January 20th, 2022

Economics is an interesting field.

Part art and part science, most colleges and universities consider it a ‘humanity’ rather than a science, where the former is more fluid in its interpretations, and the latter seen as generally being concrete and factual.

The reality is, though, that economics – and the conclusions drawn from analyzing the various components – are largely driven by expectations.

Expectations… That’s another interesting concept.

We deal with it constantly throughout negotiations, in our personal and professional relationships, and when making buying, selling, or leasing decisions.

Expectations can result in irrational outcomes. They can also create self-perpetuating or self-fulfilling prophecies. If enough people believe something will happen in the market, the market itself will reflect it. Take your pick of crypto, commodities, or equities.

So, as we ramp up another busy year, some GTA real estate professionals may be wondering if we have finally reached the tipping point in the industrial market.

Aside from the continued bumps in the interest rate, nothing dramatic has occurred. However, it appears as if the rate hikes over the course of 2022, coupled with market dynamics, have finally taken their toll on said expectations.

Some investors and occupiers have gone into a ‘wait and see’ mode, while others are trodding along with more caution. Some developers are beginning to slow their pace of new pipeline; taking this as an opportune moment to process their existing projects and to gather more data. Some occupiers have dropped development and purchase options, looking instead to lease available space.

This doesn’t mean that we will not see major development projects or acquisitions occur. In fact, we may be entering the period where those who are well-positioned can capitalize on opportunities that naturally occur in every phase of the business cycle. We may see these Parties, along with those who are more risk tolerant, seize this chance to enter or expand.

Finally, this potential stabilization and ‘return to normalcy’ after years of unprecedented growth may also be a blessing as stakeholders can more accurately value assets and let the market pricing mechanism reel in the boundless expectations we all experienced.

That is why, today, we will examine and break down the GTA industrial sales activity in 2022.

Breakdown of GTA Industrial Sales Activity in 2022

The charts below will provide some insight into the changes in sales volume and transaction activity over the course of 2022. One key headwind to factor in is the Bank of Canada Policy Interest Rate (table shown below), as well as the US Fed Funds Rate, which can affect the BoC’s decisions.

Bank of Canada – Policy Interest Rate

Bank of Canada Policy Interest Rate. Source: Bank of Canada.

