The Effect of Infrastructure on Commercial Real Estate

Forecasting Future Industrial Land, Development, and Property Values

October 1st, 2021

Influence is an interesting concept. Game theorists and advertising experts state that it comes in three major forms: emotional, logical, and repeated messaging (otherwise known as propaganda). In terms of its effectiveness, tapping into emotions is the best way to sell a product or service, while logical arguments about technical features and benefits does very little to sway consumers into action. As examples, Rolex and Lamborghini don’t talk about their products, but rather, they show how owning them makes you feel and appear to the world.

In between these two methods lies the practice of a consistent, repeated message. While not as strong as invoking hope, fear, aspirations, or frustrations, it can cement a narrative quite easily over time.

So, if you have been on our newsletter list for any period of time, then you may have heard me relay a consistent message regarding the GTA Industrial market based on historical data and market activity. It is as follows:

Availabilities are at an all-time low and have pushed up rental rates and valuations to new watermark levels. As a result, developable land has become scarce (and increasingly expensive) as private and institutional investors ‘land bank’ and construct new industrial facilities at a torrid pace. Despite this, we are caught in a supply trap whereby most new inventory is pre-leased, giving little to no relief to Users in need.

However, there are key ongoing initiatives which may change the nature of the industrial market. And we should consider them, lest we become fixated on our current dilemma. These solutions would be grand, sweeping moves which could create a paradigm shift and unlock huge swaths of land for investors and occupiers to take advantage of.

The elegance of this solution lies in its ability to incentivize stakeholders to act quickly to service, zone, and develop this land. When finished, or during the process of completion, we may find an enormous amount of ‘dry powder’ capital deployed rapidly by those eager to do so, but unable to, due to the current industrial landscape.

So what is that solution?

Well, last week, we examined the province of Ontario’s Greater Golden Horseshoe Transportation Plan, and how the proposed infrastructure projects may unlock thousands of acres that are currently inaccessible by municipalities, developers, and occupiers alike.

This week, we will look more closely at a few of these initiatives, and further examine their impact on industrial land in relative proximity; including possible increases in supply of new serviceable or developable land, as well as potential effects on land pricing.

Highway Widening Projects

Highway 401

Highway 401 is slated for additional lanes and a bus bypass route, which will hopefully free up space on Canada’s best-known and most-feared highways. We all know that the 401 has two seasons: winter and construction. However, making the route wider may not have any noticeable benefits if the supporting roadways continue to drive traffic into it.

Effect on industrial land: We do not see any clear, direct benefit to proximal land aside from the fact that it is already coveted by users looking for access to the highway.

Highway 400

The widening of Highway 400 between Kettleby and Barrie – along with the Bradford Bypass – should help alleviate traffic coming from Simcoe region and further north, especially for those cottage commuters.

Effect on industrial land: The potentially reduced congestion and improved transit times may make the proximal industrial land more attractive to users looking to move further away from the Core, however, we are unsure of the impact this initiative will have.

The QEW

The QEW between Burlington and Niagara Falls is expected to see extra lane capacity, with the hope of reducing congestion through Hamilton.

Effect on industrial land: It is unknown what effect it will have on proximal industrial land. If transit times can be reduced, then users may be more comfortable being located further from the City core.

