The Anatomy of a Multi-Storey Industrial Warehouse

The Future of Industrial Warehousing

December 4th, 2020

Let me tell you a story.

This isn’t the one with a daring hero or an epic journey against insurmountable odds. Nor is it one with a happy ending. In fact, it has no ending at all, as this tale continues to unfold and write itself in real-time.

Whereby most accounts are told from a personal or psychological perspective, this one simply tells of the various forces at-large that are at play, and how their effects are manifesting in the creation of a type of property that has yet to be proven and adopted by the mainstream in North America – and even – the greater world.

What’s this, say you?

It is the futuristic, feat of engineering that captures the imagination and carries us off into a world with drones and flying cars a la Blade Runner. It’s a concept so foreign and complex in execution that it would send many developers and contractors running for the hills. Strangely enough, it is also one that has its history in Asia for well over two decades; where builders have, as a response to necessity, cast aside notions of what can or can’t be done.

The reason it has yet to become a staple of commercial properties stateside is simply for pragmatic reasons. There was never a real need to go through all of the zoning, design, architectural, and financial hurdles that dramatically amplify risk and eat into pre-existing, easy, and healthy margins (analysts and underwriters beware).

As we enter into 2021, we are talking about a product in an asset class that is not only ‘on fire’ as it is so popularly described, but rather, it has become multi-dimensional in its forms and applications.

It has become the ‘legs’ for dozens of industries to operate via social distancing and same-day deliveries.

It has become the carrier of our food, the creator of our streaming content, the laboratory for our medicines, as well as the manufacturer of our goods.

The asset class is industrial.

And the property is multi-storey industrial warehousing.

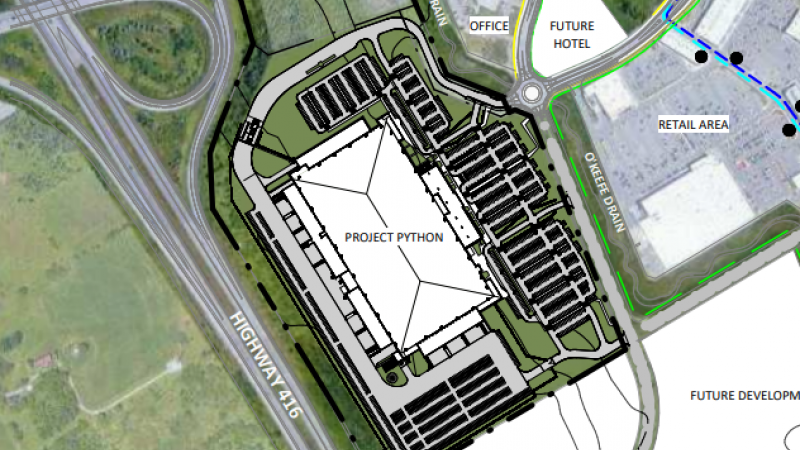

(And yes, it’s coming to Canada soon… actually, it is under construction, as we will highlight in one of our upcoming issues…)

Barrhaven warehouse, Source: OBJ

The Anatomy of a Multi-Storey Industrial Warehouse

Since multi-storey facilities are still just industrial facilities, they will no doubt share many of the same characteristics as their relatives. So let’s focus on a few key differentiators, the reasoning behind them, as well as their effects.

Accessibility by Ramps (and Elevators)

Multi-storey warehouses naturally require the ability to access the various levels. While some facilities are constructed so that upper levels can be reached by elevators, all of them (so far) have multiple ramps leading to the second and third floors. As Prologis stated in a REIT.com article regarding its experience abroad… “the company has already built 53 multi-storey distribution centers in Asia. One thing the Japan team stressed: There had to be two ramps.”