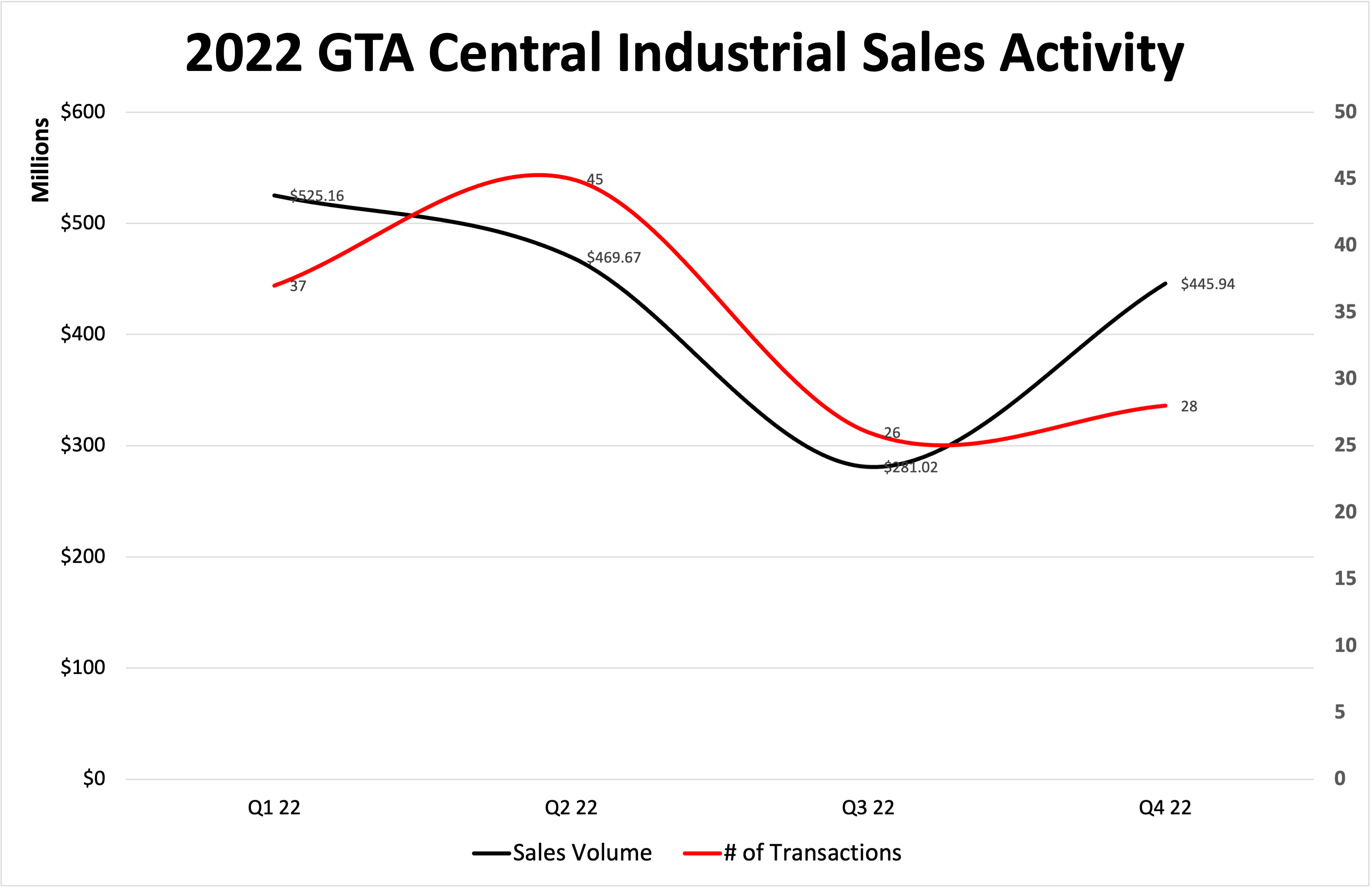

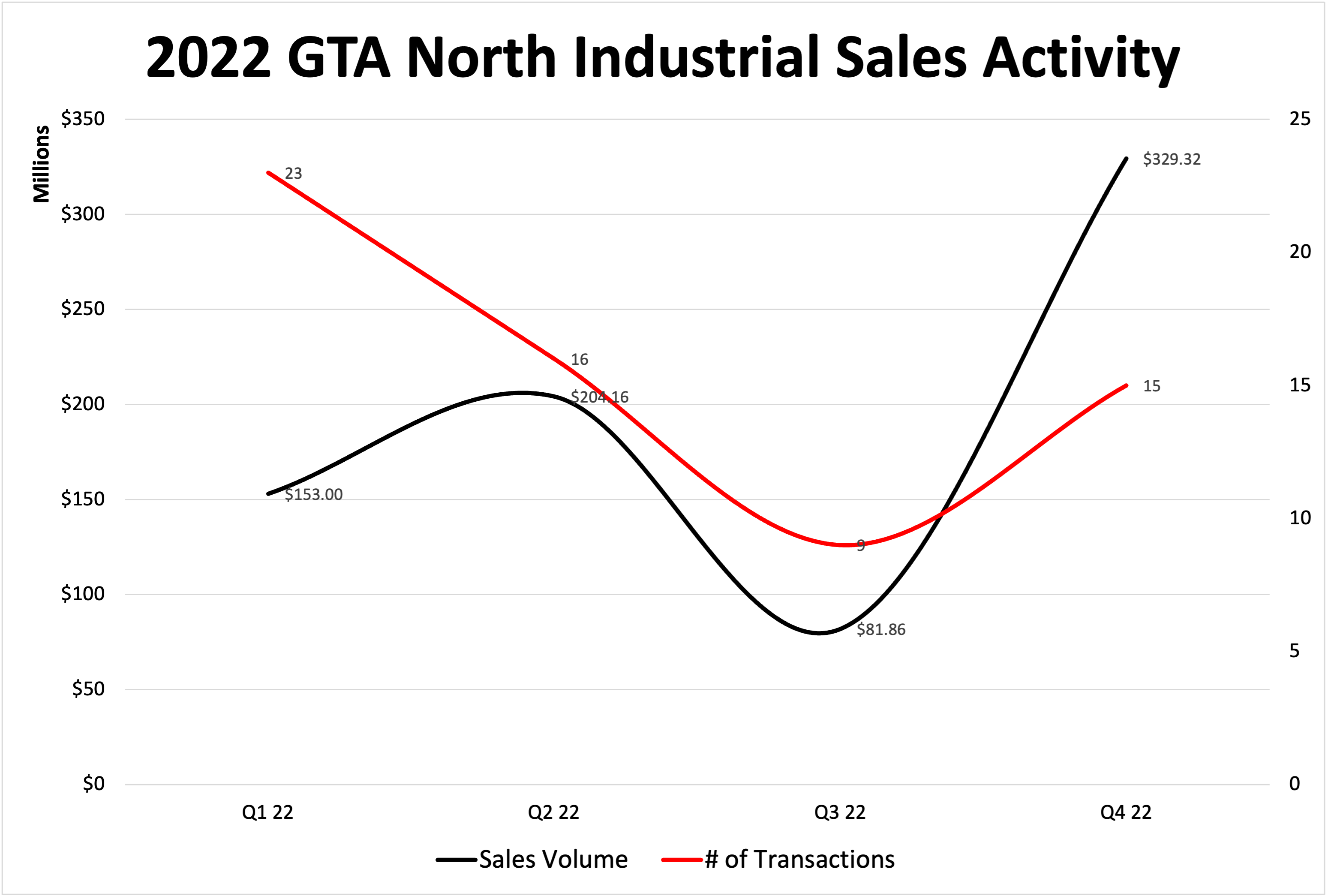

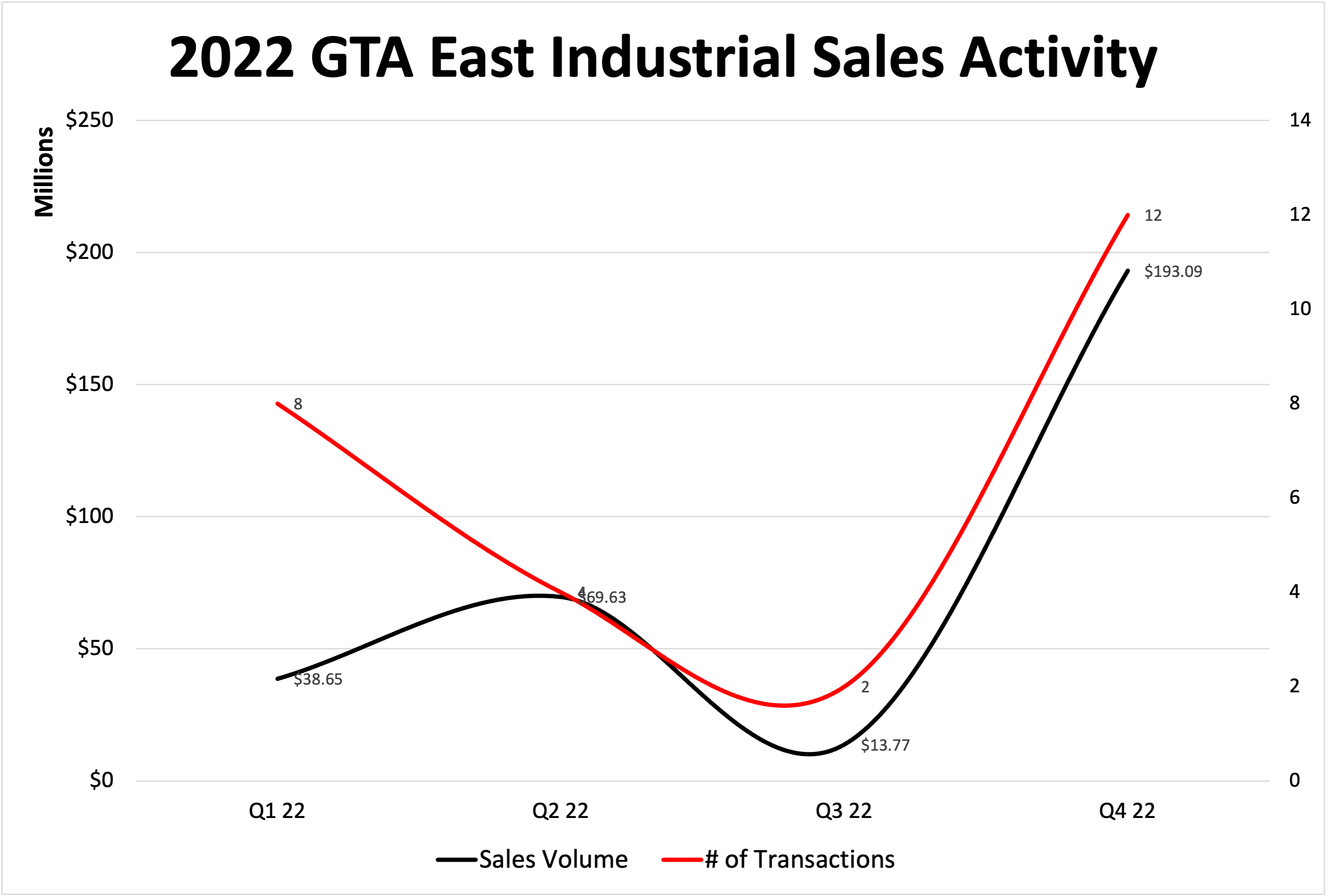

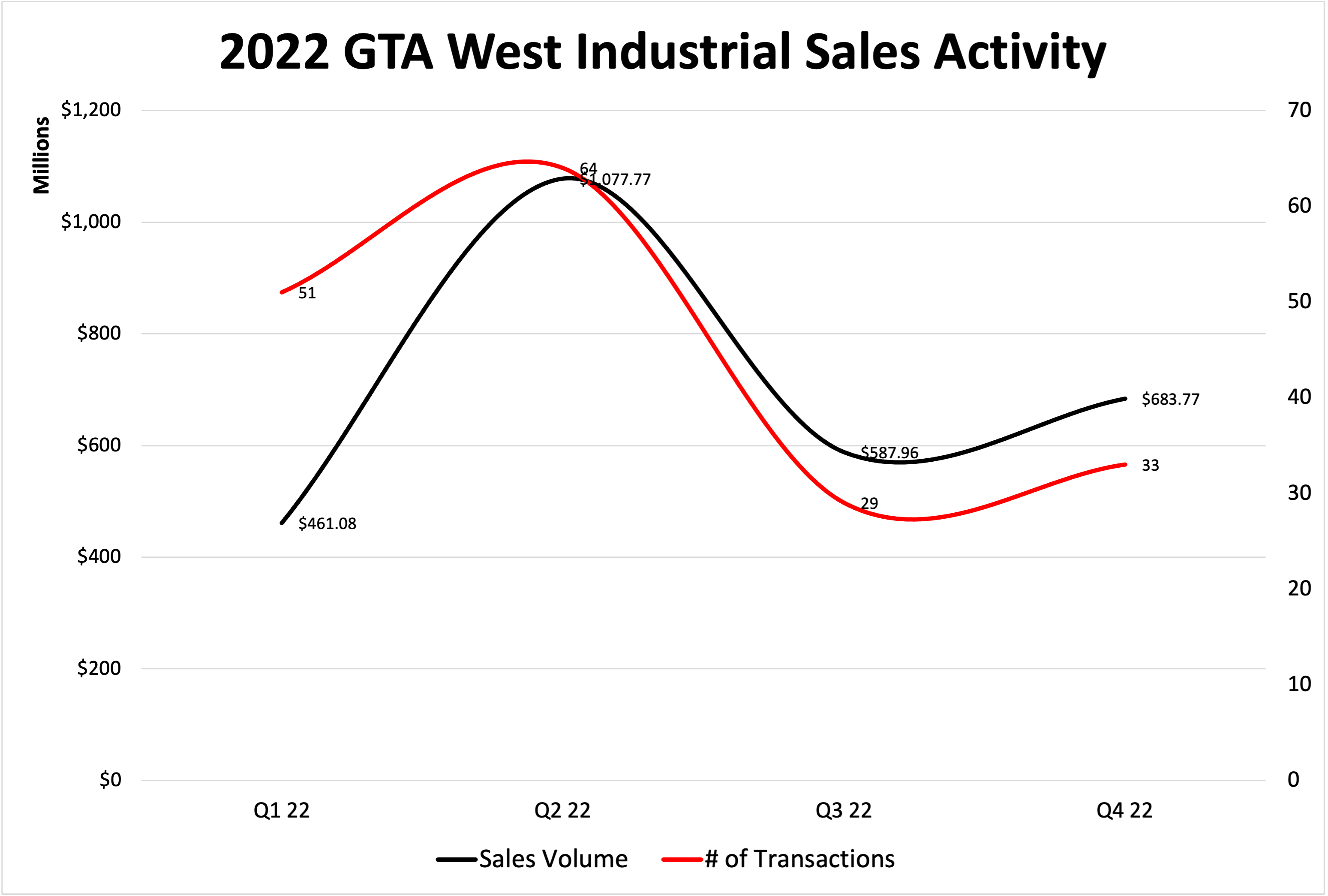

As you can see below, all GTA regions saw a decline in both sales volume and number of transactions in early Q3 2022, closely following the initial bumps in March and April, as well as the additional hikes in June and July.

GTA Central: 2022 Industrial Sales Activity.

What’s interesting to note, however, is that all regions also saw a rise in volume and activity in mid- to late-Q4. We can speculate that this occurred because investors were able to adjust and price in the increased cost of borrowing. Furthermore, many businesses likely made some year-end moves that they had been planning on executing earlier but had put off.