New Highway Construction and Extensions

Highway 413 – GTA West Multimodal Transportation Corridor

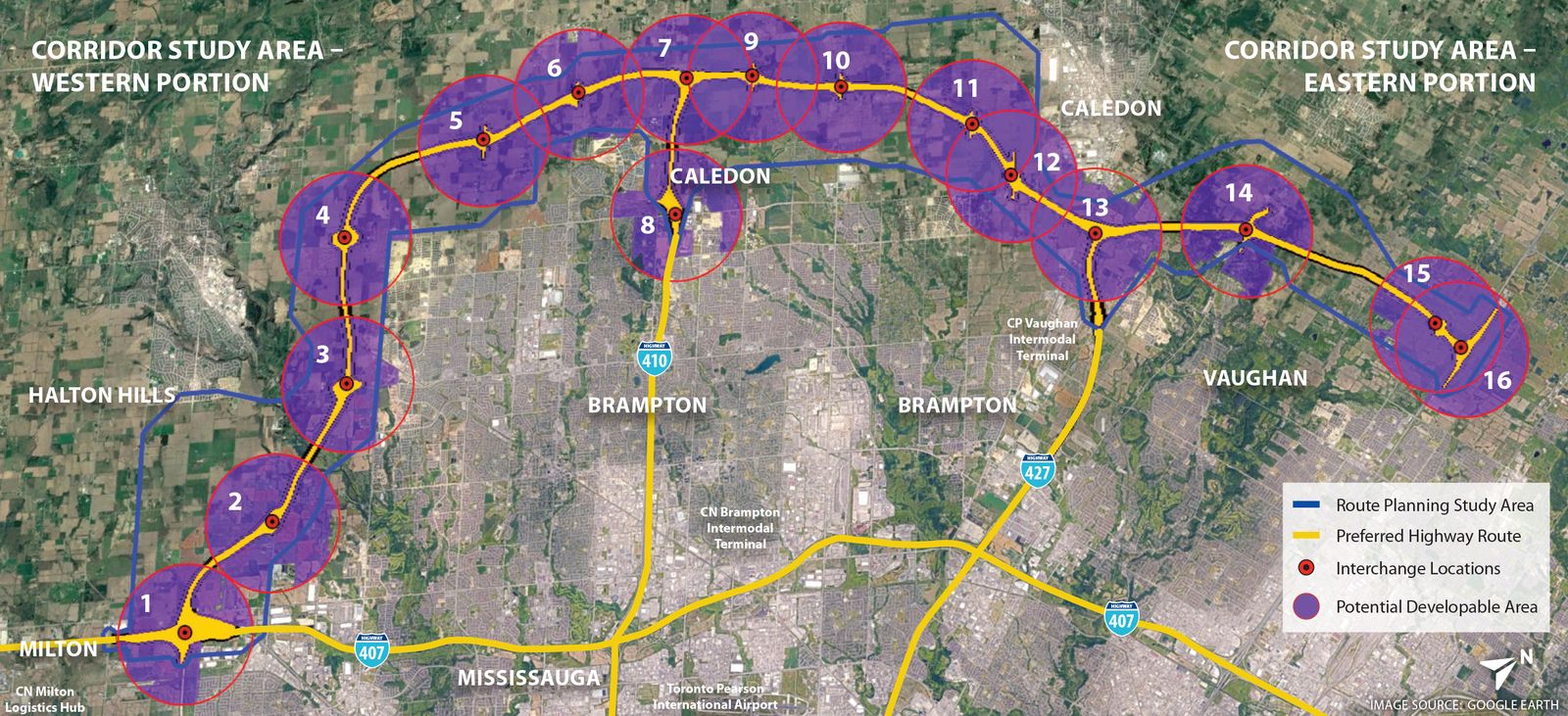

Highway 413, also known as the GTA West Multimodal Transportation Corridor, is a proposed highway and transit corridor running through Peel, Halton, and York Regions.

According to gta-west.com, “the corridor is expected to include a 4 to 6 lane, 59-kilometre 400-series highway with connections to Highways 400, 427, 410, 401, and 407 ETR. The highway would have 11 interchanges at municipal roads and features such as electric charging stations, service centres, carpool lots and truck inspection stations will all be explored as part of the design.”

“The proposed GTA West corridor would extend from Highway 400, between King Road and Kirby Road, to the 401/407 ETR interchange near Mississauga, Milton and Halton Hills. And someone travelling the full length of the route would save 30 minutes compared to the time it would take via Highways 401 and 400.”

