Vaughan Industrial Market: An In-Depth Look

July 8th, 2022

Demand for industrial product has become a runaway train. Both from a leasing and acquisition perspective, there isn’t a week that goes by where an investor, developer, or occupier makes its known that they have a requirement for hundreds of thousands of square feet of space or dozens of acres of industrial land.

At the same time, these very same investors and developers are redlining their operations in trying to bring onboard more inventory. Even with the constraints of labour and material shortages, the GTA is seeing over 16.8M SF of space under construction; a massive accomplishment by the community. That said, even with the torrid pace of land acquisition and development, values and rents continue to rise exponentially.

Whereas, just a few years ago, an industrial user could select from multiple sites and secure their facility for $5-7 PSF net, each opportunity now means dealing with heavy competition for fewer options and forking over as much as $18-20 PSF net.

This appreciation is due, in part, to the inflated cost of purchasing and building facilities. It is a simple exercise of underwriting or creating a pro forma to hit the necessary returns, which then trickle down in the form of higher rents. Then, as new benchmarks are set, the community is able to establish higher valuations for the transactions that follow.

Looking forward, as interest rates continue to rise, what will happen is still unclear. On one hand, developing will become more expensive. On the other, asset prices tend to cool as the Buyer pool thins out. Furthermore, some Occupiers may simply walk if and when asking rents are no longer feasible for their business plan.

As a result, the Investors and Occupiers remaining at the table will be those with economies of scale and deep pockets, who can absorb these costs, secure better financing terms, or go in all cash. The landscape and dynamics within the market may certainly shift, however, thinking that values will suddenly go down is unrealistic, barring any significant economic crash. At that point, however, all bets are off, and it would be impossible to predict how things unfold. In any event, industrial space remains scarce, highly-sought-after, and incredibly valuable to an economy seeking to develop independence in its manufacturing and supply chains.

With this context set, that is why, in the coming weeks, we will continue our submarket analysis, with a focus on the GTA North markets. We will aim to provide some deep insight into each, as well as provide some detail on potential opportunities that may fit in with your real estate or investment strategy.

For this week’s newsletter, we’ll feature the City of Vaughan and examine the state of its industrial market, including trends, transactions, and developments.

Vaughan Industrial Market Snapshot – Q1 2022

Source: Cushman & Wakefield Research.

Looking at the current inventory numbers, we have over 803M SF of industrial space across the GTA; yet Vaughan’s share is just over 98.8M SF (about 12.3%). In Q1 2022, however, Vaughan had 380,668 SF of absorption and 193,306 SF of new supply; the total being net negative.

The availability rate in Vaughan sits at 0.3% and will likely remain at sub-1% for the foreseeable future, despite the fact that 3,682,430 SF of industrial space is under construction. Industrial rents in Vaughan were reportedly at an average of $12.01 PSF net asking in Q1 2022. That said, we have already seen asking rents move north of $15-16 PSF net, with expectations that they will move closer to $18-20 PSF net over the coming months.

27 Director Court, Vaughan. Source: Anatolia & Colliers.

Zentil Property Management is constructing a 323,459 SF industrial facility with 36’ clear, 16 truck-level and 1 drive-in doors at 27 Director Court. Phase 1 was completed in Q1 2022 and the 216,224 SF space has already been leased. Phase 2 is expected to be ready for occupancy in Q3 2023 and will bring an additional 107,235 SF.

The site provides direct exposure to Highway 400 while also being in close proximity to Highway 407, major transportation routes, intermodals, and public transit. Colliers is leading the listing.

