Q4 2020 Insight, Toronto-Central Markets

Establishing True Valuations Across Differing Markets

January 22nd, 2021

Now that we have begun a new year, it feels like, in many ways, that we have passed not just a temporal marker but, also, a symbolic one.

While we work through some of the existing challenges in our day-to-day lives, there is cautious optimism surrounding the future.

In industrial real estate, in particular, we are seeing the re-invigoration of manufacturing industries while logistics and supply chain solutions merge into overall operations.

The past year has shown us all how important it is to have the ability to make, manage, and move goods efficiently and on-demand. The truth is, you need industrial space to achieve these objectives.

The trend of e-commerce continues to push industrial demand to new highs. So far, much of the activity has come from big players such as Amazon. This year, we expect everyone else to join in as well.

Both warehousing and logistics, as well as cold-storage users have been snapping up space and creating an even more competitive environment… not only through the purchasing of commercial space but also through the acquisitions of entire companies and their portfolios.

Everything points towards another industrial rally.

Key Takeaways from Q4 2020 – Toronto Central Markets

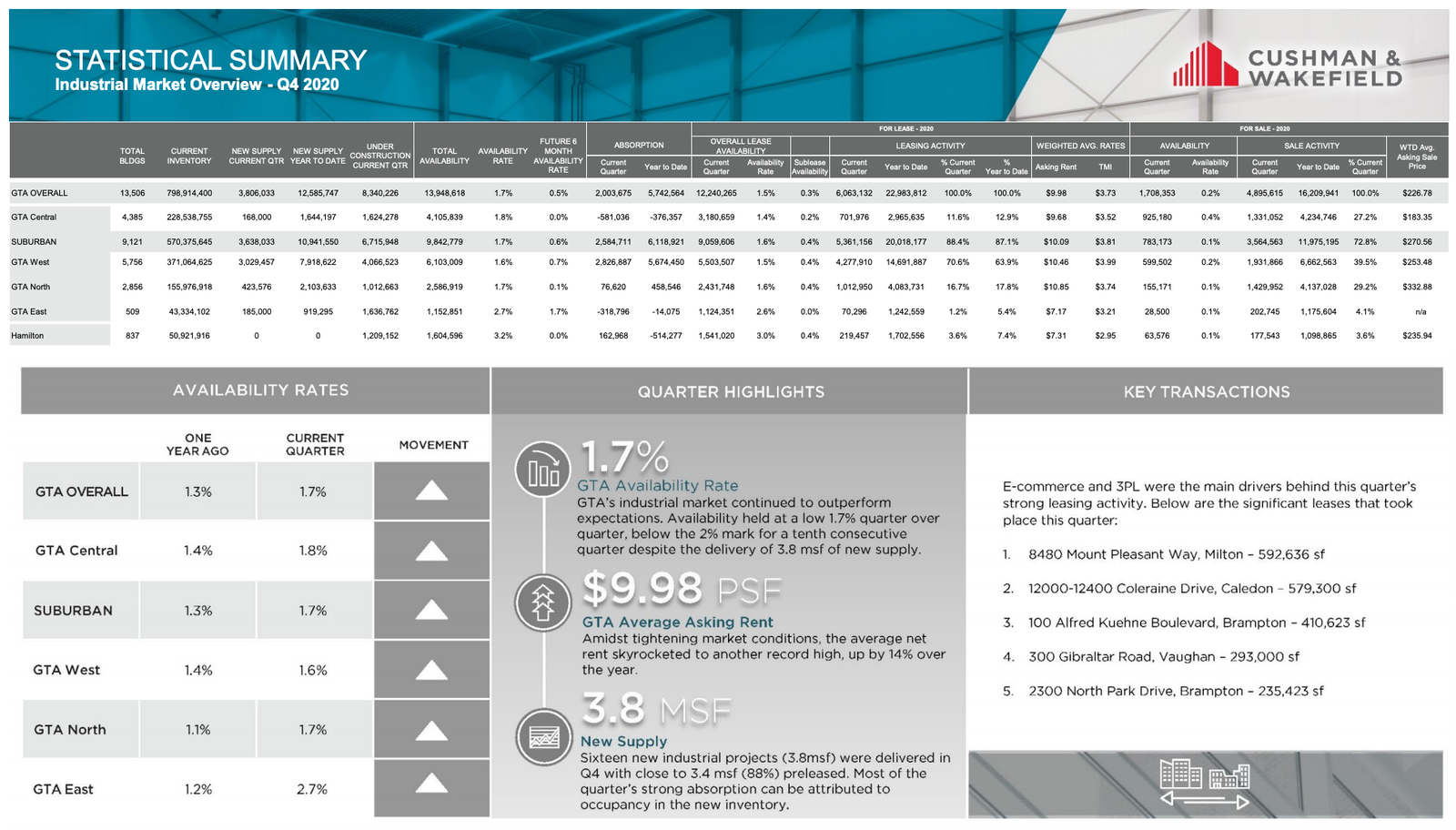

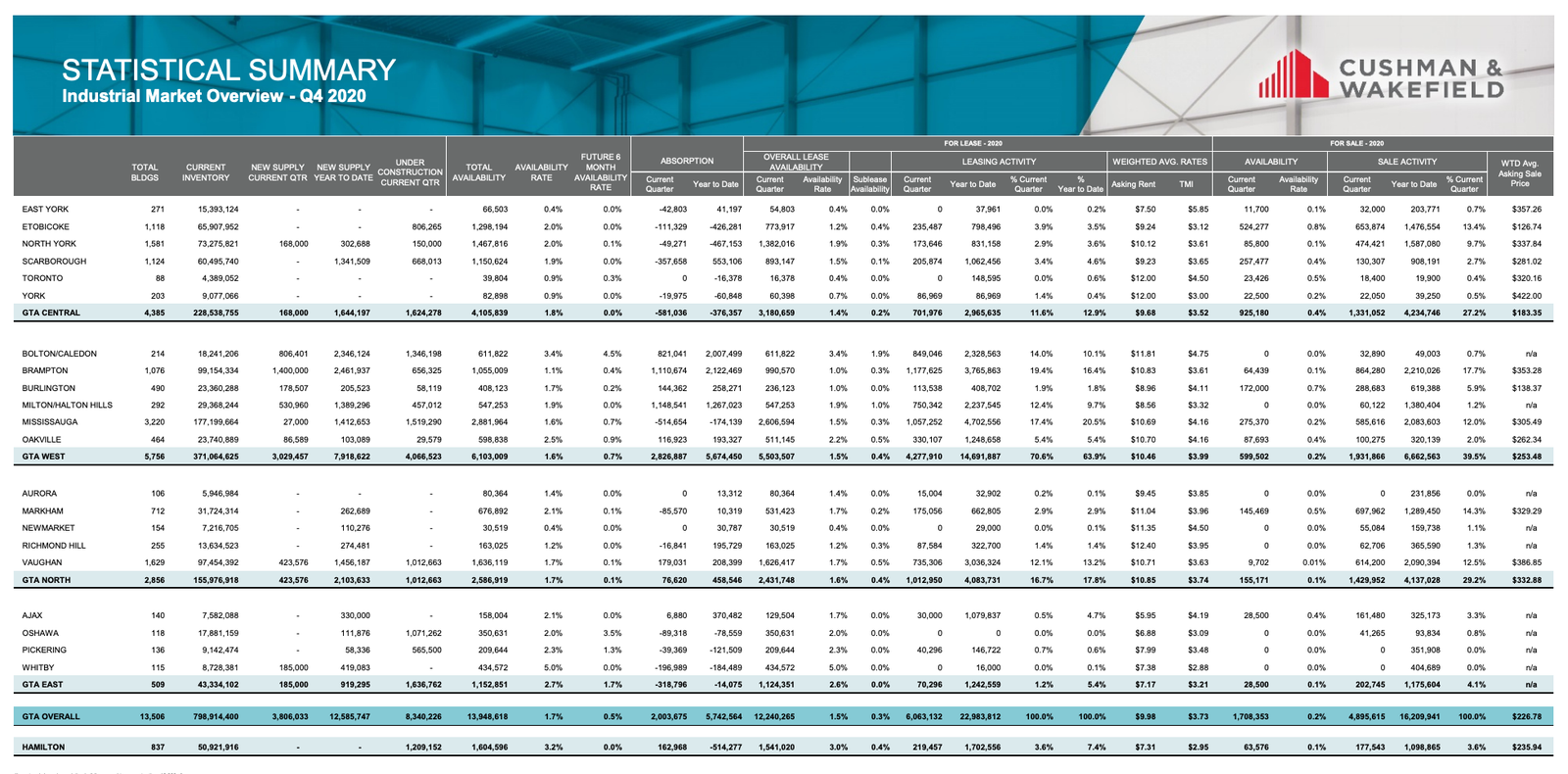

- Availability Rate increased from 1.6% to 1.8%, with lease availability rate of 1.4% and sale availability rate of 0.4%

- We had 1,624,000 SF under construction;

- We had negative absorption of 581,000 SF;

- Weighted average asking net rent was $9.68 PSF, increase from $9.11 from the previous quarter with additional rent of $3.52 PSF; and

- Weighted average asking sale price was $183.35 PSF.

