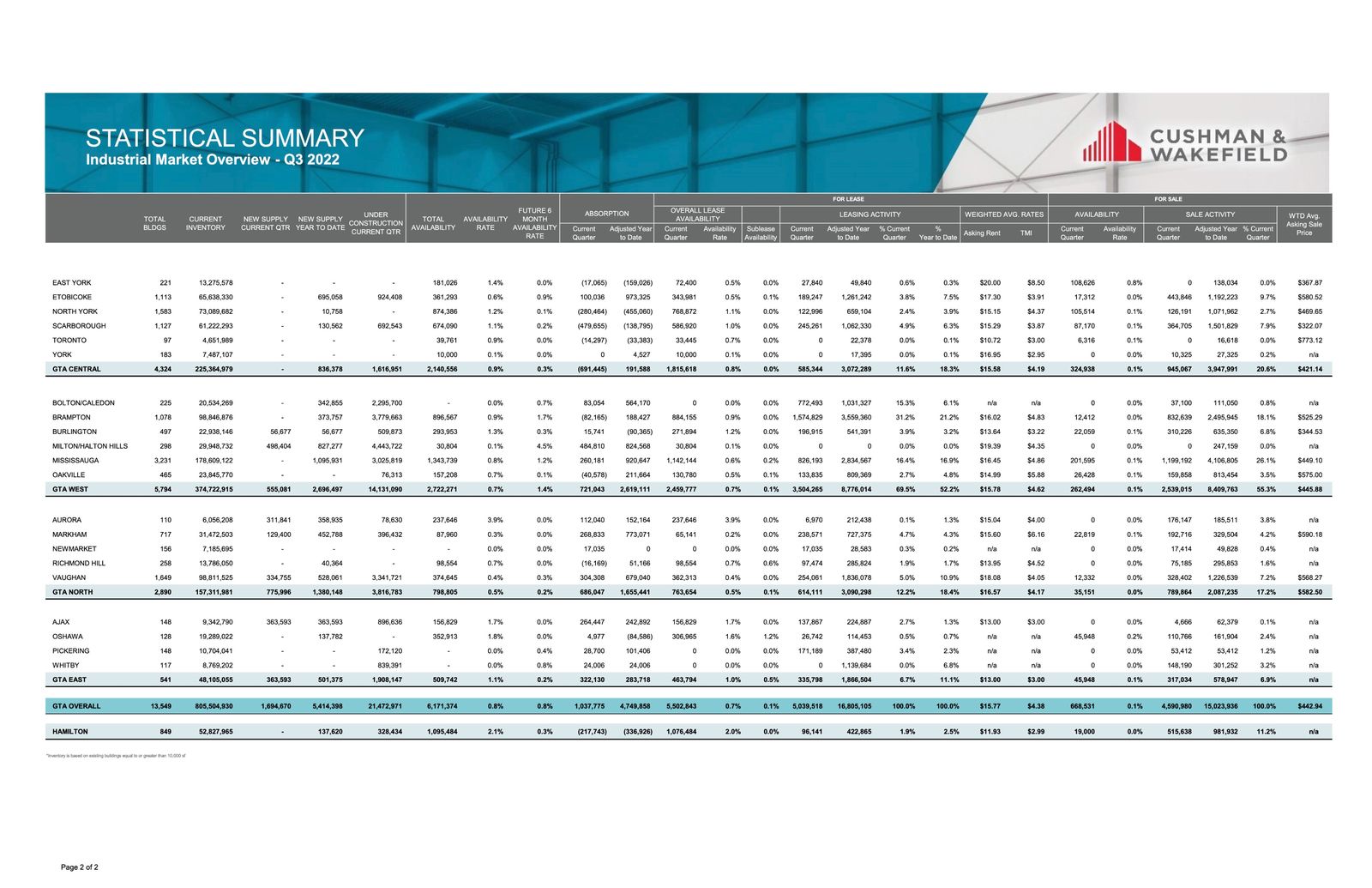

Statistical Summary – GTA West Markets – Q3 2022

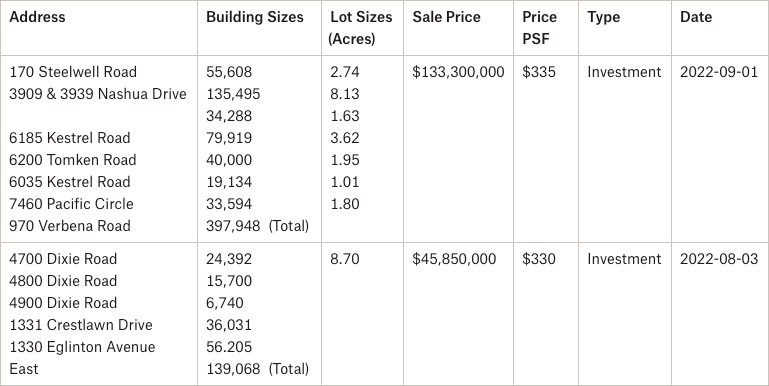

Properties Sold between July 2022 – September 2022, from 20,000 SF plus

6515 Kitimat Rd, Mississauga

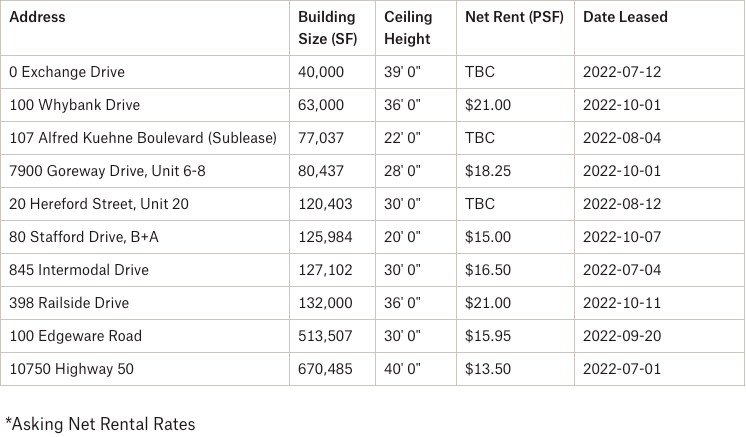

Properties Leased between July 2022 – September 2022, from 50,000 SF plus

1575 Drew Rd, Mississauga

35 Precidio Ct, Brampton

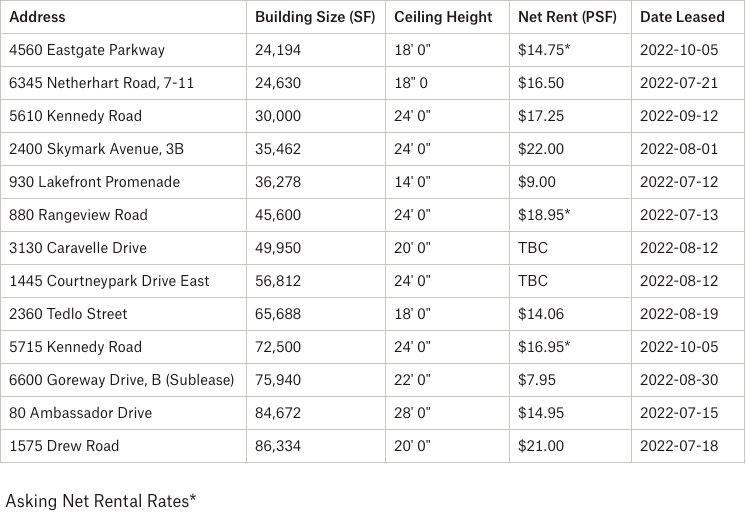

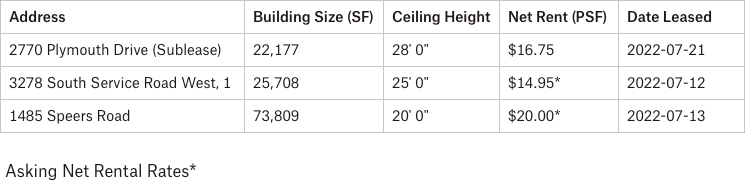

Properties Leased between July 2022 – September 2022, from 20,000 SF plus

100 Edgeware Rd, Brampton

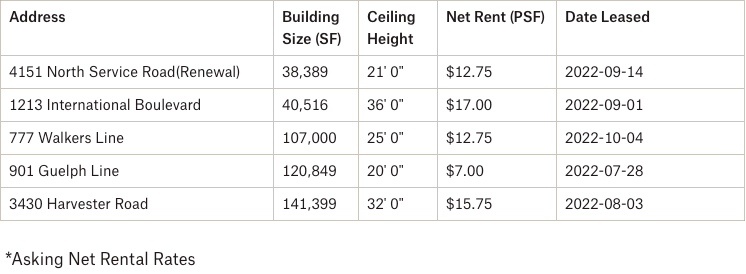

5100 Harvester Rd, Burlington

Properties Leased between July 2022 – September 2022, from 20,000 SF plus

A total of 5 properties were leased in Burlington in Q3 2022. The net rental rates achieved were from $7.00 PSF – $17.00 PSF, with an average building size of 89,631 SF and an average net rental rate of $13.05 PSF.

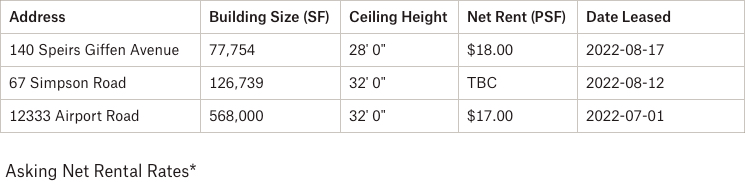

GTA West Markets (Caledon/Halton Hills/Milton)

Properties Sold/Leased between July 2022 – September 2022, from 20,000 SF plus

No properties were sold in Caledon/Halton Hills/Milton/Hamilton submarkets in Q3 2022.

A total of 3 properties were leased in Caledon/Halton Hills/Milton/Hamilton in Q3 2022. The net rental rates achieved were from $17.00 PSF – $18.00 PSF, with an average building size of 257,498 SF and an average net rental rate of $17.50 PSF.

