Industrial condominiums have become a vital component of Ontario’s commercial real estate landscape, offering a compelling alternative to traditional industrial leasing.

These properties provide businesses and investors with the advantages of ownership—control over space customization, predictable long-term costs, and potential for asset appreciation. Ideal for small-to-medium enterprises, logistics operations, and niche manufacturers, industrial condos deliver the flexibility to scale while securing a foothold in high-demand markets.

In Durham, this asset class is gaining prominence, driven by its alignment with economic shifts toward e-commerce, localized production, and efficient workspace solutions.

Durham’s industrial condo market benefits from the region’s strategic location, relative discount to other markets, and robust infrastructure, attracting businesses seeking accessibility and growth potential. From compact units tailored to startups to larger spaces for established firms, these properties cater to diverse needs, balancing affordability with investment value.

This newsletter offers a detailed analysis of current market trends, equipping stakeholders with the insights necessary to capitalize on opportunities and make strategic decisions.

With that said, for this week’s newsletter, we will revisit the topic of industrial condo developments within the GTA East submarkets of Pickering, Ajax, Whitby, and Oshawa, while taking a look at some of the major projects underway.

GTA East – Small- and Mid-Bay Industrial Condo Market

With 26 sale transactions recorded from 2024 to May 2025 and a diverse range of available properties, the GTA East submarkets offer opportunities for investors and owner-occupiers alike.

Recent Sales: Price Trends by Size

The Durham industrial condo market saw 26 transactions from 2024 through May 2025, with sale prices varying significantly by unit size. For units sized 2,000–10,000 square feet (SF), the quarterly average sale price per square foot ranged from $225.44 PSF to $392.70 PSF. Units sized 10,000–15,000 SF commanded slightly higher prices, peaking at $423.73 PSF, with a notable concentration of transactions (10) in the $402.92 PSF range. Larger units (10,000–15,000 SF) generally fetched higher per-square-foot prices, reflecting strong demand for intermediate-sized startup spaces that don’t require purchasing freestanding industrial properties.