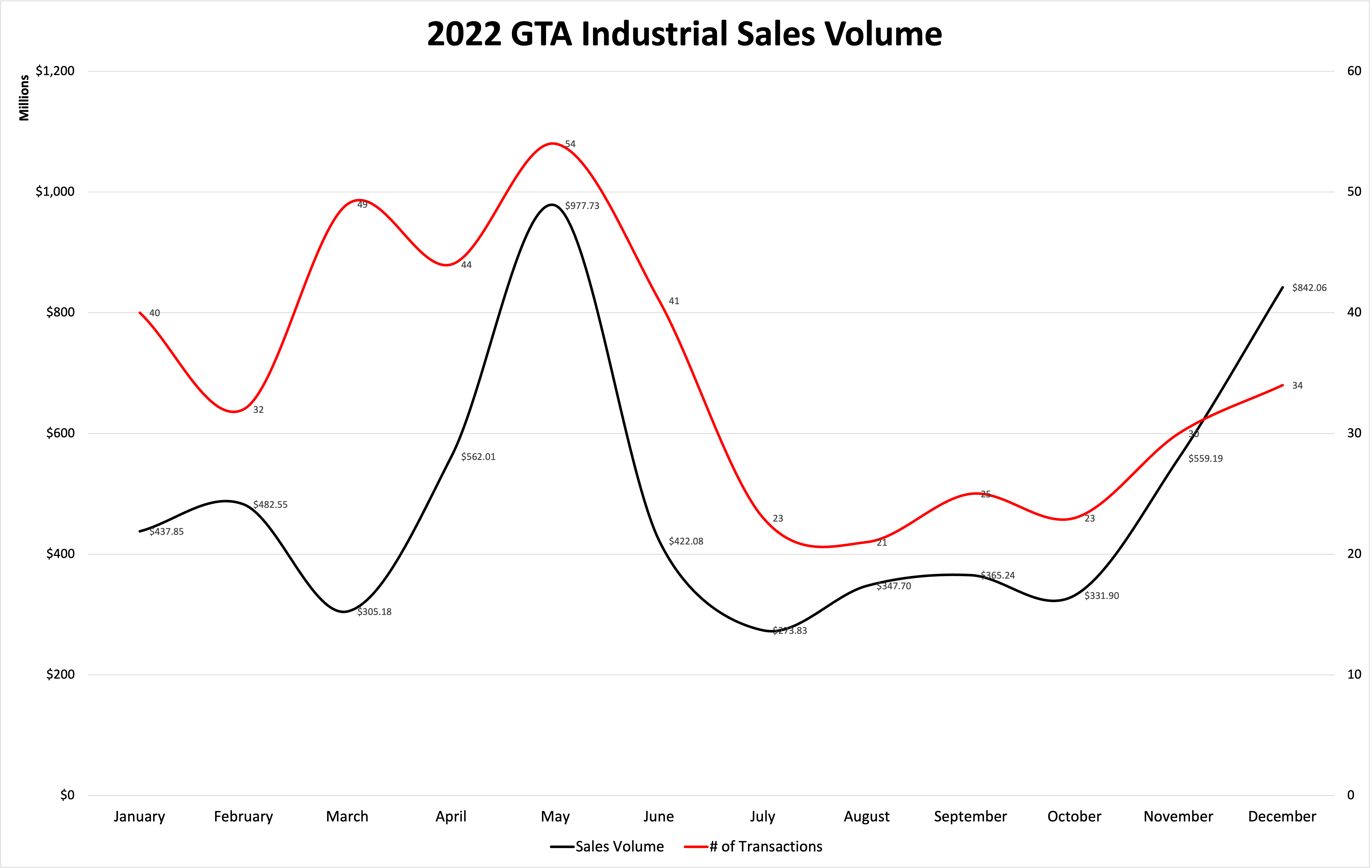

Below, we see a month-by-month breakdown of GTA industrial sales volume and transaction activity. What’s worth noting is the obvious drop in both from their respective peaks in May to their troughs in late July.

Both volume and activity stabilized throughout Q3 2022 and subsequently took off in late Q4 for reasons (we believe) mentioned above.

Finally, given the length of time needed to close transactions, we can infer that the original shock took place around March or April, which is when the first two rate hikes took place.

