Determining The Highest and Best Use Through a Development Options Report

Quite often I am asked to assist with determining the value of an industrial building.

The answer is not always that simple, especially within the City of Toronto due to its rapid growth and ever-changing landscape.

In many industrial pockets, we are seeing value-add opportunities, with properties changing from a simple industrial property to a flex office, warehouse retail, or self-storage facility.

Yet, the first step to determining the real, true value is to appraise it based on its Highest and Best Use, which we discussed at length last week.

Now, how we determine the Highest and Best use for a site is to conduct a Development Options Report with different Development Concepts.

Today, we are going to go through the Development Options Report process using a recent, specific case study.

Recently, we represented a client that sold a small two-storey office building of approximately 22,000 SF. One of the concepts showed potential development to a multi-storey facility of about 150,000 SF, which was attractive to a few potential purchasers.

Conversion from Industrial to Flex Office – North York

Let’s explore this further…

What is a Development Options Report?

This report provides an overview of current conditions and applicable land use policies. Based on this overview, it provides a preliminary planning opinion regarding the development potential of the subject property.

Tasks and Process in Preparing the Report

The following tasks have been undertaken in the preparation of this Development Options Report:

- A review of all existing and available planning documents including the Provincial Policy Statement, Growth Plan for the Greater Golden Horseshoe, City of Toronto Official Plan (in force and proposed), City of Toronto Zoning By-law, the former City of North York Zoning By-law No. 7625, and the Ministry Of The Environment And Climate Change (MOECC) – D-6 Compatibility Between Industrial Facilities policy.

- Preliminary discussions with the City of Toronto Planning staff in order to fully understand existing characteristics of the area, and land use context;

- Discussions with City Staff regarding servicing availability and updates to the area;

- An investigation into recent development applications in the surrounding area; and

- Preparation of development concepts to demonstrate the redevelopment potential of the subject property for a variety of uses.

Site

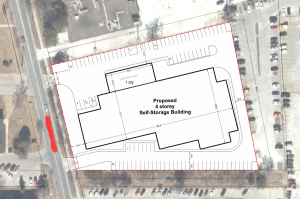

We reviewed the subject property, including the legal description, the land itself and improvements, adjacent land uses to the north, south, east and west, transportation routes, as well as servicing. Then we analyzed all of the development applications within the vicinity.

Provincial Policy Statement (2014)

The Provincial Policy Statement (PPS) provides direction on matters of provincial interest related to land use planning and development throughout the province of Ontario. The policies of the PPS are complemented by various provincial plans. Land use planning throughout the province shall have regard for and be consistent with the policies of the PPS.

Our subject property was located within an existing Settlement Area, which the PPS establishes as the focus of growth and development. Policies, as they relate to Settlement Areas, provide justification that development should be encouraged through intensification and transit-oriented development to maximize the use of existing transportation and servicing infrastructure to ensure the highest and best use of land. Redevelopment of the subject property promotes intensification within a Settlement Area and more efficient use of existing infrastructure and transit in accordance with the PPS.

With respect to employment lands conversions, Section 1.3.2.2 of the PPS directs the following:

“Planning authorities may permit conversion of lands within employment areas to non-employment uses through a comprehensive review, only where it has been demonstrated that the land is not required for employment purposes over the long term and that there is a need for the conversion.”

The redevelopment of the subject property for residential uses or uses other than those provided for in employment areas will only be permitted through a municipal comprehensive review. Such review must demonstrate that the land is not required for employment purposes over the long term and that there is a need for the conversion.

The City of Toronto OPA 231 represents the most recent municipal comprehensive review. As indicated by the Planning Staff from the City’s Strategic Initiatives, Policy & Analysis, the Province requires that the City conduct its MCR to conform to the 2017 Growth Plan by 2022. It is expected that the new MCR may begin in 2020.

Places to Grow – Growth Plan for the Greater Golden Horseshoe (2017)

While the PPS provides overall policy direction specifically related to matters of provincial interest, the Growth Plan for the Greater Golden Horseshoe (the “Growth Plan”) provides direction on the development and growth of communities within the Greater Golden Horseshoe (GGH).

