“Once a new technology rolls over you, if you’re not part of the steamroller, you’re part of the road.”

- Stewart Brand

While the above thought may serve as a cautionary tale of the costs of resistance to innovation and missed opportunities, Ontario’s industrial market has made the conscious decision to be a part of the steamroller.

Whether as a result of foresight or necessity, we are seeing the effects of economic and geopolitical moves and countermoves manifest in our daily lives. Pandemics, wars, and policy shifts have resulted in tangible increases in things many of us have taken for granted, such as the price of milk and eggs, or the cost to fill up the tank on our morning commute. Not to mention the cost to purchase a home or manage our personal finances in a time when everything seems to be unpredictable and changing on a dime.

People are searching for reasons and answers to try to understand why this is and how can it be solved.

While we cannot provide a solution to you within this modest newsletter, we will highlight one move which this writer feels has the potential for great change across the region for both consumers and the investors and businesses within the industrial markets.

That is because, the industrial sectors have always been, and will continue to be, one of the driving forces behind employment and both the production and cost of goods. And from a business’ perspective, industrial real estate is the backbone providing the opportunity to facilitate these operations and to generate wealth through real estate.

So with that said, let’s dive deeper into the emergence of an up-and-coming industry niche which is bringing about a resurgence of manufacturing across Southern Ontario, and analyze some of the positive long-term effects it may have.

The Resurgence of Manufacturing in Southern Ontario

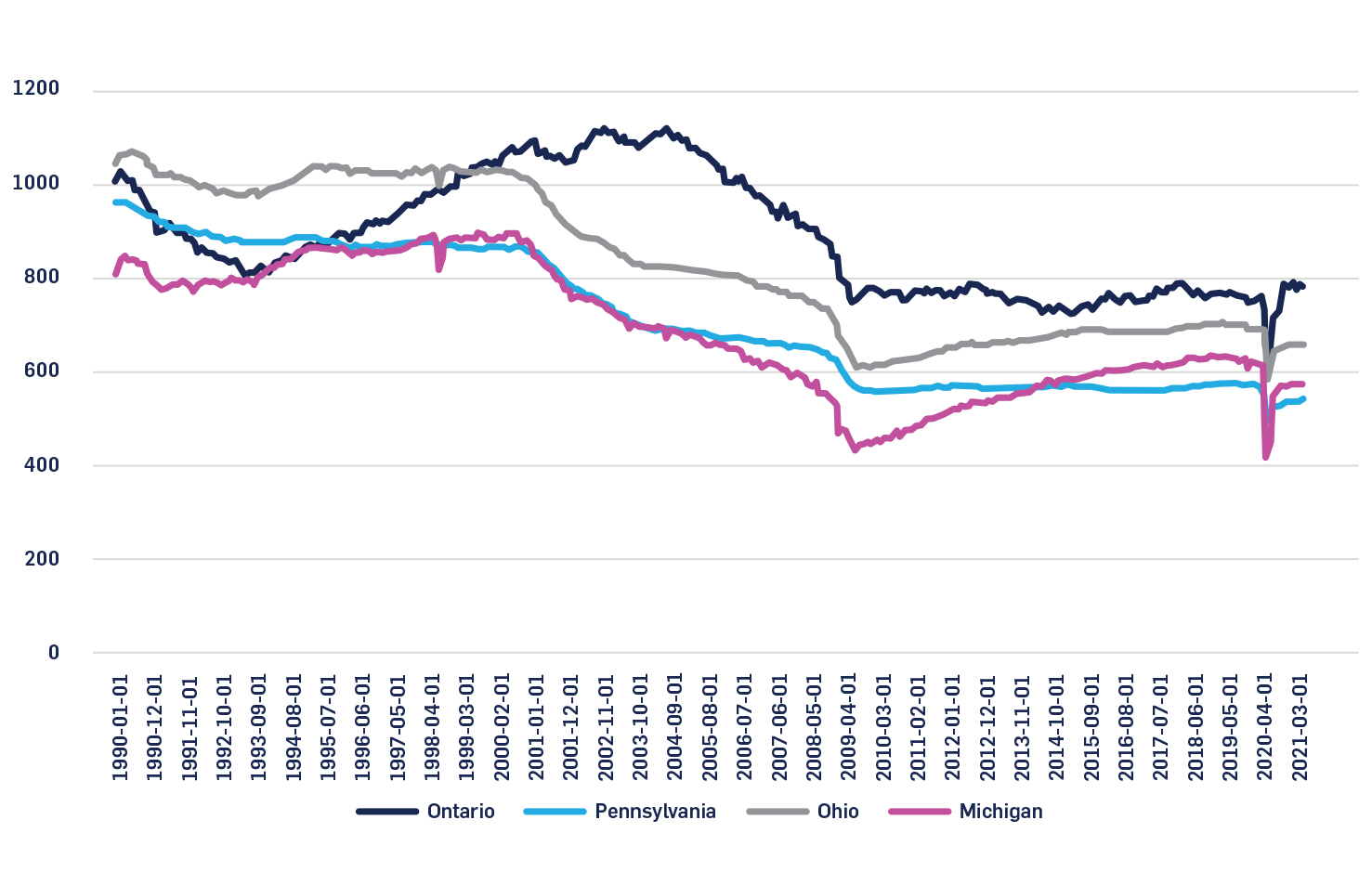

According to Ontario360 – and to nobody’s surprise – manufacturing employment in Ontario (and most OECD member-countries) has declined substantially since the 1970s due largely to outsourcing and automation.

Manufacturing employment by jurisdiction, 000s, seasonally adjusted. Source: On360.ca.

