The Best Way to Get Into the ‘Industrial Game’

Investment and Development Strategies

February 19th, 2021

Land…

They don’t make it any more….

And coupled with ever–increasing demand has led to an appreciation in values.

For instance, let’s compare two fairly similar transactions that were considered to be at the height of the market at the time of purchase.

One was sold in Q4 2018 and one in Q4 2020. Just two years apart, we saw the price go up from $2,400,000 per acre to $3,500,000 per acre.

That being said, no two sites are exactly the same and – yes – you need to know and understand the other factors impacting the final cost, such as demolition costs, any potential environmental remediation, soil stability, site work, etc..

But the fact remains, as you will see in the charts below, that industrial land is in great demand. In some cases it is so tied to a business that it becomes a main part of that business decision. In such cases, we can see that certain users are willing to pay whatever needs to be paid to acquire a certain piece of land.

And in addition to Users buying industrial land, Investors are also in pursuit. With industrial vacancy rates for purchase hovering around 0.1% across all GTA markets, sometimes the only way to add investment product to your portfolio is to create it from scratch.

Furthermore, low vacancy rates for lease of about 1.5% to 1.7% are enabling investors and developers to buy land, start with construction ASAP, and to welcome tenants months before the final and substantial completion of the project.

There is no doubt that…

It is a Landlords Market in the Greater Toronto Area…

So without further delay, let’s take a look at some recent land transactions across Toronto sub markets…

Toronto West Markets – Industrial Land Sold

Toronto North Markets – Industrial Land Sold

Toronto East Markets – Industrial Land Sold

Toronto Central Markets – Industrial Land Sold

Above, you can see values from $260,000 per acre to $3,399,000 per acre, and everything in between.

There are many factors influencing the value of industrial land, such as:

- Location;

- Size;

- Shape;

- Setbacks (from highways, TRCA land, etc);

- Time to Development;

- Servicing Cost, if any;

- Soil Stability (are caissons required); and

- Site Work (do you need to bring fill or remove soil from site).

Another fact: the lack of industrial land, as well as the ever–increasing land values and development charges have forced investors and developers to look to areas previously not considered.

The Toronto–East Markets of Pickering, Whitby, Ajax, and Oshawa were first on the new target list, given their proximity and access to major highways; specifically, Hwy. 401 and the extension of Hwy 407. We have seen some major developments there, including a few major announcements of large distribution centres to be constructed in the near future.

Now with these territories discovered and active, Developers and Investors are looking even further into the field for opportunities. And the further you go, the price is generally lower and the time to development longer.

So let us take a look at some Toronto-North Markets transactions…

- 19 acres in Vaughan purchased for $1.7 Million per acre with 1-2 years to development,

- 105 Acres in King purchased for $1,000,000 per acre, with 3-5 years to development, and

- 366 Acres in Georgina purchased for $110,000 per acre with long term horizon

Because of the aforementioned principle, many developers and money managers are therefore looking to acquire infill sites closer to the city so that they can put their money to work sooner.

Below is a list of recent transactions…

Infill Sites – Redevelopment Projects

Each site mentioned above also comes with an industrial building, whether it be smaller or larger, and with some surplus land. Some were purchased based on a sale-leaseback (whether it be shorter or longer term) and some are purchased vacant.

Some of these sites will be developed sooner and some will be developed later. The strategy is a combination of land banking with holding income in place while benefiting from the appreciation of net rental rates and industrial land values.

There are some brilliant plays that will show handsome pay–offs for investors with vision and patience.