Why are the GTA Central Markets in such demand?

Is it proximity to labour and a higher population density, and thus, a reduction in transportation cost? Or is it savings in development charges vs 905 areas, proximity to major transportation nodes, highways, public transportation, etc?… Or all of the above?

Well, one thing is for certain, the Toronto-Central Markets are highly sought-after by both Investors and Occupiers of commercial real estate and is an environment worth exploring for opportunities.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

In order to get to the truth, we need to dig a bit deeper…

This week we are covering the Toronto Central Markets (Toronto, North York, Etobicoke & Scarborough)

Statistical Summary – GTA Central Markets – Q4 2020

GTA Industrial Market Overview – Q4 2020 – Credit – Cushman & Wakefield ULC

So let’s take a closer look at how the different Toronto Central Markets performed during Q4 2020…

GTA Central Markets (Scarborough)

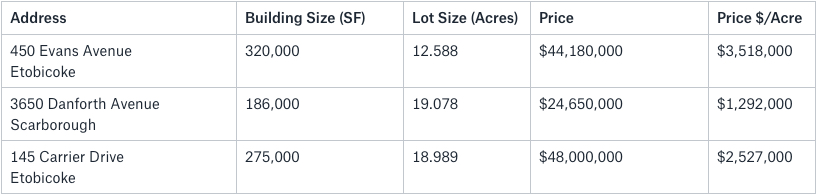

Properties Sold between October 2020 – December 2020, from 20,000 SF plus

GTA Central Markets (Scarborough)

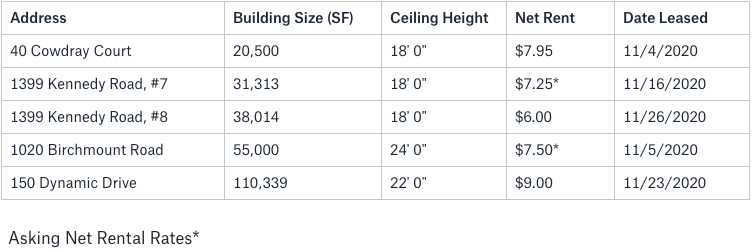

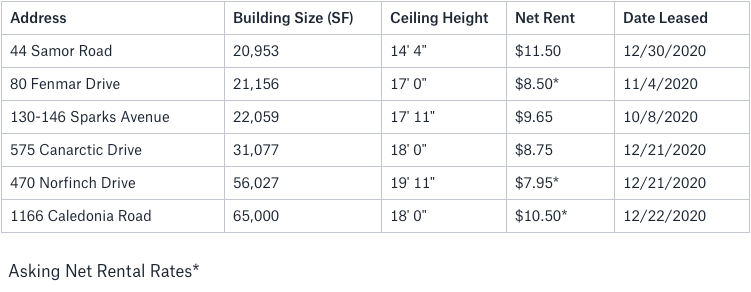

Properties Leased between October 2020 – December 2020, from 20,000 SF plus

In the Scarborough Sub Market, 5 properties were leased (totalling 255,166 SF) in Q4 2020. The net rental rates achieved were from $6.00 PSF, with an average building size of 51,033 SF and an average net rental rate of $7.54 PSF.

GTA Central Markets (North York)

Properties Sold between October 2020 – December 2020, from 20,000 SF plus

In the North York Sub-Market in Q4 2020, a total of 8 properties were sold (308,033 SF); 5 were investment sales. The prices achieved were in the range of $148 PSF – $394 PSF, with an average building size of 38,504 SF and an average price of $261 PSF.

GTA Central Markets (North York)

Properties Leased between October 2020 – December 2020, from 20,000 SF plus

In the North York Sub Market, 6 properties were leased (totalling 216,272 SF) in Q4 2020. The net rental rates achieved were from $7.95 PSF, with an average building size of 36,045 SF and an average net rental rate of $9.48 PSF.