With respect to employment land conversions, the Growth Plan provides that the conversion of lands within employment areas to non-employment uses may only be permitted through a municipal comprehensive review.

As the subject property was in an employment area, its re-designation to permit non-employment uses is considered a conversion and may only occur through a municipal comprehensive review.

City of Toronto Official Plan

The City of Toronto Official Plan designated the subject property as Employment Areas. Employment Areas are intended to be areas of economic activity and function as places of business, permitting a range of employment uses, as well as hotels, ancillary retail uses, restaurants and small-scale stores and services that serve area businesses and workers. Residential uses and sensitive uses such as schools and places of worship are not generally permitted in Employment Areas.

Official Plan Amendment No. 231 (OPA 231)

City Council adopted OPA 231 on December 18, 2013, following the Five- Year Official Plan and Municipal Comprehensive Reviews regarding employment lands. In July 2014, the Minister approved the majority of OPA 231 with some modifications. A total of 178 appeals were received to the Minister’s decision to approve OPA 231. A site-specific appeal was not received for the subject lands, and therefore OPA 231 is in full effect as it relates to the subject lands. The most recent Tribunal Order was issued on January 8, 2019.

The aim of OPA 231 is to provide greater clarity around the function of the City’s Employment Areas. To achieve this goal, Employment Areas are designated either Core or General.

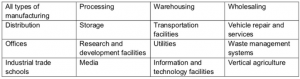

Permitted Uses in Core Employment Area OPA 231

Additional Permitted Uses in Core Employment Area OPA 231

Former General Zoning By-law 7625 (North York)

The subject property was not regulated by the new City of Toronto Zoning By-law 569-2013 and is zoned MO(6) – Industrial-Office Business Park Zone under the Former City of North York’s General Zoning By-law 7625.

Permitted Uses

Section 34(2)(a) of the By-law includes several general permitted uses for the MO Zone identified in Table 5.

MO Zone – Permitted Uses

Ministry of the Environment and Climate Change (MOECC) – D-6 Compatibility between Industrial Facilities

The D-6 guidelines are intended to be applied in the land use planning process to prevent or minimize future land use problems due to the encroachment of sensitive land uses and industrial land uses on one another. It encourages informed decision-making by Ministry staff, land use authorities and consultants to assist in determining compatible mixed land uses and ensure an adequate buffer between incompatible land uses.

An assessment of the surrounding Class I, II, and III facilities would be required to evaluate the proposed school and place of worship uses proposed in Development Concepts. These uses would need to be out of the ‘Areas of Influence’ for each type of facility. The ‘Areas of Influence’ for Class I, II & III facilities are 70, 300 and 1000 meters respectively.

Here are the different classifications of facilities:

Class I Industrial Facility

A place of business for a small scale, self-contained plant or building which produces/stores a product which is contained in a package and has a low probability of fugitive emissions. Outputs are infrequent and could be point source or fugitive emissions.

Class II Industrial Facility

A place of business for medium scale processing and manufacturing with outdoor storage of wastes or materials (i.e. it has an open process) and/or there are periodic outputs of minor annoyance. There are occasional outputs of either point source or fugitive emissions.

Class III Industrial Facility

A place of business for large scale manufacturing or processing, characterized by large physical size, outside storage of raw and finished products, large production volumes and continuous movement of products and employees during daily shift operations. It has frequent outputs of major annoyance and there is a high probability of fugitive emissions.

Toronto and Region Conservation Authority

The subject lands were outside of the regulation area of the Toronto and Region Conversation Authority (TRCA).

Planning Analysis

The redevelopment of the subject property for employment uses was supported by the site context and the existing planning policy framework in the Provincial Policy Statement, Growth Plan for the Greater Golden Horseshoe, City of Toronto Official Plan and City of Toronto OPA 231. Consistent across the planning framework was the encouragement of compact built-form that supports the economic function of the employment area in which it is located as well as the utilization of existing infrastructure and transportation systems.

The City of Toronto has applied stringent policies for lands designated as Employment Areas in the Official Plan. Based on the property’s location in the center of an Employment Area and its designation as a General Employment; employment and office uses are supported by the City’s updated Official Plan policies under this designation.

