Failing To Prepare This Could Turn The Deal Sideways!

The moment many deals turn sideways…

You’ve done what many people thought was impossible. Perhaps even too ‘risky.’

You successfully purchased, occupied, leased, financed, operated, and/or managed a property anywhere from 5 to 40 years (or more)…

You navigated the murky waters. Negotiated with dozens of parties – bankers, brokers, tenants, investors, lenders – over the years and lived to tell the tale.

And now you’re finally ready to sell.

You stand to make a nice windfall; which you’ll work with your accountant on to avoid paying capital gains.

Maybe you’ve employed a top broker to help market and sell your property…

And perhaps you’ve even managed to create a bidding war to leverage multiple offers (essentially making an even greater profit than you originally anticipated).

But then something happens that throws a wrench into the entire process.

You go into due diligence and receive a Phase 1 report from the engineers.

No good.

Phase 2? Not looking much better.

As you scramble to get an accurate assessment of the situation, the Buyers withdraw and disappear as quickly as they came.

It’s back to the drawing board with respect to marketing the asset, however, everyone in town knows there’s something up, and they will try to leverage it against you (unless you have an experienced broker, of course).

It’s potentially a nightmare situation, but one that can be avoided (and yes, even overcome should it arise, because these things do happen from time to time).

Over 25 years of representing landlords and investors, I’ve noticed this pattern over and over again. In order to maintain control over the disposition of an asset, we’ve had to ensure that every property or piece of land goes through a specific, repeatable process.

Without this, you expose yourself to the market.

To circumstance.

To luck.

Yet by running through the steps, you can not only nip any potential issues in the bud, but you can:

- uncover better ways to position or market the building,

- truly understand the highest and best use cases,

- compress the overall sales cycle, and

- leverage more and higher quality interest from buyers.

So, if you are considering purchasing or selling an industrial property, I would strongly advise that you complete a thorough pre-due-diligence so that you will know if there are any issues with the building or the site itself that need to be addressed before the property is taken to the market.

We are two issues into our series on Due Diligence, where we are diving into the different types of due diligence, case studies of successful assessment and remediation, and what exactly to look out for when preparing your property for sale.

Today we will examine Phases 1 and 2. So let’s begin…

Environmental Site Assessments.

Phase One ESA, Phase Two ESA, and Controlled Substance Report.

Phase Three ESA (remediation followed by reporting), Risk Assessment Study and Record of Site Condition Report…

These are all commonly undertaken when selling, purchasing, financing or redeveloping industrial sites in Ontario.

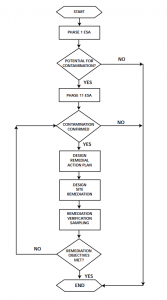

Below is a quick overview of the Environmental Site Assessment and Remediation Process.

