Industrial & E-Commerce: A Love Story – Part 2

The Impact of E-Commerce on the GTHA Industrial Real Estate Market

October 2nd, 2020

The recent pandemic and economic shutdowns forced all of us to re-establish our priorities and to re-think our businesses, our relationships, and our lives, in general.

The weaknesses and risks in our day-to-day were exposed, leaving us with the opportunity to form new habits and find innovative solutions.

If we look at our world from March 2020 onward, the majority of our services and day-to-day operations moved indoors. Many of us adopted systems to communicate and collaborate virtually, while also implementing protocols to ensure safe meetings and tours should we be forced to venture out. Were one to sit on a Toronto rooftop and observe the passer-goers, they would find, well, that there weren’t very many. Life would seem still; almost tranquil.

Except for one constant.

The movement of things.

Specifically, the transportation of physical goods to places of business and residence.

E-commerce. Online retail. Grocery delivery. Meal kits. Home office equipment. Pet food. You name it. All delivered to your door (oftentimes) within 24 hours… except for the sold-out stationery bikes, PPE, and office furniture.

These novel behaviours were borne out of necessity, however, as we adapted to our new situation, we began to realize some of the benefits, such as convenience, cost savings, time efficiencies, and work-life balance. As we emerged from the quarantine and trickled back into the ‘new normal’ daily life, it made sense to keep some of these newfound benefits and integrate them into our pre-existing schedules and routines.

And that is how we embraced the adoption of the single force driving the explosion in industrial real estate demand.

Last week, we examined The Explosion of E-Commerce and how Industrial is the New Retail. This week, let’s continue the conversation by examining…

The Impact on the GTHA Industrial Real Estate Market

As these companies focus their attention on formally setting up their operations and finding (or building) space suitable for their needs, they will and already are influencing the entirety of the commercial real estate market.

The scale is so grand, and the potential payoff so large, that any one of these players can eat up substantial amounts of incoming product pipeline.

The result of this means that, if you’re actively looking to set up a fully-customized, state-of-the-art facility (as these businesses are) then your best bet is to pre-lease in advance with a reputable developer partner, to develop from the ground up (if you can find land), or to find a facility built on-speculation and secure it appropriately.

Overall, the impact on the GTHA Industrial real estate market has been tremendous… including the demand for three (3) key types of industrial facilities which we will explore below.

Fulfillment Centres

So what are fulfillment centers? These are larger industrial facilities. A key distinction: warehouses are historically viewed and used as long-term storage solutions, while fulfillment centers offer temporary storage that will soon go out for delivery to customers.

Due to their appetite for space and limited availabilities within the City core, fulfillment centers are typically located on the periphery. The strategy for most businesses is to integrate these fulfillment centers into their overall network through last-mile distribution centers.

Amazon’s Fulfilment Centers in the GTHA:

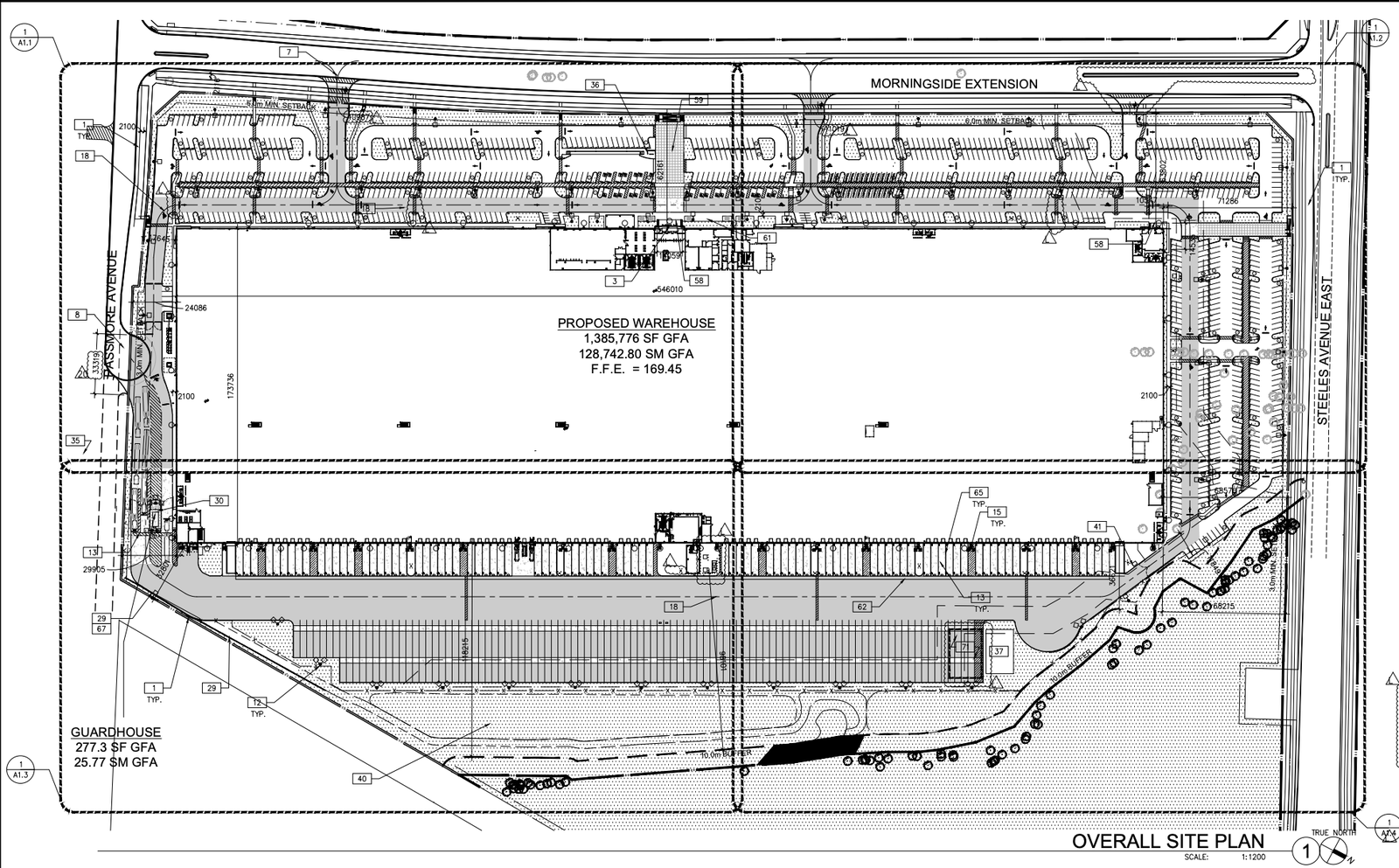

1. 6351 Steeles Ave. East, Scarborough, Ontario – 1,023,000 sq.ft.

Amazon recently opened a new fulfillment center at 6351 Steeles Ave. East in Scarborough in August 2020; its first in the City of Toronto (not including the surrounding GTA regions).