2022 GTA Industrial Sales Volume and Transaction Activity by Month.

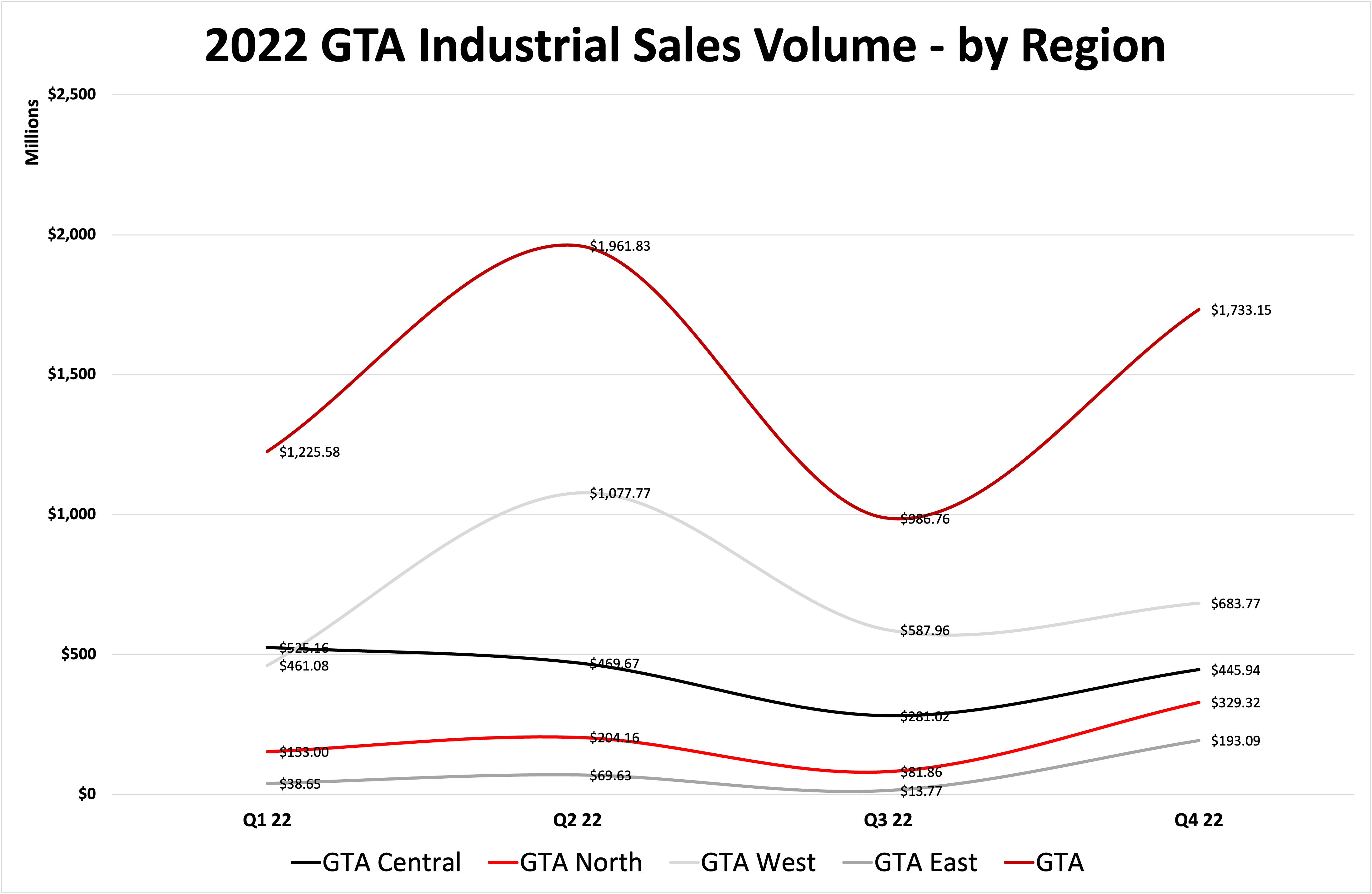

Last but not least, we broke down the overall GTA industrial sales volume by region in the chart below. From this perspective, we see a similar trend, however, each region appears to decline in volume more softly; with the largest drop occurring in the GTA West markets.

GTA Industrial Sales Volume by Region in 2022.

Conclusion

While more and more stakeholders are noticing the general caution and uncertainty playing out, the GTA industrial market remains one of the most dynamic and robust in North America.

And, as shown, industrial sales volume and activity did bounce back in late Q4 2022. The real question is, will this continue into 2023? And if not, why?

The Bank of Canada’s future decision to further hike or lower rates will no doubt incentivize expansion and beef up the Buyer pool. That said, it is this writer’s opinion that the GTA industrial market will always have plenty of opportunities, especially for those who are well-prepared and who carefully understand the risks. Industrial assets will always be a staple of any economy and, in the long run, are a prudent investment when acquired and managed properly.

With that said, if you would like a confidential consultation or a complimentary opinion of value of your industrial asset, please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is a Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com