Part 1 – A Landlord’s Market?

A few recent Toronto newspaper articles have described our commercial and industrial markets as such:

“Toronto Is Running Out Of Commercial Real Estate And Has Record High Rents”

“Toronto is the Most Constrained Industrial Market in North America”

“Availability in Canada’s Major Industrial Markets Continues to Plummet; Putting Pressure on Tenants.”

Can the ‘new normal’ rents be explained entirely by a lack of supply?

Or are there other factors at play here?

And, can we look elsewhere to model and predict what may be in store for the GTA in the near- and long-term future?

Well, the truth is, the supply of industrial space in the Greater Toronto Area reached a historic low in Q1 2019, with predictions that it will become even more constrained, while industrial net rent has reached its highest level ever.

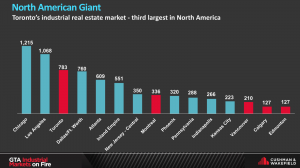

But to get an even clearer picture of what is going on, let’s first take a look at GTA Industrial Market as it relates to other centers in North America…

North American Industrial Markets Comparison – Source: Cushman & Wakefield ULC Research

The Greater Toronto Area Industrial Market is one of the top three industrial markets in North America and continues to grow…

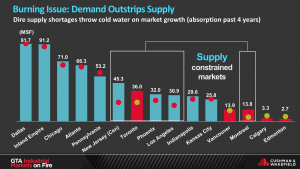

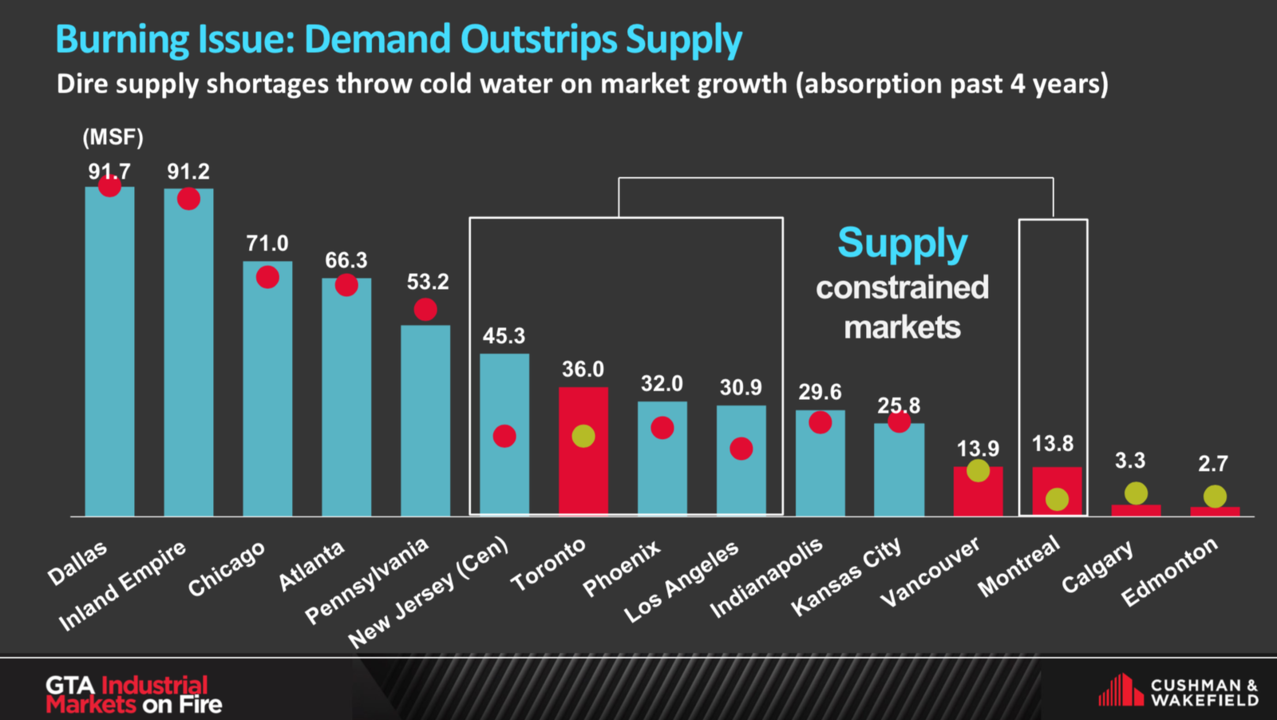

North American Industrial Markets Demand vs Supply 2015 – 2019 – Source: Cushman & Wakefield ULC

