How to Spot Opportunity in Today’s Environment…

Damned if you do. And damned if you don’t.

That seems to be the dilemma of many professionals and decision makers working in the GTA Commercial Real Estate industry these days.

There are no easy ways out.

Product is tough to find. Yet land has also become scarce (and expensive), with construction roadblocks forcing you to wait for years what was once readily available.

And even though, yes, there is inventory coming on the market, much of it is already spoken for and has been pre-leased.

So what’s one to do?

Well, it is about that time of year where we start to get numbers and reports from Q1 activity.

“Markets continue to tighten, rates are rising, and vacancies are dropping further”… is what they will all say.

Every broker and player in the market will have their own flavor showing similar stats and trends.

However, I thought it would be best to mine a few golden nuggets for the different groups of readers… and how they turn them into actionable insights.

But first, let’s look at the forces at play.

Market Forces to Consider

We won’t even dive into the fact that the GTA is underpriced when compared to other North American markets – which they are – and how they will see a 10% annual increase over the next two years (which they will).

Instead, let’s focus on the behemoth that is the combined forces of e-commerce, logistics, 3PL, and warehousing.

These are firms, which, until recently, were ok with passing off their transportation costs to third-party providers.

However, as they look to bring the entire supply and distribution chain in-house, it is becoming inefficient to reach customers directly from periphery sites alone, and transportation (along with labor) makes up the bulk of their costs.

So when you can save considerable operational costs by investing a bit more into real estate, then climbing rents is actually cheap (or irrelevant).

The rest of the market may find them high, however, it is all relative.

And that’s what we’ve seen as an enormous driving force in today’s market.

Warehouse and Distribution have led the way for leasing activity in the Big-Box Industrial market (100K SF+) – to nobody’s surprise.

Source: Cushman & Wakefield GTA Industrial Real Estate Update Report

This is coupled with rising demand for urban distribution sites, as well as cutting-edge solutions such as automated racking and multi-level facilities.

The second- and third-order effects of this are what is impacting everything else.

The rest of the market becomes crowded, and thus, we are experiencing new normals and undergoing a transition back to equilibrium.

Until pricing signals encourage more aggressive development, we will simply see players have to fight over scraps or implement longer-term strategies.

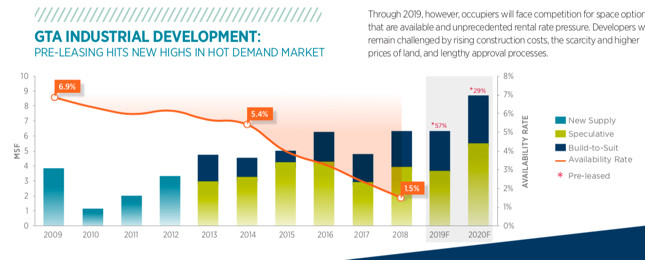

Even though we are seeing new construction and inventory coming to market, there is not enough to keep up with demand, and as mentioned previously, much of it isn’t available.

Source: Cushman & Wakefield GTA Industrial Real Estate Update Report

Stakeholders:

Tenants: Consolidating or shrinking your operations, redeveloping or repositioning older properties, moving to tertiary markets… These are all viable strategies to cope with the new environment, unless you get lucky and find something off-market, and/or are aggressive when it comes time to place an offer.

Landlords: With historic growth in rents and demand, and with a short-term crunch in supply, this may be an excellent time to consider selling or renegotiating your leases.

Investors: Cap rates continue to compress. Calls for offers repeatedly bring in a double-digit number of offers, as investors are desperate to place their capital. Further, we are seeing interest from non-GTA players more and more, adding to the competition. Finding and acting on opportunity well before it hits the market will be your best bet. Like tenants, quick, firm, and healthy offers will ensure victory.

Developers: Facing rising construction costs, lengthy approval processes, and expensive and scarce land. Rents should continue to go up to compensate for the increase in risk and demand. With this added incentive, however, developers may get what they need to approve go-ahead on new projects.

Brokers: This may seem like an irrelevant party to consider, however, brokers are a part of the overall ecosystem. As vacancies continue to sink further, brokers are leaning on their networks and relationships to find opportunities and product, given that many deals are occurring off-market. So if you are an occupier or investor, your most valuable hubs of intel are walking the streets, gathering information from the ground up.

Source: Cushman & Wakefield GTA Industrial Real Estate Update Report

Summary

Depending on who you are, and what your objectives are, you will likely come across challenges into today’s commercial real estate environment.

Whether you stand to lose out on this opportunity to capture upside value as a landlord or investor.

Or you stall your operations due to the rigidity of expanding, developing, or moving locations.

As always, however, creative solutions and untapped potential are out there if you are willing to dig and create value.

If you would like someone to help explore that process with you, then please contact me.

Until next time….

Goran

P.S. – Many thanks to Cushman & Wakefield’s research team for putting this report together.

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries. In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.