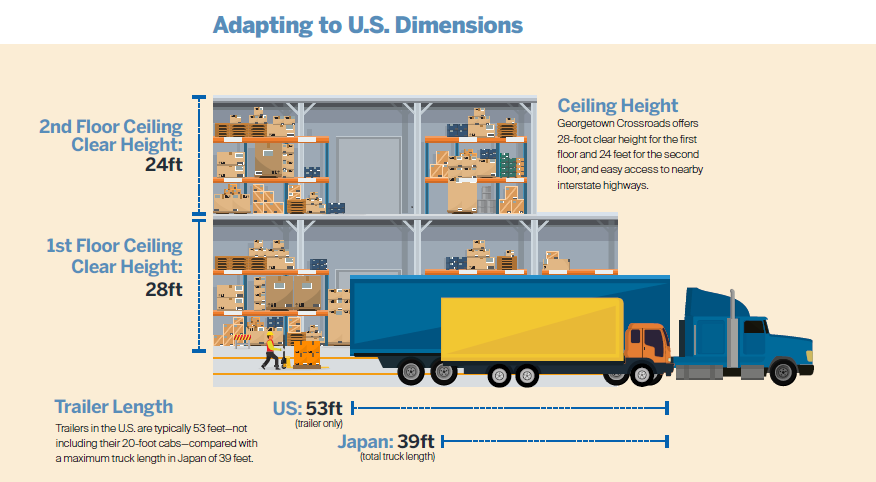

It also added, “the ramps were also more of a challenge to build because they must support heavier truck loads and longer lengths in the U.S. versus those of Japan. Trailers in the U.S. are typically 53 feet—not including their 20-foot cabs—compared with a maximum truck length in Japan of 39 feet. That meant the spiral ramps used there are not practical in the U.S. Instead, wider, longer ramps that wrap around rentable building space are needed. It also meant higher-grade concrete and thicker rebar steel than it used in its Japanese warehouses. The ramps and the truck courts are two of the most expensive parts of the design, and U.S. office parking structures weren’t a good comparison as a guide. The ramps and upper docks have to be able to handle much higher loads than conventional office towers, for example.”

Source: NAREIT, REIT.com

Additionally, Ware Malcomb published its thoughts on the matter, where it recommends straight ramps, as opposed to those used in Asia. “Large circular ramps are extremely costly and require a significant amount of land to allow for maneuverability of full-size tractor trailers. Even more importantly, they consume too much expensive land and reduce net rentable area. Straight, two-way ramps attached to the building provide the most efficient truck and car circulation, lower construction costs (primarily foundation costs) and increase the structure’s net rentable area.”

