The Often Overlooked Cost of Developing Industrial Land in the GTA

Development Charges and Their Impact on Industrial Development

March 12th, 2021

The path to owning an industrial property in the Greater Toronto Area is no easy feat. No matter if you purchase a building or develop one from the ground up, it will require a significant chunk of change.

In fact, there is a direct relationship between industrial ownership and how deep a prospective Buyer’s pockets can go.

On the acquisition side, we all know how the story goes. Nothing is readily available, and if it is, you’re competing against multiple other offers from some of the largest, most sophisticated institutional and private investors. That’s why they’re extremely active and in touch with the marketplace.

Find something off-market? You better make your best offer… and quick.

Want to reposition an asset? Construction costs are ballooning thanks to labour and material shortages.

Want to develop? Well, land is in scarce supply. The permitting and servicing process is also being stretched out and delayed. (So much so that the Provincial government is pulling strings and pushing MZOs to grant preferential treatment to ‘Fortune 50’ retailers and distributors looking to build the next 1 or 2 million SF mega-warehouse. Nothing to see here, so let’s move on…)

Furthermore, land costs are increasing so rapidly that they may be an even better ‘paper investment’ than cryptocurrencies… if you could only get your hands on any. On the bright side, we know for certain the land will still be there in a year or two.

One of the last and final items we have yet to examine are development charges across the GTA, which are, fortunately or unfortunately, also a part of the overall cost to build an industrial facility.

Mention the fact that a developer could – in theory – pay a municipality $50+ million to build a state-of-the-art distribution centre to our American counterparts and they would be pulling their hair out. South of the border, states and counties are willing to grant billions in tax credits, grants, and other subsidies, including the introduction of Opportunity Zones, to compete for new business (just think Tesla or Amazon as recent examples).

So, for those unfamiliar with the cost of doing business in the GTA, it’s important not to forget that development charges will significantly increase costs. Think about it this way… if you increase the height of your building, you would proportionately ‘reduce’ the development charge cost because it is payable per square foot, not per cubic foot. And, finally, these costs are baked into the pro formas and passed through in the rental rates and valuations.

Therefore, putting these three development costs together – land values, development charges, and construction costs – can give an Investor and Developer a conservative preliminary cost evaluation when considering a potential new project.

So, let’s take a look at some sample charges, as well as how they’ve increased over time and throughout various municipalities.

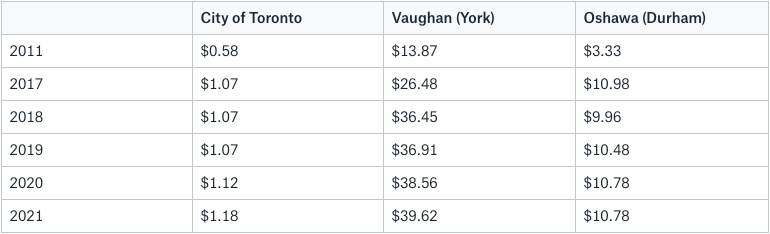

Changes in Industrial Development Charges Across the GTA

Just taking a quick look at the table above and we can see the relative increases as total costs have doubled and tripled over the past decade. Generally speaking, development charges are fees collected to offset capital costs for infrastructure projects… and differ between regions. For example, the City only places educational levies, whereas Vaughan collects fees for the town, region, and education.

With that in mind, it makes sense that areas outside of the core would be looking for developers to contribute to the future success of the municipality. And on the flipside, those very developers should want infrastructure to be built, as it can increase the value of their assets, as well as the success of the Tenants operating there.

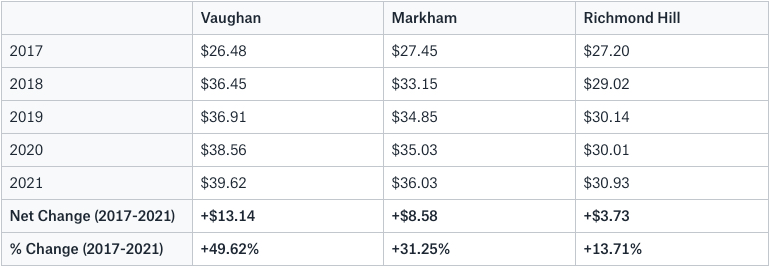

Skyrocketing Development Charges in York Region

York Region has the highest – as well as fastest-growing – development charges in the Greater Toronto Area. However, it also has more readily available, well-located land at values relatively less expensive than in the City. That being said, land values throughout York Region have also skyrocketed. This levelling of costs would promote location or other factors as the next relevant items to consider when deciding where to build.