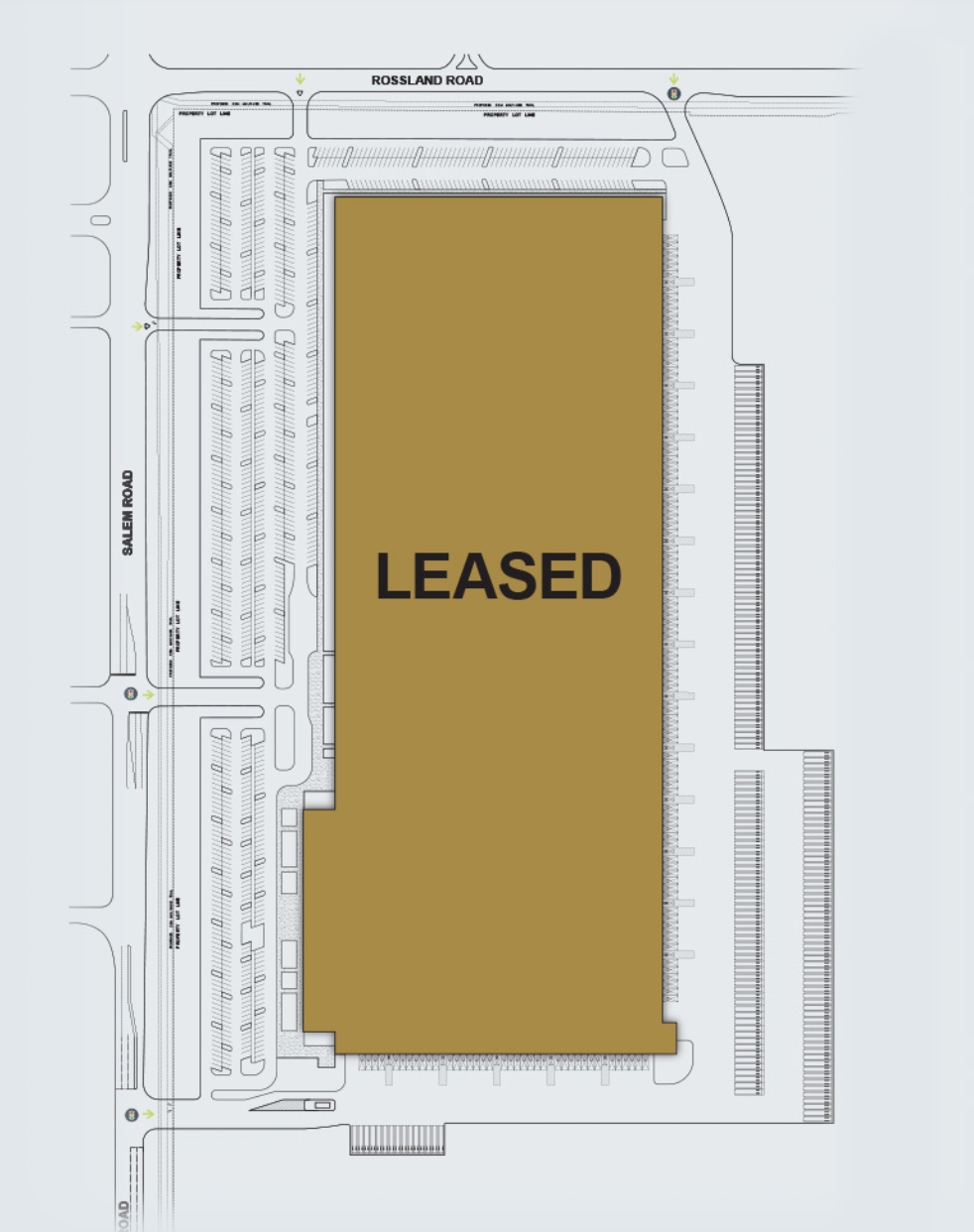

2. Salem Road & Rossland Road, Ajax, Ontario – 1,100,000 sq. ft.

Crestpoint, along with Blackwood as a partner, announced the execution of a lease with Amazon in Ajax for a 1.1 Million SF, Class A industrial building with 40’ clear height, 110 truck-level doors, and 195 trailer parking spots on 58 acres of land.

The project is situated on the northern 58 acres of Crestpoint’s GTA East Industrial Park, which spans 107 acres of shovel-ready, industrial-zoned land. The southern parcel of the GTA East Industrial Park is in for final approval on three state-of-the-art industrial buildings totaling over 900,000 square feet, with the option of a build-to-suit for one building of up to 1.0 million square feet.

3. Amazon – Hamilton, Ontario – 855,000 sq. ft.

Per the City of Hamilton’s press release, “Amazon Canada’s plans include a new 855,000 square-foot fulfillment center to be located in Mount Hope adjacent to John C. Munro Hamilton International Airport. Employees at this location will work alongside Amazon Robotics to pick, pack, and ship small items to customers such as books, electronics, and toys.”

It also added that “a new 50,000 square foot delivery station in Stoney Creek will power the last mile of Amazon’s order fulfillment process. Packages are transported to these delivery stations from Amazon fulfillment and sortation centers, and then loaded into vehicles for delivery to customers.”

Once the centers are operating, they’ll bring to the number of Amazon fulfillment centers in Ontario to 10, with six more spread across Canada.

Last-Mile/Last-Touch Facilities

The “last-mile” refers to the final step of the delivery process from a fulfillment center to the end-user. Last-mile – or last-touch – distribution centers are typically located closer to the City core or even in suburban neighbourhoods. They put the delivered goods in range from a few yards to 50 kilometres of its end destination.

On the surface, these centers may not seem important but this ‘last mile’ can make up to 28% of a shipment’s total cost. Because of this, e-commerce, transportation, and logistics companies are looking to deliver more product in both a faster timeline and in a more cost-effective manner. We are seeing this develop in real-time with companies such as Amazon, who just announced its intention to put 1,000 warehouses in suburban neighbourhoods across the United States.

When it comes to establishing last-mile facilities in the GTHA, the issue typically revolves around land… and the lack of it, as we will touch on later. That being said, developers have been willing to purchase older buildings to redevelop while maintaining certain elements and architectural features; especially for historic properties. Those investments have been worth the price purely to secure the right strategic location in proximity to urban neighbourhoods.

Amazon’s Last-Mile Facility Announcements:

Amazon has announced its intention to open a number of new delivery stations throughout Southern Ontario in the coming year, some of which are named below.

- Scarborough

- 400 Nugget Avenue – 650,000 sq. ft. – 2021

- 75 Venture Avenue – 295,000 sq. ft. – 2020

- Vaughan

- 50 & 51 Keyes Road – 193,000 sq. ft. – 2021

- 200 Tesma Avenue – 209,000 sq. ft. – 2020

- Etobicoke

- Stoney Creek

- Kitchener

Urban Redevelopment (Suitable for Last-Mile Distribution)

QuadReal – 60 Birmingham Street – Etobicoke – 400,000 sq. ft.

QuadReal Property Group is set to redevelop the old multi-storey Campbell’s Soup factory in Etobicoke. The project will include three one-storey industrial warehouses totaling 400,000 SF that will replace eight small industrial buildings while preserving some of the original facades.