The applicable planning policy prohibits residential or other uses that are not currently permitted within Employment Areas. At the direction of the Province, the City may only allow non-employment related uses as permitted through the municipal comprehensive review process.

The Former City of North York Zoning By-law 7625 permits a range of employment uses on the subject property and allows a density of 1.5 FSI on the site.

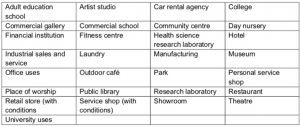

Opportunities and Constraints

Development Concepts

Once the aforementioned criteria were evaluated, four development concepts were analyzed which demonstrated potential redevelopment scenarios deemed realistic and achievable. All concepts assumed no environmental or other issues associated and reflect the as-of-right permission for redeveloping the subject property.

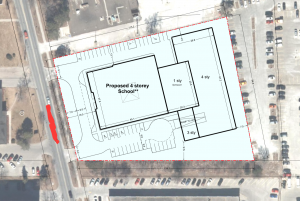

Concept 1 – School

A concept was prepared which envisions the redevelopment of the lands for a school, specifically either an Industrial Trade School, Adult Education School, College, Commercial School, or University Uses. While the Employment Area policies of the Official Plan only permit schools to be located in Employment Areas if located on a Major Road, OPA 231 introduced permissions for Industrial Trade Schools in the rest of the designation.

The development consists of a four-storey building with two wings, connected by a one-storey gymnasium at the central area of the school. The total gross floor area of the school is 13,800 square meters, meeting the as-of-right density of 1.5 FSI.

Development Option – School

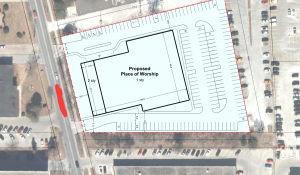

Concept 2 – Place of Worship

The second concept proposed the redevelopment of the subject property to a place of worship. Similarly, the place of worship use is permitted by the former North York Zoning By-law 7625 and is not permitted by the current Official Plan (on properties without frontage on a Major Road). In order to achieve this use for the site, the zoning regulations for the subject property must be met exactly to avoid initiating an application for Minor Variance and Zoning By-law Amendment.