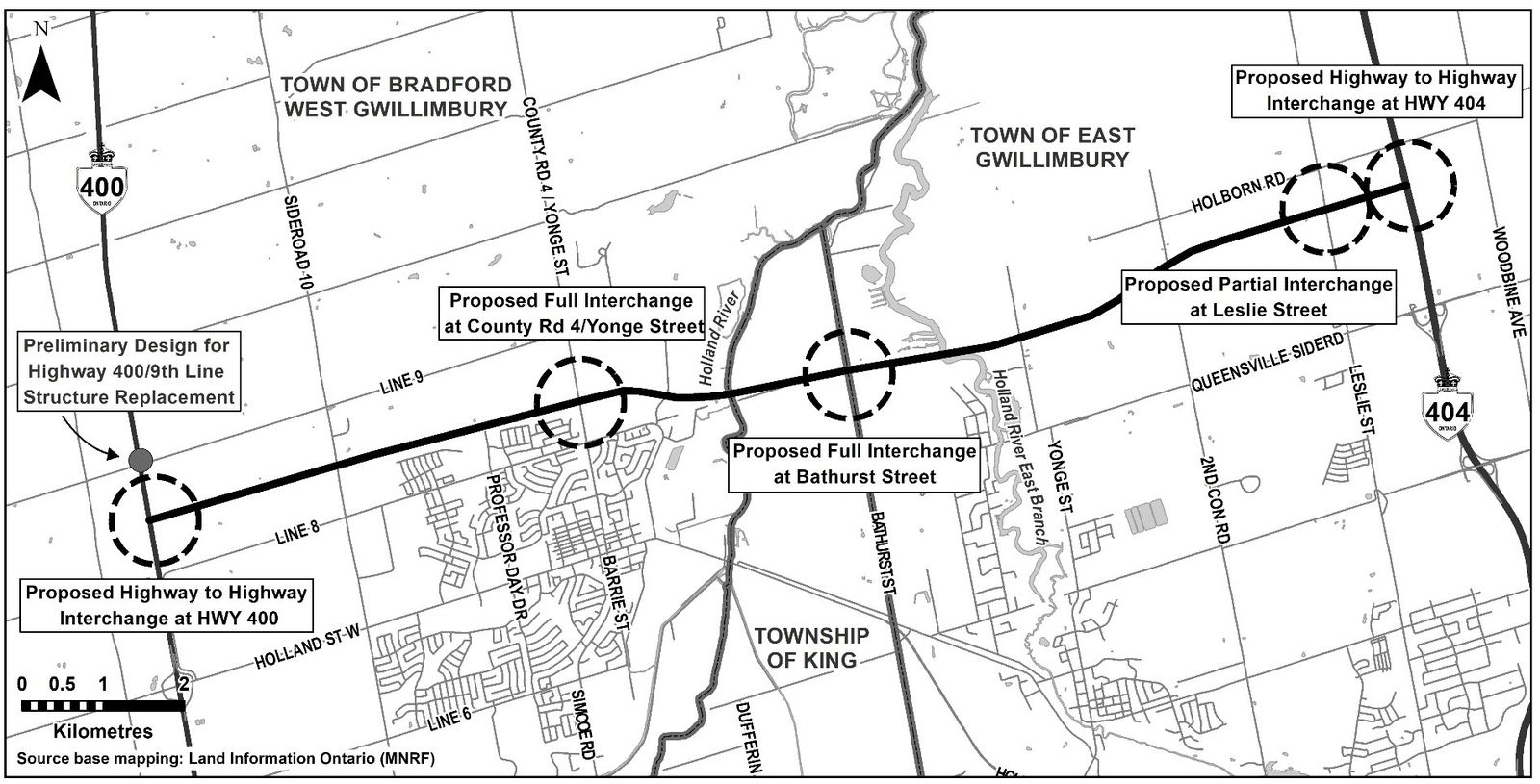

An important, but often overlooked, feature of the new route is that it will connect Highways 400 and 404 north of the city through the 16.2-km Bradford Bypass, which should alleviate a tremendous amount of congestion from drivers who currently make the loop through Highways 7, 401, or 407, or worse: commute through the major arterial roads.

