July 11th, 2025

In today’s global trade landscape filled with uncertainty, tariffs, and weekly agreement changes, bonded warehouses and foreign trade zones (FTZs) are pivotal for businesses aiming to optimize supply chains, defer costs, and comply with customs regulations.

These facilities enable the secure storage of imported goods without immediate duty payments, facilitating better cash flow and strategic operations.

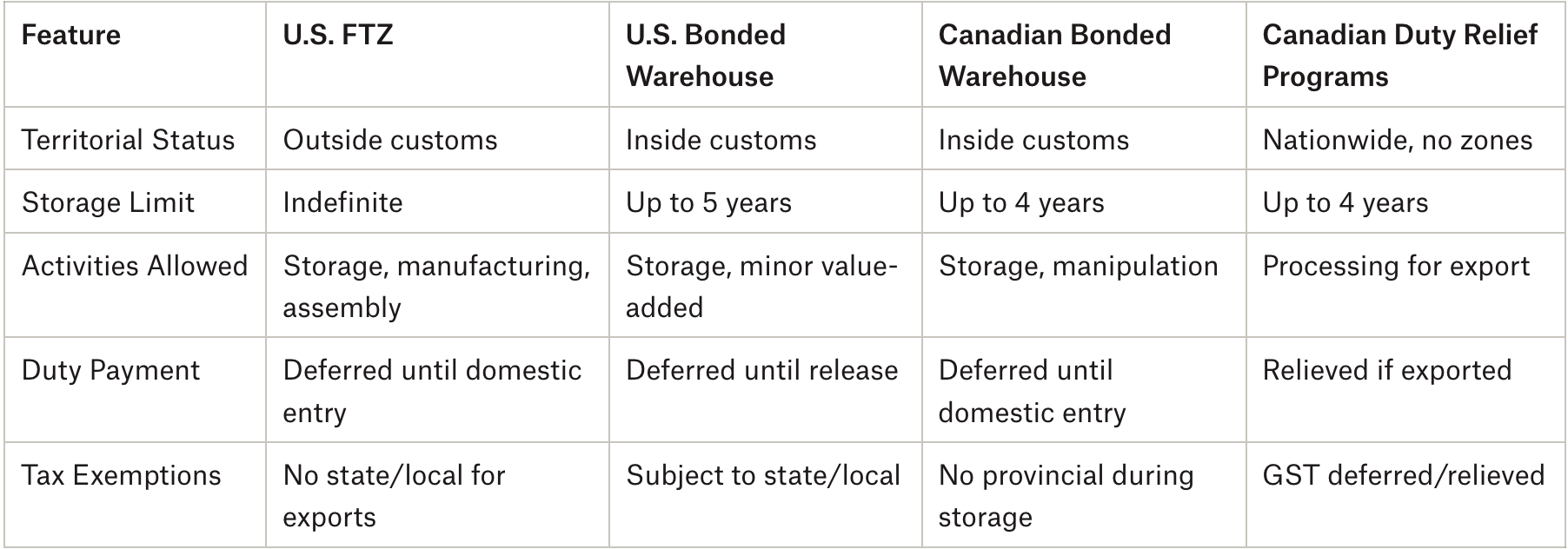

In the United States, FTZs—originated in 1934 via the Foreign-Trade Zones Act—function as areas outside customs territory, supporting manufacturing and re-exports amid rising tariffs. Bonded warehouses offer similar deferrals but with restrictions on activities.

Meanwhile, Canada lacks traditional FTZs but provides equivalent benefits through nationwide programs like bonded warehouses and duty relief, emphasizing flexibility across provinces like Ontario.

This newsletter delves into U.S. and Canadian systems, leveraging Cushman & Wakefield’s U.S. data alongside detailed insights into Ontario’s bonded warehouse operations, including approval processes in high-traffic areas such as Mississauga, Ontario.

With North American trade volumes going through enormous change in 2025, these tools help mitigate geopolitical risks and enhance competitiveness.

For instance, importers in Toronto can defer GST and duties, while U.S. manufacturers assemble products tariff-free.

Understanding these mechanisms equips companies to navigate complexities, from U.S.-China trade disputes to Canadian export incentives, fostering resilient cross-border strategies.

U.S. Foreign Trade Zones and Bonded Warehouses: Key Features and Growth

Foreign Trade Zones (FTZs) in the U.S. were established in 1934 to ease tariff burdens on manufacturers, allowing goods to be stored, manipulated, or manufactured without immediate customs duties.

