What’s in Store for Industrial Moving Forward?

Quick Facts on E-Commerce, Grocery Sales, & More

February 26th, 2021

Many of the pundits in the commercial real estate market are trying to analyze the whirlwind of a year that was 2020 and read the tea leaves for the months and year ahead.

A good portion of that crowd is still quite bullish about the industrial asset class given its role throughout the course of the pandemic, as well as the relatively stellar performance against office, retail, and hospitality.

We are pro-industrial as well – however – for those seeking to understand exactly why and how the market may evolve moving forward, then you may want to read on.

First off, in the simplest of terms, we see a direct causation between lockdowns and e-commerce. Similarly, we see a direct relationship between online sales activity and demand for industrial space.

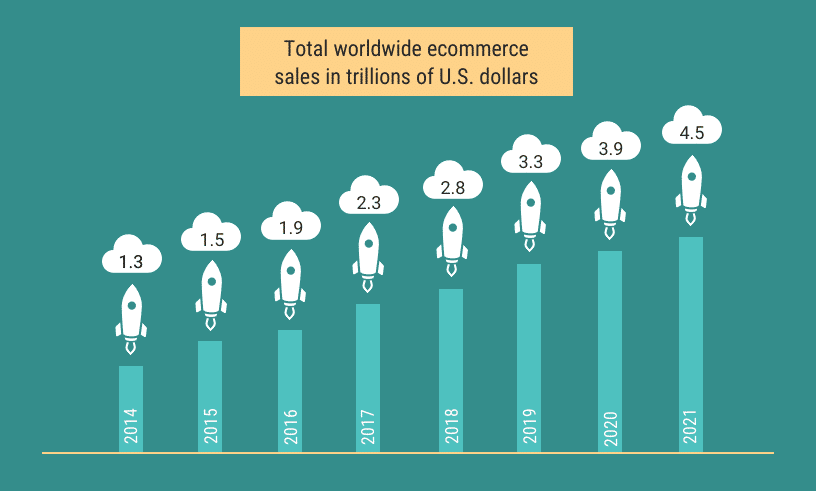

Worldwide ecommerce sales, source: Shopify via Kinsta

Therefore, we can reasonably conclude that lockdowns are one of many drivers of demand for industrial; namely, warehouses, fulfilment centres, and – in a less direct way – manufacturing facilities due to the on-shoring of operations (as a result of supply chain disruptions).

It’s not rocket science.

People need to buy stuff. And when one cannot physically go into the store they resort to the next best thing… ordering online.

Likewise, companies need to produce stuff. And when shipping goods across the globe takes too long or becomes way too expensive (just look at the current skyrocketing transportation and freight costs), then they tend to look closer to home. This reaction isn’t just to build in redundancies or decrease delivery times but is done at first when orders simply do not arrive.

Sourcing and procurement can be done in a less-globalized, decentralized fashion despite the notion that ‘we can’t do that anymore.’ And we aren’t even touching on various other applications, such as locally-grown and distributed food, drone delivery systems, 3D-printing, or other cutting-edge technologies which should roll out in the coming decade.

Finally, the logistical aspect of the equation requires physical space as part of the solution.

There are ways to stretch your current industrial space further, such as:

- higher clear heights;

- multi-level warehousing;

- warehouse management systems,

- racking;

- robotics; and

- automation…

But at the end of the day, you really have no other option but to build more space in order to increase bandwidth.

Now, the above factors seem to be what most analysts today track in order to forecast the broader market’s appetite for industrial. And it’s where we also look to get a baseline snapshot.

The crux of the issue of today lies in answering:

Will e-commerce adoption continue in a post-pandemic world?

Was this a temporary phenomenon or a permanent paradigm shift?

Will other drivers – such as online grocery sales, global e-commerce, or on-shoring – complement or replace the demand coming from domestic e-retail?

Or will we snap back to old habits and once again frequent brick-and-mortar stores with e-commerce used only some of the time, and by only some of the population?

So with these questions in mind, let’s quickly examine a few facts…

Canadian Retail and E-Commerce Sales

According to StatisticsCanada:

- Retail sales posted their largest decline since the low of April driven by the COVID-19 pandemic, decreasing 3.4% to $53.4 billion in December. Sales were down in 9 out of 11 sub-sectors, representing 83.6% of retail sales. In volume terms, retail sales fell 3.6% in December.