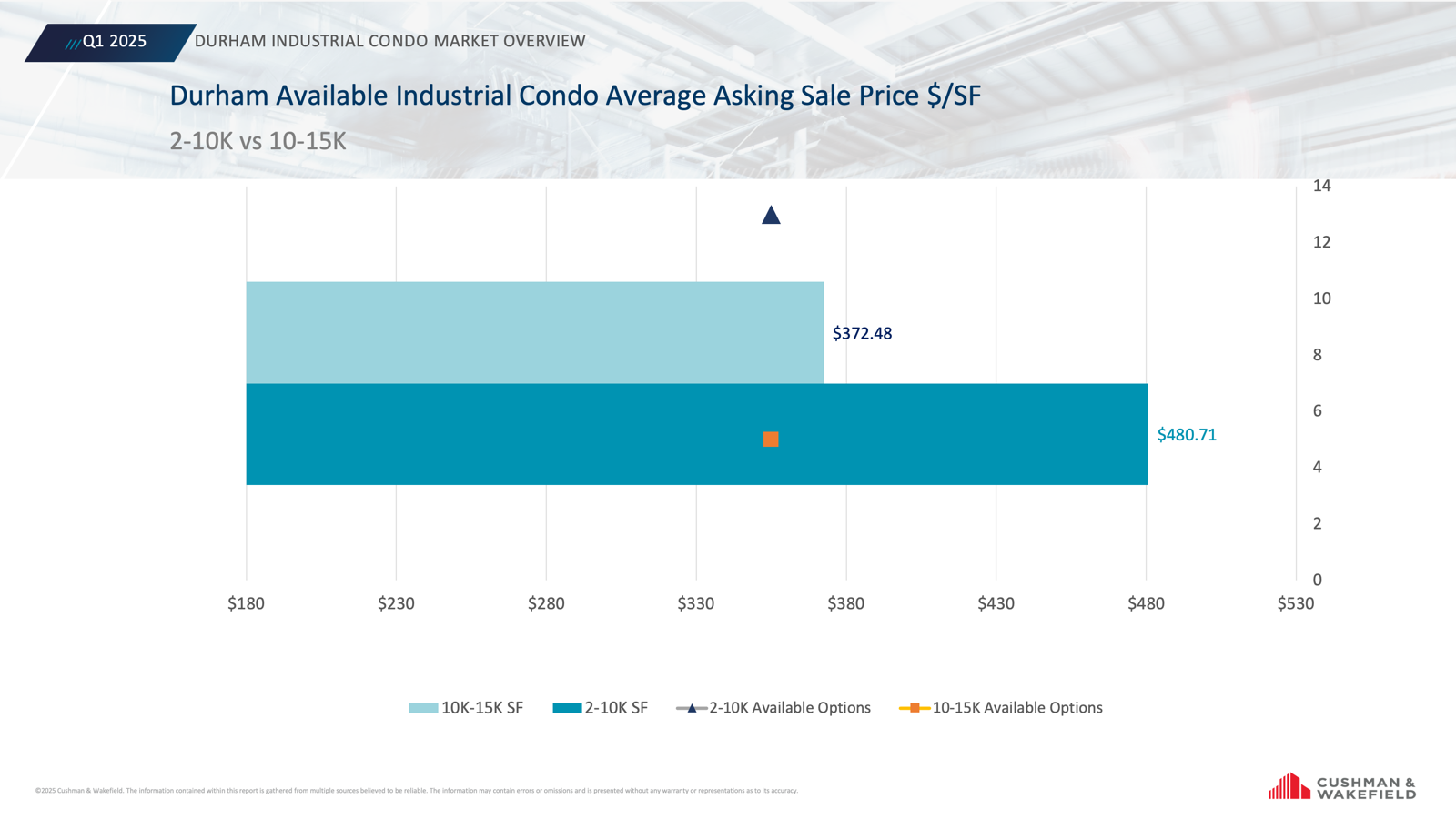

Available Inventory: Asking Prices

Available industrial condos in Q1 2025 show a clear pricing disparity between size categories. For 2,000–10,000 SF units, the average asking sale price reached $480.71/SF, with 13 available options. In contrast, 10,000–15,000 SF units averaged $372.48/SF, with only 5 options. The premium on smaller units underscores their appeal in a market where flexibility and lower total costs attract a broad buyer pool. Larger units, while more affordable per square foot, may require higher overall capital, potentially limiting their buyer base to well-funded investors or established businesses.