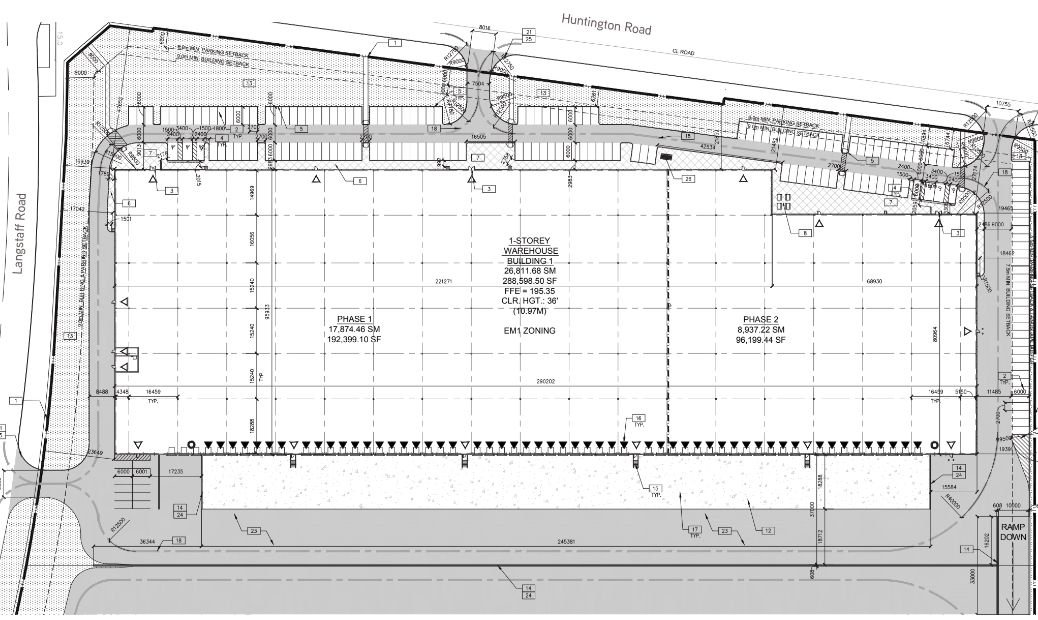

2. 8555 Huntington Road – 96,199 SF Phase 2 Occupancy in December 2022

8555 Huntington Road, Vaughan. Source: Anatolia & Colliers.

Anatolia Capital Corporation is developing a 288,598 SF industrial property with 36’ clear, 38 truck-level and 2 drive-in doors at 8555 Huntington Road. Phase 1 saw 192,399 SF constructed in December 2021, while Phase 2 will bring an additional 96,199 SF in December 2022. The entire building has been leased.

The site is located in proximity to Highways 7, 407, and 400, and will be just minutes from the Highway 427 extension interchange at Langstaff Road; providing excellent access to major transportation routes and the labour pool.

6680 Langstaff Road, Vaughan. Source: Anatolia & Colliers.

Anatolia Capital Corporation is developing a 265,530 SF industrial property with 36’ clear, 35 truck-level and 2 drive-in doors at 6680 Langstaff Road. Phase 1 will see 177,020 SF constructed in Q4 2022, while Phase 2 will bring an additional 88,510 SF in Q4 2023. As of writing, the entire building is still available for pre-lease.

Adjacent to 8555 Huntington Road, the site is located in proximity to Highways 7, 407, and 400, and will be just minutes from the Highway 427 extension interchange at Langstaff Road; providing excellent access to major transportation routes and the labour pool. Colliers is leading the listing.

Conclusion

If we keep at our current pace, it’s conceivable that we may get to a 0% availability across the GTA, aside from brief periods between Tenants, design-build projects, or speculative construction (which are themselves often pre-leased well in advance). For those businesses looking to purchase or lease existing space, things will only become more challenging and competitive.

These points underscore the tremendous value of land. While land is becoming increasingly expensive, municipalities such as Vaughan present opportunities for infill redevelopment or intensification of use. With great access to major transportation routes and the suburban labour pool, Vaughan makes a great location for industrial occupiers, however, very little space is available. With rents continuing to escalate at a rapid pace, we may see more owner-occupiers building or redeveloping sites for their own use; giving them back some control in their cost forecasts and general occupancy.

In the coming weeks, we will continue our examination of various submarkets with the aim of uncovering potential opportunities and strategies for industrial Owners and Occupiers. In the meantime, if you are an owner of industrial land or property with redevelopment potential, there are plenty of institutional and private buyers who would be willing to pay a premium to take it off your hands.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is a Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com