These zones, supervised by U.S. Customs and Border Protection (CBP), are positioned near ports of entry and treat goods as outside U.S. customs territory.

This status enables indefinite storage and value-added activities, such as assembling components into finished products that may qualify for lower tariffs upon domestic entry.

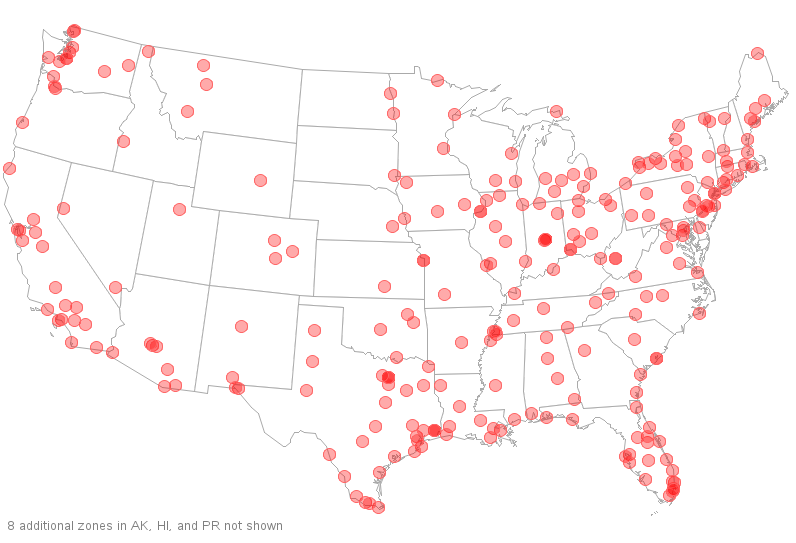

In 2023, 197 active FTZs employed 550,000 workers and processed $494 billion in merchandise—a 244% rise from 2019—with exports hitting $44 billion, up 44% over five years. This surge reflects their value in industries like automotive and electronics, where duties are deferred until goods enter the market, and re-exports avoid state/local taxes.

Source: SAS.com.

Bonded warehouses, conversely, sit inside customs territory and permit storage for up to five years, with duties deferred until release. Located near airports or ports, they support minor value-added services like repackaging but prohibit manufacturing. Goods remain liable for state and local taxes, making them suited for temporary holding and cash flow optimization. Key distinctions include FTZs’ manufacturing flexibility versus bonded warehouses’ stricter limits, with FTZs offering tax exemptions for exports.

Strategic FTZ locations enhance maritime trade: near the Port of Los Angeles, zones span Orange and parts of Los Angeles/San Bernardino counties; the Port of New York/New Jersey covers Middlesex and other New Jersey counties, plus New York City’s outer boroughs. Similar setups exist near Savannah, Houston, and Charleston, underscoring their role in logistics hubs.

Canadian Equivalents: Bonded Warehouses and Duty Relief Programs

Source: Excel Transportation | Custom Bonded Warehouse Solutions.

Canada employs a flexible, non-geographic approach to duty deferral, administered by the Canada Border Services Agency (CBSA). Without U.S.-style FTZs, programs like customs bonded warehouses allow storage of imported goods for up to four years without paying duties or GST until domestic release.

If re-exported, no duties apply, and provincial taxes are avoided during storage. Manipulation (e.g., labeling) is permitted, but manufacturing is not, aligning closely with U.S. bonded warehouses. Additional programs include Duties Relief for processing and exporting within four years, Drawback for refunds on exported materials, and Exporters of Processing Services for foreign-owned goods.

These benefits are available nationwide, with 16 “Foreign Trade Zone Points” offering support, though not restricting locations. In Toronto and the Greater Toronto Area (GTA), including Mississauga, bonded warehouses thrive near Pearson Airport and highways, serving e-commerce, aerospace, and perishables. Facilities operated by companies like Excel Transportation and Total Express provide secure storage under CBSA oversight, enabling importers to hold goods like electronics or wines while deferring payments.

In Ontario, bonded warehouses must secure CBSA approval, emphasizing security and compliance. Facilities are customs-controlled, with goods in “suspended” status until clearance. Key requirements include strict security (surveillance, access controls), accurate record-keeping, and limited access for authorized personnel like brokers and CBSA officers. Benefits include deferred duties/taxes for cash flow, temporary storage, and customs brokerage integration.