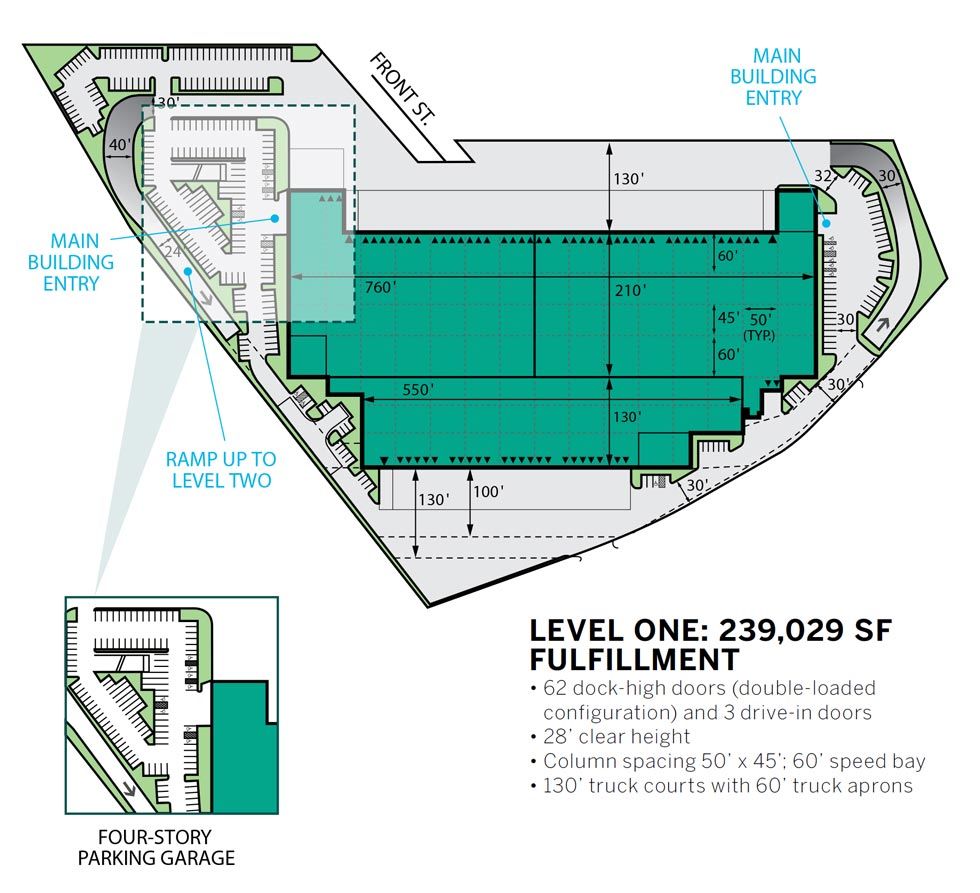

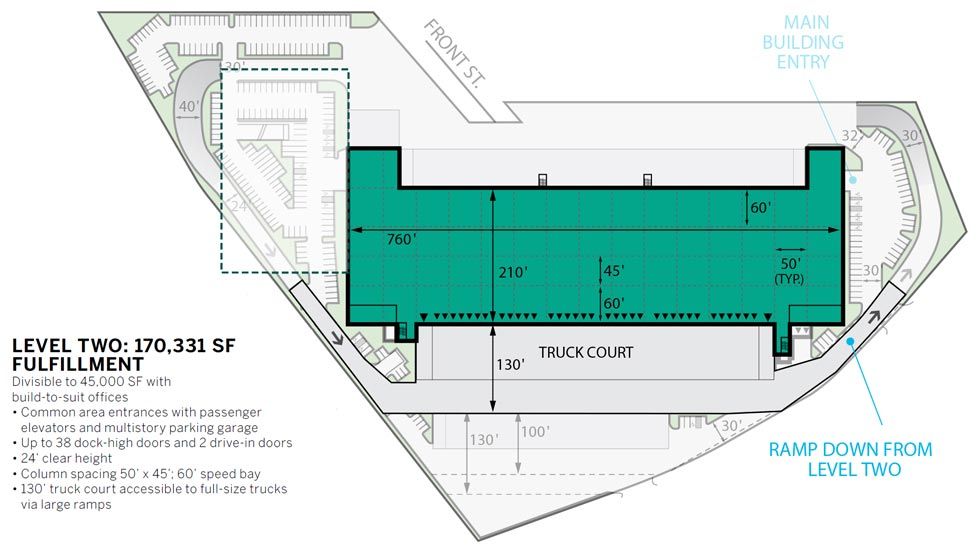

Finally, NREI published an in-depth look on the first North American project, stating, “the first multilevel warehouse to get under construction in the U.S., this project is designed with ramp accessible logistics space on the two lower levels, which total 400,000 sq. ft., and provide 28’ and 24’ clear height on floors one and two, respectively.”

