Q4 2020 Insight, Toronto-East Markets

Establishing True Valuations Across Differing Markets

February 5th, 2021

Now that we have begun a new year, it feels like, in many ways, that we have passed not just a temporal marker but, also, a symbolic one.

While we work through some of the existing challenges in our day-to-day lives, there is cautious optimism surrounding the future.

In industrial real estate, in particular, we are seeing the re-invigoration of manufacturing industries while logistics and supply chain solutions merge into overall operations.

The past year has shown us all how important it is to have the ability to make, manage, and move goods efficiently and on-demand. The truth is, you need industrial space to achieve these objectives.

The trend of e-commerce continues to push industrial demand to new highs. So far, much of the activity has come from big players such as Amazon. This year, we expect everyone else to join in as well.

Both warehousing and logistics, as well as cold-storage users have been snapping up space and creating an even more competitive environment… not only through the purchasing of commercial space but also through the acquisitions of entire companies and their portfolios.

Everything points towards another industrial rally.

Key Takeaways from Q4 2020

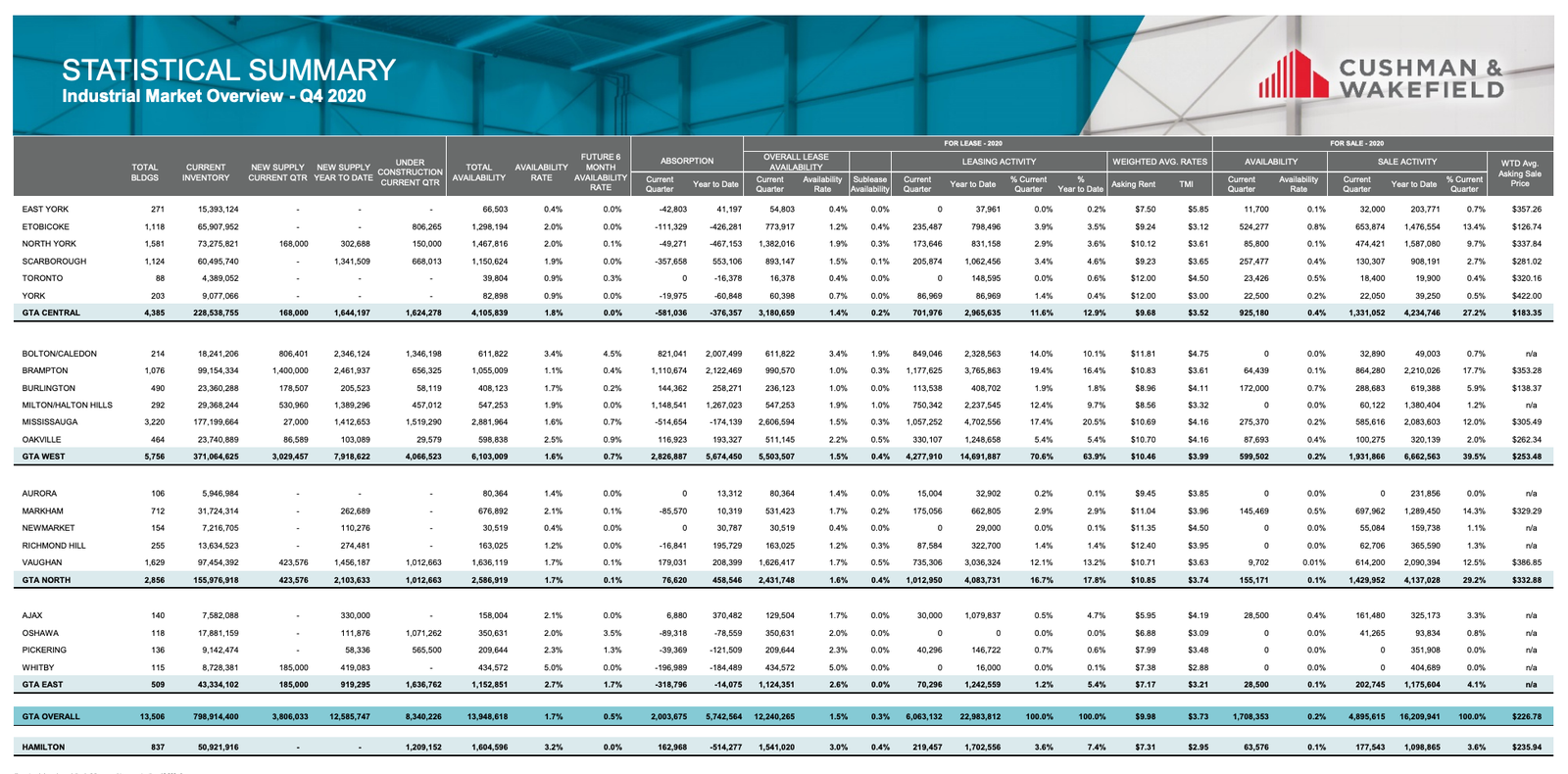

- 1.636 Million SF was under construction;

- We had 919,000 SF of new supply;

- The overall vacancy rate was 2.7% with 2.6% available for lease and 0.1% available for sale; and

- The weighted average asking lease rate was $7.17 PSF.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

In order to get to the truth, we need to dig a bit deeper…

This week we are covering the Toronto-East Markets (Pickering, Ajax, Whitby & Oshawa)

Statistical Summary – GTA Industrial Market – Q4 2020

GTA Industrial Market Overview – Q4 2020 – Credit – Cushman & Wakefield ULC

So let’s take a closer look at how the different Toronto East Markets performed this quarter…

GTA East Markets (Pickering)

Properties Sold between October 2020 – December 2020, from 20,000 SF plus

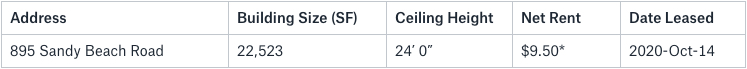

915 Sandy Beach Road, Pickering

Properties Leased between October 2020 – December 2020, from 20,000 SF plus

GTA East Markets (Ajax)

Properties Sold between October 2020 – December 2020, from 20,000 SF plus

19 Notion Road, Ajax

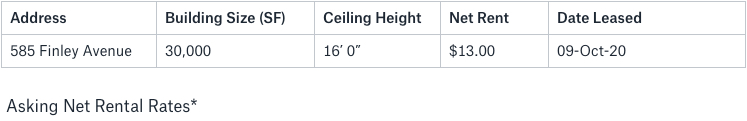

Properties Leased between October 2020 – December 2020, from 20,000 SF plus

585 Finley Avenue, Ajax

GTA East Markets (Oshawa)

Properties Sold between October 2020 – December 2020, from 20,000 SF plus

Properties Leased between October 2020 – December 2020, from 20,000 SF plus

- Rental Rates: Currently, rental rates average $7.17 PSF in the GTA East, the lowest of all GTA submarkets, which are pushing double-digits. We will see these rates increase, especially on new speculative developments that are designed for warehousing and distribution. Older facilities will trail behind these for obvious reasons.

- Property Values: Property values, like rental rates, are considerably lower relative to the other GTA submarkets.

- Development Opportunities: We are seeing a lot more development than ever before. Big players such as Panattoni, Carttera, Crestpoint, Blackwood, PIRET, etc. (to name a few) are all involved… and it will continue.

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com