In the dynamic industrial real estate sector of the Americas, the Greater Toronto Area (GTA) stands out as a key hub adapting to economic uncertainties while leveraging its strategic position for logistics and manufacturing growth.

Drawing from Cushman & Wakefield’s Q2 2025 Toronto Industrial MarketBeat report, occupiers in the GTA—spanning logistics, e-commerce, and manufacturing—are prioritizing cost efficiency amid supply chain disruptions and tariff pressures.

Vacancy has risen to a 10-year high of 5.0%, yet resilient demand signals opportunities for quality assets. Nearshoring trends are enhancing the GTA’s appeal, with proximity to U.S. markets driving interest from cross-border firms. Unlike office spaces focused on collaboration, industrial occupiers emphasize operational resilience, functional efficiency, and labor access.

As portfolios stabilize post-downsizing, CRE leaders have a chance to align assets with business outcomes, bridging financial metrics with talent and supply chain imperatives. This newsletter explores these trends, highlighting GTA-specific insights while noting broader Americas parallels, positioning the region for a potential rebound in 2026.

Key Trends Shaping Industrial Real Estate in the Greater Toronto Area in 2025

Cost Pressures and Uncertainty Dominate Decision-Making

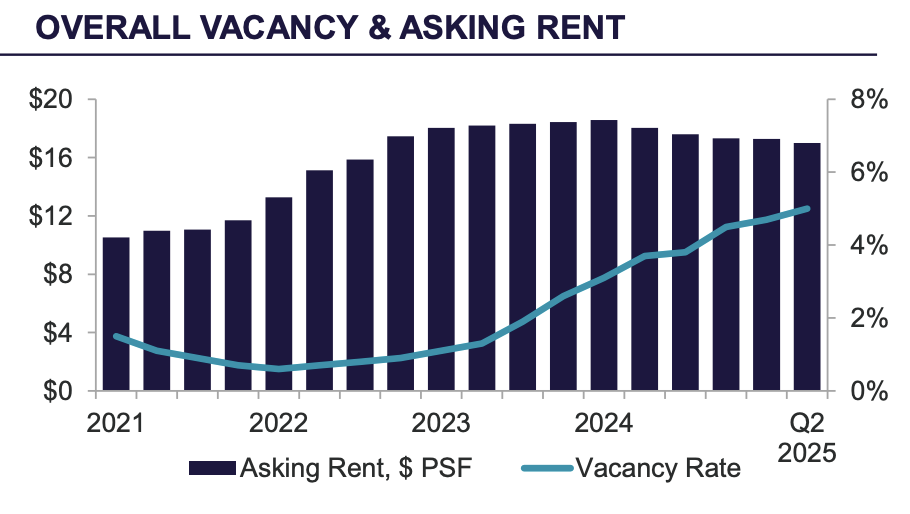

Cost remains the paramount driver for industrial occupiers in the GTA, exacerbated by higher interest rates, tariffs, and supply chain volatility. In Q2 2025, average net asking rents fell to $17.00 per square foot (PSF), marking a 5.9% year-over-year (YOY) decline—the lowest in nearly three years and the fifth consecutive quarter of drops.

GTA Industrial Market. Source: Cushman & Wakefield Research.

This reflects occupiers’ demand for value, favoring functional efficiency and prime locations over premium pricing. For example, in GTA West, rents dropped 200 basis points quarter-over-quarter (QOQ) to $17.30 PSF, amid seven quarters of decline, while older assets face steeper pressures due to outdated features.