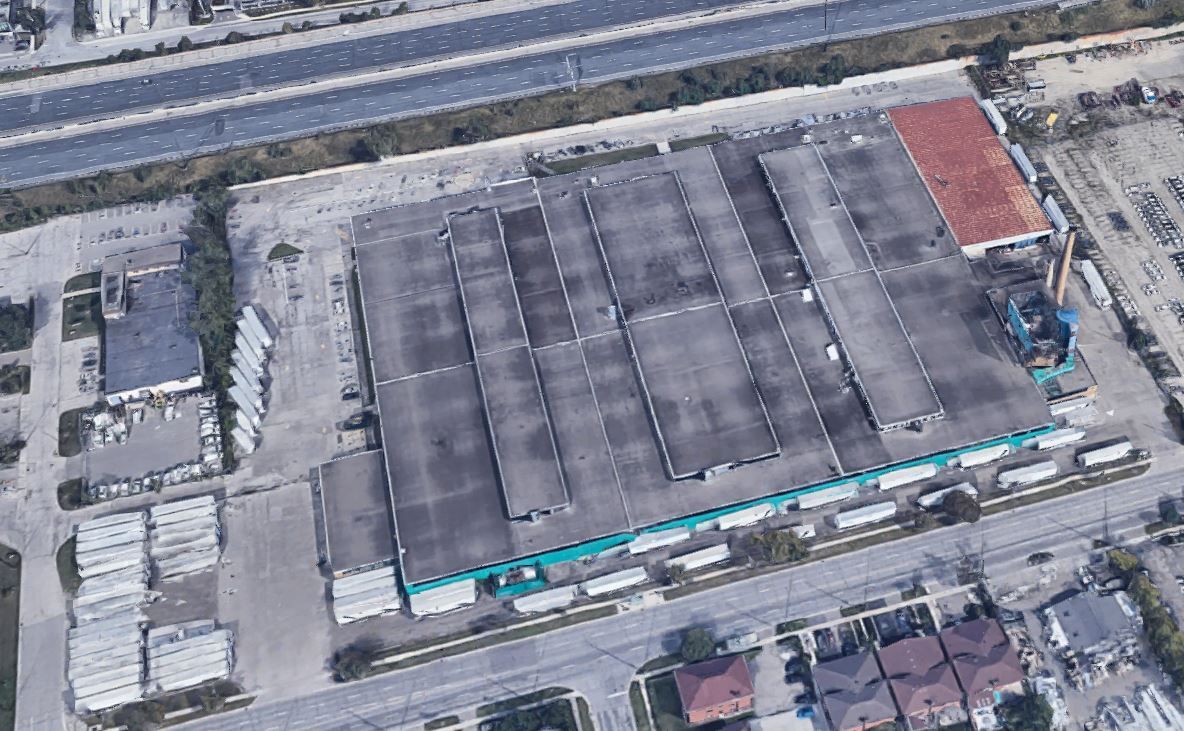

GTA Central Markets (Etobicoke)

Properties Sold between October 2020 – December 2020, from 20,000 SF plus

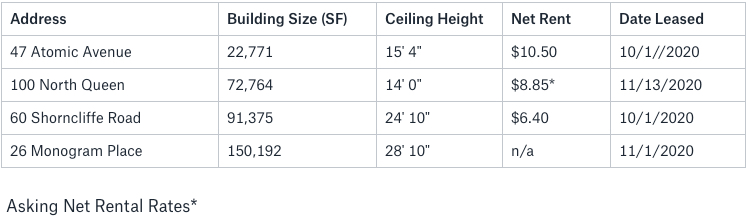

GTA Central Markets (Etobicoke)

Properties Leased between October 2020 – December 2020, from 20,000 SF plus

Land Sold between October 2020 – December 2020, from 20,000 SF plus

What Lies Ahead:

- Rental Rates: We have seen a further increase in net rental rates across the board into double-digit territory, depending on a number of factors, such as building size, location, ceiling height, etc. Based on the increase of value of industrial land, infill sites, construction costs, etc… we can only see these rates continue to grow. Overall, we are still in a Landlord’s market.

- Property Values: It really depends on the building size and location. Buildings between 20k and 50k SF are selling north of $300 PSF… and if there is any redevelopment potential, we are seeing transactions north of even $400 PSF, again, depending on size and location. CAP rates are still somewhere between 4.5% to 4.75% but it really depends on the rental rates in place. If we have older rental rates with immediate growth potential, then CAP rates could end up below 4%.

- Development Opportunities: Gold, Bitcoin, or GTA Industrial Land? Which one is seeing faster increases in value? There is a piece of land in the East End of Toronto that shows the following growth:

- Sold for $336,000 an acre in 2015.

- Sold for $884,000 an acre in 2017.

- Two thirds of the same parcel sold for $2.195M an acre in 2019.

- And the remaining third sold for $2.368M an acre in Q4 2020, which shows a growth of 705% in just 5 years.

So, I ask again: Gold, Bitcoin or GTA Industrial Land? Which one would you rather invest in?

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com