In addition, the Greater Toronto Area is one of five supply-constrained markets in North America; where demand outstrips supply by a large margin. When trying to examine what is actually happening and driving changes in our market, this is an indicator to watch closely, something that can have effects for years to come…

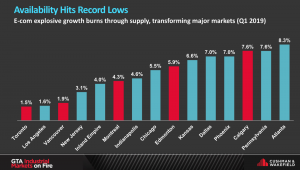

North American Industrial Markets Vacancy Rates Comparison – Source: Cushman & Wakefield ULC

Right now, though, this imbalance of supply and demand has pushed vacancy rates to a historically low rate of 1.5%.

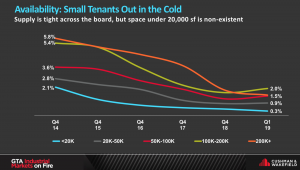

GTA Availability Comparison – Source: Cushman & Wakefield ULC

Worse, when looking at properties of a medium- to small-size, vacancy rates dip even further to below 1%; with 0.9 % for properties between 20,000 – 50,000 SF and 0.3% for properties smaller than 20,000 SF.

For smaller operations, this means finding space is downright impossible unless you can find an off-market opportunity and are willing to outbid competitors (or just get lucky).

For users looking for big-box spaces, this may mean pre-leasing a couple of years in advance or developing your own space.

So, why is that? Well, nobody is building small bays anymore; it is too expensive, plus developers are focused on delivering new ‘big-box’ warehouses suitable for e-commerce….

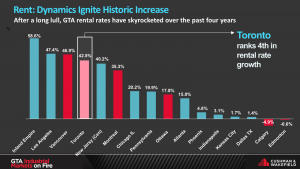

North American Industrial Markets Rental Rates Increase – Source: Cushman & Wakefield ULC

Such an imbalance of supply and demand, coupled with low vacancy rates has caused net rental rates to increase 42.5% over the last four years…

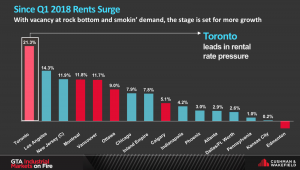

North American Industrial Markets Rental Rates Increase Q1 2018 – Q1 2019 – Source: Cushman & Wakefield ULC

In the past year alone (Q1 2018 to Q1 2019), there was an increase of 21.3%, suggesting that this trend will continue to accelerate, especially if supply continues to stagnate.

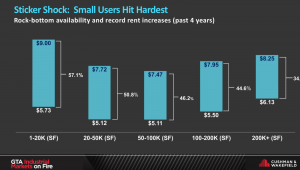

GTA Industrial Net Rental Rates Increase 2015 – 2019 – Source: Cushman & Wakefield ULC

Now, when looking at the movement of rents by building size, this pressure has hit smaller tenants the hardest, with a 57.1% increase in the small bay market (below 20,000 SF), while the large bay market (200,000 SF plus) has (only) gone up 34.6%.

This makes sense given our previous point regarding non-existent vacancies and developers’ lack of motivation to construct new product of this size.

And while there is some inventory coming to the market in the 100,000-200,000 SF and 200,000 SF plus range, much of it is already pre-leased, and thus, demand is pushing rents in those ranges higher, as is clearly shown in the upward curvature of rents.

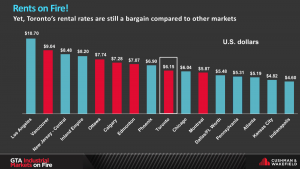

North American Industrial Markets Average Net Rental Rates Comparison – Source: Cushman & Wakefield ULC

Overall, there is still room to grow for the Average Net Rental Rates (in USD) in the Greater Toronto Area Industrial Market, given they are still way below other North American centers.

However, based on the increase in the last twelve months it appears that we will be catching up with Vancouver and Los Angeles very soon…. way sooner than expected…

In our next issue, we will take a closer look at the drivers behind the growth in the industrial market.

Until next week….

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.