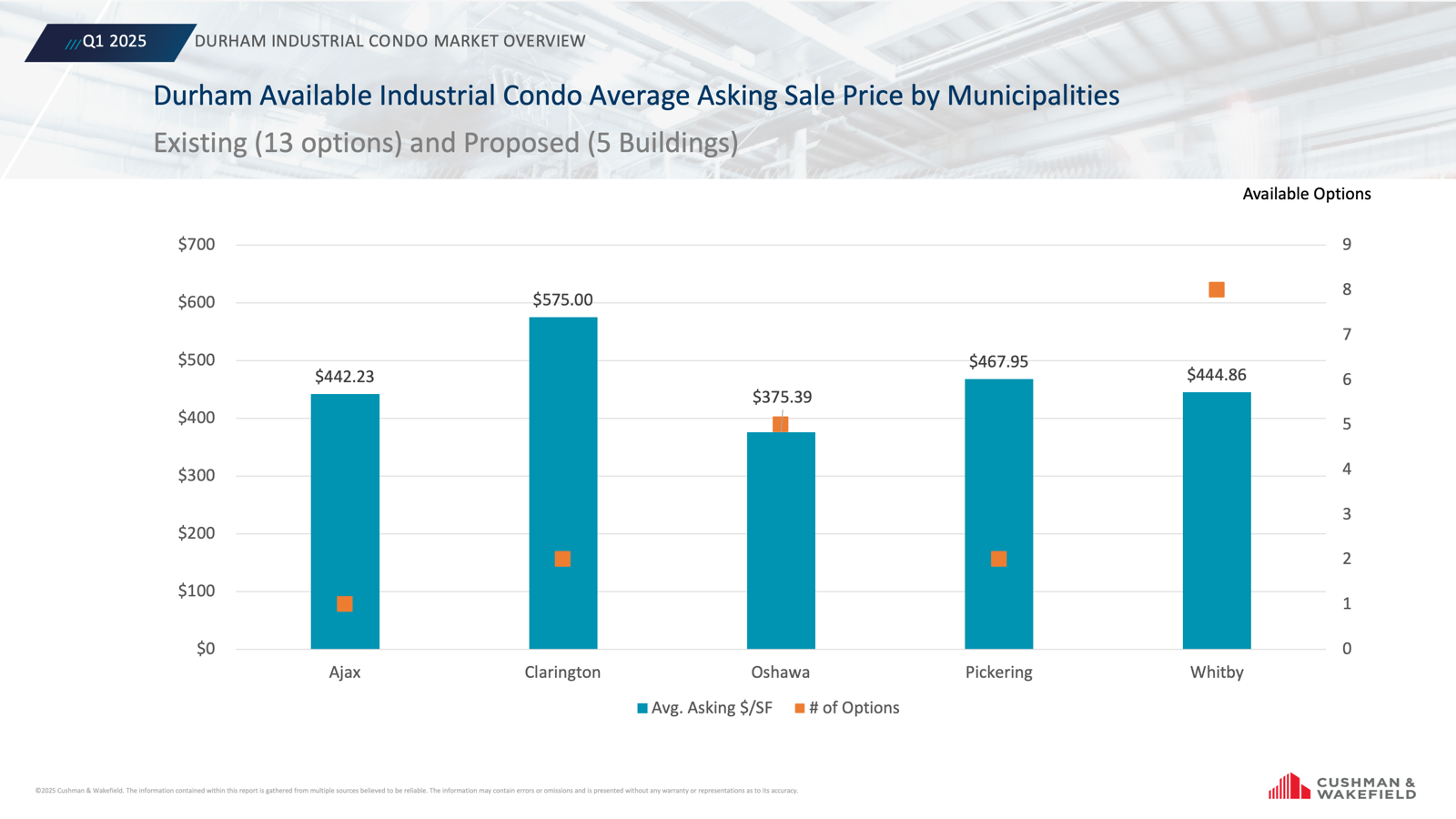

Municipal Variations: Existing vs. Proposed

Pricing across Durham’s municipalities reveals regional dynamics. Among 13 existing and 5 proposed condo options, average asking prices ranged from $375.39/SF in Oshawa to $575.00/SF in Clarington. The fluctuation in pricing is likely driven by building age and input costs; most notably land prices and the fees required to get through the planning and approvals processes.