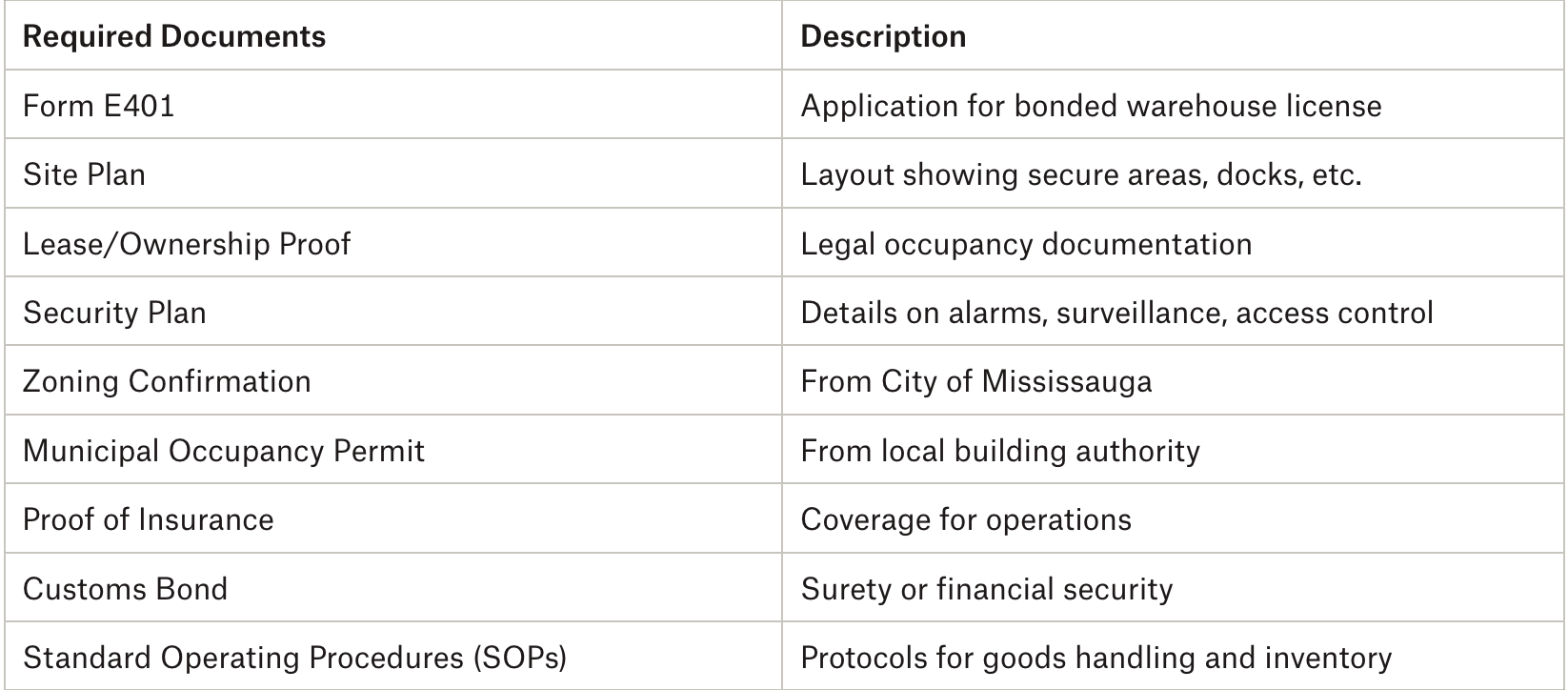

Obtaining CBSA approval for a bonded warehouse in Mississauga involves a structured process, ideal for GTA logistics due to zoning and proximity to Toronto.

- Start by understanding types—Type B for general goods is common.

- Ensure site suitability: secure, enclosed, and zoned for warehousing (verify with City of Mississauga Planning).

- Register for a Business Number and import/export account via Canada Revenue Agency (CRA).