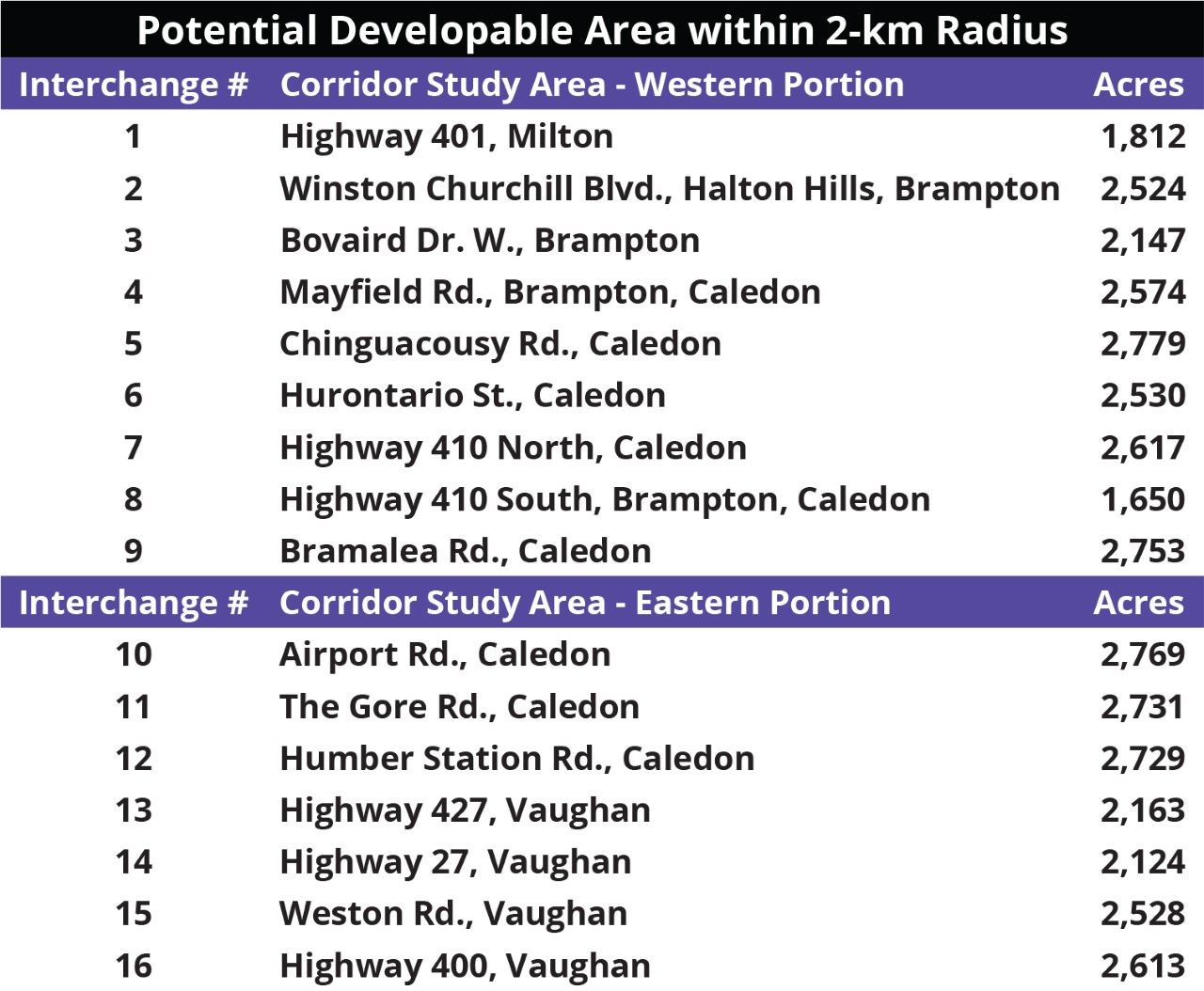

Effect on industrial land: There is lot we can pontificate, but let’s allow the table below – courtesy of Avison Young – to do most of the talking. The amount of potential developable land within a 2-km radius of the proposed project is staggering, and would unlock tens of thousands of acres of land with which to build upon. Will this reduce pricing of industrial land? Perhaps this is the wrong question. Values should increase and remain in line relative to its location, its quality, the zoning, and whether it has been serviced.