Environmental Site Assessment and Remediation Process

Phase One Environmental Site Assessment

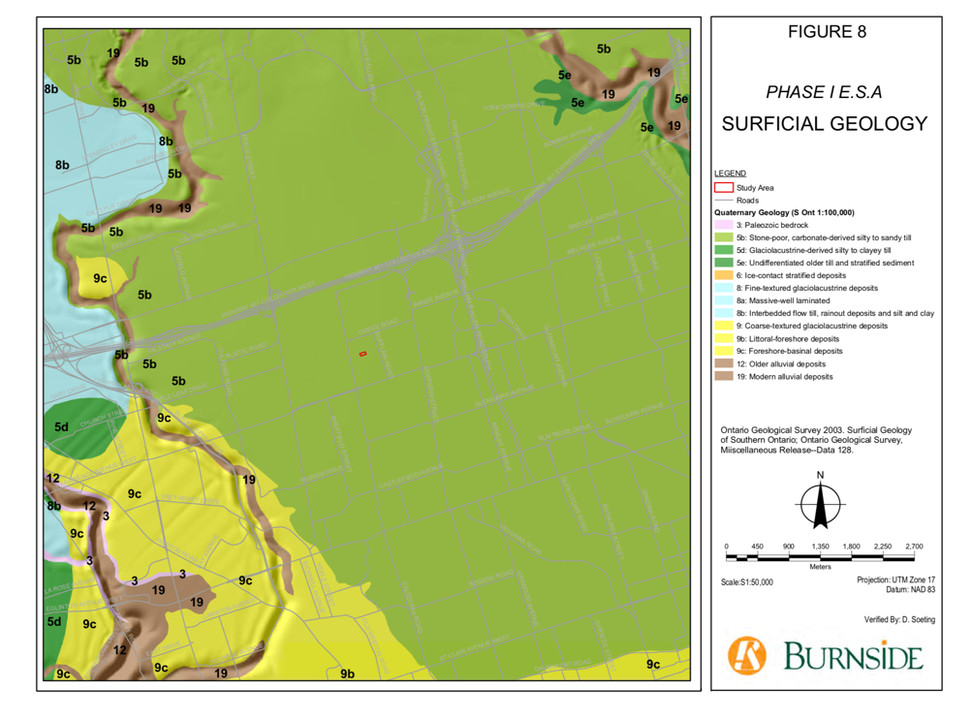

Phase One ESA is a documentary review of a property’s historical land uses and a visual inspection of the premises to identify any actual or potential sources of environmental contamination.

A Phase One ESA does not include sampling or testing of soil, groundwater, or building materials. Such analyses are conducted in a Phase Two ESA.

It is intended to identify potential contamination visiting the property to identify visual evidence of actual or potential contamination (for example, a UST, or asbestos pipe insulation), reviewing background documents (to collect data on past activities on the site and neighboring properties); interviews with site personnel, government officials and third parties, and through certain clearance letter searches with governmental authorities.

A Phase One ESA is commonly done on:

- real estate due diligence for a buyer,

- assisting a vendor in expediting a sale,

- property insurance renewals,

- financing and refinancing,

- commencement of a lease to establish a baseline condition, or

- lease termination to assess if contamination has arisen/increased during the lease.

Phase Two Environmental Site Assessment

Phase Two is a more intrusive form of investigation, as it involves the sampling and analyses of soils and groundwater. This type of investigation is undertaken as a follow-up study when a Phase One ESA reveals actual or potential sources of contamination located on site or off site.

Soil and groundwater samples are obtained via drilled boreholes or test pits, and the scope of work can range in size from a couple of holes advanced around an underground storage tank (UST), to several dozen holes as a result of an extensive investigation in order to determine the extent of already confirmed soil or groundwater contamination.

Designated Substances and Hazardous Materials Survey

The purpose of this survey is to determine the presence or absence of Designated Substances (asbestos, lead, mercury, Polychlorinated Biphenyl – PCB, silica, radioactive materials and mould) within the building(s) and to provide Designated Substance information to contractors to ensure complete and compliant removal or handling of materials prior to the start of the remediation project.

When Contamination is Identified:

Property owners can choose to go no further at this point. However, in order to obtain bank financing or to complete real estate transaction and transfer ownership, further action is necessary.

In such cases, follow-up studies should be undertaken to confirm and delineate the nature and extent of the impact. Practical and cost-effective actions can then be selected for cleanup or on-site management of the contamination.

On-Site Management of the Contamination

During preparation of the site remediation plan, it may become apparent that immediate remediation to applicable standards may not be appropriate. This may occur when:

- there is no imminent unacceptable risk to public health and safety or to the environment, because contamination is immobile and localized on site, with no impact beyond the property lines;

- the site is continuing to operate in its current mode and no change to more sensitive land use is planned;

- remediation is not practical, given the depth and location of the contaminants (e.g. removal of contamination is inhibited by such existing structures as buildings, surface equipment, underground tanks, or utilities); or

- a planned future redevelopment of the site will facilitate more effective and more efficient remediation.

In these types of situations, the proponent may elect to proceed with a site management program, instead of immediate site remediation.

Site management requires regulatory approval and it may be just a temporary solution. It may also include undertaking vapor control measures, a monitoring program, or possibly a risk analysis to define the potential environmental risk.

Disclaimer: The information provided is intended for general educational and informative purposes ONLY, and is NOT intended to be taken as legal, environmental, or tax advice.

Talk to your lawyer, accountant, attorney, or environmental or planning consultant before taking action.

Next issue, we will begin uncovering what to do when Phase 2 identifies contamination, and how to potentially navigate this often unforeseen and unwanted obstacle.

Until then…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.