According to UrbanToronto coverage, “a total of 86 loading dock spaces are proposed as part of the redevelopment to support typical warehouse distribution operations. As such, both truck level and drive-in door spaces are spread across each structure, yet strategically located in central locations so as to minimize views and excessive noise from the abutting residential neighbourhood streets.”

It is expected that the businesses that will occupy these buildings will be in the warehousing, distribution, or e-commerce industries. Further, it should be no surprise to see Tenants flock to it given its proximity to a high-density population; with downtown Toronto accessible through nearby Lake Shore Boulevard.

Cold-Storage (and Grocery) Distribution Centres

Cold-storage distribution centers are a specialty type of fulfillment center that are, in some respects, a hybrid between fulfillment centers and last-mile distribution centers. They are typically located on the fringes of or just outside the Core and in close proximity to transportation routes. There, they have greater accessibility to space for larger footprints but are also well positioned to make same-day deliveries.

Because of the cost associated with storing and shipping groceries, as well as the perishable nature of said goods, it is critical that these centers are located as close to consumers as possible.

Groceries used to be a very small percentage of online retail sales, however, they have increased exponentially since the pandemic. We have seen this trend play out in real-time. Specifically, WalMart made a multi-billion-dollar commitment to its cutting-edge operations in Canada.

Furthermore, American-behemoth Lineage Logistics recently acquired Ontario Refrigerated Services and raised $2.11 Billion in funding from prestigious partners such as Oxford, Bentall GreenOak, OPTrust, and Morgan Stanley in its bid to buy its way north of the border.

WalMart – 11110 Jane Street – Vaughan – 550,000 sq. ft.

WalMart has committed to “developing a supply chain that is the envy of the world,” part of which includes its fifth distribution center in the Greater Toronto Area that will also bring “hundreds of Canadian construction jobs along the way.”

The “next-generation 550,000 square foot distribution center at 11110 Jane Street (400 Highway and Teston Road) [is] slated to open in 2024” and will leverage “automation and technology working with Dutch automation company Vanderlande.”

The facility will be a cold-storage, fully-automated, warehousing, and distribution facility used for ambient general merchandise and food products.

The balance of WalMart Canada’s $3.5 Billion investment package will go towards:

– “Omni-capable” warehouse management systems,

– “smarter stores” with robotics, cameras, and electronic shelves,

– telematics and IoT sensors,

– AI software for predictive supply chains, and its

– blockchain transportation payments platform.

Sobey’s – 100 Gibraltar Road – Vaughan – 250,000 sq. ft.

Sobey’s launched its new 250,000 SF distribution center in Vaughan as part of its $2.1 billion plan to revamp stores and expand its e-commerce offering.

Not only will they look to spur technological innovation with their Ocado partnership, but they’ll try to do what most grocery delivery services are struggling to achieve… getting the order right.

Grocery stores remained packed throughout the pandemic despite the ability to order online. State-of-the-art industrial facilities and robotics technologies may boost consumer confidence to the point where we choose to forgo the packed lots and long lines.

According to a York Region release, the new center is “a huge hive of 250,000 totes carrying 39,000 of different products, which is the most in the world. On top of our huge hive are our robots running around picking around and optimizing.”

All of this activity in the GTHA Industrial real estate market can only be described with one word: amazing.

It’s amazing that we live and operate in an area and an asset class with so much promise and optimism.

However, that being said, there is one key headwind that may alter the strategies that investors, developers, landlords, and tenants choose to adopt in the coming years and decade.

They Don’t Make It Anymore

Overall, as the pandemic became a story about the movement of goods, so has the rise of e-commerce become a mirror for the race to find and develop physical land.

There are so many intelligent, well-staffed, well-funded, and capable developers and investors overseeing development projects in the GTHA. Yet, if you do not have the land upon which to develop, then it’s all for naught, or at least, it becomes a major roadblock.

The silver lining here is that, despite these constraints, everyone is in the same boat.

So here is how we believe things may play out.

Firstly, land will continue to be bought and sold. If you find an opportunity to purchase industrial land that is shovel-ready and in a great location, and you are a developer, then you would likely consider doing so. Not only are there shortages of the land itself, but delays in the zoning, planning, and servicing processes, so plan ahead and consult with the right people. The bottom line here is that pricing can get expensive if you’re in a pinch and need to buy, however, the pricing will continue to increase regardless of any of those facts.

And secondly, both as a result of the land shortage and the move to find infill distribution sites within the City’s core, we do see and will see more redevelopment of older industrial buildings that typically have lower clear heights or poor shipping capabilities. These make for excellent opportunities and often come down to a Tenant’s needs, timelines, and financial situation.

Overall, e-commerce has changed the industrial asset class for good. What was once the least glamorous asset class has become the ‘darling’ of commercial real estate and a prized asset for any landlord, investor, or developer.

If you require any assistance regarding your commercial real estate property or portfolio, please contact us.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com