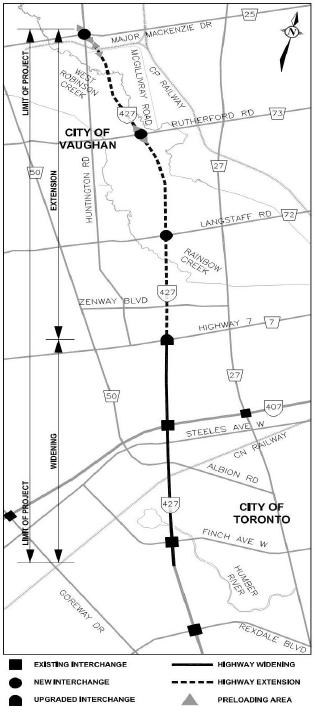

Highway 427

According to the CBC, “the [$616-million] project has two parts: an eight-lane, 6.6-kilometre extension from Highway 7 north to Major MacKenzie Drive; and the widening of the existing four-kilometre stretch of Highway 427 south of Highway 7 down to Finch Avenue.”

Due to a dispute between the government and the contractor – which stated it had been unpaid for a portion of work and asked to complete out-of-scope upgrades at no additional cost – the highway extension just opened in September 2021, after sitting vacant for more than a year.

Effect on industrial land: The extension will provide northbound relief to commuters and transport vehicles that currently have to exit onto Highway 7; thereby clogging internal roads. The new road should also unlock adjacent land leading up to Coleraine – a favourite locale of Big Box developers, and where CP Railway’s Vaughan intermodal facility currently sits.

Highway 404

According to the CBC regarding the GGH Transportation Plan, “a notable part of the plan in the northern part of the GGH appears to be an extension of the Highway 404 corridor from Woodbine Avenue in East Gwillimbury to Highway 48 in Sutton.”

Effect on industrial land: Given how far this extension is from the Core, as well as the layers of available and potential developable land, we do not expect this extension to have a dramatic impact on industrial land compared to other aspects of the plan.

Conclusion

In the coming weeks, we will break down the industrial land sales historical data in each of the major GTA markets with the objective of understanding – to a fine degree – the patterns, pricing growth rates, and volumes.

With this analysis in hand – and coupled with our knowledge of future infrastructure initiatives – we should be able to forecast future values, supply, and demand with more precision.

Investors, developers, and occupiers who apply this framework may be able to get ahead of the trends and find deals while the herd is distracted by market noise.

Key Takeaways

For investors: Until these projects become reality, one should expect to see land values increase further. Deals are being done as land owners realize the considerable appreciation and value that they may extract through selling. Furthermore, we notice a trend of families in possession of land for decades or generations moving to sell as ownership is passed down. That being said, these opportunities often go off-the-market and are brought to investors by brokers who are diligently tracking parcels and communicating with owners.

For Occupiers: Similarly, one should expect pricing to continue increasing. Opting to purchase and develop land on your own means connecting with an experienced broker to gain access to opportunities as they arise. Alternatively, partnering with a developer may be more expensive or result in an eventual lease – as opposed to long-term ownership – however, it may also be much more reliable, with less risk and better timing on delivery.

Overall, prepare to pay more. Introduce more time into your pursuits of deals. And be prepared to build (two years or more in advance) or complete an early renewal (18 to 24 months out) if you want to stay at your current location.

Finally, for a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 29 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 29 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com