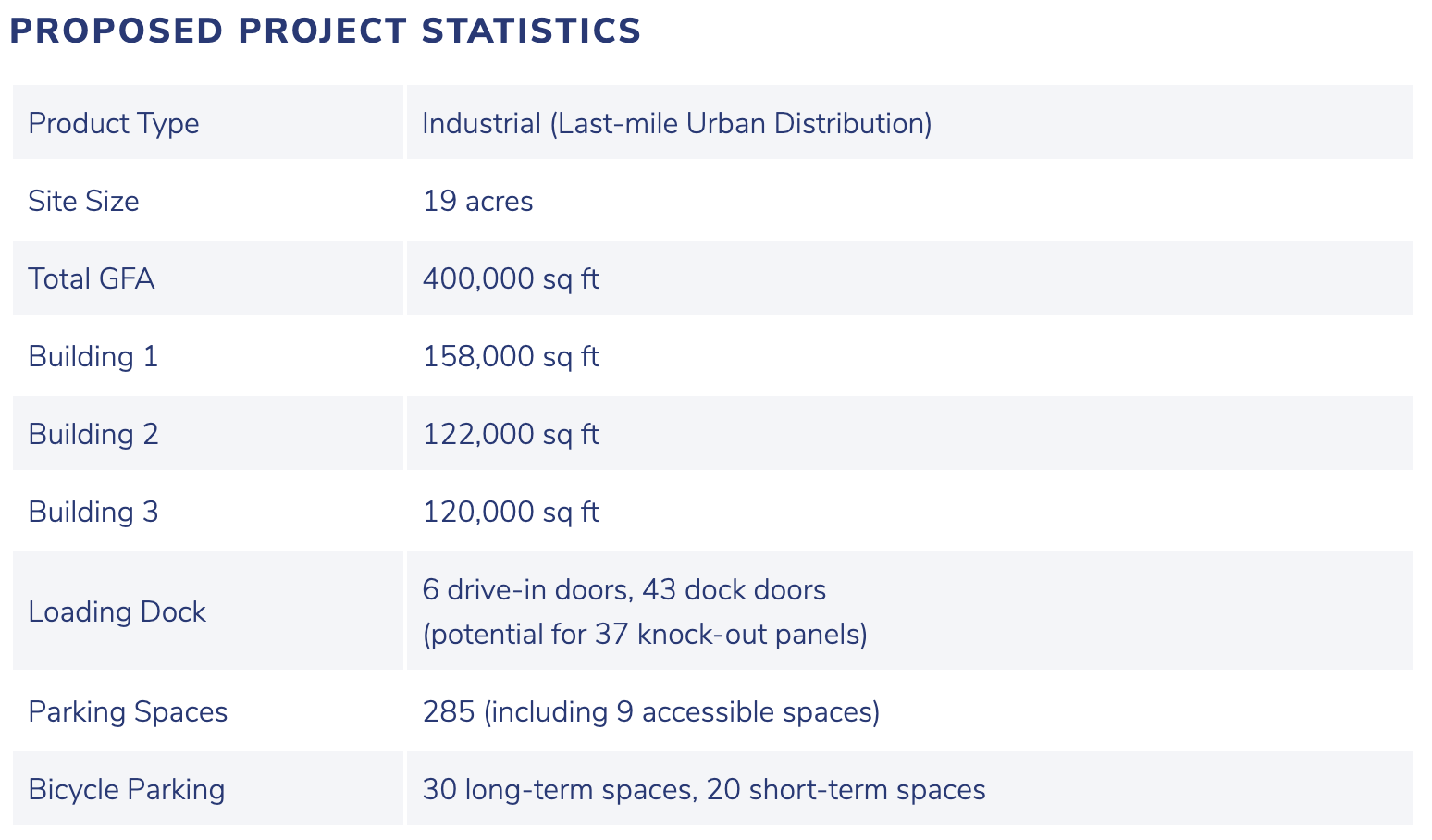

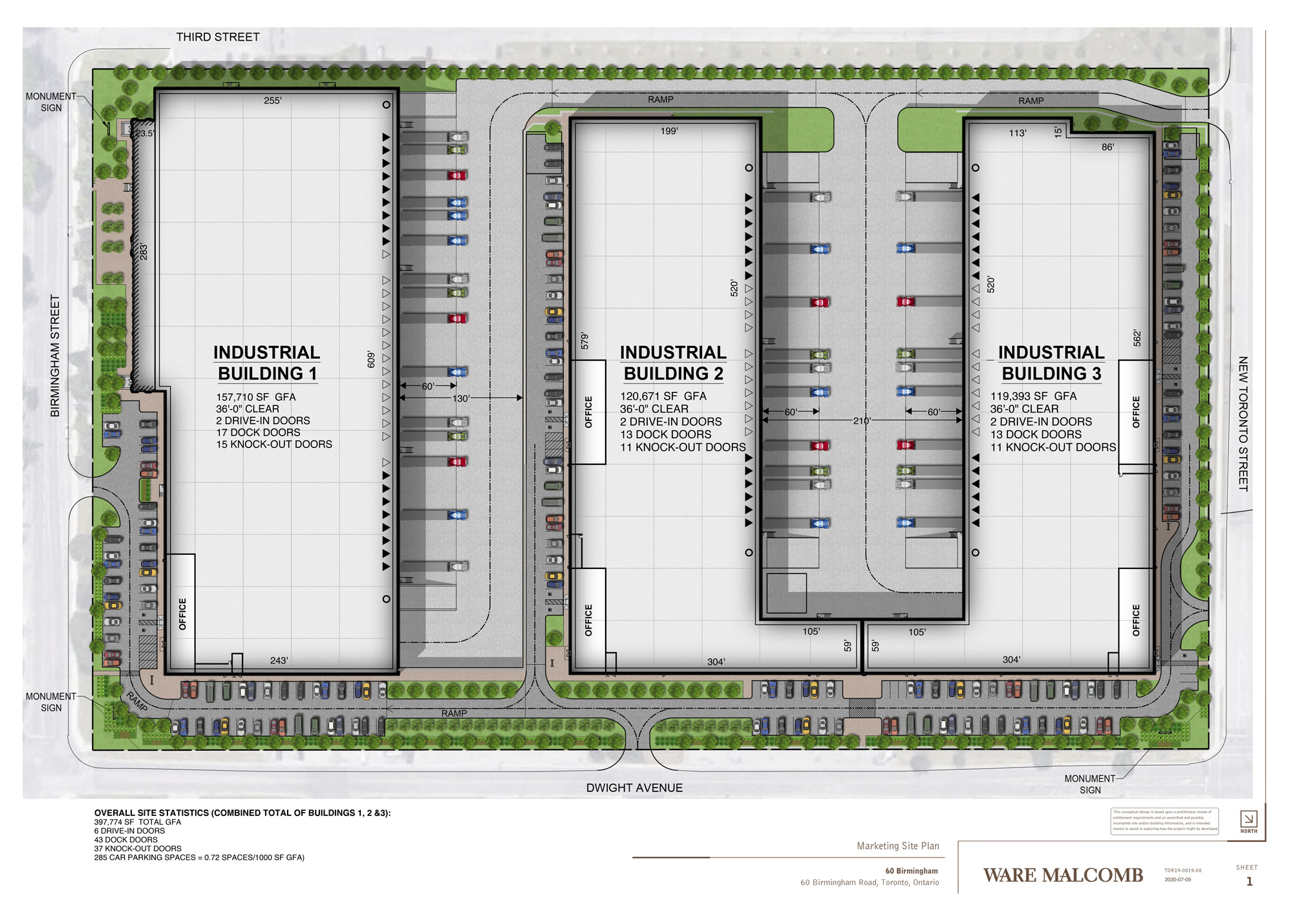

Redevelopment Project in Progress – Example

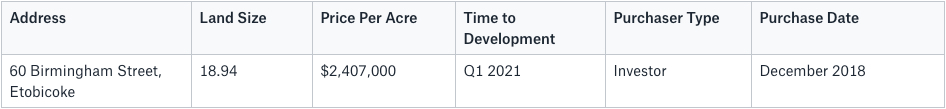

In 2018, when Campbell’s Soup decided to sell its property in South Etobicoke, a large group of investors and developers showed a great deal of interest in this property.

Quadreal, a real estate investment, development and management company was the successful bidder.

With a Purchase Price of $2,407,000 per Acre (plus demolition cost, less development charge credit, etc…), it was the highest price paid for industrial land in the GTA at that time. Of course, questions came up if such a “high price” per acre makes sense, how can they make it work?…

The reality is that we keep bringing about 5 to 6 million SF of new construction to the market every year and most of that product is leased prior to construction completion… while at the same time showcasing a healthy increase in net rental rates… So supply is chronically limited…

In the meantime, the pandemic seems to have had a positive effect on industrial real estate; completely opposite to most of the other real estate asset classes. As retail shut down, industrial became the new retail as e-commerce exploded.

Demand for warehousing and distribution space has increased ten-fold… especially for new, modern, high ceiling space close to the City Centre and as proximate to consumers as possible…

Time is money….

Promise to deliver goods to the end-user in one to two hours and these expectations directly impact industrial real estate values!

So, 24 months later, QuadReal is in the middle of demolition of an old, multi storey, obsolete industrial building which will be replaced with brand new, modern three industrial buildings.

You can find more information on this amazing development here, by clicking the image below:

Conclusion:

Looking forward, we continue to see a number of industrial infill land sale transactions in the GTA breaking $3,000,000 per acre… and even $3,500,000 per acre.

And the same questions are coming up… if such a “high price” per acre makes sense, how can they make it work?…….

Will this appreciation in value continue?

What is your opinion?

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com