Understanding the GTA Industrial Market

June 18th, 2021

You know most folks just love a good story. A carefully crafted narrative.

With all that’s happening around the world and in business – and constantly being bombarded by information – it’s one of the simplest methods in which to make sense of it all. Humans are programmed to tell tales. Thus, we tend to convert complex cause-effect relationships and deep data into anecdotes.

This tradeoff of simplicity versus accuracy allows us to communicate with one another in an efficient manner, without having to build up the narrative from the ground-up each time we wish to discuss a nuance or isolated issue.

In the context of business, these ‘nuances’ are what can give an investor, developer, or user an ‘edge’ or insight that can lead to supernormal profits and first-mover advantage. Why endlessly debate zoning laws or labour pool data when we can leverage them to find the next prime development pockets of land?

Sometimes, however, we repeat sound bites that are not factually true. We reject data that doesn’t fit the model and cherry-pick to avoid conflict. We outsource too much computing power. We oversimplify and grant too much credence to those in positions of authority. There, our naivete of the fact that they too can be fallible or possess bad intentions clouds our judgment. Or at the very least, it makes us lazy thinkers who forget that professional skepticism is not just a ‘career skill’ but also a survival tool. Take your pick from history to prove this point.

That is why, this week we wanted to embark on an exploration of the GTA industrial market – not just by looking at the broad-stroke narratives being circulated in your run-of-the-mill social media mastermind groups, but by examining the cold hard data.

Hopefully, we can each derive our own story regarding the evolution of these individual sub-markets over time… and possess the facts to back it up. So without further ado, let’s take a closer look…

Toronto-Central Markets (North York, Etobicoke, Scarborough)