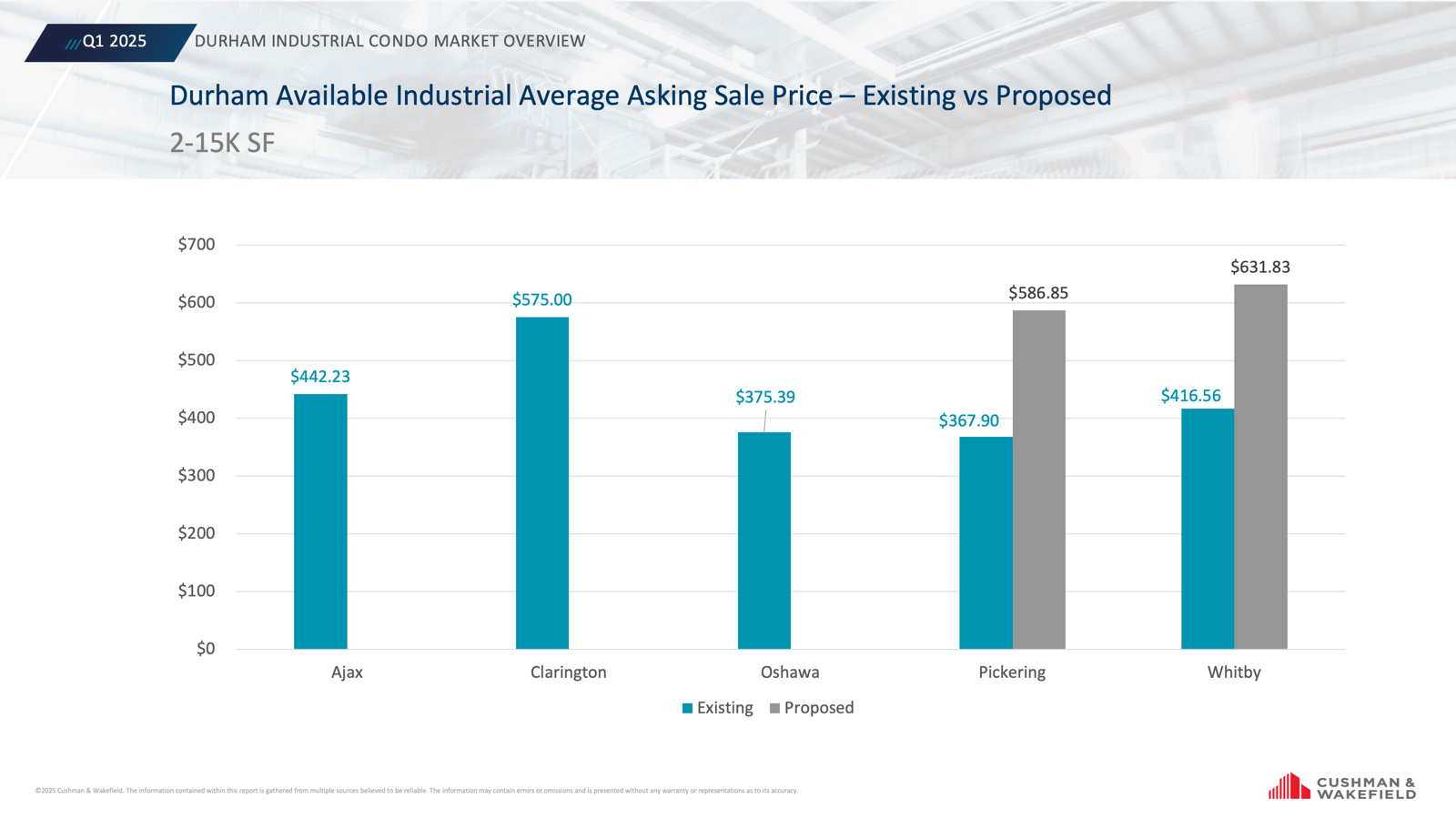

Existing vs. Proposed Condos: Pricing Insights

A deeper dive into 2,000–15,000 SF condos highlights differences between existing and proposed properties. Existing condos averaged $435.42/SF, with some reaching $575.00/SF, driven by land, development, and construction costs. Proposed condos, averaging $609.34/SF, reflect this ongoing trend that it has only become more expensive to bring new product online.

GTA East – Small-Bay Industrial Condo Development Sites

For more details, availabilities, and pricing on any of the industrial condos discussed, please contact our team.

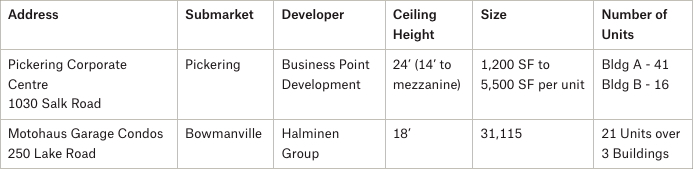

- Pickering Corporate Centre – 1030 Salk Road, Pickering – Business Point Development

Pickering Corporate Centre – 1030 Salk Road, Pickering.

According to the project’s website: “1030 Salk Road in Pickering, is Business Point’s newest and most innovative project. It is located in the centre of the city and offers brand new industrial units from 1,200 SF up to 5,500 SF (2nd Level: 100 sf to 400 sf).”

“Nestled among major companies in one of the leading master-planned Commercial Hubs in the GTA. Business Point brings a new level of design and innovation to the area and offers you the opportunity to secure and own your prestigious facility in a prestigious location. Central location with easy access to Hwy 401 and GO Station.”

- Motohaus Garage Condos – 250 Lake Road, Bowmanville – Halminen Group

Motohaus Garage Condos – 250 Lake Road, Bowmanville.

GTA East – Mid-Bay Industrial Condo Development Sites

- Victoria Crossing – 1440-1450 Victoria Street East, Whitby – Ripple Developments

One of Two Buildings at Victoria Crossing – 1440-1450 Victoria Street East, Whitby. Source: Ripple Developments.

- Lakeside Business Centre – 1155 Boundary Road, Oshawa – Beedie

Lakeside Business Centre – 1155 Boundary Road, Oshawa. Source: Beedie.

Conclusion:

The 2025 Durham industrial condo market presents a dynamic landscape. Small- and mid-bay units continue to command premium prices, reflecting strong demand from small businesses and investors seeking high returns, while proposed developments provide cost-conscious buyers with future opportunities. Ajax and Pickering remain hotspots, but emerging municipalities could gain traction as supply expands.

Investors should weigh the trade-offs between existing and proposed condos, considering factors like timeline, location, and budget. With industrial demand tied to e-commerce, logistics, and manufacturing, Durham’s market is well-positioned for growth. Stay informed as we track these trends in our next edition.

If you are looking to acquire small- or -mid-bay industrial space within the GTA Core, then an industrial condo may be your best option. While there are several great offerings on or coming to the market, these assets sell quickly, and at a premium to traditional industrial facilities.

On the development or conversion side, industrial condos are attractive as they can be constructed in infill sites, proximal to the Core’s consumer and economic base.

If you are looking to break ground and move in sometime in 2026, you will need to engage with municipalities as soon as possible and if not then it is probably already too late, however, it is never too late to begin planning and exploring.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com