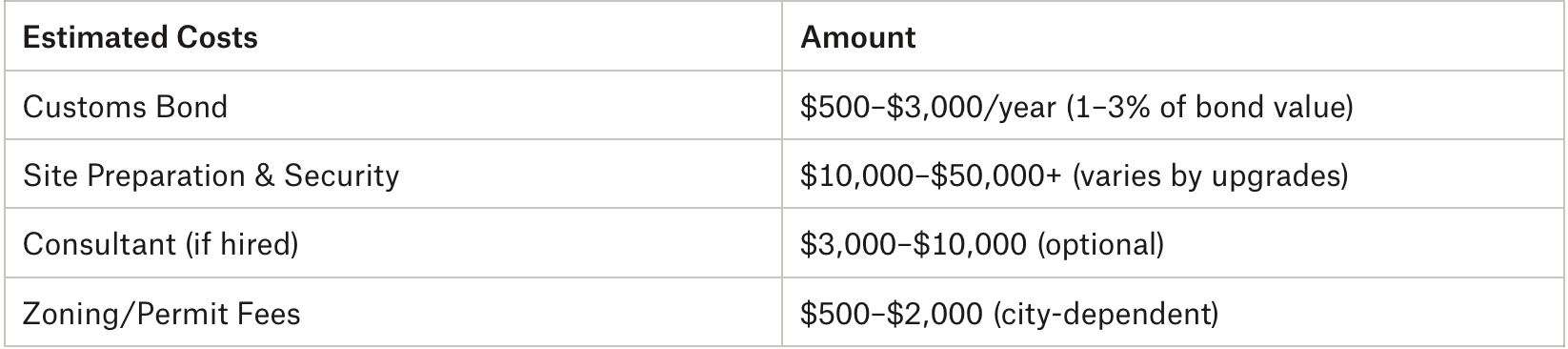

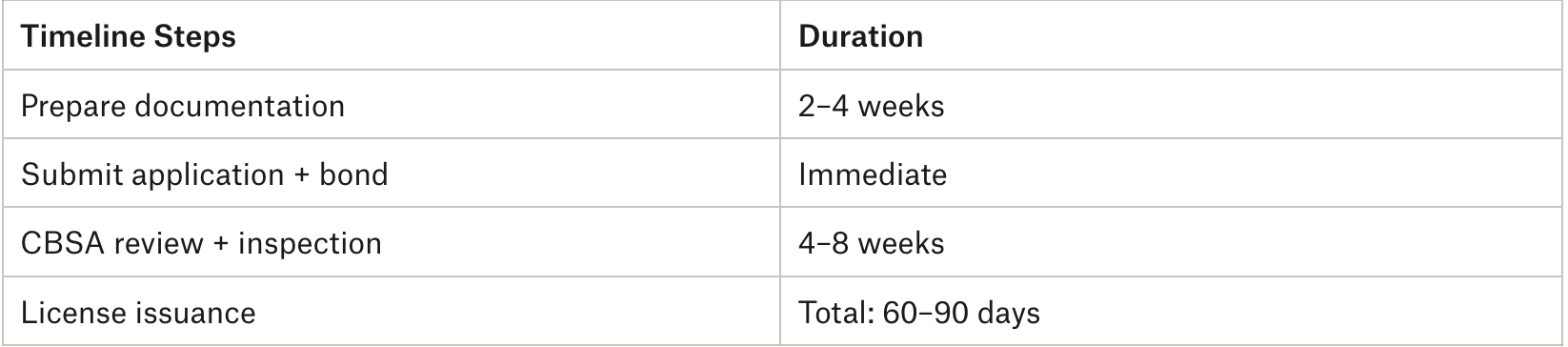

- Submit Form E401 to the Southern Ontario CBSA office, including supporting documents: detailed site plan, lease/ownership proof, security plan, SOPs for inventory, municipal occupancy permit, zoning confirmation, insurance, and a customs bond (typically $25,000–$100,000, costing 1–3% annually via surety companies).

- CBSA reviews paperwork and inspects the site for compliance, potentially requiring modifications.

- Upon approval, the license is issued and remains valid with ongoing audits, record maintenance, and bond renewals.

Conclusion:

Bonded warehouses and FTZs provide essential buffers in volatile trade environments, enabling duty deferral, secure storage, and value-added flexibility.

U.S. FTZs drive manufacturing and export growth, as seen in recent multibillion-dollar volumes, while Canada’s bonded programs offer nationwide access, with Ontario’s detailed approval processes in Mississauga supporting GTA hubs like Toronto.

By incorporating these, companies can optimize costs, comply with regulations, and leverage USMCA synergies. As 2025 brings potential tariff adjustments, adopting such tools will be key to resilience, innovation, and competitive advantage in cross-border trade.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com