Q4 2021 Insight, Toronto-North Markets

Establishing True Valuations Across Differing Markets

January 21st, 2022

After every paradigm shift, we typically see a diffusion of innovations across the market in tranches.

First, we have the innovators themselves who comprise around 2.5% of the market, followed by the early adopters (13.5%), the early majority (34%), the late majority (34%), and the laggards (15%).

According to Statista, global e-commerce is forecast to hit $4.2 trillion USD in 2022, reaching $5.8 trillion USD by 2025. User penetration is expected to hit 53.8% in 2022 and 62.4% by 2025.

However, e-commerce’s share of total retail sales sits at just 17.9%, with expectations of reaching 22.4% by 2025.

This means that, depending on how you slice the numbers, we are somewhere in the late majority for user adoption and entering the early majority for share of total retail sales. And this process will easily continue and for the next decade or two as retailers build out their digital infrastructure, such as their online platforms, Big Data, marketing distribution channels, and advertising strategies.

As a direct result of this, we can only expect the demand for industrial facilities and land to increase further as these businesses either construct their own warehousing and distribution networks or partner with third-party logistics firms – who will in turn, require more space to service their clientele.

When viewed through the lens of innovation itself, we can observe that this process of securing industrial logisitcs space is itself moving into the early majority. The innovators, such as Amazon, FedEx, and UPS, led the way in doing blockbuster deals and rapidly growing out their regional distribution centres, sorting facilities, and last-mile sites.

This begs the question, will this continue forever? Or will the behemoths reach a point where their networks are adequate, and the focus will turn to warehouse systems and portfolio management?

While the Amazons of the world are not done buying, leasing, and developing space just yet, we expect the long tail of retailers to become more involved in the activity. Those that pivoted their models in 2020 and 2021 may now be ready to roll out their omnichannel strategies. Those whose brands took off and reached the next growth phase will also need to facilitate their operations with industrial space.

As such, we expect the rest of the vibrant e-commerce ecosystem to secure their needs in the coming years. Coupled with the accelerating on-shoring of manufacturing operations, and it appears that demand will remain uninterrupted for the foreseeable future; barring any sudden, massive changes.

Investors, developers, and landlords looking to capture this demand should remain diligent around identifying opportunities; whether that be through the strategic purchasing of industrial land, value-add redevelopment, or buying cashflow from occupiers willing to pay premium rents.

Key Takeaways from Q4 2021 – Toronto North Markets

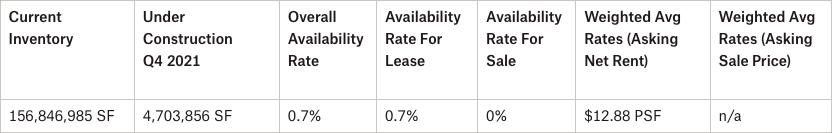

- The availability rate held steady at 0.7%, with a lease availability rate of 0.7% and a sale availability rate close to 0%;

- We had 228,015 SF of construction completed and 4,703,856 SF still under construction;

- We had absorption of 256,893 SF;

- The weighted average asking net rent increased from $12.40 to $12.88 PSF with additional rent of $4.42 PSF; and

- There is no calculable weighted average asking sale price due to the almost non-existent inventory.

Why are the GTA North Markets in such demand?

Generally, the Toronto-North markets have newer product with higher ceiling heights and better shipping access. Further, there are benefits from access to major transportation routes.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

This week we are covering the Toronto North Markets (Vaughan, Markham, Richmond Hill, Aurora, Newmarket, Stouffville)