Development Option – Place of Worship

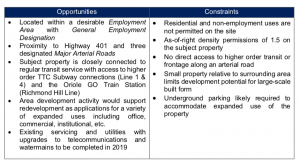

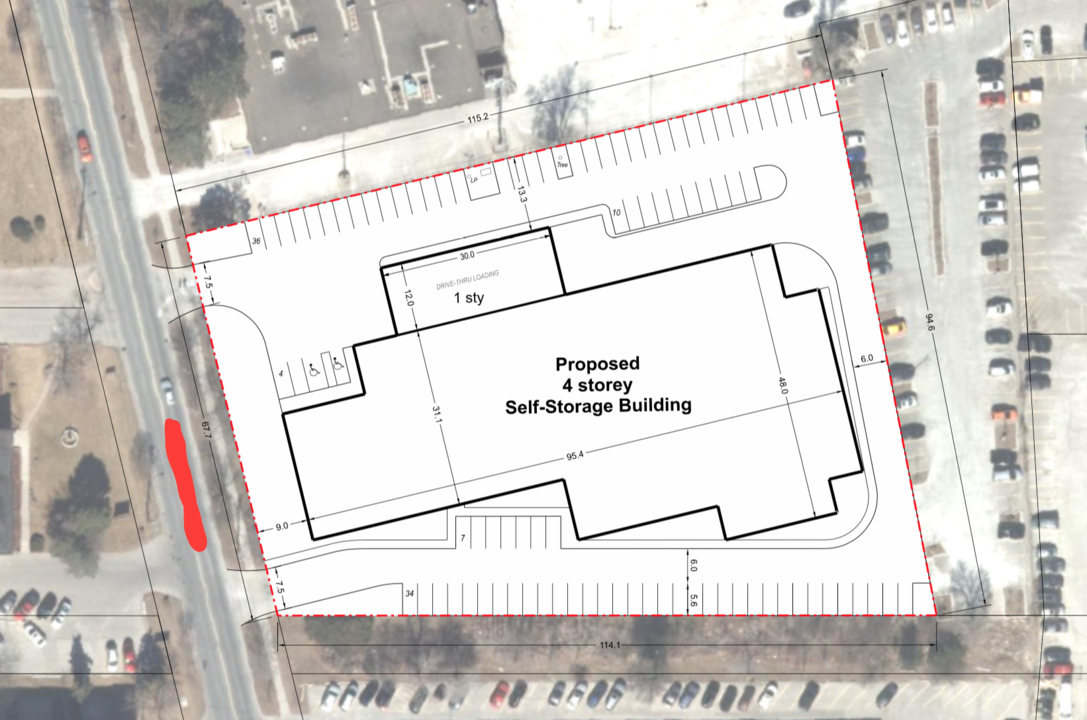

Concept 3 – Self-Storage Facility

The third development concept considered a four-storey self-storage building. The total gross floor area of the self-storage building is 13,788 square meters with a density of 1.5 FSI, up to the as-of-right allowance.

Development Option – Self Storage

Concept 4 – Office Expansion

Finally, the fourth concept contemplated the redevelopment of the subject property to accommodate expanded office use to the rear of the existing building.

The existing two-storey building would be maintained with five- and six-storey sections added, with one level of underground parking. The total gross floor area of the expanded office building would be 13,828 square metres including the existing 2,094 square metre office and the 11,734 square metre addition. The larger building would the meet as-of-right density allowance of 1.5 FSI.

Development Option – Office

Discussion of Development Concepts

A comprehensive zoning review of a detailed concept and site plan would need to be undertaken to confirm zoning deficiencies. Additionally, a Pre-Application Consultation would be needed to better understand the Staff’s level of support for any of these proposals.

Summary

This analysis has explored the development options for the subject property. The following is a list of development considerations that have been identified by this analysis:

- The subject property cannot be converted for residential or other uses not currently permitted by the Official Plan except through the next municipal comprehensive review. This review must be initiated by the City, and the timing of the review is unknown at this time and the outcome is uncertain.

- Based on the planning policy and surrounding context, employment/commercial uses are most suitable for the subject property. Residential uses in this area have not been permitted on other lands designated Employment, indicating the City’s stance on protecting its employment lands.

- Institutional uses (school, place of worship) are directed towards Major Streets within Employment Areas.

- The school use (Adult Education School, College, Commercial School, or University Uses) could be achieved through an application for Site Plan Approval which fully conforms to the applicable zoning regulations.

- The Place of Worship use could likely be achieved through an application for Site Plan Approval which fully conforms to the applicable zoning regulations.

- The self-storage use could be achieved through a Minor Variance Application (and Site Plan Application)

- The expanded Office Use could be achieved through a Site Plan Approval process.

- The proposed concepts have not been vetted through Staff; therefore, to ensure that Staff is supportive of the concepts, a formal Pre-Application Consultation (PAC) Meeting will need to be held.

- An FSI of 1.5 is permitted for the subject property. Further discussions with staff are recommended to gauge their support for greater density for the site, given its location in an urban area, its proximity to regular transit service and higher order and regional transit, and its location near Highway 401 and three Major Arterial Roads.

- The next steps in the planning process would include selecting a preferred development scenario and having initial discussions with the City of Toronto regarding their level of support for the proposal and required planning applications, as well as meeting with the local Councillor at the appropriate time.

Conclusion

And so, why should you prepare a Development Options Report to determine the Highest and Best Use?

Because it can unlock hidden value in your property.

It seems like a lot of work to do ahead of marketing a property for sale…

But for any sites that are located in the City of Toronto, and in areas that are going through rapid transformation, not doing so will likely result in you leaving money on the table.

As we’ve mentioned in previous issues regarding valuations and due diligence… you need to know more about your property than any potential purchasers.

Over the past 27 years, we have worked with numerous investors and occupiers of industrial properties to position their assets to the highest and best use; from old B-Class industrial to flex office, retail warehouses, self-storage facilities, or last-mile delivery centers.

Our most recent transaction generated fifteen competing offers and the final value above Vendor’s expectations. One of the main reasons was the fact that we completed the due diligence process in advance and created a complete package that was shared with prospective buyers prior to offer submissions.

To find out how we can help you achieve the same level of success, please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.