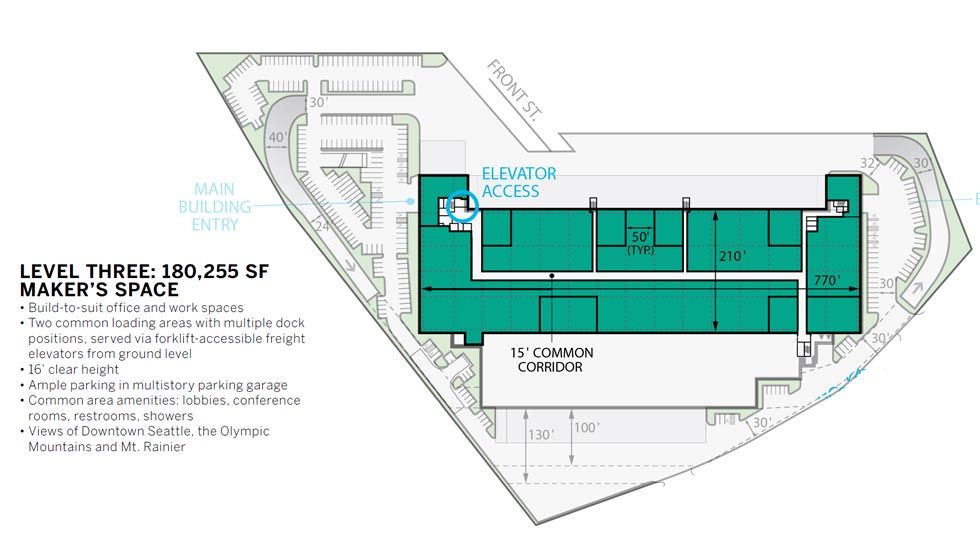

NREI concluded regarding the ramps being limited to the first two levels only, “Prologis has built six- to 12-story industrial buildings in Asia, but the design utilizes spiral ramps that reach all levels. This configuration is only possible because trucks in Asian nations, including Japan, Singapore and China, are only 25’ long, compared to 40’ long in the U.S., noting that U.S. truck length is a function of trucking regulations, which are driven by shipping container size and warehouse height. U.S. multilevel warehouses are designed with ramp access only on the first two levels, so will accommodate different types of users or products on the lower and upper levels. However, with a good enough elevator system, “The sky is the limit.” The third level, with 180,000 sq. ft. of space, is accessible via a freight elevator with two dedicated docks and offers traditional 16’ clear height.”

Source: REIT.com

Top-Level Uses

With respect to the top levels, NREI’s feature states that, “the top level is unlikely to be used for goods distribution,[suggesting] that it is suitable as a “makers” space or could accommodate anything from a build-to-suit office to a bakery operation.”

Size

According to Ware Malcomb, “building size will be a direct reflection of the structure’s proximity to a port; larger buildings of around 500,000 square feet closer to ports will serve third-party logistics providers, while smaller buildings of around 250,000 square feet will be located closer to densely populated locations.”

Varying (But Lower) Clear Heights

Prologis noted in an interview that it “polled its customers in the U.S., asking them what other features were most important. Maximum clear heights—which can now soar as high as 40 feet for new warehouses—weren’t essential.More important was the column spacing, which is 50 feet by 45 feet on the first two floors. Generally, tenants will have to make some sacrifices by choosing closer-in locations. For example, they won’t find class-A warehouses in the infill locations with 32-foot clear heights.”

That said, Prologis’ CEO spoke about their Georgetown Crossroads project, saying that it “offers 28-foot clear height for the first floor and 24 feet for the second floor, and easy access to nearby interstate highways. The building’s first floor has loading docks on both sides. The warehouse’s first two floors are able to handle standard, 53-foot-long tractor trailers. Two ramps serve the second floor, with the third level accessible by freight elevators that can hold forklifts. The third floor, with 16-foot heights, is suited for light manufacturing, creative offices, and production.”

Coverage and FAR

Ware Malcomb’s expert opinion on site coverage was that ‘coverage is king,’ adding that “the total building size is defined by its floor area ratio (FAR), the relationship between the amount of usable square footage in a building and the total area of the lot on which the building sits.”

They continued, “a higher FAR translates directly into more leasable floor area. Designers therefore need to devise ways to increase coverage wherever possible for this new building type to make financial sense. Two key functional elements of a multistory warehouse are truck ramps and automobile parking. Both requirements pose a challenge, as they significantly reduce the amount of net rentable area on a site. Designers need to develop a creative, “out of the box” design strategy to overcome the loss of coverage created by these two functional requirements.”