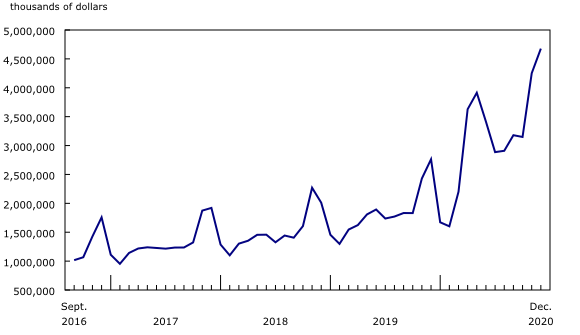

Chart 4: Retail e-commerce increases in December, Source: StatsCan

- Given the rapidly evolving economic situation, Statistics Canada is providing an advance estimate of retail sales, which suggests that sales declined 3.3% in January.

- On an unadjusted basis, retail e-commerce sales reached a record high in December, increasing by over two-thirds (+69.3%) year over year to $4.7 billion in December. In comparison, total unadjusted retail sales increased 5.9% on a year-over-year basis in December. E-commerce accounted for 7.8% of total retail trade in December—the largest share since May. The rise in e-commerce sales coincided with an uptick in the number of retailers reporting shutdowns in December.

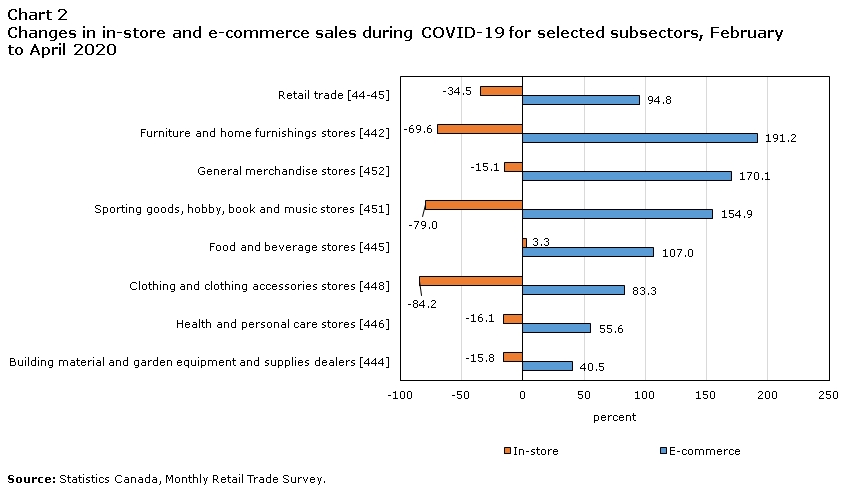

Chart 2 Changes in in-store and e-commerce sales during COVID-19 for selected sub-sectors, February to April 2020

- Overall, retail e-commerce sales increased 70.5% in 2020.

- The share of e-commerce sales out of total retail trade reached a record-high 9.8% in April.