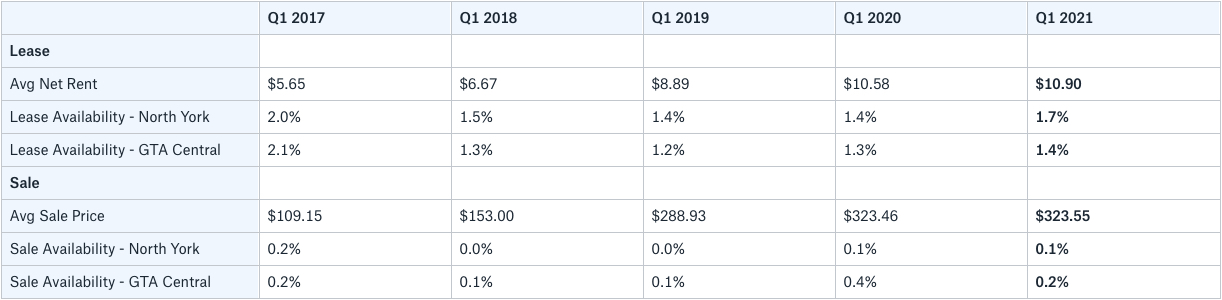

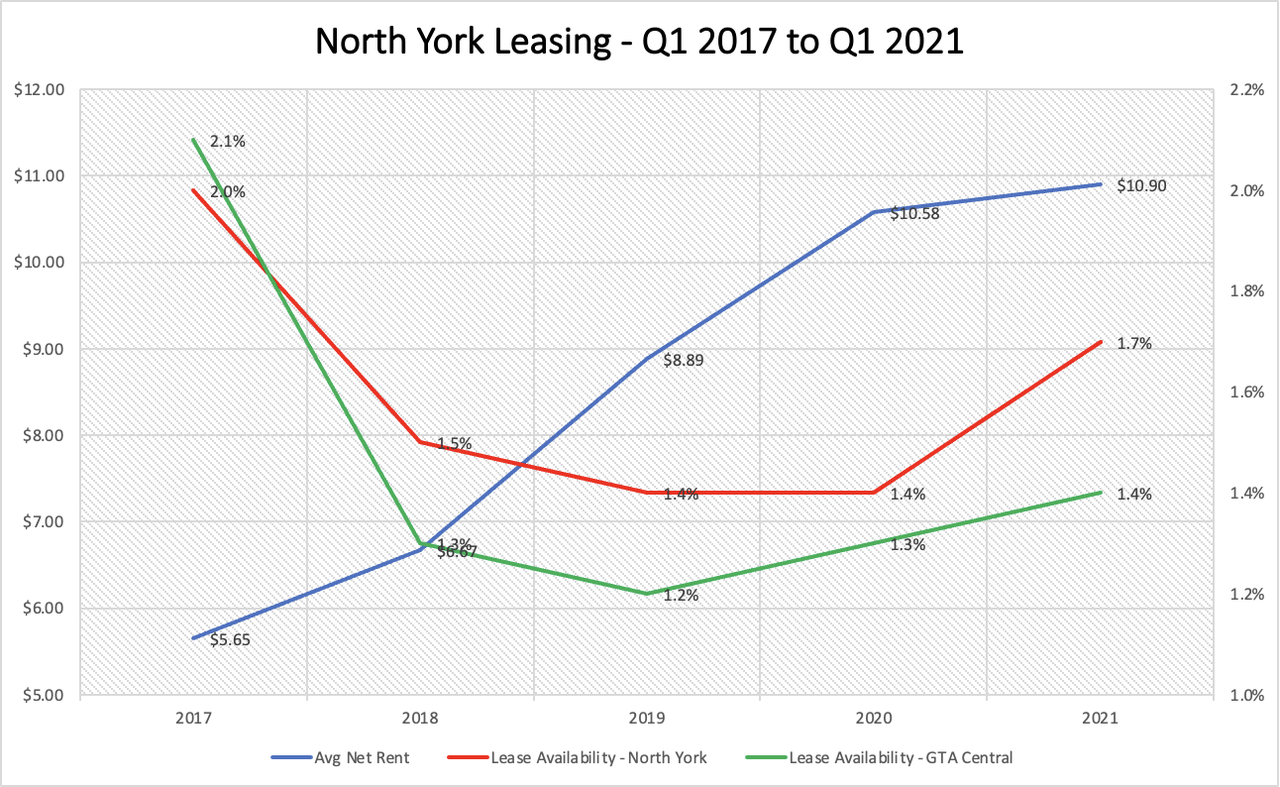

GTA Central Markets (North York)

Valuation and Rental Rate Analysis Q1 2017 – Q1 2021

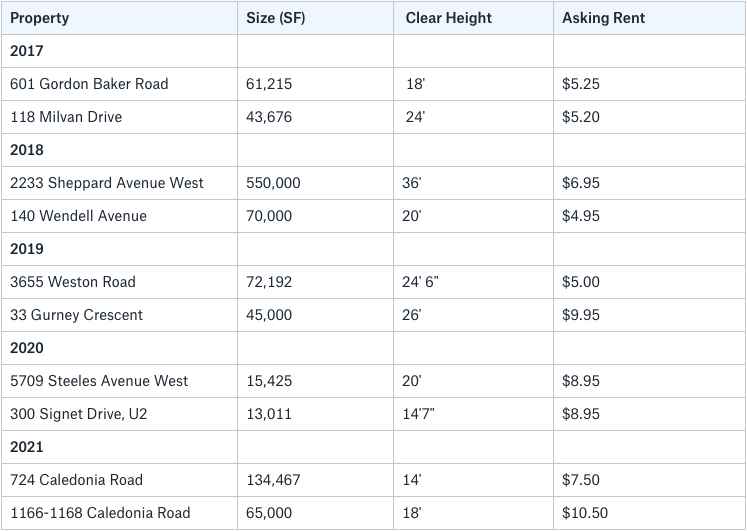

North York – Sample Lease Transactions

1166-1168 Caledonia Road, North York

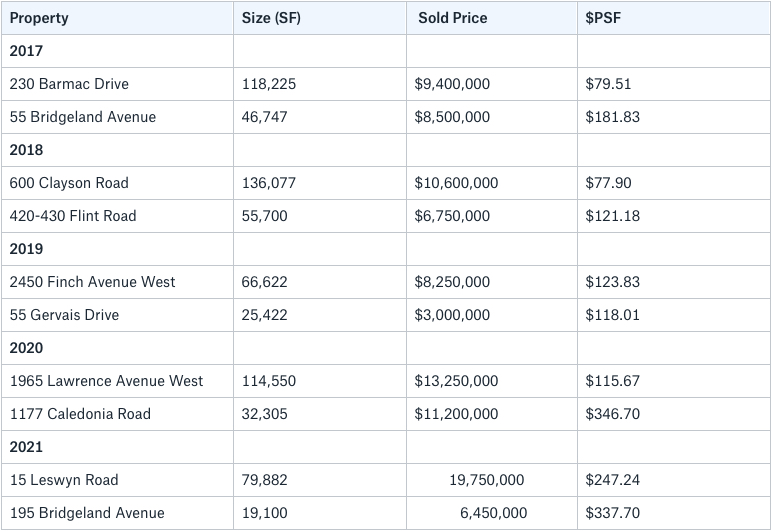

North York – Sample Sale Transactions

15 Leswyn Road, North York

GTA Central Markets (Etobicoke)

Valuation and Rental Rate Analysis Q1 2017 – Q1 2021

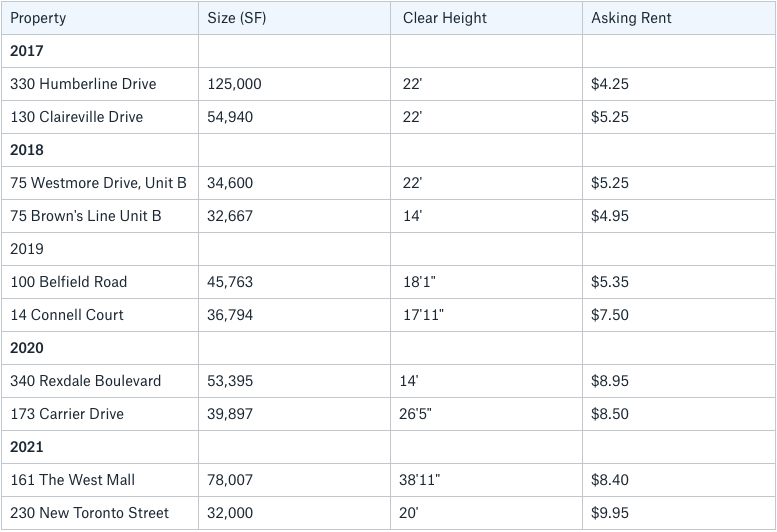

Etobicoke – Sample Lease Transactions

161 The West Mall, Etobicoke

279 Humberline Drive, Etobicoke

GTA Central Markets (Scarborough)