Consistent Rack and Aisle Dimensions

Relying on Ware Malcomb’s thoughts again – this time on the manifestation of functional design considerations – on the overall design of the facilities… “Ware Malcomb’s prototype multistory distribution center has been designed from the inside out, using the design principle of “form follows function.” Designers started by establishing a basic planning module of 4 feet 0 inches, which is the size of a standard single select rack. Single select racks represent 80 percent of all racking systems in use today, and therefore will be universally accepted by distribution center tenants and end users. Combining the rack and aisle dimensions (typically 9 feet 6 inches) creates the most efficient planning module.”

It concludes, “the next key step is to design a structural system based on this planning module. The system must be as light and economical as possible, while still delivering uncompromised standard slab loading performance. The resulting functional layout will have the exact features that will be critical for tenants to readily accept a multistory industrial distribution facility. These features include racks, aisles, clear heights, speed bays, truck loading, dock door counts and more.”

Parking

As per Ware Malcomb, “Last-mile buildings typically contain hundreds of workers and thus require significant amounts of parking. Parking structures are extremely costly, consume considerable land area and reduce net rentable area. Rooftop parking is not feasible from a functional standpoint, and would significantly increase the cost of the structure.”

“The most efficient and cost-effective way to provide large numbers of parking spaces is to insert a parking deck between the upper and lower truck yards. This creative design approach will result in reduced construction costs, large and efficient parking fields, and the separation of truck and auto circulation. It will also create a highly functional queuing area on a mezzanine level for last-mile delivery vehicles, which include panel trucks, smaller vans and cars operated by independent drivers.”

Source: NAREIT, REIT.com

Steel Structure

According to Ware Malcomb, “The building is designed with an independent steel structure and non-load bearing concrete wall panels. Wall panels can be fabricated and erected simultaneously with steel components that have longer lead times, thereby reducing construction durations and eliminating critical path schedule delays. This construction sequence will significantly reduce the amount of time it will take to erect the building, because the steel structure and the wall panels will be fabricated simultaneously and then erected sequentially. The goal is to design the most economical concrete panel height while keeping the weight to a manageable size – one that can be erected by a 300-ton crane.”

“The exterior wall design incorporates a combination of non-load bearing concrete panels and metal insulated panels on the second and third levels. Concrete panels will be either site cast/tiltup or precast, depending on which process is most economical locally. The site layout incorporates drive aisles on the building perimeter to facilitate efficient erection sequencing by standard 300-ton crawler cranes to maximize panel size and reduce the total number of panels.”

Minimize Costs and Maintenance

Finally, Ware Malcomb published its thoughts on how to minimize costs and maintenance through the enhancing and maximization of durability of the structure itself.

“Floor Slabs on Grade. These floor slabs have been designed to minimize construction joints to mitigate future maintenance costs. Column diamonds will be saw cut after panel erection to produce smoother panel faces with less patching. The floor slabs will be utilized as casting beds, thereby eliminating costly waste slabs.”

“Upper-level Floor Slabs. These floor slabs, and the supporting wide flange steel supporting structural members, have been designed to minimize defection, reduce member depth and provide standard slab loading consistent with a typical on-grade slab.”

Barrhaven warehouse, Source: OBJ

Conclusion

The concept of a multi-storey industrial warehouse is one of creativity, imagination, and ingenuity. Its existence and operation within our society will be one of necessity and financial incentive… either that or an initiative carried out by a progressive and risk-taking developer. So far, the Greater Toronto Area does not have a backer, but, given the forces at play, the Region would likely make a great candidate.

Extremely dense pockets of the urban core may be well served by these futuristic buildings and their ability to connect with consumers. The only roadblocks right now are economics and experience. With few understanding the former, and even fewer possessing the latter, it may take a bold move to get the ball rolling. However, once successfully completed, the pioneers should inspire the early majority. From there, it will not be unreasonable to see them spaced throughout the City of Toronto.

Next week, we will examine the feasibility of constructing multi-storey industrial warehouses in North America.

In the meantime, if you would like a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com