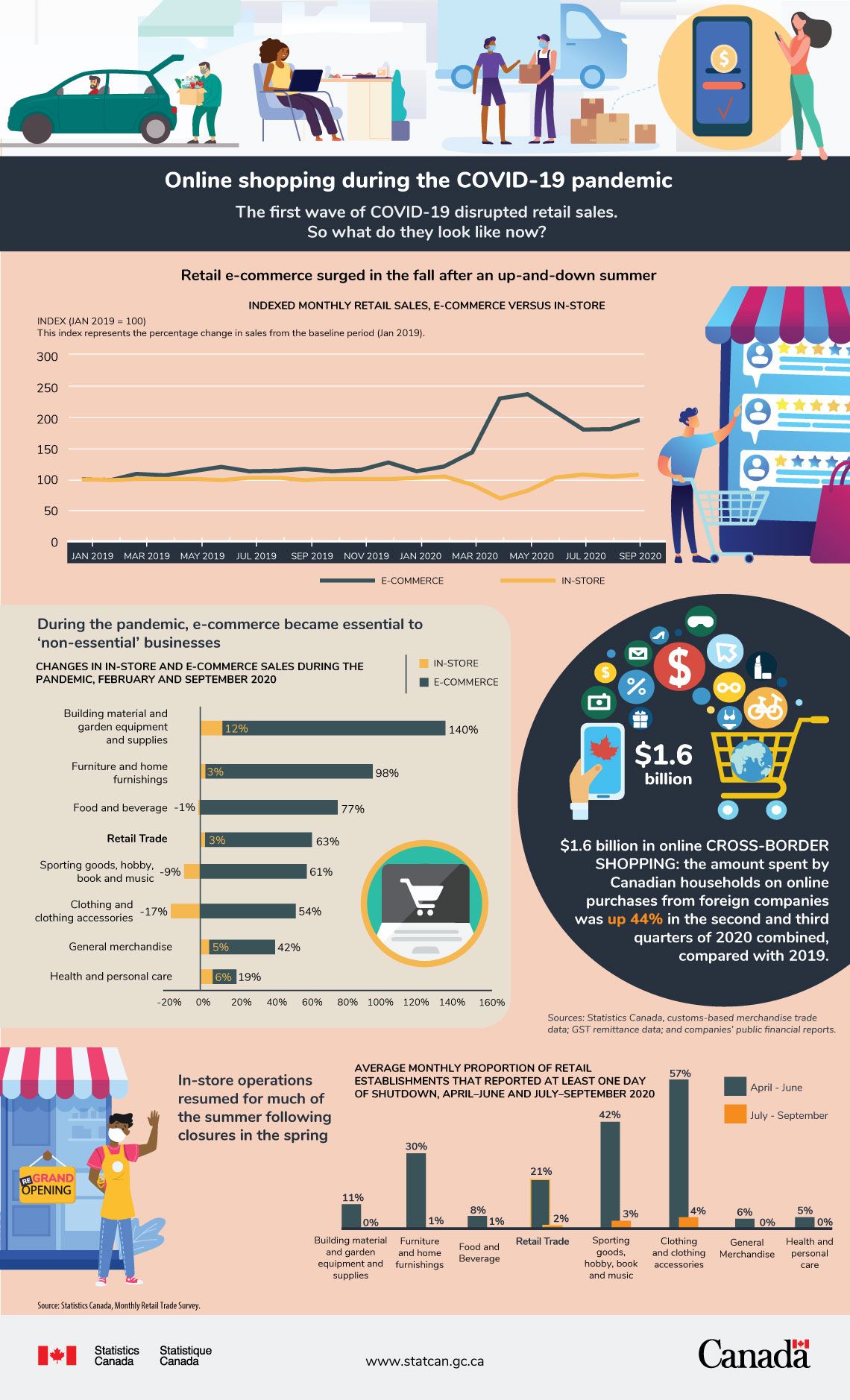

- Retail e-commerce sales accounted for 5.9% of total retail sales in 2020, up from 3.5% in 2019. The onset of COVID-19 prompted many Canadian retailers to open or expand their e-commerce presence, quickly changing the retail landscape.

- All 11 retail trade subsectors with e-commerce sales saw an increase in online sales as a result of COVID-19. From February to April 2020, only the food and beverage subsector experienced an increase in in-store sales (+3.3%) and a surge in e-commerce (+107.0%).

Infographic: Online shopping during the COVID-19 pandemic, Source: StatsCan

E-Commerce and Online Grocery Sales

- Moving forward, according to Business Insider, an estimated 40% of consumers say they plan to shop in-store either the same amount or less after being vaccinated.

- According to a survey conducted by PayPal in early April, 2020, the number of Canadian online grocery shoppers jumped 58 percent during the four weeks that followed the government’s declaration of a pandemic.

- The numbers were generated based on a comparable survey that had been conducted just a month prior, translating to fully 30 percent of Canadians shopping online in order to fulfill their food needs when the crisis first hit.

- Recent Nielsen numbers indicate that food retail online sales in Canada represented close to 3.3 percent of all sales in 2020, compared to 1.7 percent in 2019.

- According to a report by the Nasdaq, it is estimated that 95% of purchases will be made online by 2040.