Valuation and Rental Rate Analysis Q1 2017 – Q1 2021

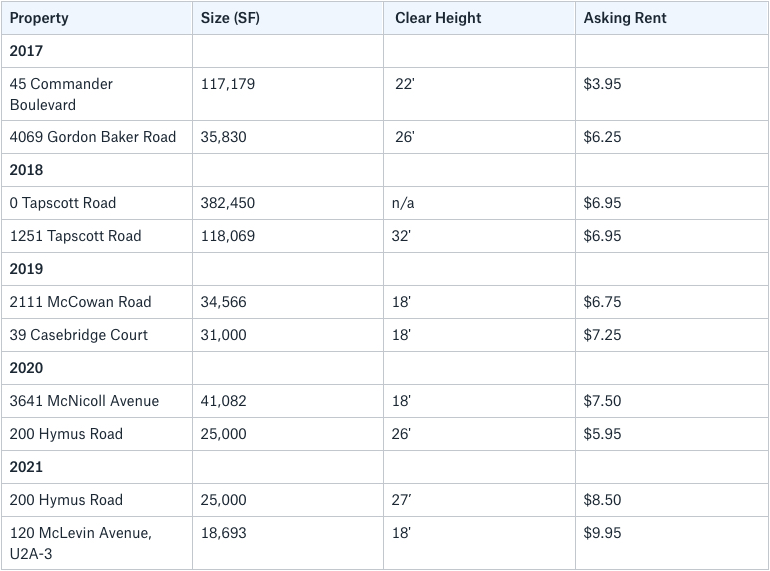

Scarborough – Sample Lease Transactions

120 McLevin Avenue, Scarborough

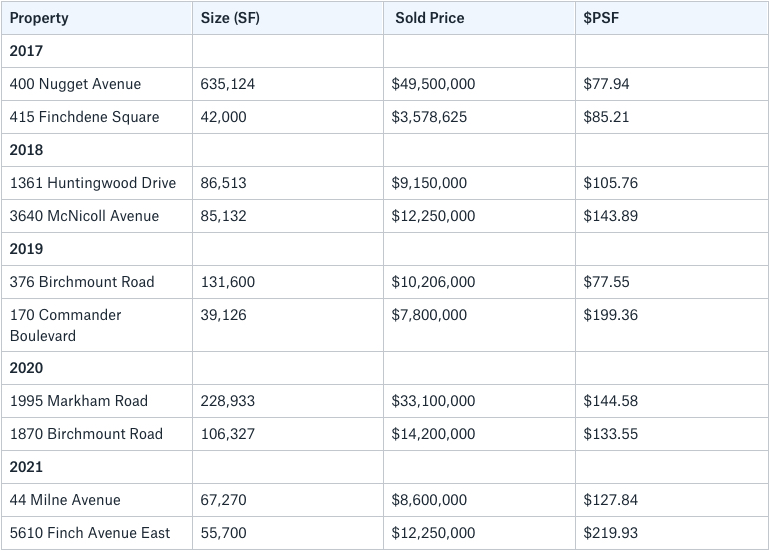

Scarborough – Sample Sale Transactions

5610 Finch Avenue East, Scarborough

Conclusion

After looking through the data, we hope you can not only begin to see some of the broader patterns but perhaps also create hypotheses as to why things may have played out the way they did. Keep in mind that much of the data collected is imperfect and should be taken with a grain of salt. Further, we hope you can also begin to make soft predictions about where the market is headed.

Our thoughts are this:

- industrial is definitively being fuelled by E-commerce demand, as well as other verticals such as online grocery sale, transportation, and even film production;

- supply chain disruptions are causing many businesses to on-shore their operations;

- these disruptions are also causing businesses to increase inventories where possible;

- land is scarce, as is available product;

- new supply is being hamstrung by labour and material shortages, as well as delayed permitting and zoning processes.

Key Takeaways

For investors: Now that we seem to be caught in a supply trap, one should expect to see values increase further, albeit at a decelerating pace relative to the jump we saw over the past 5 years. Only future data will tell how much further values have to go… That being said, it’s very likely that cap rates will continue to compress and pricing will go up further.

For Occupiers: Similarly, one should expect further increases in pricing. If you want to lease, you’ll have to pay more. If you want to own, you’ll have to pay more. In addition, it will be more difficult to find opportunity and the deals may take more time to complete unless you are lucky or hit the timing perfectly. Further to this, if you cannot find anything, you may have to develop; only if you can find any land available to do so.

Overall, prepare to pay more. Introduce more time into your pursuits of deals. And be prepared to build (two years or more in advance) or complete an early renewal (18 to 24 months out) if you want to stay at your current location.

Finally, for a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com