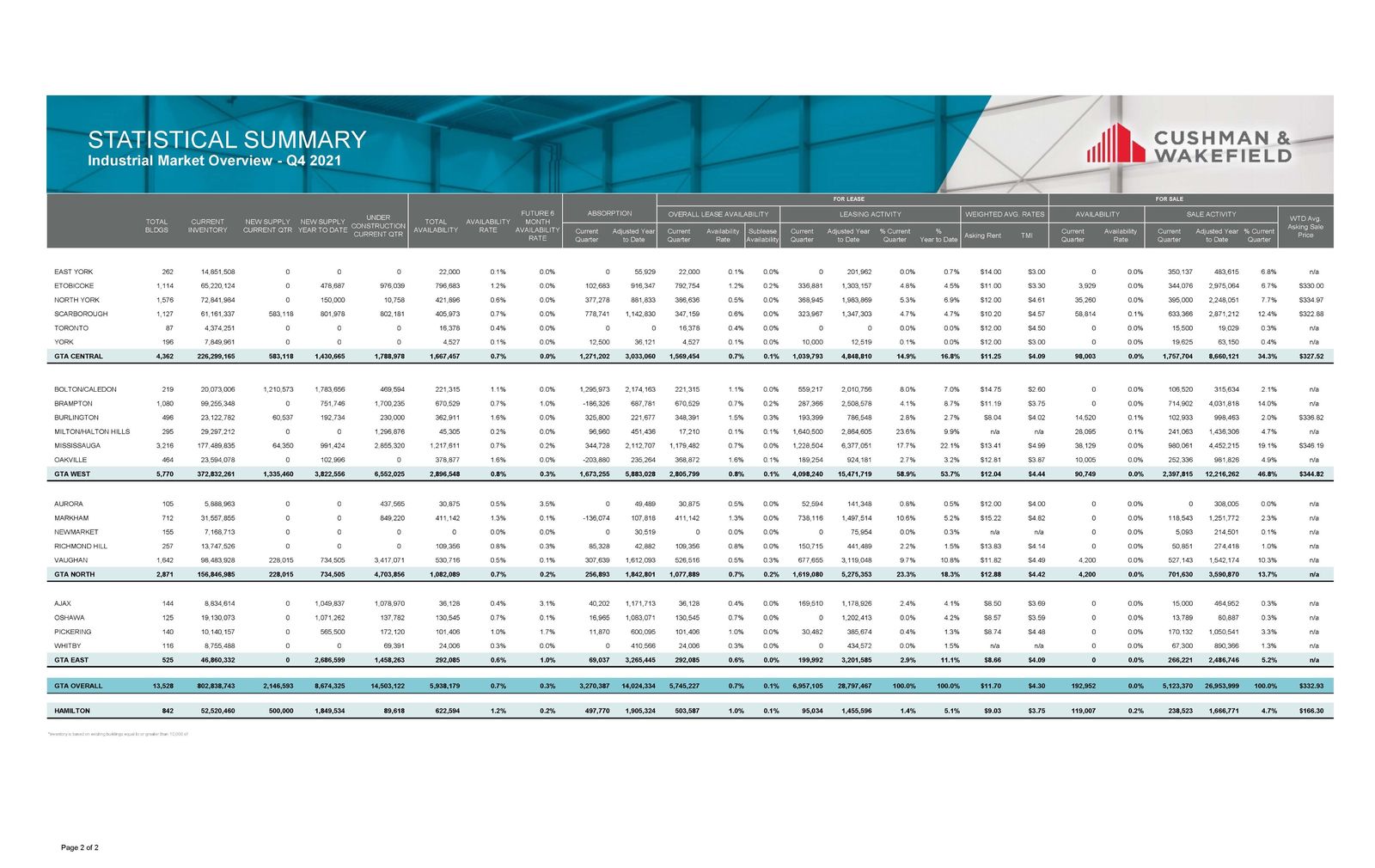

Statistical Summary – GTA North Markets – Q4 2021

Q4 2021 GTA Industrial Market Overview – Source: Cushman & Wakefield

Q4 2021, Industrial Market Overview – Source: Cushman & Wakefield

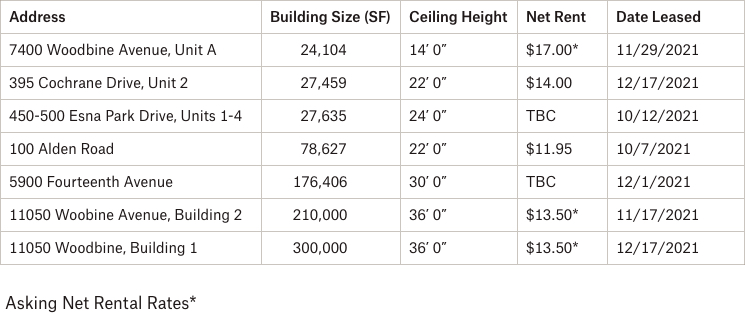

GTA North Markets (Vaughan)

311 Bowes Road, Vaughan

220 Caldari Road, Vaughan

195 Allstate Parkway, Markham

5900 Fourteenth Avenue, Markham

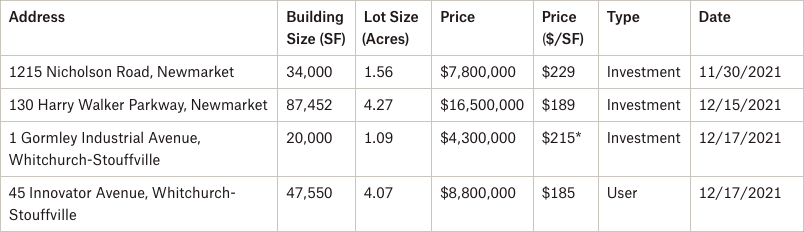

Properties Sold between October 2021 – December 2021, from 20,000 SF plus

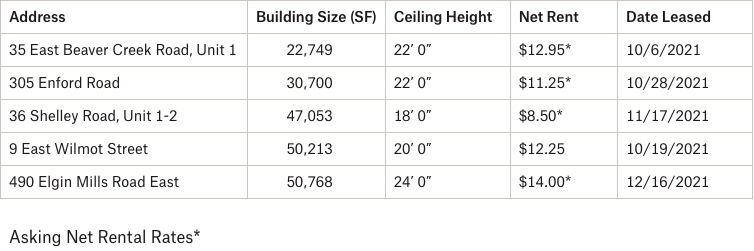

19 East Wilmot Street, Richmond Hill

Properties Leased between October 2021 – December 2021, from 20,000 SF plus

490 Elgin Mills Road East, Richmond Hill

Properties Sold between October 2021 – December 2021, from 20,000 SF plus

1215 Nicholson Road, Newmarket

Properties Leased between October 2021 – December 2021, from 20,000 SF plus

400 First Commerce Drive, Aurora

- Rental Rates: The Toronto-North markets continue to have the highest weighted average rental rates at $12.88 PSF, followed by the West markets at $12.04 PSF and Central markets at $11.25 PSF. Keep in mind that rental rates are also subject to annual escalations. We continue to see a general upward pressure across the board into double-digit territory, depending on a number of factors, such as building size, location, ceiling height, etc. Based on the increase of value of industrial land, infill sites, construction costs, etc… we can only see these rates continue to grow. Overall, we are still in a Landlord’s market.

- Property Values: We saw 701,630 SF of space trade in Q4 2021. From this, we can see that values continue to increase, depending on the building size and location. We see pricing going as far north as $400 PSF, and more. CAP rates are still somewhere between 4.5% to 4.75% but it really depends on the rental rates in place. If we have older rental rates with immediate growth potential, then CAP rates could end up below 4%.

- Development Opportunities: The Toronto-North markets still have quite a bit of land available for development in Vaughan-West along Highway 50. We are also going to see further development along Highway 400 as land sites in more central areas become more scarce. Regarding industrial land, pricing generally continues to increase.

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 29 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 29 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com