- Millennials and Gen Xers are the biggest online shoppers, with 67% of millennials and 56% of Gen Xers preferring to shop online versus in a brick-and-mortar store, according to Kinsta.

- Though the United States is often thought of as the largest market for ecommerce, it isn’t. However, it does make the list of the top 10 largest e-commerce markets in the world:

- China: $672 billion

- USA: $340 billion

- United Kingdom: $99 billion

- Japan: $79 billion

- Germany: $73 billion

- France: $43 billion

- South Korea: $37 billion

- Canada: $30 billion

- Russia: $20 billion

- Brazil: $19 billion

These figures are staggering and can offer us some insight into the demand for Canadian industrial real estate, especially as we continue to on-shore manufacturing operations and potentially increase our exports.

WalMart

- According to Business Insider, Walmart was also a clear e-commerce winner throughout 2020: The firm wrapped up its final quarter of 2020 with 79% YoY growth in online sales—likely boosted by its in-store network, which it has been using to boost fulfillment efforts.

- Yahoo Finance said that Walmart Canada’s e-commerce net sales grew 229 per cent in the most recent quarter (Q4 2020), the strongest growth of the company’s international markets, capping an unprecedented year for the world’s largest retailer.

- Net sales at Walmart Canada grew 8.6 per cent in the 13-week period ending Jan. 31, the company disclosed on Thursday. Comparable sales, a key metric in the retail industry, also jumped 8.6 per cent, thanks largely to strong sales in the food and online grocery categories.

Investments in Capabilities

- According to Yahoo Finance, “Horacio Barbeito, president and chief executive of Walmart Canada, said that several investments deployed throughout the year helped boost the company’s online sales.”

- “We deployed pickup capabilities in over 70 stores just in (the first quarter) to get to 300 stores so customers were able to order online and pick-up in store without leaving their cars. That was transformational,” Barbeito said in an interview.

- “Our marketplace also increased the number of third-party sellers, and we hired 4,500 people to serve and address the surge in online. It was investment in people, investment in tech and investment in capability that was key.”

- “Over the next year, Walmart will also continue its plan to invest $3.5 billion to build two new distribution centres and renovate more than 150 existing stores. Barbeito said the company expects to spend $700 million in 2021 on the new distribution centres and will renovate 58 stores.”

Amazon

- Despite some hiccups along the way, Amazon was a clear winner in 2020: The e-tail giant ended the year with $66.45 billion in online store sales for Q4, according to Business Insider.

- For more detail on Amazon’s many initiatives and projects within the GTA, go take a look at our “Industrial & E-Commerce: A Love Story” series on our blog.

E-Commerce and its Effects on Industrial

According to Bloomberg:

- Forty million square feet of additional warehouse space will be needed in the next five years after e-commerce sales rose 32% last year.

- “Canada is on the verge of a warehouse building boom as soaring demand for online goods is expected to continue beyond the pandemic… That’s more than all the leasable warehouse space in the country’s three largest industrial real estate markets combined, meaning there will be little choice but to build new facilities.”

- “Retailers are rushing to build logistics hubs to fulfill orders, making the country’s three largest cities, Toronto, Vancouver, and Montreal, the three tightest markets for industrial space in North America.”