Despite this decline over the past five decades, which included several economic crises, fluctuations in commodities and exchange rates, and significant competition from labour-rich nations such as China, Ontario’s manufacturing sector has remained fairly resilient.

What is different now is that, as a result of supply chain bottlenecks, transportation costs, inflation, technological advancements, and a commitment to fostering more sustainable practices, most people – whatever your personal or political leaning may be – can agree that procuring, manufacturing, and transporting goods locally just makes sense.

Not only can Canadians support employment and bolster the economy, but they can reduce the cost-of-living, make the availability of goods more stable, and become more independent of external factors.

What is truly fascinating is that this renaissance in manufacturing may be brought about by the electric vehicle industry; something few would have predicted a few short years ago (let alone in the 1970s) given Canada’s perception as a nation heavily focused on commodities such as oil, lumber, and other minerals.

What is even better is that the abundance of these resources may nicely complement the budding sector, which in turn will accelerate the vast number of cottage industries that will eventually be needed to supply parts and input products as their operations scale.

Electric Vehicle Industry to Anchor the Renaissance?

As we all know, the electric vehicle (EV) industry is now front and centre in Southern Ontario’s manufacturing discussion.

This has been led by Volkswagen’s recent announcement to construct a new mega-facility to produce electric vehicle batteries in St. Thomas, Ontario. Set to be in production by 2027, the complex is expected to be roughly 6 million square feet in size situated on approximately 550 acres; supplying auto manufacturing operations in Tennessee and South Carolina.

However, Volkswagen are not the only Party at the table. There are already numerous other announcements of major players joining in.

Rendering of Volkswagen’s new EV Facility in St. Thomas, Ontario. Source: Renx.ca.

Site of Stellantis/LG’s New EV Gigafactory at 9865 Twin Oaks Drive, Windsor. Source: CBC.

Similarly, Umicore announced in October 2022 that it would invest $1.5 billion into an EV battery facility in Loyalist, Ontario; just west of Kingston.

According to InvestCanada, “it will combine cathode active materials and precursor material manufacturing on a large industrial scale – a first for North America, and a key link in the EV supply chain. Once the plant is up and running by 2025, Umicore’s investment is expected to supply materials for up to one million electric vehicles a year and will be an important part of a growing Canadian ecosystem. For a sense of scale of the expected production, in all of 2021, there were a total of 1.6 million new motor vehicles registered across Canada.”

A Renaissance Driven By Retooling, Research, and Reinvention

Tangential to the discussion surrounding the production of EV batteries is the ecosystem and supply chain surrounding it; from procurement of input products, parts suppliers, skilled labour, and technological innovation.

Leading this is an announced $20 million Research & Development facility in Windsor, Ontario funded by auto-parts maker Flex-N-Gate. With support from the Ontario and Windsor governments, the new innovation lab – dubbed the Flex-Ion Battery Innovation Centre – will include 18 battery engineers and scientists “ building a pilot line to produce advanced lithium-ion batteries for electric vehicles,” according to a Government of Ontario press release. The plan is then to translate this R&D activity into an eventual EV battery gigafactory in Windsor in the coming years.

Finally, we have also seen a trend towards the retooling and reinvention of traditional automakers in the province, such as General Motors, Honda, and Toyota to either build out their EV operations or expand their current traditional auto production within the province.

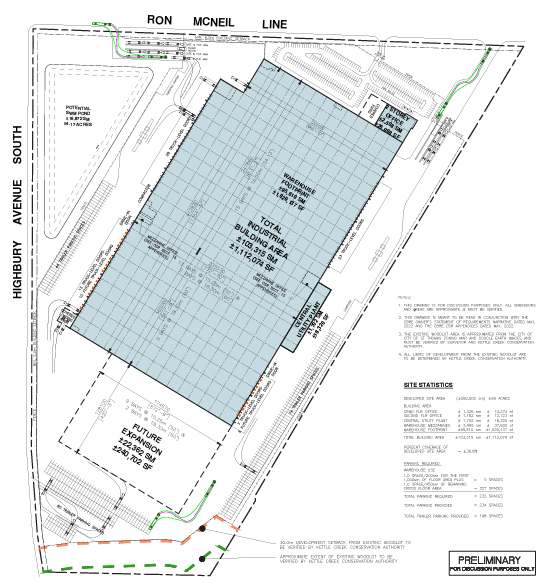

Bascially, these moves have shaken the tree. This has already resulted in the availability of shovel-ready lands in the region, such as this 66.9 acre site in St. Thomas with three site plan variations ranging from 850,000 SF to 1,200,000 SF of industrial space. Ellington Partners is currently marketing this opportunity.

Conclusion:

All of these initiatives will undoubtedly drive demand for local suppliers, skilled labour, and logistics providers to make, store, and move these manufactured products.

A single stone now has the potential to create a lasting ripple effect in Ontario’s manufacturing sector; opening up an abundance of opportunities for those directly and indirectly involved with EV battery manufacturing.

If Ontario can secure the talent it needs and fosters these new developments, we will see a major impact to the industrial market; which has been largely focused on Big Box warehousing over the past decade. New clusters of EV manufacturing and innovation will only seep into other sectors, such as agriculture and food processing, mining, robotics, nuclear power, and metalworking, among others.

This potential hurdle of scarce labour, if approached correctly, may also help lead the advancement of further automation and robotics to meet the growing demand to supply and operate these facilities.

In any event, industrial land and properties are the common element throughout and their development will play a pivotal role in the final outcomes.

When, where, what, and how these new projects come about is largely unknown but ready to be written by those with the vision and appetite to make it happen.

What we know for certain is why; and it has become clear that Ontario wants to be back in the conversation as an independent and innovative region.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com