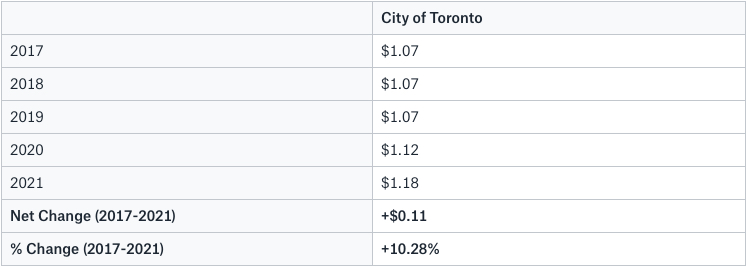

Low Rates with Modest Increases in the City of Toronto

Technically, the City of Toronto does not have any development charges, but only educational levies, which are part of the total cost to develop a property. The City also has relatively expensive land that is difficult to find. Again, one should take these ‘lower’ charges with a grain of salt as most factors have already been priced in, and most of the low-hanging fruit have already been developed.

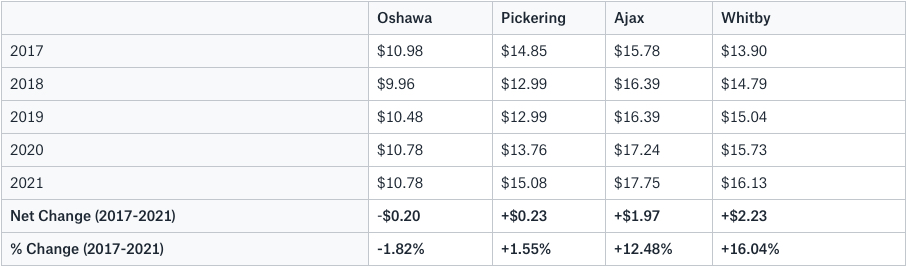

Finding Value in Durham’s Municipalities

Despite Durham Region’s development charges being more expensive than in the City of Toronto, it is being touted as an ‘up and coming’ region for new development. This is mainly driven by lower relative land values. But also because many Tenants are looking to tap into the market that has been somewhat neglected. A strong labour pool, transportation network, and other infrastructure make this a good ‘value’ play.

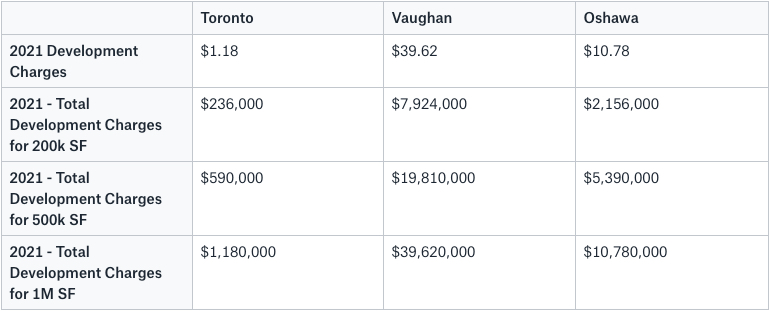

Example: 2021 Development Charges for ‘Big Box’ Industrial Facilities

To conclude our issue, let’s take a quick look at what it would cost in development charges to construct a building in Toronto, Vaughan, or Oshawa. The numbers speak for themselves. And when overlaid with land values and construction costs, one can get a clear picture as to the feasibility and reality of developing in the GTA.

Conclusion

Overall, there is a price to pay to develop in the Greater Toronto Area. And it’s a game played by some of the most sophisticated institutional and private investors and developers. So, simply looking at relative costs or rates cannot give you the entire picture… nor should it be used on its own to justify green-lighting a project. One should think through the entire initiative and ensure that long-term, stable income will be a by-product of the capital, energy, and time ventured.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com