GTA West Markets (Oakville)

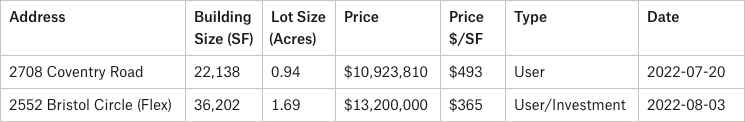

Properties Sold between July 2022 – September 2022, from 20,000 SF plus

2552 Bristol Circle, Oakville

- Rental Rates: We see many transactions achieving in excess of $16-$18 PSF net. We are also hearing that some of the current developments are increasing their price guidance to above $19-20 PSF net. That trend will continue.

- Property Values: The average weighted asking sale price for the GTA-West markets in Q3 2022 was $445.88 PSF. On one hand, and depending on the submarket, we would expect values to further increase due to the lack of available properties for sale. On the other hand, the economic uncertainty coupled with rising interest rates are beginning to cool the market as some investors opt to sit on the sidelines.

- Development Opportunities: In the third quarter of 2022, we had approximately 14.1 million square feet under construction in the GTA-West markets. This represents approximately 66% of all new development across the GTA (21.47 million SF), with the bulk of activity taking place in Brampton, Milton, and Halton Hills.

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 29 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 29 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com