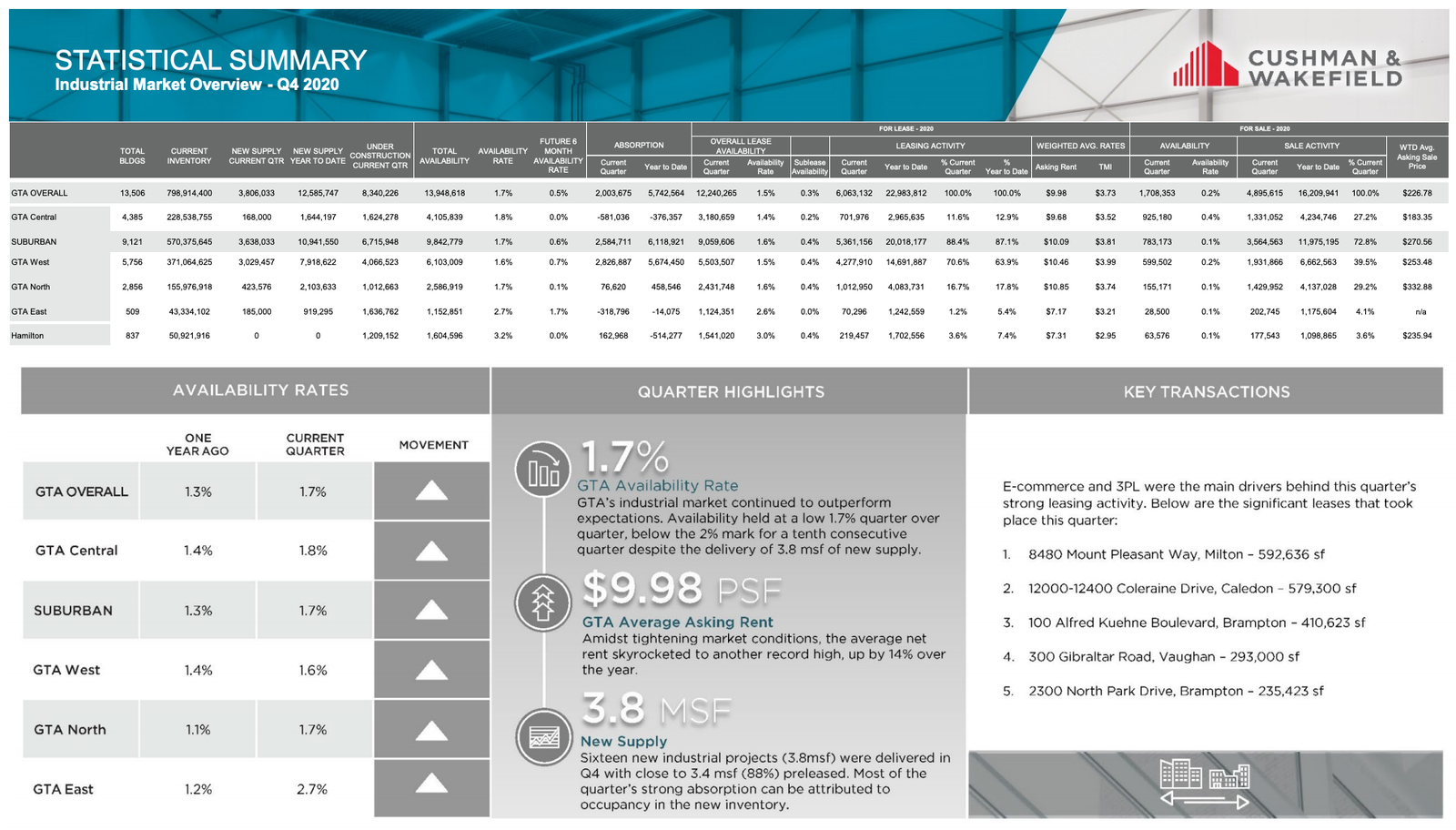

Industrial Market Overview – Q4 2020. Source: Cushman & Wakefield, ULC.

So What Does It All Mean?

As the saying goes, only time will tell. We can hypothesize and analyze all we like, however, underneath all of the pro formas and financial models we are dealing with human beings.

There’s no doubt in my mind that we have fundamentally changed something in our consumption behaviour… and that going straight back to our old habits will probably be difficult for some… If at all, it may take some time to gradually grow comfortable with returning to crowded settings.

But even more importantly, I believe many of us realize the value of our time. Time not spent commuting. Time not spent getting 100% formally dressed and ready each and every day. Time not spent rushing to do a long list of errands…

However, maybe those are things some of us miss and took for granted. Either way, having the option to do both, when you like, so that you can free up your time (or leisurely spend it), would be the real silver lining.

Finally, as we have experienced over the past 3-5 years, the industrial real estate market in the GTA is getting tighter and tighter… No matter how many new buildings come on board, they are all pre-leased prior to completion.. and the trend of increasing net rental rates and property values will continue… There is a lot more room to grow.

If your lease is expiring, you must start early. If you need more space, you must start early. Please start your search as soon as you can. Do not leave it for the last minute. We advise our clients, depending on the operation, that 2 years prior to expiry of their lease is not too early.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com