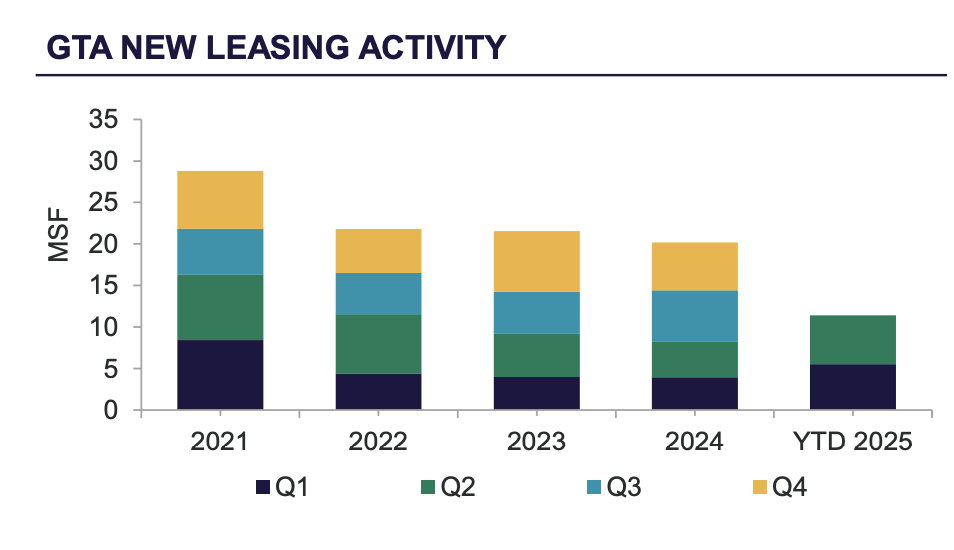

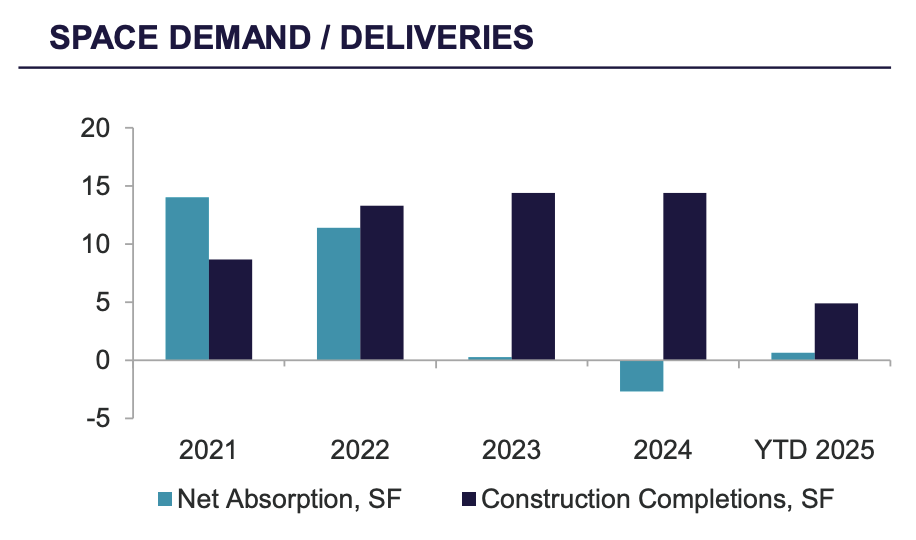

Uncertainty from trade policies continues to subdue demand, with the GTA market out of balance as supply outpaces absorption. Net absorption in Q2 was just 59,000 square feet (SF), down sharply from 590,000 SF in Q1, resulting in YTD absorption of 647,854 SF.

This is contrasted with the U.S., where rent growth moderated to 2.6% annually, with coastal markets like Los Angeles seeing -10.2% YOY declines. Industrial teams in the GTA are increasingly data-driven, emphasizing financial KPIs like rent and utilization, but struggle to integrate non-financial metrics such as labor access and resilience. Challenges in data quality and stakeholder alignment persist, mirroring wider CRE issues and hindering ROI forecasting.

Evolving Organizational Models: Aligning with Operations and HR

Industrial real estate in the GTA is evolving as a strategic operations tool, with reporting structures shifting toward supply chain and HR to tackle efficiency and talent needs. In the Americas, including the GTA where labor access is critical, about one-third of firms have realigned CRE reporting recently, often to HR for workforce integration. This shift acknowledges industrial spaces’ role in attracting skilled workers for on-site manufacturing and logistics, differing from offices’ employee engagement focus.

Metrics, however, remain skewed: financial indicators like cost efficiency dominate, while operational ones such as workflow and productivity are underutilized. GTA occupiers grapple with uncertainty in ROI projections, advocating for cross-functional metrics that link real estate to outcomes like supply chain velocity and retention. This positions industrial CRE as a bridge between finance, operations, and HR, enhancing collaboration and value demonstration beyond costs.

Flexible Location Strategies as a Talent and Supply Chain Imperative

Geographic flexibility is vital for GTA industrial occupiers optimizing supply chains and talent pools. Across the Americas, 61% have broadened hiring, with GTA firms using portfolios to tap distributed labor, especially in tech-enhanced manufacturing. Nearshoring bolsters the GTA’s strategies, attracting U.S. firms for cost and proximity advantages.

Demand for skilled labor surges, influenced by e-commerce and manufacturing, prompting prioritization of infill and last-mile sites for connectivity. In GTA East, despite high vacancy at 7.0%, new leasing hit a 21-year quarterly high of 1.3 MSF, driven by a major 700,000 sf lease, highlighting flexible strategies’ impact.

Portfolio Stability Emerges as Supply Adjusts

Post-pandemic downsizing is waning in GTA industrial portfolios. Two-thirds reduced footprints recently, but only 35% plan more cuts, pivoting to proactive management. Q2 saw 2.5 million square feet (MSF) of new deliveries, with YTD at 4.9 MSF and full-year projections at 11.5 MSF—below the 14.4 MSF average of 2023-2024.

The construction pipeline hit a six-year low of 7.5 MSF, down 53.8% YOY, with GTA West comprising 58.7%. Vacancy rose to 5.0% (up 30 bps QOQ), a 10-year high, but utilization climbs to 60% amid quality flight and policies. Submarket variances include GTA East’s 190 bps QOQ vacancy drop due to strong leasing, versus GTA West’s 85.8% of new supply remaining vacant.

In the U.S., vacancy at 7.1% shows similar stability, with inland markets like Dallas absorbing +6.8 MSF. Long-term, e-commerce drives GTA growth, with one-third expecting expansion.

Landlords’ Opportunity: Industrial as a Value-Added Service

GTA occupiers view industrial spaces as operational services, with 85% seeking enhanced landlord support in automation and modern amenities, 46% willing to pay premiums. This fuels rent premiums for top-tier assets, up 150 basis points since 2019.

Efficiency and resilience needs are met for only 60% of tenants. Partnerships can improve this, with landlords providing labor-friendly warehouses—evident in newer GTA developments with >32-foot ceilings facing lower vacancy.

Unlike offices’ cultural emphasis, GTA industrial focuses on logistics, rewarding proactive landlords with asset value gains amid incentives like rent-free periods for larger tenancies.

Conclusion:

The 2025 industrial outlook for the Greater Toronto Area illustrates a market navigating caution toward opportunity, balancing cost pressures and uncertainty with nearshoring and quality-driven strategies.

By crafting metrics that connect real estate to operational and talent results, occupiers can elevate industrial assets as growth catalysts.

Landlords investing in modern, efficient spaces will secure premiums and enduring partnerships.

As supply moderates and demand from e-commerce and manufacturing rebounds, innovative approaches will build resilience, converting regional challenges into advantages in the broader Americas landscape.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

| Goran Brelih, SIOR

Executive Vice President, Broker Office: 416-756-5456

NewsletterJoin our mailing list to receive the latest news and updates from our team. You have Successfully Subscribed! |